- Strong Earnings, Balance Sheet and

Liquidity

- Enhanced Portfolio Through $1.5

Billion Life Science and Innovation Real Estate Acquisition Leased

by Leading Universities, Academic Medical Centers and Research

Institutions

- Commitment to Grow High-Quality

Hospital Business

- Updated and Improved 2016

Guidance

Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) today

announced strong earnings for the third quarter ended September 30,

2016, driven by the Company’s high-quality healthcare and senior

living properties and accretive investments:

- Income from continuing operations per

diluted common share for the third quarter 2016 grew 223 percent to

$0.42 compared to the same period in 2015. The increase from the

third quarter 2015 is principally due to accretive investments,

improved property performance, and lower transaction costs.

- Normalized Funds From Operations

(“FFO”) for the third quarter 2016 grew 5 percent to $1.03 per

diluted common share on a comparable basis (“Comparable”), which

adjusts all prior periods for the effects of the successful spin

off (the “Spin-Off”) of Care Capital Properties, Inc. (“CCP”)

(NYSE: CCP) completed in August 2015.

- Reported FFO per diluted common share,

as defined by the National Association of Real Estate Investment

Trusts (“NAREIT FFO”), for the third quarter 2016 grew 28 percent

to $1.00 compared to the same period in 2015.

Strong Quarter Demonstrates the Ventas

Advantage

“We are delighted to report strong financial performance in the

third quarter, delivered by our excellent people, platforms and

properties,” said Chairman and Chief Executive Officer Debra A.

Cafaro. “With superior earnings growth, outstanding liquidity,

financial strength, terrific capital markets execution and

disciplined capital allocation, the Ventas team continues to

deliver on our promise of producing reliable growth and income from

a high-quality diversified portfolio. The completion of our

acquisition of life science and innovation centers leased by

leading universities and our commitment to finance Ardent’s

expansion and build an excellent hospital business further solidify

our position as the premier provider of capital at the intersection

of health care and real estate. We remain confident in our ability

to continue to drive shareholder value.”

Third Quarter Portfolio

Performance

Constant currency cash net operating income (“NOI”) growth for

the Company’s quarterly same-store total portfolio (1,184 assets)

was 2.4 percent on a reported basis for the third quarter 2016.

Reported quarterly same-store results by segment follow:

- The seniors housing operating portfolio

(“SHOP”) same-store cash NOI grew 2.0 percent, fueled by growth in

key markets.

- The triple net leased portfolio

same-store cash NOI grew 4.2 percent, benefiting from lease

escalations.

- Medical office building (“MOB”)

portfolio same-store cash NOI grew 0.2 percent, in line with

expectations.

Third Quarter & Other

Highlights

- In October 2016, the Company announced

that it issued a commitment to provide secured debt financing in

the amount of $700 million to a subsidiary of Ardent Health

Services (“Ardent”) in connection with Ardent’s agreement to

acquire LHP Hospital Group. The transaction is expected to be

accretive and close in the first quarter of 2017, pending customary

regulatory reviews and approvals.

- In September 2016, the Company

completed its accretive acquisition of institutional-quality life

science and innovation centers managed by Wexford Science &

Technology, LLC (“Wexford”) for total consideration of $1.5

billion. The acquisition marks Ventas’s entry into the attractive

life science sector with high-quality real estate leased by top

universities, academic medical centers and research companies and

includes a pipeline of attractive near-term development

opportunities.

- During and immediately following the

quarter, to fund the Wexford acquisition, Ventas raised over $900

million in aggregate gross proceeds from the sale of common stock

at an average gross price exceeding $73 per share through a block

equity offering and “at the market” equity issuances. Year-to-date,

total equity issuances have totaled 18.9 million shares and $1.3

billion in aggregate gross proceeds.

- The Company issued $450 million of 3.25

percent 10-year senior notes in September, which represented the

most attractive 10-year bond issuance in the Company’s

history.

- During and immediately following the

quarter, the Company sold real estate assets and received final

repayment on loans receivable for aggregate proceeds of $197

million. Year-to-date, the Company has sold 14 properties and

received final repayment on loans receivable for aggregate proceeds

of $272 million.

- The Company’s credit profile was

excellent at quarter-end, including:

- 5.8x net debt to adjusted EBITDA ratio,

consistent with the prior quarter and a 0.3x improvement

year-over-year;

- 39 percent total indebtedness to gross

asset value, an improvement of one percentage point from the prior

quarter and three percentage points year-over-year; and

- 4.7x fixed charge coverage, an

improvement of 0.1x from the prior quarter and 0.3x

year-over-year.

- The Company currently has an

outstanding liquidity position, with $1.8 billion available under

its revolving credit facility and $134 million of cash or cash

equivalents.

Collaborative Agreements with

Sunrise

- In September 2016, Ventas and Sunrise

Senior Living (“Sunrise”) reached mutually beneficial agreements

that strengthen the decade-long relationship of the companies.

These new arrangements provide Sunrise and its onsite employees

with long-term stability, reinforcing their focus on caring for

seniors, and align the companies behind profitable growth. The

agreements reduce management fees paid by Ventas to Sunrise under

existing management contracts, maintain the existing term of the

contracts and provide Sunrise with incentives for future

outperformance. Ventas and Sunrise have also entered into a new

multi-year development pipeline agreement that gives Ventas the

option to fund certain future Sunrise developments.

Continued Leadership

Excellence

- Ventas Chairman and Chief Executive

Officer Debra A. Cafaro was recognized by the Harvard Business

Review as one of “The Best-Performing CEOs in the World.” She

is one of 30 CEOs named to the Harvard Business Review list

for three consecutive years and one of only two women on this

year’s list. Ventas’s financial performance ranked in the top

30 of 886 companies globally for Ms. Cafaro’s tenure, which exceeds

17 years.

- Ventas Chairman and Chief Executive

Officer Debra A. Cafaro was recognized by Modern Healthcare as one

of the “100 Most Influential People in Healthcare” for 2016. This

is the third time Ms. Cafaro has received this recognition,

demonstrating her commitment to and stature in the healthcare

industry.

Updated 2016 Guidance

The Company updated and improved its expectations for full year

2016 constant currency cash NOI growth for the 1,044 assets in the

full year same-store pool to now range from 2.5 to 3 percent in

2016, compared to its previously disclosed guidance of 2 to 3

percent.

Ventas also increased its outlook for 2016 income from

continuing operations per diluted share to now range between $1.51

and $1.63. The Company expects reported normalized FFO per diluted

share to now range between $4.10 and $4.13, an increase of nearly 3

cents at the midpoint and now representing 4 to 5 percent per share

growth over 2015 on a Comparable basis. The Company also increased

its NAREIT FFO per diluted share expectations to range between

$4.09 and $4.13.

The Company continues to expect to complete approximately $500

million in total 2016 dispositions; it has already closed $272

million year-to-date. Consistent with its practice, the Company’s

guidance does not include any further material investments,

dispositions or capital activity. A reconciliation of the Company’s

guidance to the Company’s projected GAAP earnings is included in

this press release.

The Company’s guidance is based on a number of other assumptions

that are subject to change and many of which are outside the

control of the Company. If actual results vary from these

assumptions, the Company’s expectations may change. There can be no

assurance that the Company will achieve these results.

Third Quarter Conference

Call

Ventas will hold a conference call to discuss this earnings

release today at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

The dial-in number for the conference call is (844) 776-7841 (or

(661) 378-9542 for international callers). The participant passcode

is “Ventas.” The conference call is being webcast live by NASDAQ

OMX and can be accessed at the Company’s website at

www.ventasreit.com. A replay of the

webcast will be available following the call online, or by calling

(855) 859-2056 (or (404) 537-3406 for international callers),

passcode 96801614, beginning at approximately 2:00 p.m. Eastern

Time and will remain for 36 days.

Ventas, Inc., an S&P 500 company, is a leading real estate

investment trust. Its diverse portfolio of approximately 1,300

assets in the United States, Canada and the United Kingdom consists

of seniors housing communities, medical office buildings, life

science and innovation centers, skilled nursing facilities,

specialty hospitals and general acute care hospitals. Through its

Lillibridge subsidiary, Ventas provides management, leasing,

marketing, facility development and advisory services to highly

rated hospitals and health systems throughout the United States.

More information about Ventas and Lillibridge can be found at

www.ventasreit.com and www.lillibridge.com.

Supplemental information regarding the Company can be found on

the Company’s website under the “Investor Relations” section or at

www.ventasreit.com/investor-relations/annual-reports---supplemental-information.

A comprehensive listing of the Company’s properties is available at

www.ventasreit.com/our-portfolio/properties-by-stateprovince.

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements regarding the Company’s or its tenants’,

operators’, borrowers’ or managers’ expected future financial

condition, results of operations, cash flows, funds from

operations, dividends and dividend plans, financing opportunities

and plans, capital markets transactions, business strategy,

budgets, projected costs, operating metrics, capital expenditures,

competitive positions, acquisitions, investment opportunities,

dispositions, merger or acquisition integration, growth

opportunities, expected lease income, continued qualification as a

real estate investment trust (“REIT”), plans and objectives of

management for future operations and statements that include words

such as “anticipate,” “if,” “believe,” “plan,” “estimate,”

“expect,” “intend,” “may,” “could,” “should,” “will” and other

similar expressions are forward-looking statements. These

forward-looking statements are inherently uncertain, and actual

results may differ from the Company’s expectations. The Company

does not undertake a duty to update these forward-looking

statements, which speak only as of the date on which they are

made.

The Company’s actual future results and trends may differ

materially from expectations depending on a variety of factors

discussed in the Company’s filings with the Securities and Exchange

Commission. These factors include without limitation: (a) the

ability and willingness of the Company’s tenants, operators,

borrowers, managers and other third parties to satisfy their

obligations under their respective contractual arrangements with

the Company, including, in some cases, their obligations to

indemnify, defend and hold harmless the Company from and against

various claims, litigation and liabilities; (b) the ability of the

Company’s tenants, operators, borrowers and managers to maintain

the financial strength and liquidity necessary to satisfy their

respective obligations and liabilities to third parties, including

without limitation obligations under their existing credit

facilities and other indebtedness; (c) the Company’s success in

implementing its business strategy and the Company’s ability to

identify, underwrite, finance, consummate and integrate

diversifying acquisitions and investments; (d) macroeconomic

conditions such as a disruption of or lack of access to the capital

markets, changes in the debt rating on U.S. government securities,

default or delay in payment by the United States of its

obligations, and changes in the federal or state budgets resulting

in the reduction or nonpayment of Medicare or Medicaid

reimbursement rates; (e) the nature and extent of future

competition, including new construction in the markets in which the

Company’s seniors housing communities and medical office buildings

(“MOBs”) are located; (f) the extent of future or pending

healthcare reform and regulation, including cost containment

measures and changes in reimbursement policies, procedures and

rates; (g) increases in the Company’s borrowing costs as a result

of changes in interest rates and other factors; (h) the ability of

the Company’s tenants, operators and managers, as applicable, to

comply with laws, rules and regulations in the operation of the

Company’s properties, to deliver high-quality services, to attract

and retain qualified personnel and to attract residents and

patients; (i) changes in general economic conditions or economic

conditions in the markets in which the Company may, from time to

time, compete, and the effect of those changes on the Company’s

revenues, earnings and funding sources; (j) the Company’s ability

to pay down, refinance, restructure or extend its indebtedness as

it becomes due; (k) the Company’s ability and willingness to

maintain its qualification as a REIT in light of economic, market,

legal, tax and other considerations; (l) final determination of the

Company’s taxable net income for the year ending December 31, 2016;

(m) the ability and willingness of the Company’s tenants to renew

their leases with the Company upon expiration of the leases, the

Company’s ability to reposition its properties on the same or

better terms in the event of nonrenewal or in the event the Company

exercises its right to replace an existing tenant, and obligations,

including indemnification obligations, the Company may incur in

connection with the replacement of an existing tenant; (n) risks

associated with the Company’s senior living operating portfolio,

such as factors that can cause volatility in the Company’s

operating income and earnings generated by those properties,

including without limitation national and regional economic

conditions, costs of food, materials, energy, labor and services,

employee benefit costs, insurance costs and professional and

general liability claims, and the timely delivery of accurate

property-level financial results for those properties; (o) changes

in exchange rates for any foreign currency in which the Company

may, from time to time, conduct business; (p) year-over-year

changes in the Consumer Price Index or the UK Retail Price Index

and the effect of those changes on the rent escalators contained in

the Company’s leases and the Company’s earnings; (q) the Company’s

ability and the ability of its tenants, operators, borrowers and

managers to obtain and maintain adequate property, liability and

other insurance from reputable, financially stable providers; (r)

the impact of increased operating costs and uninsured professional

liability claims on the Company’s liquidity, financial condition

and results of operations or that of the Company’s tenants,

operators, borrowers and managers, and the ability of the Company

and the Company’s tenants, operators, borrowers and managers to

accurately estimate the magnitude of those claims; (s) risks

associated with the Company’s MOB portfolio and operations,

including the Company’s ability to successfully design, develop and

manage MOBs and to retain key personnel; (t) the ability of the

hospitals on or near whose campuses the Company’s MOBs are located

and their affiliated health systems to remain competitive and

financially viable and to attract physicians and physician groups;

(u) risks associated with the Company’s investments in joint

ventures and unconsolidated entities, including its lack of sole

decision-making authority and its reliance on its joint venture

partners’ financial condition; (v) the Company’s ability to obtain

the financial results expected from its development and

redevelopment projects; (w) the impact of market or issuer events

on the liquidity or value of the Company’s investments in

marketable securities; (x) consolidation activity in the seniors

housing and healthcare industries resulting in a change of control

of, or a competitor’s investment in, one or more of the Company’s

tenants, operators, borrowers or managers or significant changes in

the senior management of the Company’s tenants, operators,

borrowers or managers; (y) the impact of litigation or any

financial, accounting, legal or regulatory issues that may affect

the Company or its tenants, operators, borrowers or managers; and

(z) changes in accounting principles, or their application or

interpretation, and the Company’s ability to make estimates and the

assumptions underlying the estimates, which could have an effect on

the Company’s earnings.

CONSOLIDATED BALANCE SHEETS (In thousands,

except per share amounts)

September 30, June 30, March 31,

December 31, September 30, 2016

2016 2016 2015 2015

Assets Real estate investments: Land and improvements $

2,089,329 $ 2,041,880 $ 2,060,247 $ 2,056,428 $ 2,068,467 Buildings

and improvements 21,551,049 20,272,554 20,395,386 20,309,599

20,220,624 Construction in progress 192,848 127,647 119,215 92,005

124,381 Acquired lease intangibles 1,522,708

1,332,173 1,343,187 1,344,422 1,347,493

25,355,934 23,774,254 23,918,035 23,802,454 23,760,965 Accumulated

depreciation and amortization (4,754,532 ) (4,560,504 )

(4,409,554 ) (4,177,234 ) (3,972,544 ) Net real estate property

20,601,402 19,213,750 19,508,481 19,625,220 19,788,421 Secured

loans receivable and investments, net 821,663 1,003,561 1,002,598

857,112 766,707 Investments in unconsolidated real estate entities

97,814 96,952 98,120 95,707

96,208 Net real estate investments 21,520,879 20,314,263

20,609,199 20,578,039 20,651,336 Cash and cash equivalents 89,279

57,322 51,701 53,023 65,231 Escrow deposits and restricted cash

89,521 65,626 76,710 77,896 74,491 Goodwill 1,043,075 1,043,479

1,044,983 1,047,497 1,052,321 Assets held for sale 195,252 195,271

54,263 93,060 152,014 Other assets 488,258 417,511

424,436 412,403 418,584

Total

assets $ 23,426,264 $ 22,093,472 $

22,261,292 $ 22,261,918 $ 22,413,977

Liabilities and equity Liabilities: Senior notes payable and

other debt $ 11,252,327 $ 10,901,131 $ 11,247,730 $ 11,206,996 $

11,284,957 Accrued interest 70,790 80,157 66,988 80,864 67,440

Accounts payable and other liabilities 930,103 735,287 738,327

779,380 791,556 Liabilities related to assets held for sale 77,608

88,967 12,625 34,340 48,860 Deferred income taxes 315,713

320,468 333,354 338,382 352,658

Total liabilities 12,646,541 12,126,010 12,399,024 12,439,962

12,545,471 Redeemable OP unitholder and noncontrolling

interests 209,278 217,686 191,739 196,529 198,832

Commitments and contingencies Equity: Ventas stockholders'

equity: Preferred stock, $1.00 par value; 10,000 shares authorized,

unissued — — — — — Common stock, $0.25 par value; 353,793; 341,055;

337,486; 334,386 and 333,027 shares issued at September 30, 2016,

June 30, 2016, March 31, 2016, December 31, 2015 and September 30,

2015, respectively 88,431 85,246 84,354 83,579 83,238 Capital in

excess of par value 12,870,566 11,961,951 11,758,306 11,602,838

11,523,312 Accumulated other comprehensive loss (49,614 ) (44,195 )

(19,932 ) (7,565 ) (592 ) Retained earnings (deficit) (2,420,766 )

(2,313,287 ) (2,208,474 ) (2,111,958 ) (1,992,848 ) Treasury stock,

1; 0; 1; 44 and 61 shares at September 30, 2016, June 30, 2016,

March 31, 2016, December 31, 2015 and September 30, 2015,

respectively (78 ) — (59 ) (2,567 ) (3,675 ) Total

Ventas stockholders' equity 10,488,539 9,689,715 9,614,195

9,564,327 9,609,435 Noncontrolling interest 81,906

60,061 56,334 61,100 60,239 Total

equity 10,570,445 9,749,776 9,670,529

9,625,427 9,669,674

Total liabilities and

equity $ 23,426,264 $ 22,093,472 $

22,261,292 $ 22,261,918 $ 22,413,977

CONSOLIDATED STATEMENTS OF INCOME (In thousands,

except per share amounts)

For the Three Months Ended For the Nine Months Ended

September 30, September 30, 2016 2015

2016 2015 Revenues: Rental income: Triple-net

leased $ 210,424 $ 201,028 $ 635,030 $ 571,591 Office 158,273

142,755 446,496 420,287 368,697 343,783

1,081,526 991,878 Resident fees and services 461,974 454,825

1,390,387 1,356,384 Office building and other services revenue

4,317 10,000 17,006 29,951 Income from loans and investments 31,566

18,924 78,098 66,192 Interest and other income 562 74

792 719 Total revenues 867,116 827,606 2,567,809

2,445,124

Expenses: Interest 105,063 97,135 312,001 263,422

Depreciation and amortization 208,387 226,332 666,735 657,262

Property-level operating expenses: Senior living 312,145 304,540

932,675 902,154 Office 48,972 43,305 136,619

129,152 361,117 347,845 1,069,294 1,031,306 Office building

services costs 974 6,416 6,277 19,098 General, administrative and

professional fees 31,567 32,114 95,387 100,399 Loss on

extinguishment of debt, net 383 15,331 3,165 14,897 Merger-related

expenses and deal costs 16,217 62,145 25,073 105,023 Other 2,430

4,795 8,901 13,948 Total expenses

726,138 792,113 2,186,833 2,205,355

Income before unconsolidated entities, income taxes, discontinued

operations, real estate dispositions and noncontrolling interest

140,978 35,493 380,976 239,769 Income (loss) from unconsolidated

entities 931 (955 ) 2,151 (1,197 ) Income tax benefit 8,537

10,697 28,507 27,736 Income from continuing

operations 150,446 45,235 411,634 266,308 Discontinued operations

(118 ) (22,383 ) (755 ) 13,434 (Loss) gain on real estate

dispositions (144 ) 265 31,779 14,420 Net

income 150,184 23,117 442,658 294,162 Net income attributable to

noncontrolling interest 732 265 1,064 1,047

Net income attributable to common stockholders $ 149,452

$ 22,852 $ 441,594 $ 293,115

Earnings per common share: Basic: Income from continuing

operations attributable to common stockholders, including real

estate dispositions $ 0.43 $ 0.14 $ 1.29 $ 0.85 Discontinued

operations (0.00 ) (0.07 ) (0.00 ) 0.04 Net income

attributable to common stockholders $ 0.43 $ 0.07 $

1.29 $ 0.89 Diluted: Income from continuing

operations attributable to common stockholders, including real

estate dispositions $ 0.42 $ 0.14 $ 1.28 $ 0.84 Discontinued

operations (0.00 ) (0.07 ) (0.00 ) 0.04 Net income

attributable to common stockholders $ 0.42 $ 0.07 $

1.28 $ 0.88

Weighted average shares used in

computing earnings per common share: Basic 350,274 332,491

341,610 329,440 Diluted 354,186 336,338 345,352 333,210

Dividends declared per common share $ 0.73 $ 0.73 $ 2.19 $ 2.31

QUARTERLY CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

2016 Quarters 2015

Quarters Third Second First Fourth

Third Revenues: Rental income: Triple-net

leased $ 210,424 $ 210,119 $ 214,487 $ 208,210 $ 201,028 Office

158,273 144,087 144,136 145,958 142,755

368,697 354,206 358,623 354,168 343,783 Resident fees and

services 461,974 464,437 463,976 454,871 454,825 Office building

and other services revenue 4,317 5,504 7,185 11,541 10,000 Income

from loans and investments 31,566 24,146 22,386 20,361 18,924

Interest and other income 562 111 119 333

74 Total revenues 867,116 848,404 852,289 841,274

827,606

Expenses: Interest 105,063 103,665 103,273

103,692 97,135 Depreciation and amortization 208,387 221,961

236,387 236,795 226,332 Property-level operating expenses: Senior

living 312,145 307,989 312,541 307,261 304,540 Office 48,972

43,966 43,681 45,073 43,305 361,117

351,955 356,222 352,334 347,845 Office building services costs 974

1,852 3,451 7,467 6,416 General, administrative and professional

fees 31,567 32,094 31,726 27,636 32,114 Loss (gain) on

extinguishment of debt, net 383 2,468 314 (486 ) 15,331

Merger-related expenses and deal costs 16,217 7,224 1,632 (2,079 )

62,145 Other 2,430 2,303 4,168 4,009

4,795 Total expenses 726,138 723,522 737,173

729,368 792,113 Income before

unconsolidated entities, income taxes, discontinued operations,

real estate dispositions and noncontrolling interest 140,978

124,882 115,116 111,906 35,493 Income (loss) from unconsolidated

entities 931 1,418 (198 ) (223 ) (955 ) Income tax benefit 8,537

11,549 8,421 11,548 10,697

Income from continuing operations 150,446 137,849 123,339 123,231

45,235 Discontinued operations (118 ) (148 ) (489 ) (2,331 )

(22,383 ) (Loss) gain on real estate dispositions (144 ) 5,739

26,184 4,160 265 Net income 150,184

143,440 149,034 125,060 23,117 Net income attributable to

noncontrolling interest 732 278 54 332

265 Net income attributable to common stockholders $ 149,452

$ 143,162 $ 148,980 $ 124,728 $ 22,852

Earnings per common share: Basic: Income from

continuing operations attributable to common stockholders,

including real estate dispositions $ 0.43 $ 0.42 $ 0.44 $ 0.38 $

0.14 Discontinued operations (0.00 ) (0.00 ) (0.00 ) (0.01 ) (0.07

) Net income attributable to common stockholders $ 0.43 $

0.42 $ 0.44 $ 0.37 $ 0.07 Diluted:

Income from continuing operations attributable to common

stockholders, including real estate dispositions $ 0.42 $ 0.42 $

0.44 $ 0.38 $ 0.14 Discontinued operations (0.00 ) (0.00 ) (0.00 )

(0.01 ) (0.07 ) Net income attributable to common stockholders $

0.42 $ 0.42 $ 0.44 $ 0.37 $ 0.07

Weighted average shares used in computing earnings per

common share: Basic 350,274 338,901 335,559 332,914 332,491

Diluted 354,186 342,571 339,202 336,406 336,338

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

For the Nine Months Ended September 30,

2016 2015 Cash flows from operating

activities: Net income $ 442,658 $ 294,162 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation and amortization (including amounts in discontinued

operations) 666,735 736,870 Amortization of deferred revenue and

lease intangibles, net (15,307 ) (19,312 ) Other non-cash

amortization 7,174 3,051 Stock-based compensation 15,885 16,061

Straight-lining of rental income, net (21,386 ) (25,118 ) Loss on

extinguishment of debt, net 3,165 14,897 Gain on real estate

dispositions (including amounts in discontinued operations) (31,779

) (14,649 ) Gain on real estate loan investments (2,271 ) — Gain on

sale of marketable debt securities — (5,800 ) Income tax benefit

(30,832 ) (30,717 ) (Income) loss from unconsolidated entities

(2,151 ) 1,197 Distributions from unconsolidated entities 5,574

20,550 Other (1,075 ) 3,276 Changes in operating assets and

liabilities: Decrease in other assets 1,753 11,164 (Decrease)

increase in accrued interest (10,053 ) 6,338 (Decrease) increase in

accounts payable and other liabilities (26,820 ) 10,075 Net

cash provided by operating activities 1,001,270 1,022,045 Cash

flows from investing activities: Net investment in real estate

property (1,421,592 ) (2,556,988 ) Investment in loans receivable

and other (154,949 ) (74,386 ) Proceeds from real estate disposals

63,561 409,633 Proceeds from loans receivable 194,063 106,909

Proceeds from sale or maturity of marketable securities — 76,800

Funds held in escrow for future development expenditures — 4,003

Development project expenditures (94,398 ) (90,458 ) Capital

expenditures (75,296 ) (75,812 ) Investment in unconsolidated

operating entity — (26,282 ) Other (6,175 ) (27,984 ) Net cash used

in investing activities (1,494,786 ) (2,254,565 ) Cash flows from

financing activities: Net change in borrowings under credit

facility 46,728 (790,406 ) Net cash impact of CCP Spin-Off —

(128,749 ) Proceeds from debt 876,617 2,511,061 Proceeds from debt

related to CCP Spin-Off — 1,400,000 Repayment of debt (916,505 )

(1,329,070 ) Purchase of noncontrolling interest (1,604 ) (3,819 )

Payment of deferred financing costs (6,147 ) (23,893 ) Issuance of

common stock, net 1,265,702 417,818 Cash distribution to common

stockholders (750,402 ) (759,575 ) Cash distribution to redeemable

OP unitholders (6,486 ) (12,776 ) Purchases of redeemable OP units

— (33,188 ) Contributions from noncontrolling interest 5,926 —

Distributions to noncontrolling interest (5,121 ) (11,250 ) Other

21,507 6,489 Net cash provided by financing

activities 530,215 1,242,642 Net increase in cash and

cash equivalents 36,699 10,122 Effect of foreign currency

translation on cash and cash equivalents (443 ) (239 ) Cash and

cash equivalents at beginning of period 53,023 55,348

Cash and cash equivalents at end of period $ 89,279 $ 65,231

Supplemental schedule of non-cash activities: Assets

and liabilities assumed from acquisitions: Real estate investments

$ 59,666 $ 2,567,150 Utilization of funds held for an Internal

Revenue Code Section 1031 exchange (6,954 ) (8,911 ) Other assets

acquired 79,879 20,221 Debt assumed 47,641 177,857 Other

liabilities 60,446 57,937 Deferred income tax liability 2,279

50,836 Redeemable OP unitholder interests assumed — 87,245

Noncontrolling interest 22,225 — Equity issued — 2,204,585 Non-cash

impact of CCP Spin-Off — 1,256,404 Equity issued for purchase of OP

and Class C units 22,970 —

QUARTERLY CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

2016 Quarters 2015

Quarters Third Second First Fourth

Third Cash flows from operating activities: Net income $

150,184 $ 143,440 $ 149,034 $ 125,060 $ 23,117 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization (including amounts in discontinued

operations) 208,387 221,961 236,387 236,793 240,210 Amortization of

deferred revenue and lease intangibles, net (5,217 ) (5,053 )

(5,037 ) (4,817 ) (5,682 ) Other non-cash amortization 2,487 2,241

2,446 2,397 2,142 Stock-based compensation 5,848 5,008 5,029 3,476

4,869 Straight-lining of rental income, net (5,960 ) (5,581 )

(9,845 ) (8,674 ) (8,357 ) Loss (gain) on extinguishment of debt,

net 383 2,468 314 (486 ) 15,331 Loss (gain) on real estate

dispositions (including amounts in discontinued operations) 144

(5,739 ) (26,184 ) (4,162 ) (217 ) Gain on real estate loan

investments (2,238 ) (33 ) — — — Income tax benefit (9,389 )

(12,287 ) (9,156 ) (11,667 ) (12,477 ) (Income) loss from

unconsolidated entities (931 ) (1,418 ) 198 47 955 Loss on

re-measurement of equity interest upon acquisition, net — — — 176 —

Distributions from unconsolidated entities 1,701 1,884 1,989 2,912

5,577 Other (1,799 ) (375 ) 1,099 3,241 170 Changes in operating

assets and liabilities: (Increase) decrease in other assets (8,856

) 15,444 (4,835 ) 31,152 20,875 (Decrease) increase in accrued

interest (9,284 ) 13,542 (14,311 ) 13,657 (9,770 ) Increase

(decrease) in accounts payable and other liabilities 19,335

8,082 (54,237 ) (19,383 ) 27,578 Net cash provided by

operating activities 344,795 383,584 272,891 369,722 304,321 Cash

flows from investing activities: Net investment in real estate

property (1,387,139 ) (20,833 ) (13,620 ) (93,800 ) (1,303,078 )

Investment in loans receivable and other (2,499 ) (6,236 ) (146,214

) (96,758 ) (18,727 ) Proceeds from real estate disposals — 9,350

54,211 82,775 136,442 Proceeds from loans receivable 186,419 6,019

1,625 2,267 13,634 Proceeds from sale or maturity of marketable

securities — — — — 19,575 Development project expenditures (24,719

) (34,912 ) (34,767 ) (29,216 ) (27,828 ) Capital expenditures

(28,371 ) (23,204 ) (23,721 ) (31,675 ) (32,383 ) Investment in

unconsolidated operating entity — — — — (26,282 ) Other (1,910 ) —

(4,265 ) (2,720 ) (19,171 ) Net cash used in investing

activities (1,258,219 ) (69,816 ) (166,751 ) (169,127 ) (1,257,818

) Cash flows from financing activities: Net change in borrowings

under credit facility 22,424 (113,136 ) 137,440 66,949 (469,072 )

Net cash impact of CCP Spin-Off — — — — (128,749 ) Proceeds from

debt 460,400 416,072 145 1,686 1,403,090 Proceeds from debt related

to CCP Spin-Off — — — — 1,400,000 Repayment of debt (176,168 )

(589,028 ) (151,309 ) (106,526 ) (1,050,628 ) Purchase of

noncontrolling interest — (1,604 ) — — (3 ) Payment of deferred

financing costs (2,303 ) (3,768 ) (76 ) (772 ) (9,285 ) Issuance of

common stock, net 887,963 228,108 149,631 73,205 65,651 Cash

distribution to common stockholders (256,931 ) (247,975 ) (245,496

) (243,838 ) (243,171 ) Cash distribution to redeemable OP

unitholders (2,049 ) (2,114 ) (2,323 ) (2,319 ) (8,079 )

Contributions from noncontrolling interest 246 5,680 — — —

Distributions to noncontrolling interest (1,539 ) (1,839 ) (1,743 )

(1,399 ) (1,783 ) Other 13,624 1,732 6,151 494

561 Net cash provided by (used in) financing

activities 945,667 (307,872 ) (107,580 ) (212,520 ) 958,532

Net increase (decrease) in cash and cash equivalents 32,243

5,896 (1,440 ) (11,925 ) 5,035 Effect of foreign currency

translation on cash and cash equivalents (286 ) (275 ) 118 (283 )

(336 ) Cash and cash equivalents at beginning of period 57,322

51,701 53,023 65,231 60,532 Cash

and cash equivalents at end of period $ 89,279 $ 57,322

$ 51,701 $ 53,023 $ 65,231

QUARTERLY CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued) (In thousands)

2016 Quarters

2015 Quarters Third Second First

Fourth Third Supplemental schedule of non-cash

activities: Assets and liabilities assumed from acquisitions: Real

estate investments $ 51,001 $ 6,107 $ 2,558 $ (1,190 ) $ 3,649

Utilization of funds held for an Internal Revenue Code Section 1031

exchange — (6,954 ) — — — Other assets acquired 79,018 927 (66 )

(131 ) 3,716 Debt assumed 47,641 — — — — Other liabilities 57,808

80 2,558 (3,478 ) 8,149 Deferred income tax liability 2,345 — (66 )

1,317 (784 ) Noncontrolling interest 22,225 — — 840 — Non-cash

impact of CCP Spin-Off — — — — 1,256,404 Equity issued for purchase

of OP and Class C units 2,200 1,422 19,348 — —

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Funds From Operations (FFO) and Funds

Available for Distribution (FAD) Including Comparable

Earnings1

(Dollars in thousands, except per share

amounts)

Q3 YOY 2015 2016 Growth

Q3 Q4 YTD

Q1 Q2 Q3

YTD '15-'16 Income from continuing

operations $ 45,235 $ 123,231

$ 389,539 $ 123,339 $

137,849 $ 150,446 $ 411,634

233 % Income from continuing operations per

share $ 0.13 $

0.37 $ 1.17

$ 0.36 $ 0.40

$ 0.42 $ 1.19

223 % Discontinued operations

(22,383 ) (2,331 ) 11,103

(489 ) (148 ) (118 )

(755 ) Gain (loss) on real estate dispositions

265 4,160 18,580

26,184 5,739

(144 ) 31,779 Net

income 23,117 125,060 419,222

149,034 143,440 150,184 442,658 Net

income attributable to noncontrolling interest 265

332 1,379

54 278 732

1,064 Net income attributable to common

stockholders 2 $ 22,852 $

124,728 $ 417,843 $ 148,980

$ 143,162 $ 149,452 $

441,594 554 % Net income attributable to

common stockholders per share 2 $ 0.07

$ 0.37 $ 1.25 $ 0.44

$ 0.42 $ 0.42 $ 1.28

500 % Adjustments: Depreciation and

amortization on real estate assets 224,688

235,101 887,126 234,726 220,346

206,560 661,632 Depreciation on real estate assets

related to noncontrolling interest (1,964 )

(1,926 ) (7,906 ) (2,075

) (1,814 ) (1,865 )

(5,754 ) Depreciation on real estate assets

related to unconsolidated entities 1,445 2,982

7,353 1,989 1,220 1,113 4,322

Loss on re-measurement of equity interest upon acquisition,

net — 176 176 — — —

— (Gain) loss on real estate dispositions (265

) (4,160 ) (18,580 )

(26,184 ) (5,739 ) 144

(31,779 ) Loss (gain) on real estate dispositions

related to unconsolidated entities — 19 19

(536 ) 41 — (495 )

Discontinued operations: Loss (gain) on real estate

dispositions 48 (2 ) (231 )

— 1 — 1 Depreciation and

amortization on real estate assets 13,878

— 79,608 —

— — —

Subtotal: FFO add-backs 237,830

232,190 947,565 207,920 214,055

205,952 627,927 Subtotal: FFO add-backs per

share $ 0.71 $

0.69 $ 2.84

$ 0.61 $ 0.62

$ 0.58 $ 1.82

FFO (NAREIT) attributable to common

stockholders $ 260,682 $ 356,918

$ 1,365,408 $ 356,900 $

357,217 $ 355,404 $ 1,069,521

36 % FFO (NAREIT) attributable to common

stockholders per share $ 0.78

$ 1.06 $

4.09 $ 1.05

$ 1.04 $ 1.00

$ 3.10 28 %

Adjustments: Change in fair value of financial

instruments (18 ) 454 460

(79 ) (7 ) 14 (72

) Non-cash income tax benefit (12,477 )

(11,668 ) (42,384 ) (9,157

) (12,286 ) (9,389 )

(30,832 ) Loss (gain) on extinguishment of debt,

net 16,301 (486 ) 15,797 314

2,468 383 3,165 (Gain) loss on non-real

estate dispositions related to unconsolidated entities —

— — — (585 ) 28

(557 ) Merger-related expenses, deal costs and

re-audit costs 100,548 659 152,344

3,254 8,550 16,965 28,769

Amortization of other intangibles 438

438 2,058 438

438 438

1,314 Subtotal: normalized FFO

add-backs 104,792 (10,603 ) 128,275

(5,230 ) (1,422 ) 8,439

1,787 Subtotal: normalized FFO add-backs per share

$ 0.31 $

(0.03 ) $ 0.38

$ (0.02 ) $ (0.00

) $ 0.02 $

0.01 Normalized FFO attributable to

common stockholders $ 365,474 $

346,315 $ 1,493,683 $ 351,670

$ 355,795 $ 363,843 $

1,071,308 (0 %) Normalized FFO attributable

to common stockholders per share $ 1.09 $

1.03 $ 4.47 $ 1.04 $

1.04 $ 1.03 $ 3.10 (6

%) Adjusted: Normalized FFO from CCP Spin-Off

$

(35,393 ) $ — $ (173,400

) — — $ — $ —

Adjusted Normalized FFO per share from CCP Spin-Off

$

(0.11 ) $ — $ (0.52

) $ — $ — $ —

$ — Comparable Normalized FFO attributable to

common stockholders $ 330,081 $

346,315 $ 1,320,283 $ 351,670

$ 355,795 $ 363,843 $

1,071,308 10 % Comparable Normalized FFO

attributable to common stockholders per share

$ 0.98 $ 1.03

$ 3.95 $ 1.04

$ 1.04 $

1.03 $ 3.10

5 % Non-cash items included in normalized

FFO: Amortization of deferred revenue and lease intangibles,

net (5,682 ) (4,817 )

(24,129 ) (5,037 ) (5,053

) (5,217 ) (15,307 ) Other

non-cash amortization, including fair market value of debt

2,142 2,397 5,448 2,446 2,241

2,487 7,174 Stock-based compensation

4,869 3,476 19,537 5,029 5,008

5,848 15,885 Straight-lining of rental income,

net (8,357 ) (8,674 )

(33,792 ) (9,845 )

(5,581 ) (5,960 )

(21,386 ) Subtotal: non-cash items included

in normalized FFO (7,028 ) (7,618 )

(32,936 ) (7,407 ) (3,385

) (2,842 ) (13,634 ) Capital

expenditures (33,536 )

(33,496 ) (112,700 )

(24,987 ) (25,103 )

(29,991 ) (80,081 )

Normalized FAD attributable to common stockholders

$ 324,910 $ 305,201 $

1,348,047 $ 319,276 $ 327,307

$ 331,010 $ 977,593 2 %

Adjusted: Normalized FAD from CCP Spin-Off

$ (29,987

) $ — $ (155,081 )

$ — — $ — $ —

Comparable Normalized FAD attributable to common

stockholders $ 294,923

$ 305,201 $

1,192,966 $ 319,276

$ 327,307 $

331,010 $ 977,593

12 % Merger-related expenses, deal costs and

re-audit costs (100,548 )

(659 ) (152,344 )

(3,254 ) (8,550 )

(16,965 ) (28,769 )

FAD attributable to common stockholders $

224,362 $ 304,542 $ 1,195,703

$ 316,022 $ 318,757 $

314,045 $ 948,824 40 % Adjusted:

FAD from CCP Spin-Off

$ 7,204 $ 2,333

$ (108,677 ) $ 489 $

148 $ 118 $ 755 Comparable

FAD attributable to common stockholders $

231,566 $ 306,875

$ 1,087,026 $ 316,511

$ 318,905 $

314,163 $ 949,579

36 % Weighted average diluted shares

336,338 336,406 334,007 339,202

342,571 354,186 345,352 1 Per

share amounts may not add due to rounding. Per share quarterly

amounts may not add to annual per share amounts due to material

changes in the Company’s weighted average diluted share count, if

any. 2 CCP impacts calculated based on net income

related to discontinued operations, less the de minimis share of

discontinued operations net income not related to CCP assets,

assuming (a) G&A of $2.5 million in Q1’15 and Q2’15 ($0.01 per

share per quarter) and $1.3 million in Q3’15 ($0.00 per share) and

(b) interest expense of $6.9 million in Q1’15 and Q2’15 ($0.02 per

share per quarter) and $4.3 million in Q3’15 ($0.01 per share);

these adjustments differ from the respective amounts found in

discontinued operations.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. However, since real estate values historically have

risen or fallen with market conditions, many industry investors

deem presentations of operating results for real estate companies

that use historical cost accounting to be insufficient by

themselves. For that reason, the Company considers FFO, normalized

FFO, FAD and normalized FAD to be appropriate supplemental measures

of operating performance of an equity REIT. In particular, the

Company believes that normalized FFO is useful because it allows

investors, analysts and Company management to compare the Company’s

operating performance to the operating performance of other real

estate companies and between periods on a consistent basis without

having to account for differences caused by unanticipated items and

other events such as transactions and litigation. In some cases,

the Company provides information about identified non-cash

components of FFO and normalized FFO because it allows investors,

analysts and Company management to assess the impact of those items

on the Company’s financial results.

The Company uses the NAREIT definition of FFO. NAREIT defines

FFO as net income attributable to common stockholders (computed in

accordance with GAAP) excluding gains (or losses) from sales of

real estate property, including gain (or loss) on re-measurement of

equity method investments, and impairment write-downs of

depreciable real estate, plus real estate depreciation and

amortization, and after adjustments for unconsolidated partnerships

and joint ventures. Adjustments for unconsolidated partnerships and

joint ventures will be calculated to reflect FFO on the same basis.

The Company defines normalized FFO as FFO excluding the following

income and expense items (which may be recurring in nature): (a)

merger-related costs and expenses, including amortization of

intangibles, transition and integration expenses, and deal costs

and expenses, including expenses and recoveries relating to

acquisition lawsuits; (b) the impact of any expenses related to

asset impairment and valuation allowances, the write-off of

unamortized deferred financing fees, or additional costs, expenses,

discounts, make-whole payments, penalties or premiums incurred as a

result of early retirement or payment of the Company’s debt; (c)

the non-cash effect of income tax benefits or expenses and

derivative transactions that have non-cash mark-to-market impacts

on the Company’s income statement; (d) the financial impact of

contingent consideration, severance-related costs and charitable

donations made to the Ventas Charitable Foundation; (e) gains and

losses for non-operational foreign currency hedge agreements and

changes in the fair value of financial instruments; (f) gains and

losses on non-real estate dispositions related to unconsolidated

entities; and (g) expenses related to the re-audit and re-review in

2014 of the Company’s historical financial statements and related

matters. Normalized FAD represents normalized FFO excluding

non-cash components, straight-line rental adjustments and deducting

capital expenditures, including tenant allowances and leasing

commissions. FAD represents normalized FAD after subtracting

merger-related expenses, deal costs and re-audit costs.

FFO, normalized FFO, FAD and normalized FAD presented herein may

not be identical to those presented by other real estate companies

due to the fact that not all real estate companies use the same

definitions. FFO, normalized FFO, FAD and normalized FAD should not

be considered as alternatives to net income or income from

continuing operations (both determined in accordance with GAAP) as

indicators of the Company’s financial performance or as

alternatives to cash flow from operating activities (determined in

accordance with GAAP) as measures of the Company’s liquidity, nor

are they necessarily indicative of sufficient cash flow to fund all

of the Company’s needs. The Company believes that income from

continuing operations is the most comparable GAAP measure because

it provides insight into the Company’s continuing operations. The

Company believes that in order to facilitate a clear understanding

of the consolidated historical operating results of the Company,

FFO, normalized FFO, FAD and normalized FAD should be examined in

conjunction with net income and income from continuing operations

as presented elsewhere herein.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

EPS, FFO and FAD Guidance Attributable

to Common Stockholders 1,2

(Dollars in millions, except per share

amounts)

Tentative / Preliminary and

Subject to Change FY2016 - Guidance 2016 - Per

Share Low High Low

High

Income from Continuing Operations $525

$568 $1.51

$1.63 Adjustments 3 98 88 0.28 0.25

Net

Income Attributable to Common Stockholders $623

$656 $1.79

$1.89 Depreciation and Amortization

Adjustments 901 870 2.59 2.50 Other Adjustments 3 (100 ) (90 )

(0.29 ) (0.26 )

FFO (NAREIT) Attributable to Common

Stockholders $1,424 $1,436

$4.09 $4.13

Merger-Related Expenses, Deal Costs and Re-Audit Costs 29 31 0.08

0.09 Other Adjustments 3 (27 ) (31 ) (0.08 ) (0.09 )

Normalized FFO

Attributable to Common Stockholders $1,426 $1,436

$4.10 $4.13 % Year-Over-Year Comparable Growth

4 % 5 % Non-Cash Items

Included in Normalized FFO (16 ) (18 ) Capital Expenditures (111 )

(116 )

Normalized FAD

Attributable to Common Stockholders $1,299

$1,302 Merger-Related Expense,

Deal Costs and Re-Audit Costs (29 ) (31 ) Other Adjustments 3 0 0

FAD Attributable to

Common Stockholders $1,270

$1,271 Weighted Average Diluted Shares

347,897 347,897 1

The Company’s guidance constitutes

forward-looking statements within the meaning of the federal

securities laws and is based on a number of assumptions that are

subject to change and many of which are outside the control of the

Company. Actual results may differ materially from the Company’s

expectations depending on factors discussed in the Company’s

filings with the Securities and Exchange Commission.

2

Totals and per share amounts may not add

due to rounding. Per share quarterly amounts may not add to annual

per share amounts due to changes in the Company's weighted average

diluted share count, if any.

3

See table titled “Funds From Operations

(FFO) and Funds Available for Distribution (FAD) Including

Comparable Earnings” for detailed breakout of “adjustments” for

each respective category.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION Net Debt to Adjusted Pro Forma EBITDA

The following information considers the pro forma effect on net

income attributable to common stockholders of the Company’s

investments and other capital transactions that were completed

during the three months ended September 30, 2016, as if the

transactions had been consummated as of the beginning of the

period. The following table illustrates net debt to pro forma

earnings before interest, taxes, depreciation and amortization

(including non-cash stock-based compensation expense), excluding

gains or losses on extinguishment of debt, consolidated joint

venture partners’ share of EBITDA, merger-related expenses and deal

costs, expenses related to the re-audit and re-review in 2014 of

the Company’s historical financial statements, net gains or losses

on real estate activity, gains or losses on re-measurement of

equity interest upon acquisition, changes in the fair value of

financial instruments and unrealized foreign currency gains or

losses, and including the Company’s share of EBITDA from

unconsolidated entities and adjustments for other immaterial or

identified items (including amounts in discontinued operations)

(“Adjusted Pro Forma EBITDA”) (dollars in thousands). The Company

believes that net debt, Adjusted Pro Forma EBITDA and net debt to

Adjusted Pro Forma EBITDA are important supplemental measures in

evaluating the credit strength of the Company and its ability to

service its debt obligations. The Company believes that net debt,

Adjusted Pro Forma EBITDA and net debt to Adjusted Pro Forma EBITDA

are useful to investors, analysts and Company management because

they allow the comparison of the Company’s credit strength between

periods and to other real estate companies without the effect of

items that by their nature are not comparable from period to period

and tend to obscure the Company’s actual credit quality.

Income from continuing operations $ 150,446 Discontinued

operations (118 ) Loss on real estate dispositions (144 ) Net

income 150,184 Net income attributable to noncontrolling interest

732 Net income attributable to common stockholders 149,452

Pro forma adjustments for current period investments, capital

transactions and dispositions 14,323 Pro forma net income

attributable to common stockholders for the three months ended

September 30, 2016 163,775 Add back: Interest 100,281 Depreciation

and amortization 204,317 Stock-based compensation 5,848 Loss on

real estate dispositions 145 Loss on extinguishment of debt, net 7

(Income) loss from unconsolidated entities, net of Ventas share of

EBITDA from unconsolidated entities 5,509 Net income (loss)

attributable to noncontrolling interest, net of consolidated joint

venture partners’ share of EBITDA (3,076 ) Income tax benefit

(8,537 ) Change in fair value of financial instruments 12

Unrealized foreign currency gains (359 ) Other taxes 597

Merger-related expenses, deal costs and re-audit costs 16,489

Adjusted Pro Forma EBITDA 485,008 Adjusted Pro Forma

EBITDA annualized $ 1,940,032 As of September 30,

2016: Debt $ 11,252,327 Debt on held for sale assets 65,981 Cash

(89,279 ) Restricted cash pertaining to debt (22,888 ) Consolidated

joint venture partners’ share of debt (80,938 ) Ventas share of

debt from unconsolidated entities 116,118 Net debt $

11,241,321 Net debt to Adjusted Pro Forma EBITDA 5.8

x

NON-GAAP FINANCIAL MEASURES

RECONCILIATION NOI and Same-Store Cash NOI

The Company considers NOI and same-store cash NOI to be

important supplemental measures to net income because they allow

investors, analysts and Company management to assess the Company’s

unlevered property-level operating results and to compare the

Company’s operating results with the operating results of other

real estate companies and between periods on a consistent basis.

The Company defines NOI as total revenues, less interest and other

income, property-level operating expenses and office building

services costs (including amounts in discontinued operations). Cash

receipts may differ due to straight-line recognition of certain

rental income and the application of other GAAP policies. The

Company defines same-store cash NOI as the NOI for properties

owned, consolidated and operational for the full period in both

comparison periods excluding the impact of non-cash items such as

straight-line rent and the impact of exchange rate movements across

the comparison periods. In certain cases, results for same-store

cash NOI may be adjusted to reflect non-recurring items and the

receipt of cash payments and fees not fully recognized as NOI in

the period. Same-store cash NOI excludes assets intended for

disposition and, for the SHOP portfolio, those properties that

transitioned operators after the start of the prior comparison

period.

NON-GAAP FINANCIAL MEASURES RECONCILIATION

(Dollars in thousands) Total Portfolio Same-Store Cash

NOI For the Three Months Ended

Percentage September 30, Increase 2016

2015 Total Revenues, Excluding Interest and

Other Income $ 866,554 $ 827,532 Less: Total Property-Level

Operating Expenses (361,117 ) (347,845 ) Office Building Services

Costs (974 ) (6,416 )

Net Operating Income 504,463

473,271 Adjustments: NOI Not Included in Same-Store

(47,519 ) (36,759 ) Straight-Lining of Rental Income (5,936 )

(8,353 ) Non-Cash Rental Income (4,709 ) (3,879 ) Non-Segment NOI

(32,426 ) (19,453 ) Constant Currency Adjustment — (845 )

(90,590 ) (69,289 ) Cash NOI as Reported $ 413,873 $

403,982

2.4 % NON-GAAP

FINANCIAL MEASURES RECONCILIATION (Dollars in thousands)

Triple-Net Portfolio Same-Store Cash NOI

For the Three Months Ended Percentage September

30, Increase 2016 2015 Total

Revenues, Excluding Interest and Other Income $ 211,670 $ 202,039

Less: Total Property-Level Operating Expenses — — Office Building

Services Costs — —

Net Operating Income

211,670 202,039 Adjustments: NOI Not Included

in Same-Store (30,893 ) (25,387 ) Straight-Lining of Rental Income

(2,607 ) (4,991 ) Non-Cash Rental Income (5,092 ) (4,601 ) Constant

Currency Adjustment — (898 ) (38,592 ) (35,877 ) Cash

NOI as Reported $ 173,078 $ 166,162

4.2

% NON-GAAP FINANCIAL MEASURES

RECONCILIATION (Dollars in thousands) Senior

Housing Operating Portfolio Same-Store Cash NOI

For the Three Months Ended Percentage September

30, Increase 2016 2015 Total

Revenues, Excluding Interest and Other Income $ 461,974 $ 454,825

Less: Total Property-Level Operating Expenses (312,145 ) (304,540 )

Office Building Services Costs — —

Net Operating

Income 149,829 150,285 Adjustments: NOI

Not Included in Same-Store (3,164 ) (6,505 ) Constant Currency

Adjustment — 53 (3,164 ) (6,452 ) Cash NOI as

Reported $ 146,665 $ 143,833

2.0 %

NON-GAAP FINANCIAL MEASURES RECONCILIATION

(Dollars in thousands) Office Portfolio Same-Store

Cash NOI For the Three Months Ended

Percentage September 30, Increase 2016

2015 Total Revenues, Excluding Interest and

Other Income $ 160,484 $ 151,214 Less: Total Property-Level

Operating Expenses (48,972 ) (43,305 ) Office Building Services

Costs (974 ) (6,416 )

Net Operating Income 110,538

101,493 Adjustments: NOI Not Included in Same-Store

(13,463 ) (4,867 ) Straight-Lining of Rental Income (3,329 ) (3,363

) Non-Cash Rental Income 383 722 (16,409 ) (7,508 )

Cash NOI as Reported $ 94,129 $ 93,985

0.2 %

Click here to subscribe to Mobile Alerts for

Ventas, Inc.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161028005397/en/

Ventas, Inc.Ryan K. Shannon(877) 4-VENTAS

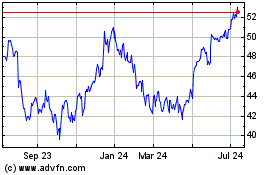

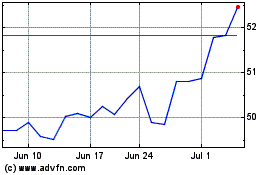

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024