NXP Deal Adds to Qualcomm CEO's Tumultuous Tenure

October 27 2016 - 4:29PM

Dow Jones News

By Don Clark

Steve Mollenkopf started his career as a chip engineer. But his

latest exploit might land him in the annals of financial

engineering.

Qualcomm Inc.'s chief executive is driving the semiconductor

industry's largest-ever acquisition, a $39 billion all-cash deal

for NXP Semiconductors NV that will transform Mr. Mollenkopf's

business, more than double the number of employees under his

direction and take Qualcomm into manufacturing for the first

time.

Mr. Mollenkopf acknowledged the challenges ahead in his

customary soft-spoken, confident style, the same tone he maintained

in recent years as Qualcomm weathered a major antitrust

investigation in China and high-profile pressure from an activist

investor.

"We've been through a lot," Mr. Mollenkopf said in an

interview.

But he said he "feels good" about his ability to oversee the

massive job of integrating NXP, a Netherlands-based company that

inherited sprawling semiconductor operations that began more than

60 years ago as operations of Philips NV and Motorola Inc.

"This feels like the type of ambition that is Qualcomm," Mr.

Mollenkopf said.

The deal, he said, should help Qualcomm more quickly move into

automotive chips and other products that are quickly adding

communications and processing power to cars. That push is

increasingly important as Qualcomm's core business in chips for

smartphones comes under pressure from slowing sales in that

market.

Mr. Mollenkopf, 47 years old, was promoted to CEO from chief

operating officer in 2014 after nearly 20 years at the company,

taking over from Chairman Paul Jacobs, the son of founder and

former CEO Irwin Jacobs -- the first person outside the Jacobs

family to lead the company. The company called the transition a

long-planned decision, but also indicated it may have been

accelerated by overtures from other potential employers.

An electrical engineer by training -- he studied at Virginia

Polytechnic Institute before earning a master's degree in the field

from the University of Michigan -- Mr. Mollenkopf has a distinctly

low-key personal style, even compared with the staid habits of his

predecessor. He said he currently drives an SUV, make and model

unspecified.

"I used to drive a Tesla," he said. "I'm waiting to get the next

one."

Mr. Mollenkopf spearheaded what had previously been Qualcomm's

biggest acquisition, a $3.1 billion deal in 2011 for Atheros

Communications Inc. that added a substantial business in Wi-Fi

chips.

That tie-up pales in comparison with the $39 billion deal to

acquire NXP, which has roughly 44,000 employees compared with

Qualcomm's roughly 30,000 by Mr. Mollenkopf's estimate. The Dutch

company, which last year completed the acquisition of Freescale

Semiconductor Inc., sells thousands of products to more than 25,000

customers. Qualcomm, by contrast, sells a much narrower line of

chips to scores of handset makers and other customers.

NXP also has seven factories that turn silicon wafers into

chips, manufacturing about half the products the company sells.

Industry executives say chip fabrication will require entirely new

skills of Qualcomm, which relies on external manufacturing services

to produce chips it designs.

Not only was Qualcomm a pioneer in the so-called fabless

semiconductor business model; Mr. Mollenkopf himself was the

chairman for two years of the Global Semiconductor Alliance, an

industry group originally founded to represent the interest of chip

companies without factories.

But Mr. Mollenkopf and some analysts say people tend to overlook

the expertise Qualcomm has built up over the years through

overseeing its manufacturing partners. He noted that the company

has been learning more about manufacturing issues through a joint

venture announced in January with Japan's TDK Corp. to make and

sell some kinds of wireless components.

Qualcomm will lean heavily on NXP's existing managers to oversee

day-to-day manufacturing operations, Mr. Mollenkopf said, noting

they successfully integrated Freescale's factories with their own.

"They learned a lot along the way," he said.

While Qualcomm is best-known for designing chips -- long used in

smartphones from the likes of Apple Inc. and Samsung Semiconductor

Co. -- the company gets more than half of its profit from licensing

wireless patents to handset makers. Such competitors and other

companies have at times complained to regulators about Qualcomm's

market muscle, leading to a string of antitrust investigations.

In February 2015, Qualcomm agreed to pay a $975 million fine to

Chinese authorities as part of an antitrust settlement, which also

included several changes to Qualcomm's practices in licensing

patents for mobile phones sold in China.

That business model came under more scrutiny the same year when

activist investor Jana Partners purchased a stake worth more than

$2 billion in Qualcomm and pressed for changes aimed at boosting

the company's share price. Qualcomm considered the possibility of

breaking its chip business apart from its patent-licensing

business, but wound up opting for other restructuring moves that

included $1.4 billion in expense cuts.

Mr. Mollenkopf argued that the investments Qualcomm makes in

inventing and patenting technology provide an advance look at what

features will be needed in chips as markets such as smartphones

evolve. The company, for example, has been deeply involved in

influencing the evolution of the next generation of cellular

technology, known as 5G.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

October 27, 2016 16:14 ET (20:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

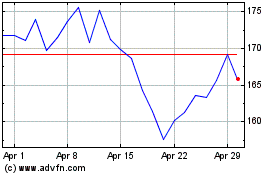

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024