Ameriprise Earnings Miss Views

October 25 2016 - 5:54PM

Dow Jones News

By Anne Steele

Ameriprise Financial Inc.'s quarterly operating earnings missed

expectations as Chief Executive Jim Cracchiolo said the

financial-services company faced a volatile climate.

"With good inflows in investment advisory accounts, retail

client assets grew to a record high," Mr. Cracchiolo said in

prepared remarks. "In a more volatile climate and period of change

for the industry, we are managing expenses well."

At the end of the period, total assets under management and

administration were $796 billion and the company had 9,747 total

advisers.

Net income fell to $215 million, or $1.30 a share, down from

$397 million, or $2.17 a share, a year ago. Operating earnings,

which exclude realized gains and losses, market effects on variable

annuity benefits and other items, rose to $2.29 a share.

Revenue rose 3.9% to $3 billion.

Analysts polled by Thomson Reuters expected per-share operating

profit of $2.42 a share on revenue of $2.88 billion.

Ameriprise was spun off from American Express Co. in September

2005.

Write to Anne Steele at anne.steele@wsj.com.

(END) Dow Jones Newswires

October 25, 2016 17:39 ET (21:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

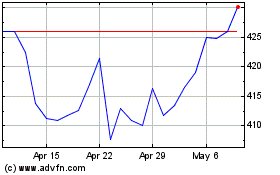

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024