AIG Expands Property Terrorism Insurance Capacity to $1 Billion; Establishes Global Terrorism Risk Engineering Services

October 26 2016 - 8:10AM

Business Wire

American International Group, Inc. (NYSE:AIG) today announced

that it has raised its property terrorism insurance limits globally

to $1 billion. The larger capacity is available to clients on a

stand-alone basis or as expanded limits within AIG’s Large Limits

property insurance offering, which provides clients with all-risk

coverage limits up to $2.5 billion per occurrence.

AIG’s prior limits for property terrorism insurance was $250

million, including in high concentration risk areas in major urban

central business districts.

In many larger cities, typically those classified as Tier 1

terrorism risks, there is limited capacity for clients seeking

terrorism coverage. At the same time, AIG has found that more

clients, particularly those operating as multinationals, are

looking to partner with insurers that have the capacity and service

capabilities to help protect them against the broad spectrum of

risks they face worldwide, including terrorism.

In expanding its appetite for terrorism risk, AIG will rely on

its data analytics and risk engineering capabilities, including new

and proprietary terrorism risk engineering services, as well as

enhanced risk selection tools.

In 2015, AIG made a strategic investment with Clemson University

to establish a risk engineering and systems analytics center to

deepen the skills sets and capabilities of its more than 600

engineers, while enhancing the company’s overall efforts to

transform data analytics into actionable insight for the company

and its clients.

“This coverage provides our clients with market leading capacity

that will respond to terrorist attacks worldwide. Demand from our

clients for better protection against this risk has been strong.

With our reinsurance partners and the investments we have made in

analytics and risk engineering, we are confident in our ability to

meet this demand and help our clients better prepare for, mitigate,

and manage a terrorism event,” said George Stratts, President of

Property and Special Risks.

American International Group, Inc. (AIG) is a leading global

insurance organization. Founded in 1919, today AIG member companies

provide a wide range of property casualty insurance, life

insurance, retirement products, mortgage insurance and other

financial services to customers in more than 100 countries and

jurisdictions. These diverse offerings include products and

services that help businesses and individuals protect their assets,

manage risks and provide for retirement security. AIG common stock

is listed on the New York Stock Exchange and the Tokyo Stock

Exchange.

Additional information about AIG can be found at www.aig.com and

www.aig.com/strategyupdate | YouTube: www.youtube.com/aig |

Twitter: @AIGinsurance | LinkedIn:

http://www.linkedin.com/company/aig. These references with

additional information about AIG have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

AIG is the marketing name for the worldwide property-casualty,

life and retirement, and general insurance operations of American

International Group, Inc. For additional information, please visit

our website at www.aig.com. All products and services are written

or provided by subsidiaries or affiliates of American International

Group, Inc. Products or services may not be available in all

countries, and coverage is subject to actual policy language.

Non-insurance products and services may be provided by independent

third parties. Certain property-casualty coverages may be provided

by a surplus lines insurer. Surplus lines insurers do not generally

participate in state guaranty funds, and insureds are therefore not

protected by such funds.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161026005895/en/

AIGMedia:Matt Gallagher,

212-458-3247matthew.gallagher2@aig.comorInvestors:Liz Werner,

212-770-7074elizabeth.werner@aig.com

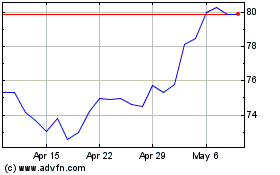

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

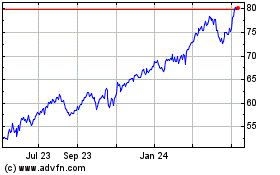

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024