Current Report Filing (8-k)

October 25 2016 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 23, 2016

______________________

Fiesta Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

______________________

|

|

|

|

|

|

|

|

|

Delaware

|

001-35373

|

90-0712224

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

14800 Landmark Boulevard, Suite 500, Dallas, Texas

|

75254

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code (972) 702-9300

N/A

(Former name or former address, if changed since last report.)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On October 24, 2016, Fiesta Restaurant Group, Inc. (the “Company”) issued a press release announcing certain preliminary financial results for its third fiscal quarter ended October 2, 2016. The entire text of the press release is attached as Exhibit 99.1 and is incorporated by reference herein.

ITEM 2.05. COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES.

On October 23, 2016, the Company concluded that it had impairment and lease and other charges as required under generally accepted accounting principles relating in part to the closure of ten (10) Company-owned Pollo Tropical restaurants on October 24, 2016. Of the ten (10) closed Pollo Tropical restaurants, three (3) restaurants in Texas will be rebranded as Taco Cabana restaurants. The decision to close the ten (10) Pollo Tropical restaurants was based on a restaurant portfolio examination as part of the Company’s strategic review process to enhance long-term shareholder value.

The Company expects to record total non-cash impairment charges in the third quarter of 2016 of approximately $18 million to $21 million and related lease and other charges of $2 million to $4 million in the fourth quarter of 2016 with respect to the closed restaurants, which will result in future cash expenditures.

ITEM 2.06. MATERIAL IMPAIRMENTS.

The information required to be disclosed under this Item 2.06 is included in Item 2.05 above and incorporated by reference herein.

The Company issued a press release on October 24, 2016 announcing estimated charges associated with Company-owned Pollo Tropical restaurants referenced above, the full text of which is attached as Exhibit 99.1 and incorporated by reference into Item 2.05 and Item 2.06.

ITEM 9.0. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

99.1

|

Fiesta Restaurant Group, Inc. Press Release, dated October 24, 2016.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIESTA RESTAURANT GROUP, INC.

Date: October 24, 2016

By:

/s/ Joseph A. Zirkman

Name: Joseph A. Zirkman

Title: Senior Vice President, General Counsel and Secretary

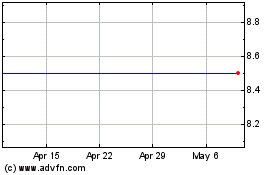

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

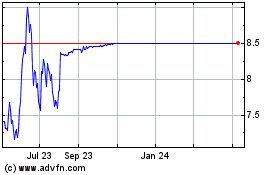

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Apr 2023 to Apr 2024