Kite Realty Group Trust (NYSE: KRG) (the “Company”) announced

operating results for the third quarter ended September 30, 2016.

The attached financial statements, exhibits and reconciliations of

non-GAAP measures provide the details of these results.

Third Quarter Highlights

- Net loss attributable to common

shareholders was $1.7 million, or $0.02 per diluted common

share.

- Funds From Operations (“FFO”), as

adjusted, was $0.52 per diluted common share, or $44.7

million.

- FFO, as defined by NAREIT, was $0.51

per diluted common share, or $43.6 million.

- Weighted average debt maturities

increased to 6.6 years from 5.0 years in the prior quarter.

- The Company’s operating partnership,

Kite Realty Group, L.P., completed its inaugural public offering

for $300 million of 4.00% Senior Notes due 2026.

- Small shop occupancy was 88.7%, an

increase of 120 basis points compared to the same period in the

prior year.

- Same-property Net Operating Income

(“NOI”) increased 2.1% for the comparable operating portfolio, or

2.9% excluding the impact of the Company’s Redevelopment, Repurpose

and Reposition ("3-R") initiative, both percentages compared to the

same period in the prior year.

- The Company commenced construction on

four additional 3-R projects, for a total of 12 projects in

process. These 12 projects have an estimated incremental return

averaging approximately 9% to 10%, and aggregate costs for all of

these projects are expected to range between $58.1 million and

$67.0 million.

“Our third quarter performance marks another successful quarter

for Kite and has positioned us to finish 2016 on a strong note,”

said John A. Kite, Chairman and CEO. “Our team’s aggressive efforts

further improved our small shop leasing by 120 basis points

compared to last year, reaching 88.7%. The momentum also continued

for our anchor tenants as we opened over 180,000 square feet of

space since the end of the second quarter. Finally, we executed on

several balance sheet initiatives, furthering our strong position,

including our inaugural $300 million public bond offering as we

continue to enhance our balance sheet flexibility.”

Financial & Portfolio

Results

Net loss attributable to common shareholders for the three

months ended September 30, 2016, was $1.7 million compared to net

income of $0.4 million for the same period in 2015. Net loss

attributable to common shareholders for the nine months ended

September 30, 2016, was $2.2 million compared to net income of

$10.1 million for the same period in 2015.

FFO, as adjusted, for the three months ended September 30, 2016,

was $44.7 million, or $0.52 per diluted common share, for the Kite

Portfolio, compared to $43.9 million, or $0.51 per diluted common

share, for the same period in the prior year. FFO, as adjusted, was

$132.9 million, or $1.56 per diluted common share, for the nine

months ended September 30, 2016, compared to $127.8 million, or

$1.50 per diluted common share, for the same period in 2015.

FFO, as defined by NAREIT, was $43.6 million, or $0.51 per

diluted common share, for real estate properties in which the

Company’s operating subsidiaries own an interest (to which we refer

as the “Kite Portfolio”), compared to $42.8 million, or $0.50 per

diluted common share, for the same period in the prior year. For

the nine months ended September 30, 2016, FFO, as defined by

NAREIT, was $128.5 million, or $1.50 per diluted common share,

compared to $130.7 million, or $1.53 per diluted common share, for

the same period in 2015.

Same-property NOI increased 2.1% for the comparable operating

portfolio, which includes 103 retail operating properties. If the

impact of the Company’s 3-R initiative is excluded, same-property

NOI increased 2.9%. Both of these percentages are based on

comparisons to the same period in the prior year.

As of September 30, 2016, the Company owned interests in 121

operating, development and redevelopment properties totaling

approximately 24 million square feet. The owned gross leasable area

in the Company’s retail operating portfolio was 95.2% leased as of

September 30, 2016.

The Company executed leases on 110 individual spaces for a total

of 627,925 square feet during the third quarter of 2016, including

84 comparable new and renewal leases for 519,271 owned square feet.

The Company generated positive cash spreads of 13.1% on comparable

new leases executed during the quarter and 8.7% on comparable

renewals, for a blended spread of 9.7%.

Balance Sheet

During the third quarter, the Company refinanced $700 million in

unsecured bank facilities, including the extensions of $200 million

of its $400 million term loan for an additional five years to

mature in 2021 and its $500 million revolving credit facility to

mature in 2021, including extension options. The revised terms of

the unsecured financings improved the Company’s borrowing base,

lowered the interest rate and extended the term to maturity.

The Company also completed its inaugural $300 million public

bond offering of 4.00% Senior Notes due 2026. The majority of the

net proceeds from the offering were used to repay the $200 million

term loan maturing July 1, 2019 (or January 1, 2020, with the

six-month extension). The remaining net proceeds were used, along

with funds from the line of credit, to pay off approximately $70

million of CMBS debt that matured in the third quarter and $76

million attributable to the Parkside construction loan. As a result

of these initiatives, the Company’s weighted average debt maturity

extended from 5 years in the prior period to 6.6 years at the end

of the third quarter.

Redevelopment and

Development

The Company’s 3-R initiative, which includes a total of 24

different projects in various stages, continued to progress during

the third quarter. The Company commenced construction at Burnt

Store Promenade (Punta Gorda, FL), Centennial Gateway (Las Vegas,

NV), Traders Point (Indianapolis, IN), and Trussville Promenade

(Birmingham, AL). Combined with projects already in process, the

Company now has 12 3-R projects under construction, with an

estimated incremental return averaging approximately 9% to 10% and

aggregate estimated costs of $58.1 million to $67.0 million.

Earnings Guidance

The Company is updating its guidance for 2016 FFO, as adjusted,

to $2.05 to $2.07 from $2.04 to $2.08 per diluted common share.

This guidance excludes certain non-recurring items such as

transaction costs, debt extinguishment gains/losses and certain

other income and charges. Please refer to the full list of guidance

assumptions on page 37 of the Company’s Quarterly Financial

Supplemental.

Guidance Range For

Full Year 2016 Low High Consolidated

net loss per diluted common share $ (0.04 ) $ (0.02 ) Add:

Depreciation, amortization and other 2.03

2.03 FFO, per diluted common share, as defined by

NAREIT 1.99 2.01 Add: Transaction costs and certain other charges

0.06 0.06

FFO, as adjusted,

per diluted common share $ 2.05 $

2.07

Earnings Conference Call

The Company will conduct a conference call to discuss its

financial results on Friday, October 28, 2016, at 1:00 p.m. EDT. A

live webcast of the conference call will be available online on the

Company’s corporate website at www.kiterealty.com. The dial-in

numbers are (574) 990-9933 for domestic callers and (844) 309-0605

for toll-free (passcode 67725615). In addition, a webcast replay

link will be available on the corporate website.

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of September 30, 2016,

the Company owned interests in a portfolio of 121 operating,

development and redevelopment properties totaling approximately 24

million total square feet across 20 states. For more information,

please visit the Company’s website at www.kiterealty.com.

Safe Harbor

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy, as well as

economic uncertainty caused by fluctuations in the prices of oil

and other energy sources, financing risks, including the

availability of and costs associated with sources of liquidity, the

Company’s ability to refinance, or extend the maturity dates of,

its indebtedness, the level and volatility of interest rates, the

financial stability of tenants, including their ability to pay rent

and the risk of tenant bankruptcies, the competitive environment in

which the Company operates, acquisition, disposition, development,

joint venture, property ownership and management risks, the

Company’s ability to maintain its status as a real estate

investment trust for federal income tax purposes, potential

environmental and other liabilities, impairment in the value of

real estate property the Company owns, risks related to the

geographical concentration of the Company’s properties in Florida,

Indiana and Texas, insurance costs and coverage, risks associated

with cybersecurity attacks and the loss of confidential information

and other business interruptions, the dilutive effects of future

offerings of issuing additional securities, and other factors

affecting the real estate industry generally. The Company refers

you to the documents filed by the Company from time to time with

the SEC, specifically the section titled “Risk Factors” in the

Company’s and the Operating Partnership’s Annual Report on Form

10-K for the year ended December 31, 2015, which discuss these and

other factors that could adversely affect the Company’s results.

The Company undertakes no obligation to publicly update or revise

these forward-looking statements, whether as a result of new

information, future events or otherwise.

Kite Realty Group Trust

Consolidated Balance Sheets (Unaudited) ($

in thousands) September 30, December 31,

2016 2015 Assets: Investment properties, at

cost $ 3,990,208 $ 3,933,140 Less: accumulated depreciation

(531,946 ) (432,295 ) 3,458,262 3,500,845 Cash and cash

equivalents 28,793 33,880 Tenant and other receivables, including

accrued straight-line rent of $27,875 and $23,809 respectively, net

of allowance for uncollectible accounts 50,350 51,101 Restricted

cash and escrow deposits 9,585 13,476 Deferred costs and

intangibles, net 133,114 148,274 Prepaid and other assets 10,814

8,852

Total Assets $ 3,690,918 $

3,756,428

Liabilities and Shareholders’ Equity:

Mortgage and other indebtedness, net $ 1,732,344 $ 1,724,449

Accounts payable and accrued expenses 93,440 81,356 Deferred

revenue and other liabilities 120,550 131,559

Total Liabilities 1,946,334 1,937,364 Commitments and

contingencies Limited Partners’ interests in the Operating

Partnership and other redeemable noncontrolling interests 99,478

92,315

Shareholders’ Equity: Kite Realty Group Trust

Shareholders’ Equity:

Common Shares, $.01 par value, 225,000,000

shares authorized, 83,545,486 and 83,334,865 shares issued and

outstanding at September 30, 2016 and December 31, 2015,

respectively

835 833 Additional paid in capital 2,049,702 2,050,545 Accumulated

other comprehensive loss (8,738 ) (2,145 ) Accumulated deficit

(397,391 ) (323,257 )

Total Kite Realty Group Trust

Shareholders’ Equity 1,644,408 1,725,976 Noncontrolling

Interests 698 773

Total Equity 1,645,106

1,726,749

Total Liabilities and Shareholders'

Equity $ 3,690,918 $ 3,756,428

Kite Realty

Group Trust Consolidated Statements of Operations For

the Three and Nine Months Ended September 30, 2016 and 2015

(Unaudited) ($ in thousands, except per share

data) Three Months Ended Nine Months Ended

September 30, September 30, 2016 2015

2016 2015 Revenue: Minimum rent $ 69,518 $

66,279 $ 205,436 $ 196,656 Tenant reimbursements 17,531 16,787

52,691 51,891 Other property related revenue 2,073 4,081

7,120 9,163

Total revenue 89,122 87,147

265,247 257,710

Expenses: Property operating 11,916 11,994

35,454 36,519 Real estate taxes 10,690 10,045 32,327 29,821

General, administrative, and other 5,081 4,559 15,228 14,131

Transaction costs — 1,089 2,771 1,550 Depreciation and amortization

45,543 42,549 131,625 124,196

Total

expenses 73,230 70,236 217,405 206,217

Operating income 15,892 16,911 47,842 51,493 Interest

expense (17,139 ) (13,881 ) (47,964 ) (40,995 ) Income tax expense

of taxable REIT subsidiary (15 ) (9 ) (763 ) (134 ) Gain on

settlement — — — 4,520 Other expense, net — (60 ) (94 ) (189

)

(Loss) income from continuing operations (1,262 ) 2,961

(979 ) 14,695 Gain on sales of operating properties — —

194 3,363

Net (loss) income (1,262 )

2,961 (785 ) 18,058 Net income attributable to noncontrolling

interest (420 ) (435 ) (1,391 ) (1,626 ) Dividends on preferred

shares — (2,114 ) — (6,342 )

Net (loss) income

attributable to Kite Realty Group Trust common shareholders $

(1,682 ) $ 412 $ (2,176 ) $ 10,090

(Loss)

income per common share - basic and diluted $ (0.02 ) $ 0.00

$ (0.03 ) $ 0.12 Weighted average common

shares outstanding - basic 83,474,348 83,325,074

83,399,813 83,453,660 Weighted average common shares

outstanding - diluted 83,474,348 83,433,379

83,399,813 83,566,554

Common dividends declared

per common share $ 0.2875 $ 0.2725 $ 0.8625

$ 0.8175

Kite Realty Group Trust Funds From

Operations For the Three and Nine Months Ended September 30,

2016 and 2015 (Unaudited) ($ in thousands,

except per share data) Three Months Ended Nine Months

Ended September 30, September 30, 2016

2015 2016 2015 Funds From Operations

Consolidated net (loss) income $ (1,262 ) $ 2,961 $ (785 ) $ 18,058

Less: cash dividends on preferred shares — (2,114 ) — (6,342 )

Less: net income attributable to noncontrolling interests in

properties (461 ) (415 ) (1,383 ) (1,416 ) Less: gains on sales of

operating properties — — (194 ) (3,363 ) Add: depreciation and

amortization of consolidated entities, net of noncontrolling

interests 45,310 42,387 130,909 123,812

Funds From Operations of the Operating Partnership1 43,587 42,819

128,547 130,749 Less: Limited Partners' interests in Funds From

Operations (918 ) (967 ) (2,708 ) (2,698 ) Funds From Operations

attributable to Kite Realty Group Trust common shareholders $

42,669 $ 41,852 $ 125,839 $ 128,051 FFO

per share of the Operating Partnership - basic $ 0.51 $ 0.50

$ 1.51 $ 1.53 FFO per share of the Operating

Partnership - diluted $ 0.51 $ 0.50 $ 1.50 $

1.53 Funds From Operations of the Operating

Partnership1 $ 43,587 $ 42,819 $ 128,547 $ 130,749 Less: gain on

settlement — — — (4,520 ) Add: accelerated amortization of debt

issuance costs (non-cash) 1,121 — 1,121 — Add: transaction costs —

1,089 2,771 1,550 Add: severance charge — — 500

— Funds From Operations of the Operating Partnership,

as adjusted $ 44,708 $ 43,908 $ 132,939 $

127,779 FFO per share of the Operating Partnership, as

adjusted - basic $ 0.52 $ 0.52 $ 1.56 $ 1.50

FFO per share of the Operating Partnership, as adjusted -

diluted $ 0.52 $ 0.51 $ 1.56 $ 1.50

Weighted average Common Shares outstanding - basic

83,474,348 83,325,074 83,399,813 83,453,660

Weighted average Common Shares outstanding - diluted

83,565,227 83,433,379 83,488,618 83,566,554

Weighted average Common Shares and Units outstanding - basic

85,417,753 85,238,537 85,336,859 85,214,390

Weighted average Common Shares and Units outstanding -

diluted 85,508,632 85,346,842 85,425,664

85,327,283

Funds From Operations per

diluted share Consolidated net (loss) income $ (0.01 ) $ 0.03 $

(0.01 ) $ 0.21 Less: cash dividends on preferred shares — (0.02 ) —

(0.07 ) Less: net income attributable to noncontrolling interests

in properties (0.01 ) (0.01 ) (0.02 ) (0.02 ) Less: gains on sales

of operating properties — — — (0.04 ) Add: depreciation and

amortization of consolidated entities, net of noncontrolling

interests 0.53 0.50 1.53 1.45 Funds

From Operations of the Operating Partnership per diluted share1 $

0.51 $ 0.50 $ 1.50 $ 1.53 Funds

From Operations of the Operating Partnership per diluted share1 $

0.51 $ 0.50 $ 1.50 $ 1.53 Less: gain on settlement — — — (0.05 )

Add: accelerated amortization of debt issuance costs 0.01 — 0.01 —

Add: transaction costs — 0.01 0.04 0.02 Add: severance charge —

— 0.01 — Funds From Operations of the

Operating Partnership per diluted share, as adjusted $ 0.52

$ 0.51 $ 1.56 $ 1.50

____________________

1

“Funds From Operations of the Kite Portfolio" measures 100%

of the operating performance of the Operating Partnership’s real

estate properties and construction and service subsidiaries in

which the Company owns an interest. “Funds From Operations

attributable to Kite Realty Group Trust common shareholders”

reflects a reduction for the redeemable noncontrolling weighted

average diluted interest in the Operating Partnership.

Funds from Operations (FFO) is a widely used performance measure

for real estate companies and is provided here as a supplemental

measure of operating performance. We calculate FFO in accordance

with the best practices described in the April 2002 National Policy

Bulletin of the National Association of Real Estate Investment

Trusts (NAREIT), which we refer to as the White Paper. The White

Paper defines FFO as net income (determined in accordance with

generally accepted accounting principles (GAAP)), excluding gains

(or losses) from sales and impairments of depreciated property,

plus depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real estate owner

and operator, we believe that FFO is helpful to investors in

measuring our operational performance because it excludes various

items included in net income that do not relate to or are not

indicative of our operating performance, such as gains or losses

from sales of depreciated property and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. For informational purposes,

we have also provided FFO adjusted for a severance charge,

accelerated amortization of debt issuance costs and transaction

costs in 2016 and a gain on settlement and transaction costs in

2015. We believe this supplemental information provides a

meaningful measure of our operating performance. We believe our

presentation of FFO, as adjusted, provides investors with another

financial measure that may facilitate comparison of operating

performance between periods and among our peer companies. FFO

should not be considered as an alternative to net income

(determined in accordance with GAAP) as an indicator of our

financial performance, is not an alternative to cash flow from

operating activities (determined in accordance with GAAP) as a

measure of our liquidity, and is not indicative of funds available

to satisfy our cash needs, including our ability to make

distributions. Our computation of FFO may not be comparable to FFO

reported by other REITs that do not define the term in accordance

with the current NAREIT definition or that interpret the current

NAREIT definition differently than we do.

Kite Realty Group Trust Same

Property Net Operating Income For the Three and Nine Months

Ended September 30, 2016 and 2015 (Unaudited)

($ in thousands) Three Months Ended September 30,

Nine Months Ended September 30, 2016 2015 %

Change 2016 2015 % Change Number of

properties for the quarter1 103 103

Leased percentage

95.3 % 95.4 % 95.3 % 95.2 %

Economic Occupancy

percentage2 93.6 % 93.7 % 93.8 % 93.6 % Minimum

rent $ 55,630 $ 54,828 $ 164,809 $ 162,155 Tenant recoveries 14,973

14,931 44,865 45,038 Other income 614 551 1,177

1,120 71,217 70,310 210,851 208,313 Property

operating expenses (8,619 ) (8,689 ) (25,360 ) (27,517 ) Real

estate taxes (8,936 ) (9,042 ) (27,123 ) (26,576 ) (17,555 )

(17,731 ) (52,483 ) (54,093 )

Net operating income - same

properties3 $ 53,662 $

52,579 2.1 % $ 158,368

$ 154,220 2.7 % Net

operating income - same properties excluding the impact of the 3-R

initiative4 2.9 % Reconciliation of

Same Property NOI to Most Directly Comparable GAAP Measure: Net

operating income - same properties $ 53,662 $ 52,579 $ 158,368 $

154,220 Net operating income - non-same activity5 12,854 12,529

39,098 37,150 Other expense, net (15 ) (69 ) (857 ) (323 ) General,

administrative and other (5,081 ) (4,559 ) (15,228 ) (14,131 )

Transaction costs — (1,089 ) (2,771 ) (1,550 ) Depreciation expense

(45,543 ) (42,549 ) (131,625 ) (124,196 ) Interest expense (17,139

) (13,881 ) (47,964 ) (40,995 ) Gain on settlement — — — 4,520

Gains on sales of operating properties — — 194 3,363 Net income

attributable to noncontrolling interests (420 ) (435 ) (1,391 )

(1,626 ) Dividends on preferred shares — (2,114 ) —

(6,342 ) Net (loss) income attributable to common shareholders $

(1,682 ) $ 412 $ (2,176 ) $ 10,090

____________________

1

Same property analysis excludes operating properties in

redevelopment as well as office properties (Thirty South Meridian

and Eddy Street Commons).

2

Excludes leases that are signed but for which tenants have not yet

commenced the payment of cash rent. Calculated as a weighted

average based on the timing of cash rent commencement during the

period.

3

Same property net operating income excludes net gains from outlot

sales, straight-line rent revenue, bad debt expense and recoveries,

lease termination fees, amortization of lease intangibles and

significant prior year expense recoveries and adjustments, if any.

4

See pages 27 and 28 for further detail of

the properties included in the 3-R initiative.

5

Includes non-cash activity across the portfolio as well as net

operating income from properties not included in the same property

pool.

The Company believes that Net Operating Income ("NOI") is

helpful to investors as a measure of its operating performance

because it excludes various items included in net income that do

not relate to or are not indicative of its operating performance,

such as depreciation and amortization, interest expense, and

impairment, if any. The Company believes that Same Property NOI is

helpful to investors as a measure of its operating performance

because it includes only the NOI of properties that have been owned

for the full period presented, which eliminates disparities in net

income due to the redevelopment, acquisition or disposition of

properties during the particular period presented and thus provides

a more consistent metric for the comparison of the Company's

properties. NOI and Same Property NOI should not, however, be

considered as alternatives to net income (calculated in accordance

with GAAP) as indicators of the Company's financial performance.

The Company’s computation of Same Property NOI may differ from the

methodology used by other REITs, and therefore, may not be

comparable to such other REITs.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027006638/en/

Kite Realty Group TrustMaggie Daniels, CFA Investor Relations

and Strategy317-713-7644mdaniels@kiterealty.com

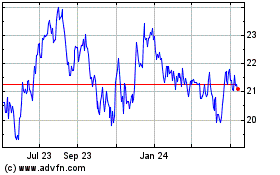

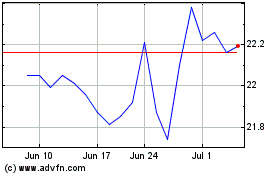

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024