Blue Chips Rise Despite Drag From Apple -- WSJ

October 27 2016 - 3:02AM

Dow Jones News

By Akane Otani and Mike Bird

The Dow Jones Industrial Average rose as a gain by Boeing helped

offset Apple's losses.

Corporate earnings have driven some of the largest moves in

stocks over the past week. More than a third of S&P 500

companies have reported quarterly earnings, according to FactSet,

with energy, industrial and technology companies posting the

weakest results so far.

Apple, which reported its first annual revenue decrease in 15

years, was the biggest decliner in the Dow industrials on

Wednesday, falling $2.66, or 2.2%, to $115.59. The company is the

biggest drag on the S&P 500 tech sector's third-quarter

earnings, according to FactSet analyst John Butters.

Ahead of the earnings report Tuesday, Apple's share price had

risen 15% from a recent low Sept. 9, two days after the company

unveiled the latest iPhone.

The Dow industrials got their biggest lift Wednesday from

Boeing, which contributed nearly 45 points to the index after the

aircraft maker raised its full-year guidance. Boeing rose 6.52, or

4.7%, to 145.54, its highest level of the year.

The blue-chip index recovered from earlier losses and closed up

30.06 points, or 0.2%, at 18199.33.

"Earnings growth is going to be really, really key for continued

growth in the market, even though we've muddled along without that

for a while, " said Karyn Cavanaugh, senior market strategist at

Voya Investment Management.

The Nasdaq Composite fell 33.13 points, or 0.6%, to 5250.27, and

the S&P 500 shed 3.73 points, or 0.2%, to 2139.43.

Chipotle Mexican Grill fell 37.65, or 9.3%, to 368.02 after the

burrito chain reported declines in quarterly sales and profit

Tuesday as it recovers from a string of food-safety incidents.

Southwest Airlines lost 3.55, or 8.5%, to 38.40 after it

signaled that a weak revenue environment could persist.

U.S. crude-oil prices fell to a three-week low. A U.S. Energy

Information Administration report showed that crude stockpiles

dropped by 553,000 barrels in the week ended Oct. 21. But some

analysts said the drop wasn't large enough to shake off concerns

about the Organization of the Petroleum Exporting Countries'

ability to reach a consensus about cutting production. U.S. crude

fell 1.6% to $49.18 a barrel.

Bond yields in developed markets pushed higher. The yield on the

10-year Treasury note was at 1.790%, compared with 1.758%

Tuesday.

Elsewhere around the globe, stocks mostly fell. The Stoxx Europe

600 index pulled back 0.4% and the U.K.'s FTSE 100 index shed 0.8%.

The British pound bounced back against the dollar, rising 0.5% to

$1.2246 after falling Tuesday.

In Asian trading Wednesday, stocks closed broadly lower, with

Hong Kong's Hang Seng falling 1%. Japanese equities bucked the

trend as the Nikkei Stock Average rose 0.2%.

Corrections & Amplifications: European stocks opened lower

Wednesday, and German 10-year yields rose in intraday trading to

0.08% from around 0.02% on Tuesday. Earlier versions of this

article misstated the day of the week as Thursday and incorrectly

gave the figures as 0.57% and 0.22%.

Write to Akane Otani at akane.otani@wsj.com and Mike Bird at

Mike.Bird@wsj.com

(END) Dow Jones Newswires

October 27, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

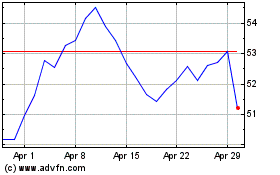

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

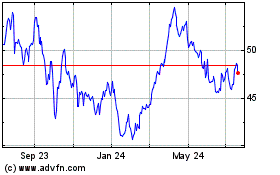

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024