Stocks Mixed as Earnings Vary

October 26 2016 - 12:50PM

Dow Jones News

By Akane Otani and Mike Bird

Gains in Boeing's shares helped offset Apple's losses in the Dow

Jones Industrial Average during choppy trading Wednesday.

Corporate earnings have driven some of the largest moves in

stocks over the past week. More than a third of S&P 500

companies have reported quarterly results, according to FactSet,

with energy, industrial and technology companies posting the

weakest earnings growth so far.

Apple, which posted its first annual revenue decline in 15 years

on Tuesday, was the biggest loser in the Dow industrials on

Wednesday, falling 2.7%. The company is the biggest drag on the

S&P 500 tech sector's third-quarter earnings growth from a year

earlier, according to FactSet analyst John Butters.

The Dow industrials got a lift from Boeing, which rose 3.3%

after the aircraft maker raised its full-year guidance. The

blue-chip index rose 52 points, or 0.3%, to 18221, recovering from

earlier losses.

"Earnings growth is going to be really, really key for continued

growth in the market, even though we've muddled along without that

for a while, " said Karyn Cavanaugh, senior market strategist at

Voya Investment Management.

The Nasdaq Composite was recently down 0.3% and the S&P 500

was little changed.

U.S. crude pared losses after an Energy Information

Administration report showed storage levels fell last week. Oil

prices were recently down 0.8% at $49.60 a barrel.

Bond yields in developed markets pushed higher. The yield on the

10-year Treasury note was at 1.786%, according to Tradeweb,

compared with 1.758% Tuesday. German 10-year yields rose to 0.09%,

from around 0.02% on Tuesday.

Elsewhere around the globe, stocks mostly fell.

The Stoxx Europe 600 index pulled back 0.4% and the U.K.'s FTSE

100 index dropped 0.85%. The British pound bounced back against the

dollar, rising 0.4% to $1.2231 after falling Tuesday.

"With the terms and conditions of the U.K.'s future trade links

still unclear it is too early to rule out further downside risks in

sterling," said Geoffrey Yu, head of UBS Wealth Management's U.K.

investment office. Mr. Yu believes sterling could fall to as low as

$1.10 temporarily over the next year.

Asian stocks closed broadly lower, with Hong Kong's Hang Seng

down 1%. Japanese equities bucked the trend, with the Nikkei Stock

Average closing up 0.2%.

Write to Akane Otani at akane.otani@wsj.com and Mike Bird at

Mike.Bird@wsj.com

(END) Dow Jones Newswires

October 26, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

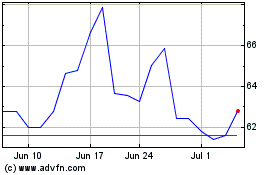

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

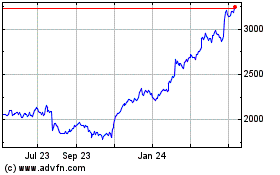

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024