British Airways Parent IAG Cuts Earnings Outlook -- Update

October 28 2016 - 6:31AM

Dow Jones News

By Robert Wall

LONDON-- British Airways parent International Consolidated

Airlines Group SA Friday cut its earnings outlook further after

third-quarter operating profit fell 3.6%, weighed down by the sharp

drop in sterling after the U.K. voted to leave the European

Union.

Operating profit for the crucial July through September period

was 1.21 billion euros ($1.32 billion), compared with EUR1.25

billion in the year-earlier quarter. The figure strips out some

nonoperating costs and taxes and in this year's third quarter

reflected a EUR162 million currency headwind.

IAG shares, down about 30% for the year after the Brexit vote

and sterling's fall, were up 4.2% in midmorning trade on Friday

amid signs that downward pressure on ticket prices from

overcapacity among European airlines is starting to moderate.

Declines in unit revenue are easing and may be near to bottoming

out, IAG Chief Financial Officer Enrique Dupuy told analysts.

To help ease overcapacity, IAG has repeatedly cut growth in

seats-for-sale throughout the year and again in the last quarter.

It now expects capacity to advance 9.5%, boosted by the addition of

Aer Lingus, compared with a 10.5% increase forecast at the outset

of the year. Mr. Dupuy said "this is something we are going to be

continuing."

Net profit rose 9.9% to EUR930 million from EUR848 million.

Sales in the period declined 4% to EUR6.5 billion.

The currency impact was "significant" though, IAG Chief

Executive Willie Walsh said.

IAG reports earnings in euros, but its British Airways unit that

generates most profit principally sells tickets in pounds which are

now worth less.

The airline group, which also includes Aer Lingus and Spanish

carriers Iberia and Vueling, cut its profit outlook for the year

following the referendum. The pound has depreciated further since

then against the dollar and the euro. Mr. Walsh said the guidance

in July was based on the prevailing exchange rates now changed.

IAG Friday said it would deliver a full-year operating profit of

EUR2.5 billion. It had already revised its outlook down to low

double-digit growth in its adjusted operating profit beyond the

EUR2.3 billion generated in 2015. IAG began the year expecting to

deliver an operating profit of about EUR3.2 billion

European airlines have faced a multitude of headwinds weighing

on earnings. Ticket prices are plummeting because of overcapacity,

terror attacks have spooked passengers and repeated

air-traffic-control strikes have led to thousands of flight

cancellations.

Mr. Walsh said trading conditions said the business conditions

were "tough," with low growth in Europe and weakness in markets

such as Brazil. Conditions are worse than expected a year ago, he

said, and had not improved since the Brexit vote.

The impact from air-traffic control strikes this year has been

more pronounced than in prior years, he added.

Britain's June 23 vote to leave the EU has led the country's

currency fall to more than 30-year lows. IAG isn't the only airline

to suffer. Ryanair Holdings PLC, Europe's biggest discount airline,

in October said its profit in the fiscal year ending March 31,

2017, would advance more slowly than expected because of the

currency headwind.

Mr. Walsh, an Irishman who said he personally had opposed

Britain leaving the EU, kept the carrier from joining others in

lobbying to retain membership in the trade bloc, arguing an exit

wouldn't materially impact the airline.

British Airways may raise ticket prices to offset sterling's

weakness, Mr. Walsh said. However, he added that the currency

weakness also have given the carrier a competitive edge on the

important trans-Atlantic market because many of its costs have

effectively fallen compared with U.S. rivals.

Britons were still traveling abroad for vacations, Mr. Walsh

said, though trip lengths are shorter.

Even before the Brexit vote, Mr. Walsh had signaled IAG would

work hard this year to improve BA's competitiveness. The company

announced a first EUR62 million restructuring charge for the

airline, with more planned.

IAG on Thursday said it would pay an interim dividend of EUR0.11

per share, a 10% increase over the prior-year period, which it

expects to be about half of the full-year payout.

IAG also said British Airways agreed with pension trustees a

technical deficit of GBP2.8 billion ($3.4 billion), only slightly

higher than the early projection. Annual payments are little

changed.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

October 28, 2016 06:16 ET (10:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

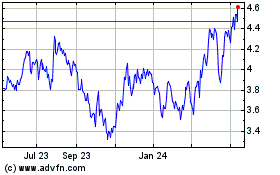

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

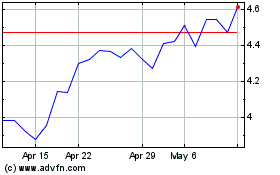

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Apr 2023 to Apr 2024