Current Report Filing (8-k)

October 26 2016 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 22, 2016

______________

CoroWare, Inc.

(Exact name of registrant as specified in its charter)

______________

|

|

|

|

|

Delaware

|

000-33231

|

95-4868120

|

|

(State of Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

601 108

th

Avenue Northeast, Suite 1900

Bellevue, WA 98004

(Address of principal executive offices)

(800) 641-2676

(Registrant's telephone number, including area code)

______________

Copies to:

Gary L. Blum, Esq.

Law Offices of Gary L. Blum

3278 Wilshire Boulevard, Suite 603

Los Angeles, CA 90010

Phone: (213) 381-7450

Fax: (213) 384-1035

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement.

On October 22, 2016, CoroWare, Inc. (“Coroware”) received a formal notice of default from YA Global Investments, LP (“YA Global”) with respect to various loan agreements (“Loan Agreements”). The formal notice of default is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Coroware, in its Form 8-K filed on February 9, 2016, described its entry into a Forbearance Agreement dated February 5, 2016 with YA Global whereby YA Global and Coroware agreed to consolidate outstanding convertible notes previously in default totaling $2,829,690 (principal and interest) owed to YA Global into a new Amended, Restated and Consolidated Convertible Debenture (“Debenture”) of the same amount secured by Coroware intellectual property and other assets, and YA Global agreed to refrain from converting the new Debenture or exercising any rights or remedies that they may have as specified in the new Debenture over a period ending on April 30, 2016, unless a breach of the Forbearance Agreement or the new Debenture occurs. The conditions of the Forbearance Agreement have already been fulfilled by Coroware. The Forbearance Agreement and the Debenture comprise the Loan Agreements.

The Debenture, issued on February 9, 2016 in the principal amount of $2,829,690, bears annual interest of 6%, and has a Maturity Date of April 30, 2016, which may be extended at the option of YA Global provided no Event of Default (such as failure to timely pay any amount due, initiation of Coroware bankruptcy proceedings, cessation of quoting or listing of Coroware common stock for five (5) consecutive trading days, etc.) shall have occurred. Interest, in case of an Event of Default, at YA Global’s option, shall be increased to 18% per annum. The Debenture is secured by a pledge of Coroware assets, intellectual property and Coroware guaranties pursuant to an Amended and Restated Global Security Agreement, an Amended and Restated Intellectual Property Security Agreement) and a Global Guaranty Agreement. The Debenture is convertible at any time by YA Global, subject to a 9.99% limitation on the total amount of outstanding common shares owned by YA Global after a conversion; however this limitation may be waived by YA Global upon not less than 65 days prior notice to Coroware. The Conversion Price is the lesser of (a) $0.0003 or (b) fifty percent (50%) of the lowest daily Volume Weighted Average Price of the Common Stock during the twenty (20) consecutive trading days immediately preceding the date of conversion.

The foregoing description of the agreements referenced above is a general description only and does not purport to be a complete description of all terms of the agreements.

As a result of Coroware

’

s defaults on the Loan Agreements, including but not limited to failure to make payment in accordance with the Loan Agreements, YA Global has accelerated the amount to be immediately due and owing under the Loan Agreements to be a total of $2,885,607.98 ($2,769,990.00 principal and $115,617.98 interest (as of Oct. 18, 2016)). Interest accrues at the rate of $446.46 per day. According to the notice of default, YA Global will proceed with litigation unless Coroware has paid the full amount due and owing by October 28, 2016.

The notice of default notes that YA Global is the senior secured creditor with respect to all accounts receivable of Coroware (and its subsidiaries) and directs Coroware to inform all account debtors to remit all sums due Coroware to YA Global.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Formal notice of default by Coroware, Inc. with respect to various loan agreements from YA Global Investments, LP dated September 21, 2016

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

COROWARE, INC.

|

|

|

|

|

|

|

|

Date: October 25, 2016

|

By:

|

/s/ Lloyd Spencer

|

|

|

|

|

Lloyd Spencer

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

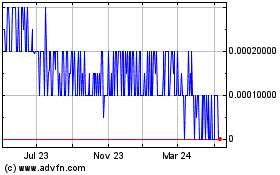

Carbonmeta Technologies (PK) (USOTC:COWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

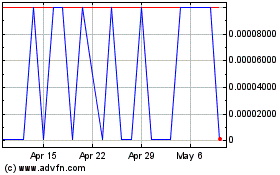

Carbonmeta Technologies (PK) (USOTC:COWI)

Historical Stock Chart

From Apr 2023 to Apr 2024