Praxair Lowers Earnings View Amid Sluggishness

October 27 2016 - 8:53AM

Dow Jones News

By Anne Steele

Industrial-gas company Praxair Inc. (PX) lowered its earnings

forecast for the year and gave a downbeat outlook for the fourth

quarter amid soft manufacturing activity in the U.S. and

elsewhere.

Chief Executive Steve Angel, who had said currency translation

headwinds would ease though underlying economic improvement was

unlikely for the second half of the year, called the third-quarter

results mixed.

Mr. Angel noted "strong demand in more resilient food, beverage

and healthcare markets, but persistent weakness from industrial

sectors like manufacturing and upstream energy."

The company sells packaged gases including atmospheric gases

found in air like carbon dioxide, hydrogen and helium. Lower

volumes in North and South America due to weaker manufacturing

activity in the U.S. and Brazil offset volume growth from new

on-site projects, primarily in South America, Asia and Europe.

For 2016, Praxair now expects adjusted per-share earnings in the

range of $5.44 to $5.51, compared with its previous guidance for

earnings of $5.45 to $5.60 a share. For the fourth quarter, Praxair

expects per-share earnings in the range of $1.36 to $1.43, while

analysts polled by Thomson Reuters expected $1.46 a share.

In all for the September quarter, Praxair reported a profit of

$339 million, or $1.18 a share, down from $401 million, or $1.40 a

share, a year earlier. Excluding a charge, the company earned $1.41

a share; it expected per-share earnings in the range of $1.35 to

$1.42.

Sales rose 1.1% to $2.72 billion. Analysts polled by Thomson

Reuters were expecting $2.7 billion. Praxair said the top line was

dented 1% by currency translation.

Shares, which have climbed 8.5% in the past 12 months, were

inactive premarket.

Write to Anne Steele at anne.steele@wsj.com.

(END) Dow Jones Newswires

October 27, 2016 08:38 ET (12:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

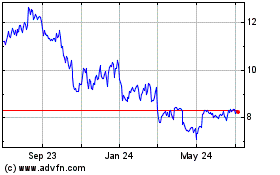

P10 (NYSE:PX)

Historical Stock Chart

From Mar 2024 to Apr 2024

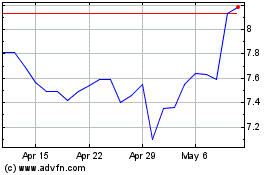

P10 (NYSE:PX)

Historical Stock Chart

From Apr 2023 to Apr 2024