Pentagon Is Expected to Split Lockheed's Next F-35 Order

October 25 2016 - 12:04PM

Dow Jones News

By Doug Cameron

The U.S. Defense Department said it may split a $14 billion

order for the next two batches of F-35 combat jets after failing to

reach agreement on a single deal with lead contractor Lockheed

Martin Corp.

Lockheed has been in talks with the Pentagon for months about a

combined deal for 160 jets covering two years of production, and

the two sides had hoped to reach agreement in early 2016.

But negotiations over price and other issues have dragged on

longer than expected as the Pentagon tries to cut the cost of the

F-35A model used by the U.S. Air Force to around $80 million by the

end of the decade.

The F-35 program office said it may now award a deal first on

the smaller ninth batch of jets, which involves more than 63

planes, rather than combine it with a 10th batch.

Negotiating F-35 deals in bigger batches was intended to cut the

Pentagon's price and help Lockheed and its partners negotiate

better deals with their suppliers, but the process is proving

tougher than expected.

The F-35 accounts for about 20% of Lockheed's revenue and is an

important contributor to sales and earnings at others including

Northrop Grumman Corp. and BAE Systems PLC, as well as dozens of

smaller contractors.

Analysts are closely watching pricing on the next two batches of

jets as the F-35 currently generates lower margins than Lockheed's

other planes.

The Pentagon paid Lockheed almost $1 billion in August to cover

supplier costs on the ninth batch and is in talks about another

payment to help fund the 10th, according to the program office.

Lockheed declined to comment on talks with the Pentagon but said

in its updated guidance released with earnings Tuesday that its

forecasts for 2016 and 2017 hinge on when it secures the next two

F-35 deals.

Third-quarter profit roundly beat analysts' expectations and the

company boosted 2016 sales guidance and forecast revenue would rise

another 7% next year to almost $50 billion.

Lockheed reported a quarterly profit of $2.4 billion compared

with $865 million a year earlier as per-share earnings rose to

$7.93 from $2.77 share. Revenue climbed 15% to $11.55 billion. For

the full year, it expects earnings of about $12.10 a share on

revenue of $46.5 billion. It previously forecast $11.15 to $11.45 a

share on $45 billion to $46.2 billion in sales.

Anne Steele contributed to this article

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 25, 2016 11:49 ET (15:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

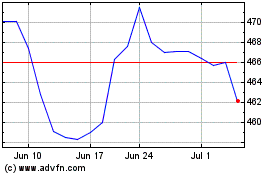

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

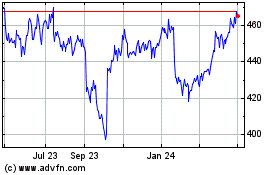

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024