Highlights:

Motorcycle retail sales increased high-single digits percent,

and as expected, ORV retail sales were down high-single digits

during the quarter. Total Company North American retail sales were

down nine percent for the quarter, in-line with expectations.

ORV dealer inventory was down 16%, year-over-year. Total dealer

inventory was down 10%.

Third quarter results included expenses totaling approximately

$65 million for increased warranty, legal and other costs

associated with product recall activity.

Announced acquisition of Transamerican Auto Parts (“TAP”) to

bolster leadership position in a growing off-road aftermarket

space.

Narrowing full year 2016 guidance of $3.40 to $3.60 per diluted

share, on total Company sales declines of mid- to high-single

digits.

Polaris Industries Inc. (NYSE:PII) today reported third quarter

net income of $32.3 million, or $0.50 per diluted share, for the

quarter ended September 30, 2016 compared to $155.2 million, or

$2.30 per diluted share reported in the third quarter of 2015.

Sales for the third quarter of 2016 totaled $1,185.1 million, down

19 percent from last year’s third quarter sales of $1,456.0

million.

“Our third quarter results, while discouraging, were in line

with our revised guidance and reflect our ongoing execution of the

RZR® recalls and significant quality and safety improvement

initiatives. During the past three months, we have accelerated our

efforts to get our loyal owners back to riding safely, and are now

over 50 percent complete with the RZR® 900/1000 recalls and

slightly below 50 percent on the more recent RZR® Turbo recall

notice. In addition to these recall challenges, we continued to

face a weak overall Powersports industry, but were encouraged by

continued retail strength for Indian and our overall motorcycle

business, and the return to growth for side-by-sides in September,”

commented Scott Wine, Polaris’ Chairman and Chief Executive

Officer.

“We remain committed to improving our fundamentals and executing

our long-term strategy to be the ‘Best in Powersports, Plus’. Our

recent announcement to acquire Transamerican Auto Parts, a $740

million, vertically integrated multi-channel leader in the $10+

billion Jeep and truck aftermarket accessory space, is consistent

with our strategy and exciting due to its growth potential. This

transaction provides us an immediate leadership position in a

growing market, while allowing us to accelerate growth and

profitability for Polaris,” continued Mr. Wine. “We are making the

necessary investments, both internally and externally, to realize

the true potential of our organization. Along with improvements in

product safety and quality, we are using Huntsville and our go to

market Retail Flow Management (“RFM”) process to establish Lean as

a competitive advantage, we are bringing technology to the

forefront of our industry with Ride Command™, and we are working to

transform the customer experience, from purchase to service, to

enhance profitability. This commitment to improving our execution

and our overall performance will drive a steadier cadence of growth

and profitability in the future.”

Third Quarter

Segment Results (in thousands)

Includes respective parts, garments and accessories ("PG&A")

related sales

Three months ended September 30,

Nine months ended September 30, 2016

2015 Change 2016 2015

Change

Sales

Off-Road Vehicles/Snowmobiles $ 923,389 $ 1,193,514 (23 )% $

2,452,525 $ 2,846,901 (14 )% Motorcycles 183,193 188,679 (3 )%

602,762 535,699 13 % Global Adjacent Markets 78,485

73,807 6 % 243,553 231,072

5 %

Total Sales $ 1,185,067

$ 1,456,000 (19 )% $

3,298,840 $ 3,613,672 (9

)%

Gross

profit

Off-Road Vehicles/Snowmobiles $ 231,323 $ 388,542 (40 )% $ 670,982

$ 927,803 (28 )% % of sales 25.1 % 32.6 % -750 bps 27.4 % 32.6 %

-523 bps Motorcycles 21,164 28,424 (26 )% 89,841 73,236 23 % % of

sales 11.6 % 15.1 % -351 bps 14.9 % 13.7 % +123 bps Global Adjacent

Markets 21,828 21,200 3 % 66,163 61,987 7 % % of sales 27.8 % 28.7

% -91 bps 27.2 % 26.8 % +34 bps Corporate (13,545 )

(22,543 ) (34,135 ) (34,258 )

Total

gross profit $ 260,770 $

415,623 (37 )% $ 792,851

$ 1,028,768 (23 )% % of

sales 22.0 % 28.5 % -655 bps 24.0 % 28.5 % -444 bps

Off-Road Vehicle (“ORV”) and

Snowmobile segment sales, including its respective

PG&A sales, decreased 23 percent from the third quarter of 2015

to $923.4 million. Gross profit decreased 40 percent to $231.3

million, or 25.1 percent of sales, in the third quarter of 2016,

compared to $388.5 million, or 32.6 percent of sales, in the third

quarter of 2015 due to higher warranty costs related to recent

recall activity primarily for the Company’s RZR® vehicles.

ORV wholegood

sales decreased 25 percent to $619.0 million reflecting the

Company’s decision to delay model year 2017 shipments, including

the high margin RZR® Turbo vehicles, in order to revalidate its new

model line-up and protect dealer inventory levels. Compared to the

2015 third quarter, Polaris North American ORV unit retail sales

were down high-single digits percent, consisting of consumer

purchases for side-by-side vehicles down high-single digits percent

and ATV retail sales down low-double digits percent. The North

American ORV industry was down low-single digits percent compared

to the third quarter last year. ORV dealer inventory was down 16

percent in the 2016 third quarter compared to the same period last

year.

Snowmobile

wholegood sales decreased 35 percent to $119.9 million due to

timing of shipments, year-over-year, as the Company manufactured

and shipped its snowmobiles earlier in 2015.

Motorcycle segment sales,

including its respective PG&A sales, decreased three percent in

the 2016 third quarter to $183.2 million. Victory® and Indian®

motorcycles reported increased vehicle sales growth, while

Slingshot® sales were down during the quarter due to shipment

timing. Gross profit decreased 26 percent to $21.2 million, or 11.6

percent of sales in the third quarter of 2016, compared to $28.4

million, or 15.1 percent of sales, in the third quarter of 2015 due

to higher warranty expense related to recent safety and service

bulletins, primarily for Slingshot®.

North American consumer retail demand for the Polaris motorcycle

segment, including Victory®, Indian Motorcycle® and Slingshot®,

increased high-single digits percent during the 2016 third quarter

with Indian Motorcycle® and Victory® increasing low-teens percent

combined, while overall motorcycle industry retail sales 900cc and

above was down high-single digits percent in the 2016 third

quarter. Product availability for all three motorcycle brands

remained adequate throughout the quarter as both the Company’s

Spirit Lake, Iowa motorcycle plant and the new Slingshot®

production line in Huntsville, Alabama are producing at retail

demand levels.

Global Adjacent Markets

segment sales along with its respective PG&A sales, increased

six percent to $78.5 million in the 2016 third quarter compared to

the 2015 third quarter. Gross profit increased three percent to

$21.8 million, or 27.8 percent of sales, in the third quarter of

2016, compared to $21.2 million, or 28.7 percent of sales, in the

third quarter of 2015.

Supplemental

Data:

Parts, Garments, and Accessories

(“PG&A”) sales, which are included in each of the

three respective reporting segments, declined one percent during

the 2016 third quarter to $224.4 million driven by lower retail

sales.

International sales to customers

outside of North America totaled $141.0 million for the third

quarter of 2016, including PG&A, a decrease of eight percent

from the same period in 2015. International sales on a constant

currency basis were down seven percent in the 2016 third

quarter.

Gross profit for the total Company decreased 37 percent

to $260.8 million in the third quarter of 2016, compared to $415.6

million in the third quarter of 2015. As a percentage of sales,

gross profit declined 655 basis points to 22.0 percent of sales for

the third quarter of 2016, compared to 28.5 percent of sales for

the same period last year. Increased warranty and promotional costs

and negative product mix, partially offset by lower commodity costs

and product cost reduction efforts, were the primary reasons for

the gross margin erosion.

Operating expenses increased 16 percent to $222.6

million, or 18.8 percent of sales, for the third quarter of 2016,

compared to $192.0 million, or 13.2 percent of sales, for the third

quarter of 2015. The change was primarily driven by higher general

and administrative expenses due to higher product liability and

recall related legal costs and increased research and development

expenses for product revalidation and ongoing innovation.

Income from financial services was $19.2 million during

the third quarter 2016, a one percent increase compared to $19.1

million in the third quarter of 2015 directly related to lower

retail sales during the quarter.

Non-operating other expense (income), net, which

primarily relates to foreign currency exchange-rate movements and

the corresponding effects on foreign currency transactions related

to the Company’s foreign subsidiaries, was $5.7 million of expense

in the third quarter of 2016 compared to $1.3 million of income in

the third quarter of 2015.

The provision for income taxes for the third quarter of

2016 was $13.5 million or 29.5 percent of pretax income compared to

$84.5 million or 35.3 percent of pretax income for the third

quarter of 2015. The lower income tax provision rate in the third

quarter 2016 is primarily due to the extension of the research and

development credit by the U.S. Congress in the 2015 fourth quarter,

in addition to certain favorable tax adjustments in the 2016 third

quarter that had a more significant impact on the income tax rate

due to the lower pretax income generated during the quarter.

Financial Position and Cash Flow

Net cash provided by operating activities was $426.2 million for

the nine months ended September 30, 2016, compared to $464.0

million for the same period in 2015. The decrease in net cash

provided by operating activities for the 2016 period was due to

lower net income in the quarter offset somewhat by lower factory

inventory and increased accrued expenses. Total debt for the

quarter, including capital lease obligations and notes payable, was

$436.7 million. The Company’s debt-to-total capital ratio was 32

percent at September 30, 2016, compared to 25 percent a year ago.

Cash and cash equivalents were $122.7 million at September 30,

2016, down from $225.3 million for the same period in 2015.

Share Buyback Activity

During the third quarter 2016, the Company repurchased and

retired 111,000 shares of its common stock for $10.5 million. As of

September 30, 2016, the Company currently has authorization from

its Board of Directors to repurchase up to an additional 8.6

million shares of Polaris stock.

2016 Business Outlook

For the full year 2016, the Company is narrowing its earnings

guidance range to $3.40 to $3.60 per diluted share with sales

expected to be down in the mid- to high-single digit percent range.

The full year 2016 earnings guidance excludes the TAP acquisition.

Sales expectations by segment for the full year 2016 are as

follows: ORV/Snowmobile sales expected down in the high-single to

low-double digits percent range; Motorcycle sales up low-single

digits percent; and Global Adjacent Market sales up high-single

digits percent.

Non-GAAP Measure - Constant Currency Reporting

This release and our related earnings call include a discussion

of the Company’s 2016 third quarter results and 2016 expectations

on a constant currency basis, which is a non-GAAP measure, as well

as on a GAAP basis. For purpose of comparison, the results on a

constant currency basis uses the respective prior year exchange

rates for the comparative period to enhance the visibility of the

underlying business trends, excluding the impact of translation

arising from foreign currency exchange rate fluctuations.

Third Quarter Conference Call and Webcast

Presentation

Today at 9:00 AM (CT) Polaris Industries Inc. will host a

conference call and webcast to discuss the third quarter 2016

results released this morning. The call will be hosted by Scott

Wine, Chairman and CEO; Ken Pucel, Executive Vice President –

Operations, Engineering and Lean; and Mike Speetzen, Executive Vice

President – Finance and CFO. A slide presentation and link to

the webcast will be posted on the Polaris Investor Relations

website at ir.polaris.com.

To listen to the conference call by phone, dial 877-706-7543 in

the U.S. and Canada, or 973-200-3967 internationally. The

Conference ID is # 95425239.

A replay of the conference call will be available approximately

two hours after the call for a one-week period by accessing the

same link on our website, or by dialing 855-859-2056 in the U.S.

and Canada, or 404-537-3406 internationally.

About Polaris

Polaris Industries Inc. (NYSE: PII) is a global powersports

leader with annual 2015 sales of $4.7 billion. Polaris fuels the

passion of riders, workers and outdoor enthusiasts with our

RANGER®, RZR® and Polaris GENERAL™ side-by-side off-road vehicles;

our Sportsman® and Polaris ACE® all-terrain off-road vehicles;

Victory® and Indian Motorcycle® midsize and heavyweight

motorcycles; Slingshot® moto-roadsters; and Polaris RMK®, INDY®,

Switchback® and RUSH® snowmobiles. Polaris enhances the riding

experience with parts, garments and accessories sold under multiple

recognizable brands, and has a growing presence in adjacent markets

globally with products including military and commercial off-road

vehicles, quadricycles, and electric

vehicles. www.polaris.com

Except for historical information contained herein, the matters

set forth in this news release, including management’s expectations

regarding 2016 and future sales, shipments, net income, and net

income per share and operational initiatives are forward-looking

statements that involve certain risks and uncertainties that could

cause actual results to differ materially from those

forward-looking statements. Potential risks and uncertainties

include such factors as the Company’s ability to successfully

implement its manufacturing operations expansion initiatives, cost

reduction initiatives, product offerings, promotional activities

and pricing strategies against competitors; economic conditions

that impact consumer spending; acquisition integration costs;

product recalls; warranty expenses; impact of changes in Polaris

stock price on incentive compensation plan costs; foreign currency

exchange rate fluctuations; environmental and product safety

regulatory activity; effects of weather; commodity costs; uninsured

product liability claims; uncertainty in the retail and wholesale

credit markets; performance of affiliate partners; changes in tax

policy and overall economic conditions, including inflation,

consumer confidence and spending and relationships with dealers and

suppliers. Investors are also directed to consider other risks and

uncertainties discussed in documents filed by the Company with the

Securities and Exchange Commission. The Company does not undertake

any duty to any person to provide updates to its forward-looking

statements.

(summarized financial data follows)

POLARIS INDUSTRIES

INC.CONSOLIDATED STATEMENTS OF INCOME(In Thousands,

Except Per Share Data)(Unaudited)

Three months ended September 30,

Nine months ended September 30, 2016 2015

2016 2015 Sales $ 1,185,067 $ 1,456,000 $ 3,298,840 $

3,613,672 Cost of sales 924,297 1,040,377 2,505,989

2,584,904 Gross profit 260,770 415,623 792,851 1,028,768

Operating expenses: Selling and marketing 89,751 91,169 244,812

240,510 Research and development 47,568 44,432 136,256 124,726

General and administrative 85,257 56,411 219,403

157,898 Total operating expenses 222,576 192,012 600,471

523,134 Income from financial services 19,195 19,065

59,155 51,345 Operating income 57,389 242,676 251,535

556,979 Non-operating expense: Interest expense 4,051 2,966 10,718

8,848 Equity in loss of other affiliates 1,798 1,345 5,439 4,716

Other expense (income), net 5,700 (1,345 ) 7,586

8,776 Income before income taxes 45,840 239,710 227,792 534,639

Provision for income taxes 13,528 84,537 77,425

189,960 Net income $ 32,312 $ 155,173 $

150,367 $ 344,679 Net income per share: Basic $ 0.50

$ 2.35 $ 2.33 $ 5.20 Diluted $ 0.50 $ 2.30 $ 2.30 $ 5.09 Weighted

average shares outstanding: Basic 64,151 65,912 64,535 66,222

Diluted 65,027 67,368 65,435 67,781

POLARIS INDUSTRIES

INC.CONSOLIDATED BALANCE SHEETS(In

Thousands)(Unaudited) September 30,

2016 September 30, 2015 Assets Current

Assets: Cash and cash equivalents $ 122,696 $ 225,264 Trade

receivables, net 152,342 176,221 Inventories, net 755,943 674,612

Prepaid expenses and other 63,594 72,241 Income taxes receivable

55,096 10,052 Deferred tax assets — 111,251 Total current

assets 1,149,671 1,269,641 Property and equipment, net 687,697

587,935 Investment in finance affiliate 92,203 88,690 Deferred tax

assets 173,741 46,271 Goodwill and other intangible assets, net

271,419 232,142 Other long-term assets 95,594 83,467

Total assets $ 2,470,325 $ 2,308,146

Liabilities

and Shareholders’ Equity Current Liabilities: Current portion

of debt, capital lease obligations and notes payable $ 4,746 $

4,839 Accounts payable 308,971 381,174 Accrued expenses:

Compensation 112,025 104,336 Warranties 130,054 55,097 Sales

promotions and incentives 162,853 145,091 Dealer holdback 116,386

101,261 Other 139,145 83,553 Income taxes payable 11,898

34,269 Total current liabilities 986,078 909,620 Long term income

taxes payable 25,241 15,201 Capital lease obligations 19,122 20,652

Long-term debt 412,844 289,197 Deferred tax liabilities 12,574

15,913 Other long-term liabilities 77,025 105,280

Total

liabilities $ 1,532,884 $ 1,355,863

Deferred

compensation 9,110 14,923

Shareholders’ equity: Total

shareholders’ equity 928,331 937,360

Total

liabilities and shareholders’ equity $ 2,470,325 $

2,308,146

POLARIS INDUSTRIES INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(In Thousands)(Unaudited)

Nine months ended September 30, 2016

2015 Operating Activities: Net income $ 150,367 $ 344,679

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 121,903 112,902

Noncash compensation 43,137 53,642 Noncash income from financial

services (22,354 ) (21,810 ) Deferred income taxes (8,134 ) (5,280

) Excess tax benefits from share-based compensation (1,408 )

(34,301 ) Other, net 12,027 4,716 Changes in operating assets and

liabilities: Trade receivables 5,686 22,700 Inventories (33,804 )

(112,776 ) Accounts payable 5,702 35,002 Accrued expenses 145,207

13,621 Income taxes payable/receivable (278 ) 54,389 Prepaid

expenses and others, net 8,193 (3,482 ) Net cash provided by

operating activities 426,244 464,002 Investing Activities: Purchase

of property and equipment (155,360 ) (148,998 ) Investment in

finance affiliate, net 29,223 22,227 Investment in other affiliates

(6,861 ) (15,337 ) Acquisition of businesses, net of cash acquired

(54,830 ) (27,019 ) Net cash used for investing activities (187,828

) (169,127 ) Financing Activities: Borrowings under debt

arrangements / capital lease obligations 1,767,272 2,155,310

Repayments under debt arrangements / capital lease obligations

(1,795,316 ) (2,059,711 ) Repurchase and retirement of common

shares (154,381 ) (247,795 ) Cash dividends to shareholders

(105,732 ) (104,808 ) Proceeds from stock issuances under employee

plans 15,651 26,672 Excess tax benefits from share-based

compensation 1,408 34,301 Net cash used for financing

activities (271,098 ) (196,031 ) Impact of currency exchange rates

on cash balances 29 (11,180 ) Net increase (decrease) in

cash and cash equivalents (32,653 ) 87,664 Cash and cash

equivalents at beginning of period 155,349 137,600

Cash and cash equivalents at end of period $ 122,696 $

225,264

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025005535/en/

Polaris Industries Inc.Richard Edwards, 763-542-0500

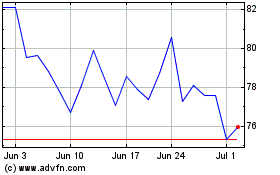

Polaris (NYSE:PII)

Historical Stock Chart

From Mar 2024 to Apr 2024

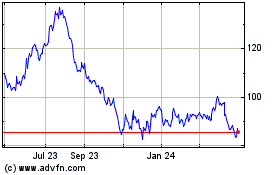

Polaris (NYSE:PII)

Historical Stock Chart

From Apr 2023 to Apr 2024