Paris, 25 October 2016

Third quarter 2016 financial information

Accelerated growth in third quarter

revenue and restated EBITDA, driven by very high-speed broadband

and convergence

-

The Group achieved a solid

commercial performance in the 3rd quarter of

2016, driven by very high-speed broadband and convergence, with

845,000 net mobile contract1 additions and

348,000 additional fibre customers. There were 25.5 million 4G

customers in Europe at 30 September 2016 (1.7x increase in one

year) and 9.8 million customers of convergent offers at that date

(+11% year on year).

In France, mobile contract1 net

additions remained at a high level (+187,000 in the 3rd quarter),

confirming the attractiveness of Orange's segmented offers. Fixed

broadband was also very buoyant, with 134,000 net additions in the

3rd quarter, led

by fibre (+126,000) with 1.308 million customers at 30 September

2016.

In Spain, fixed broadband growth continued to be very strong with

194,000 net fibre additions in the 3rd quarter and

1.411 million fibre customers at 30 September 2016. Mobile

contracts[1] climbed

steadily, with 94,000 net additions in the 3rd

quarter, a stronger performance than in the 3rd

quarter of 2015.

In Poland, the commercial performance was very satisfactory with

309,000 net mobile contract additions (the highest level in several

years), after three quarters of already strong growth. In Belgium,

the mobile contract1 customer base

rose for the sixth consecutive quarter.

In Africa and the Middle East, the mobile customer base at 30

September 2016 was 113.5 million customers and included Tigo in the

Democratic Republic of the Congo (3.4 million customers) and

Cellcom in Liberia (1.5 million customers), both of which were

consolidated in the 3rd quarter. The

trend in net additions improved significantly with 103,000 net

customer additions in the 3rd quarter

after a decrease of 1.4 million customers in the 2nd quarter, on

a comparable basis. Orange Money had 20 million customers at 30

September 2016 (+30% year on year).

-

Revenues reached 10.323 billion

euros in the 3rd quarter of

2016, up 0.8%, after rising 0.3% in the 1st half

(on a comparable basis). At 30 September 2016, revenues had

increased 0.5%. The improving trend was confirmed despite the

impact of the decline of national roaming in France and of roaming

price reductions in Europe.

Growth accelerated in Spain, rising 7.8% in the

3rd quarter

after an increase of 6.2% in the 2nd quarter.

Growth resumed in the Belgium and Luxembourg segment (+1.7%), and

the trend improved in the Enterprise segment (+0.7%). France posted

a modest decline of 0.6% in the 3rd quarter,

while revenues rose 2.5% in Africa and the Middle East in the

3rd quarter

following growth of 2.3% in the 2nd quarter.

-

Restated EBITDA (3.597 billion

euros in the 3rd quarter of

2016) rose 1.6% (+58 million euros) on a comparable basis and

the restated EBITDA margin was 34.9%, an improvement of 0.3

percentage points compared with the 3rd quarter of

2015. Restated EBITDA for the first nine months of the year (9.510

billion euros) increased 0.2% (+19 million euros) and the restated

EBITDA margin was essentially stable at 31.3%.

-

CAPEX for the first nine months

of the year (4.733 billion euros at 30 September 2016) increased

5.3% on a comparable basis and the ratio of CAPEX to revenues

was 15.6% (+0.7 percentage points compared with 30 September 2015).

Investments in very high-speed fixed and mobile broadband (fibre,

4G and 4G+) continued their steady climb, in line with the goals of

the Essentiels2020 strategic plan. Investments also increased in

the datacentres, in customer equipment (new Livebox in France) and

in the new Smart Store concept stores.

2016 outlook

For the full-year 2016, Orange confirms that restated EBITDA will

be greater than that of 2015 on a comparable basis. This objective

will be supported by continued commercial momentum, investments,

and efforts to improve the cost structure.

The Group also confirms the target of

a restated ratio of net debt to EBITDA of around 2x in the medium

term to preserve Orange's financial strength and investment

capacity. Within this framework, the Group is maintaining a policy

of selective, value-creating acquisitions concentrating on markets

in which it is already present.

The Group plans to propose the

payment of a dividend of 0.60 euros per share for 2016[2]. An interim

dividend for 2016 of 0.20 euros per share will be paid on 7

December 2016[3].

Commenting on the publication of the results for

the first nine months of 2016, Stéphane Richard, Chairman &

Chief Executive Officer of the Orange Group, stated:

"The third quarter

was again marked by a strong commercial performance, reflecting the

success of Essentiels2020 - our strategy of differentiation through

investment in high-speed broadband networks and the reinvention of

our customer relationships. This performance can be seen in the

accelerated growth of our revenues and restated EBITDA and enables

us to confirm all of our objectives for 2016.

In France, due to a

strong commercial dynamic, we reached the end of September with

more than 10 million 4G customers, 1.3 million fibre customers and

more than half of our broadband customer base using converged

services. These developments have led to further improvement in

both the satisfaction and loyalty of our mobile and fixed

customers.

The increasing

growth in revenues in Europe mainly stems from the excellent

performance in Spain, with very strong growth in both mobile and

fixed broadband, as well as the return to growth in Belgium, where

our new convergent offers are showing early signs of

success.

In Africa and the

Middle East, where Orange Money customers now exceed 20 million,

the increasing take-up of smartphones and our commercial strategy

has translated into strong growth in mobile data revenues. The

integration of the recently acquired operations in Sierra Leone,

Burkina Faso, Liberia and the Democratic Republic of the Congo is

on track, with the latter two operations now consolidated.

Lastly, the

Enterprise business is performing well, with a third consecutive

quarter of revenue growth, again due to the development of our IT

activities and integration services."

*

* *

The Board of Directors of Orange SA met on 24

October 2016 and examined the Group's results for the period ended

30 September 2016.

The financial data and comparable basis data in this press release

are unaudited data.

More detailed information is available on the Orange

website:

www.orange.com

Key figures

| |

|

|

|

|

|

|

|

|

| |

|

2016 |

2015 |

2015 |

|

change |

|

change |

| In millions

of euros |

|

comparable basis |

historical basis |

|

comparable basis |

|

historical basis |

| |

|

|

|

|

|

|

|

|

|

| Revenues |

30,401 |

30,258 |

29,841 |

|

0.5 % |

|

1.9 % |

| Of which: |

|

|

|

|

|

|

|

| |

France |

14,144 |

14,289 |

14,279 |

|

(1.0)% |

|

(0.9)% |

|

|

Europe |

7,798 |

7,666 |

7,345 |

|

1.7

% |

|

6.2

% |

|

|

|

Spain |

3,706 |

3,520 |

3,064 |

|

5.3

% |

|

21.0

% |

|

|

|

Poland |

1,963 |

2,042 |

2,145 |

|

(3.9)% |

|

(8.5)% |

|

|

|

Belgium

& Luxembourg |

920 |

913 |

913 |

|

0.8

% |

|

0.8

% |

|

|

|

Central

European countries |

1,215 |

1,194 |

1,227 |

|

1.7

% |

|

(1.0)% |

| |

|

Intra-Europe eliminations |

(6) |

(2) |

(3) |

|

- |

|

- |

|

|

Africa & Middle East |

3,887 |

3,772 |

3,587 |

|

3.0

% |

|

8.4

% |

|

|

Enterprise |

4,756 |

4,707 |

4,748 |

|

1.0

% |

|

0.2

% |

|

|

International Carriers & Shared

Services |

1,360 |

1,386 |

1,442 |

|

(1.8)% |

|

(5.7)% |

| |

Intra-Group eliminations |

(1,544) |

(1,562) |

(1,561) |

|

- |

|

- |

| Restated EBITDA* |

9,510 |

9,491 |

9,351 |

|

0.2 % |

|

1.7 % |

| |

As % of

revenues |

31.3 % |

31.4 % |

31.3 % |

|

(0.1)

pt. |

|

(0.1)

pt. |

| CAPEX (excluding

licences) |

4,733 |

4,496 |

4,235 |

|

5.3 % |

|

11.8 % |

| |

As % of

revenues |

15.6 % |

14.9 % |

14.2 % |

|

0.7

pt. |

|

1.4

pt. |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

3rd

quarter |

3rd

quarter |

3rd

quarter |

|

change comparable |

|

change historical |

| |

|

|

2016 |

2015 |

2015 |

|

basis |

|

basis |

| In millions

of euros |

|

comparable basis |

historical basis |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Revenues |

10,323 |

10,240 |

10,284 |

|

0.8 % |

|

0.4 % |

| Of which: |

|

|

|

|

|

|

|

| |

France |

4,768 |

4,797 |

4,794 |

|

(0.6)% |

|

(0.5)% |

|

|

Europe |

2,670 |

2,597 |

2,652 |

|

2.8

% |

|

0.7

% |

|

|

|

Spain |

1,288 |

1,194 |

1,216 |

|

7.8

% |

|

5.9

% |

|

|

|

Poland |

657 |

684 |

709 |

|

(3.9)% |

|

(7.4)% |

|

|

|

Belgium

& Luxembourg |

311 |

306 |

306 |

|

1.7

% |

|

1.7

% |

|

|

|

Central

European countries |

417 |

414 |

421 |

|

0.8

% |

|

(1.1)% |

| |

|

Intra-Europe eliminations |

(3) |

(1) |

(1) |

|

- |

|

- |

|

|

Africa & Middle East |

1,371 |

1,338 |

1,304 |

|

2.5

% |

|

5.1

% |

|

|

Enterprise |

1,567 |

1,556 |

1,577 |

|

0.7

% |

|

(0.6)% |

|

|

International Carriers & Shared

Services |

456 |

479 |

486 |

|

(4.7)% |

|

(6.1)% |

| |

Intra-Group eliminations |

(510) |

(527) |

(528) |

|

- |

|

- |

| Restated EBITDA* |

3,597 |

3,540 |

3,561 |

|

1.6 % |

|

1.0 % |

| |

As % of

revenues |

34.9 % |

34.6 % |

34.6 % |

|

0.3

pt. |

|

0.2

pt. |

| CAPEX (excluding

licenses) |

1,566 |

1,559 |

1,563 |

|

0.5 % |

|

0.2 % |

| |

As % of

revenues |

15.2 % |

15.2 % |

15.2 % |

|

(0.1)pt. |

|

(0.0)pt. |

|

|

|

|

|

|

|

|

|

|

|

* EBITDA restatements are described

in appendix 2.

Comments on key Group figures

Revenues

Orange Group revenues for the first nine months of the year were

30.401 billion euros. An increase of 0.8% in the 3rd quarter of

2016, after rising 0.3% in both the 1st half of 2016

and the 2nd half of 2015

(on a comparable basis), confirmed the improving trend despite the

impact of decreased national roaming in France and roaming price

reductions in Europe.

The Group's revenues grew 0.5% in the first nine months of the year

on a comparable basis[4]. Fixed

broadband services rose 5.1% at 30 September 2016, led by fibre and

TV content in France and Spain, while mobile services rose

0.4%.

The revenue trends in the 3rd quarter of

2016 were as follows by region (on a comparable basis):

In France, the growth of fixed broadband services remained strong

(+5.8% in the 3rd quarter),

led by fibre and TV content. Mobile services declined 3.8%,

marked in particular by the downturn in national roaming and

roaming price reductions in Europe.

In Europe, revenues rose 2.8% in the 3rd quarter

after rising 1.9% in the 2nd quarter, led

by growth in Spain:

-

in Spain, revenue growth accelerated (+7.8%

after rising 6.2% in the 2nd quarter),

led by mobile services and mobile equipment sales, while the growth

of fixed broadband continued to be strong (+7.8%) with the success

of fibre;

-

in Poland, revenues were down 3.9% in the

3rd quarter,

continuing the trend of the previous two quarters. In particular,

the decline of mobile services (-3.1%) reflected the development of

SIM-only offers and of convergence;

-

Belgium & Luxembourg: revenue growth resumed

in the 3rd quarter

(+1.7%) principally with the rebound of mobile equipment

sales;

-

the Central European Countries rose 0.8% in the

3rd quarter:

growth in Romania (+3.3%) was partly offset by a decline in

Slovakia (-2.7%) and in Moldova (-3.7%).

Africa and the Middle East grew 2.5% after an

increase of 2.3% in the 2nd quarter, led

by Egypt, Guinea, Côte d'Ivoire and Mali.

Enterprise segment: IT and integration services rose 4.1% in the

quarter, led by security and Cloud services, while connectivity

(voice and data services) was relatively stable.

Customer base growth

In France, mobile contracts (25.8 million customers at 30 September

2016) climbed 8.7% and represented 87.3% of the mobile customer

base at that date (+3.3 percentage points year on year). In Europe,

mobile contracts (32.9 million customers) were up 6.6% year on year

and represented 63.9% of the mobile customer base (+2.5 percentage

points in one year). The increase in contracts in the Europe zone

principally related to Poland and Spain.

Africa and the Middle East had 113.5 million mobile customers at 30

September 2016, including Tigo in the Democratic Republic of the

Congo (3.4 million customers) and Cellcom in Liberia (1.5 million

customers), which were consolidated in the 3rd

quarter. The trend in net additions improved significantly with the

addition of 103,000 customers in the 3rd quarter,

after a decrease of 1.4 million customers in the 2nd quarter (on

a comparable basis), which had been impacted in particular by

customer identity verification processes coming into force in most

countries. On a comparable basis, the mobile customer base of the

Africa and the Middle East segment declined 1.9% year on

year.

The Group had a total of 194.5 million mobile services customers at

30 September 2016, an increase of 0.2% year on year (+294,000

additional customers) on a comparable basis.

There were 18.1 million fixed broadband customers at 30 September

2016, an increase of 3.3% year on year on a comparable basis with

582,000 additional customers, including 443,000 in France and

197,000 in Spain. Fixed broadband subscribers included 2.898

million fibre subscribers at 30 September 2016, with 1.411 million

in Spain and 1.308 million in France.

Meanwhile, there were 8.2 million TV customers at 30 September

2016, compared with 7.7 million at 30 September 2015 on a

comparable basis, a year-on-year increase of 7.1%.

Restated EBITDA

Restated EBITDA was 9.510 billion euros in the first nine months of

2016, an increase of 0.2% (+19 million euros) on a comparable

basis, and the restated EBITDA margin was 31.3%, nearly stable in

relation to the first nine months of 2015 (-0.1 percentage

point).

In the 3rd quarter of

2016, restated EBITDA rose 1.6% (+58 million euros) to 3.597

billion euros while the restated EBITDA margin was 34.9% (+0.3

percentage points) on a comparable basis compared to the

3rd quarter of

2015.

The increase in restated EBITDA in the 3rd quarter of

2016 was mainly tied to revenue growth (+82 million euros), while

commercial expenses and content costs increased 58 million euros to

support business growth.

The other operating costs were down 33 million euros: the reduced

labour expenses were partially offset by increased operating taxes

(particularly in the Africa and Middle East segment), while other

expenses remained stable, thanks in particular to the actions

carried out under the Explore2020 operational efficiency

improvement plan.

CAPEX

CAPEX reached 4.733 billion euros in the first nine months of

2016[5], up 5.3% in

relation to the first nine months of 2015, on a comparable basis.

The ratio of CAPEX to revenues was 15.6%, an increase of 0.7

percentage points compared to 30 September 2015.

Investments in fibre rose strongly (+14.6% compared with the first

nine months of 2015) and mainly related to France and Spain. There

were 6.3 million households with connectivity in France at 30

September 2016, 9.0 million in Spain, and 1.2 million in

Poland.

Investments in very high-speed mobile services increased 14.4%

compared to the first nine months of 2015. At 30 September 2016,

84% of the population in France had 4G coverage, 89% in Spain, 97%

in Poland, 99.5% in Belgium, 74% in Romania, 77% in Slovakia and

96% in Moldova. In Africa and the Middle East, 4G was commercially

launched in 10 countries: Botswana, Cameroon, Côte d'Ivoire,

Guinea-Bissau, Jordan, Liberia, Morocco, Mauritius, Senegal and

Tunisia. At the same time, 4G+ deployment continued in France and

in the other European countries.

There was also an increase in investments in customer equipment,

with Orange's new Livebox marketed since May 19th, and

information systems (datacentres in France, integration of Jazztel

in Spain, and customer relations in Africa and the Middle

East).

The modernisation of stores continued, mainly in France with the

opening of 14 new Smart Stores in the 3rd quarter of

2016, bringing the total in France to 37.

Changes in asset portfolio

The four companies recently acquired in Africa have gradually been

consolidated in the Group's financial statements. Cellcom in

Liberia and Tigo in the Democratic Republic of the Congo were fully

consolidated at 30 September 2016. The two subsidiaries acquired

from the Bharti Airtel group in Burkina Faso and Sierra Leone will

be consolidated in the 4th

quarter.

Orange announced on 20 July 2016 that, through its entity Orange

Business Services, it had acquired Log'in Consultants, a business

dedicated to integration services for workstation

virtualisation.

In early October, the French and European regulatory and prudential

authorities authorised Orange to acquire 65% of the capital of

Groupama Banque, which will be renamed Orange Bank in January 2017.

The Orange Bank offering will be available in France in the first

half of 2017.

On 18 October 2016, Orange acquired 100% of the capital of Sun

Communications, the leading supplier of paid television in Moldova,

which will enable Orange to market broadband convergent offers in

the country.

Review by operating segment

France

Revenues in France showed a modest decline of 0.6% in the

3rd quarter of

2016 after falling 1.7% in the 2nd quarter on a

comparable basis. They benefited from an improvement in the trend

for mobile services to operators (particularly MVNOs and network

sharing) and a recovery in mobile equipment sales (+11.4% after a

1.8% decrease in the 2nd

quarter).

Mobile services declined 3.8% in the 3rd quarter of

2016. They continued to be affected by lower revenues from the

national roaming contract and the reduction of roaming prices in

Europe, as well as the impact of the rapid growth of SIM-only

offers, which represented 61% of consumer contracts at 30 September

2016 (+13 percentage points year on year). The Open convergent

offers and the Sosh offers continued to post strong growth, with

7.569 million Open customers at 30 September 2016 (+11.2% year on

year) and 3.209 million Sosh customers (+13.9% year on year). The

total contract customer base[6] (20.644

million customers at 30 September 2016) recorded year-on-year

growth of 2.8%. There were 10.3 million 4G customers at that same

date representing 50% of the contract customer base6.

Fixed services grew 0.7% in the 3rd quarter of

2016. Growth of fixed broadband services accelerated (+5.8% in the

3rd quarter

after rising 4.4% in the 2nd quarter),

led by growth of the customer base and an increase in ARPU. The

fixed broadband customer base had 11.056 million subscribers at 30

September 2016 (+4.2% year on year). It included 1.308 million

fibre subscribers, compared with 827,000 one year earlier, a

year-on-year increase of 58%. ARPU rose 0.5% as at 30 September

2016, reflecting the growing share of fibre and premium offers

(Play and Jet offers) and the development of TV content offers.

Convergent offers represented 51% of the fixed broadband customer

base at 30 September 2016 (+3 percentage points in one

year).

Traditional telephony fell 11.2% in the 3rd quarter of

2016 while fixed services to operators rose 2.1% with growth in the

number of broadband subscriptions marketed to operators and in

related collection and transmission services.

Europe

Revenues from the Europe zone increased 2.8% in the 3rd quarter of

2016 after climbing 1.9% in the 2nd quarter, led in

particular by strong growth in Spain (+7.8% in the 3rd quarter

after rising 6.2% in the 2nd

quarter).

For the Europe zone as a whole, revenues from mobile services

increased 3.3% in the 3rd quarter. The

contract customer base had 32.9 million customers at 30 September

2016, an increase of 6.6% year on year, and represented 63.9% of

the total mobile customer base at that date (+2.5 percentage points

in one year). The marketing of contracts continued to be brisk,

with 550,000 net additions in the 3rd quarter

after 585,000 in the 2nd

quarter.

Revenues from fixed broadband rose 4.8% in the 3rd

quarter, reflecting the rapid development of fibre and of TV

content offers in Spain. The fixed broadband customer base had 6.1

million customers at 30 September 2016 (+2.0% year on year),

including 1.5 million fibre customers, mainly in Spain. At 30

September 2016, the fixed broadband customer base also included the

first customers of recently marketed convergent offers, which were

offered via cable in Belgium and via fibre in Romania.

Spain

The revenue trend in Spain improved for the sixth consecutive

quarter, with growth of 7.8% posted in the 3rd

quarter of 2016 after the increases of 6.2% in the 2nd quarter and

1.8% in the 1st quarter (on

a comparable basis).

This reflected the mobile services trend, which rose 9.8% in the

3rd quarter of

2016 after rising 8.9% in the 2nd quarter and

4.4% in the 1st quarter.

These services benefited from the richer offers that began at the

end of 2015, and from 4G deployment, with 7.2 million customers at

30 September 2016 (1.6x increase in one year). The customer base

continued to grow, with the number of contract customers (12.5

million at 30 September 2016) increasing 5.4% year on year, while

the number of prepaid offer customers (3.3 million) increased

1.0%.

Fixed services rose 4.6% in the 3rd quarter of

2016, a continuation of the two previous quarters. Fixed broadband

revenues continued to climb sharply (+7.8% in the 3rd quarter).

There were 3.886 million fixed broadband customers at 30 September

2016 (+5.3% year on year), and quarterly ARPU rose 2.6%. Fibre

experienced very strong growth, with 1.411 million customers at

that date (2.5x increase in one year) and represented 36% of the

fixed broadband customer base (+21 percentage points in one year).

TV services also rose rapidly, with 458,000 customers at 30

September 2016 (2.1x increase in one year), led by the success of

content offers and in particular the broadcast of football

championships. Meanwhile, convergent offers represented 83% of the

fixed broadband customer base at 30 September 2016 (+2.4 percentage

points in one year).

Poland

Revenues in Poland declined 3.9% in the 3rd quarter of

2016 after falling 3.5% in the 2nd quarter, on

a comparable basis.

Mobile services decreased 3.1% in the 3rd quarter.

ARPU erosion followed the same trend as in the previous quarters,

in connection with the development of SIM-only offers, multi-SIM

offers and convergent offers. In the third quarter, commercial

momentum was particularly strong, with 309,000 net contract

additions, due to the success of commercial activities and to

increased customer migrations from prepaid offers to contracts. In

all, the contract customer base (9.085 million customers at 30

September 2016) recorded growth of +12.3% year on year. 4G

continued to develop rapidly, with 3.8 million users at 30

September 2016 (2.4x increase in one year), and the number of

convergent offers (837,000 customers at that same date) increased

25.5% year on year. The number of pre-paid offer customers declined

600,000 in the 3rd quarter,

linked to the introduction of customer identity verification

requirements, though this had a limited impact on the revenue

trend.

Growth continued to be buoyant in mobile equipment sales (+51.2% in

the 3rd quarter),

led by the development of sales using an instalment payment

plan.

Fixed services declined 8.6% in the 3rd quarter.

Traditional telephony fell 13.0% and fixed broadband decreased

6.8%, impacted by a decline in the number of clients and price

reductions occurring in 2015. Commercial activity in very

high-speed broadband (VDSL and fibre) was brisk: there were 44,000

net additions in the 3rd quarter,

including 18,000 additional fibre customers. At 30 September 2016,

there were 436,000 customers of very high-speed offers (VDSL and

fibre), a year-on-year increase of 61%. The fixed broadband

customer base had 2.025 million customers at 30 September 2016

(-5.0% year on year).

Other revenues declined significantly in the 3rd

quarter in connection with the end of infrastructure projects

occurring in the 4th quarter of

2015 and the decreased revenues from ICT.

Belgium & Luxembourg

Revenues in Belgium and Luxembourg increased 1.7% in the

3rd quarter of

2016 after decreasing 1.6% in the 2nd quarter. The

return to growth in the 3rd quarter was

linked in particular to a recovery in mobile equipment sales after

the 2nd quarter

downturn.

Mobile services were relatively stable in the 3rd

quarter (-0.1%). The impact of roaming price decreases in Europe,

effective from 30 April, was compensated by growth in the contract

customer base and an increase in contract ARPU (+1.5%). The mobile

contract customer base[7] (2.335

million customers at 30 September 2016) continued to grow steadily

(+2.9% year on year) and there were 1.4 million 4G users at 30

September 2016 (+65% year on year). The MVNO customer base had

1.992 million customers at 30 September 2016 (+17.3% year on

year).

At 30 September 2016, Orange Belgium had 17,600 customers of the

new Internet + TV convergent offers, with a strong increase in

September additions supported by the first advertising campaign

devoted to the new offers.

Central European countries

Revenues in the Central European Countries rose 0.8% in the

3rd quarter of

2016 after rising 1.5% in the 2nd quarter (on

a comparable basis).

In Romania, revenues increased 3.3% in the 3rd

quarter, as they did in the 2nd quarter, led

by mobile services (incoming traffic). TV services had 315,000

customers at 30 September 2016 (+26.3% year on year). The first

very high-speed fixed service offers[8], launched

last May in three cities, have been marketed at a national level

since September 5th.

In Slovakia, revenues fell 2.7% in the 3rd quarter,

after declining 1.0% in the 2nd quarter. The

downturn between the two quarters concerned fixed services to

operators, while mobile services continued to be impacted by the

erosion of ARPU.

In Moldova, revenues fell 3.7% in the 3rd quarter,

after declining 6.1% in the 2nd quarter (on

a comparable basis). The mobile services trend improved but

continued to be impacted by the significant downturn in incoming

international traffic.

The mobile customer base of the Central European Countries had 15.3

million customers at 30 September 2016. Contracts (8.1 million

customers) increased 4.4% and represented 52.9% of the mobile

customer base at 30 September 2016 (+2.5 percentage points in one

year). The 4G mobile customer base had 2.8 million customers at

that same date, an increase of 1.2 million since the beginning of

the year. There were 165,000 fixed broadband customers, an increase

of 10.6% year on year.

Africa & Middle East

Revenues from the Africa and Middle East segment rose 2.5% in the

3rd quarter of

2016 on a comparable basis. Excluding the two entities consolidated

for the first time at 30 September 2016 (Tigo in the Democratic

Republic of the Congo and Cellcom in Liberia), growth was 3.1% in

the 3rd quarter, an

improvement of 0.8 percentage points compared with the 2nd quarter

(+2.3%), while revenues continued to be impacted by the

strengthened requirement for customer identity verification in most

countries.

Mobile services rose 3.5% in the 3rd quarter, led

by data services, where growth continued to be strong (+34% in the

3rd quarter).

Similarly, Orange Money revenues increased 48% in the 3rd quarter.

Orange Money had 20 million customers at 30 September 2016 (+30%

year on year).

The principal contributors to revenue growth in the 3rd quarter were

Egypt, Guinea, Côte d'Ivoire and Mali.

The mobile customer base of the Africa and Middle East segment had

113.5 million customers at 30 September 2016, after reaching 108.5

million at 30 June. The addition of 5.0 million customers in the

3rd quarter

largely corresponded to the contributions from the two new

companies consolidated at 30 September 2016: 3.4 million customers

from Tigo in the Democratic Republic of the Congo and 1.5 million

from Cellcom in Liberia. The net additions trend improved with the

addition of 103,000 customers in the 3rd quarter,

after a decrease of 1.4 million customers in the 2nd quarter (on

a comparable basis) in connection with the strengthened requirement

for verification of customer identities in most

countries.

On 13 October 2016, Orange Egypt acquired a 4G licence for 15 years

encompassing two blocks of 10 MHz spectrum and a virtual fixed

operator's licence for 498 million USD. This acquisition gave

Orange Egypt wider spectrum and allowed it to offer its customers

better service quality than was envisaged at 30 June 2016; the

financial terms were also different from those predicted at 30 June

2016, with a price of more than 102 million USD and payment in full

made in 2016 rather than being spread out over three years.

Enterprise

Revenues from the Enterprise segment increased 0.7% in the

3rd quarter of

2016 after rising 0.3% in the 2nd quarter, on

a comparable basis. Growth of 1.0% was achieved over the first nine

months of the year, led by IT and integration services

(+4.5%).

Voice services fell a modest 1.5% in the 3rd quarter, as

in the 2nd quarter. The

downward trend of traditional telephony was largely offset by the

growth of voice-over-IP and customer relations services (contact

number services).

Data services remained stable at -0.3% in the 3rd

quarter after rising 0.5% in the 2nd quarter.

Revenues from IPVPN subscribers continued to rise steadily (+1.7%

in the 3rd quarter),

offsetting the downturn in legacy data services. There were 351,000

IPVPN subscribers at 30 September 2016, growth of 0.6% year on

year.

IT and integration services rose 4.1% in the 3rd

quarter after climbing 1.2% in the 2nd quarter. The

Cloud and security services continued their strong growth, at 16%

and 8% respectively in the 3rd quarter.

International Carriers & Shared

Services

Revenues from the International Carriers and Shared Services

segment fell 4.7% in the 3rd quarter of

2016 on a comparable basis, mostly in connection with the downturn

in services to international carriers.

Schedule of upcoming events

23 February 2017: presentation of

2016 results

Contacts

press: +33 1 44 44 93 93

Jean-Bernard Orsoni

jeanbernard.orsoni@orange.com

Tom Wright

tom.wright@orange.com

Olivier Emberger

olivier.emberger@orange.com

|

financial communications: +33 1 44 44 04 32

(analysts and investors)

Patrice Lambert-de Diesbach

p.lambert@orange.com

Constance Gest

constance.gest@orange.com

Luca Gaballo

luca.gaballo@orange.com

Caroline Maury

caroline.maury@orange.com

Samuel Castelo

samuel.castelo@orange.com

Didier Kohn

didier.kohn@orange.com |

All press releases are available

on the following websites:

www.orange.com; www.orange.es; www.orange-ir.pl;

www.orange.be; www.orange-business.com

Disclaimer

This press release contains forward-looking statements about

Orange. Although we believe these statements are based on

reasonable assumptions, they are subject to numerous risks and

uncertainties, including matters not yet known to us or not

currently considered material by us, and there can be no assurance

that anticipated events will occur or that the objectives set out

will actually be achieved. Important factors that could cause

actual results to differ from the results anticipated in the

forward-looking statements include, among others: the success of

Orange's strategy, particularly its ability to maintain control

over customer relations when facing competition with OTT players,

Orange's ability to withstand intense competition in mature markets

and business activities, its ability to capture growth

opportunities in emerging markets and the risks specific to those

markets, fiscal and regulatory constraints and changes, and

the results of litigation regarding regulations, competition

and other matters, the success of Orange's French and international

investments, joint ventures and strategic partnerships in

situations in which it may not have control of the enterprise, and

in countries presenting additional risk, risks related to

information and communications technology systems generally,

including networks or software failures due to cyberattacks, damage

to networks caused by natural disasters, voluntary acts or other

reasons, loss or disclosure to third parties of customers data,

health concerns surrounding telecommunications equipment and

devices, Orange's credit ratings, its ability to access capital

markets and the state of capital markets in general, exchange rate

or interest rate fluctuations, and changes in assumptions

underlying the carrying amount value of certain assets and

resulting in their impairment. More detailed information on the

potential risks that could affect our financial results will be

found in the Registration Document and in the annual report on Form

20-F filed on April 4, 2016 with, respectively, the French Autorité

des Marchés Financiers (AMF) and the U.S. Securities and Exchange

Commission. Forward-looking statements speak only as of the date

they are made. Other than as required by law (in particular

pursuant to sections 223-1 and seq. of the General Regulations of

the AMF), Orange does not undertake any obligation to update them

in light of new information or future developments.

Appendix 1: revenues by

operating segment

| |

|

|

|

|

|

|

| |

2016 |

2015 |

2015 |

change |

change |

| |

|

|

comparable basis |

historical basis |

comparable basis |

historical basis |

| In millions of euros |

|

|

|

(in %) |

(in %) |

| |

|

|

|

|

|

|

| September 30 |

|

|

|

|

|

| France |

14,144 |

14,289 |

14,279 |

(1.0)% |

(0.9)% |

| Mobile services |

5,424 |

5,638 |

5,638 |

(3.8)% |

(3.8)% |

| Mobile equipment sales |

520 |

486 |

486 |

6.9

% |

6.9

% |

| Fixed services |

7,773 |

7,734 |

7,734 |

0.5

% |

0.5

% |

|

|

Fixed

services retail |

4,771 |

4,808 |

4,808 |

(0.8)% |

(0.8)% |

|

|

Fixed

wholesale |

3,002 |

2,927 |

2,927 |

2.6

% |

2.6

% |

| Other

revenues |

427 |

430 |

421 |

- |

- |

| Europe |

7,798 |

7,666 |

7,345 |

1.7 % |

6.2 % |

| Mobile services |

4,640 |

4,504 |

4,542 |

3.0

% |

2.2

% |

| Mobile equipment sales |

695 |

644 |

643 |

7.9

% |

8.1

% |

| Fixed services |

2,341 |

2,359 |

1,999 |

(0.8)% |

17.1

% |

| Other

revenues |

122 |

160 |

161 |

- |

- |

| Of which: |

|

|

|

|

|

| Spain |

3,706 |

3,520 |

3,064 |

5.3 % |

21.0 % |

| Mobile services |

1,959 |

1,818 |

1,776 |

7.8

% |

10.3

% |

| Mobile equipment sales |

366 |

374 |

366 |

(2.2)% |

(0.0)% |

| Fixed services |

1,380 |

1,316 |

914 |

4.9

% |

51.1

% |

| Other

revenues |

1 |

11 |

7 |

- |

- |

| Poland |

1,963 |

2,042 |

2,145 |

(3.9)% |

(8.5)% |

| Mobile services |

922 |

944 |

994 |

(2.3)% |

(7.2)% |

| Mobile equipment sales |

166 |

105 |

110 |

57.7

% |

50.4

% |

| Fixed services |

808 |

886 |

929 |

(8.8)% |

(13.0)% |

| Other

revenues |

67 |

107 |

112 |

- |

- |

| Belgium &

Luxembourg |

920 |

913 |

913 |

0.8 % |

0.8 % |

| Mobile services |

762 |

753 |

753 |

1.2

% |

1.2

% |

| Mobile equipment sales |

84 |

88 |

88 |

(5.3)% |

(5.3)% |

| Fixed services |

54 |

61 |

61 |

(12.2)% |

(12.2)% |

| Other

revenues |

21 |

11 |

11 |

- |

- |

| Central European

countries |

1,215 |

1,194 |

1,227 |

1.7 % |

(1.0)% |

| Mobile services |

1,002 |

991 |

1,021 |

1.1

% |

(1.9)% |

| Mobile equipment sales |

80 |

76 |

78 |

4.6

% |

2.0

% |

| Fixed services |

100 |

96 |

97 |

3.2

% |

3.1

% |

| Other

revenues |

34 |

31 |

31 |

- |

- |

| Intra-Europe eliminations |

(6) |

(2) |

(3) |

- |

- |

| Africa & Middle

East |

3,887 |

3,772 |

3,587 |

3.0 % |

8.4 % |

| Mobile services |

3,190 |

3,068 |

2,888 |

4.0

% |

10.5

% |

| Mobile equipment sales |

56 |

58 |

55 |

(2.9)% |

3.2

% |

| Fixed services |

572 |

577 |

573 |

(0.8)% |

(0.2)% |

| Other

revenues |

68 |

69 |

71 |

- |

- |

| Enterprise |

4,756 |

4,707 |

4,748 |

1.0 % |

0.2 % |

| Voice services |

1,128 |

1,148 |

1,151 |

(1.8)% |

(2.0)% |

| Data services |

2,133 |

2,129 |

2,208 |

0.2

% |

(3.4)% |

| IT and

integration services |

1,495 |

1,431 |

1,389 |

4.5 % |

7.7 % |

| International Carriers &

Shared Services |

1,360 |

1,386 |

1,442 |

(1.8)% |

(5.7)% |

| International Carriers |

1,143 |

1,175 |

1,175 |

(2.7)% |

(2.7)% |

| Shared

Services |

217 |

211 |

268 |

3.0 % |

(18.8)% |

| Intra-Group eliminations |

(1,544) |

(1,562) |

(1,561) |

- |

- |

| Group total |

30,401 |

30,258 |

29,841 |

0.5 % |

1.9 % |

| |

|

|

|

|

|

|

| |

|

2016 |

2015 |

2015 |

change |

change |

| |

|

|

comparable basis |

historical basis |

comparable basis |

historical basis |

| In millions of euros |

|

|

|

(in %) |

(in %) |

| |

|

|

|

|

|

|

| 3rd

quarter |

|

|

|

|

|

| France |

4,768 |

4,797 |

4,794 |

(0.6)% |

(0.5)% |

| Mobile services |

1,834 |

1,906 |

1,906 |

(3.8)% |

(3.8)% |

| Mobile equipment sales |

194 |

174 |

174 |

11.4

% |

11.4

% |

| Fixed services |

2,590 |

2,572 |

2,572 |

0.7

% |

0.7

% |

|

|

Fixed

services retail |

1,593 |

1,595 |

1,595 |

(0.1)% |

(0.1)% |

|

|

Fixed

wholesale |

997 |

977 |

977 |

2.1

% |

2.1

% |

| Other

revenues |

150 |

145 |

142 |

- |

- |

| Europe |

2,670 |

2,597 |

2,652 |

2.8 % |

0.7 % |

| Mobile services |

1,602 |

1,550 |

1,568 |

3.3

% |

2.2

% |

| Mobile equipment sales |

242 |

208 |

222 |

16.7

% |

8.9

% |

| Fixed services |

781 |

789 |

805 |

(0.9)% |

(2.9)% |

| Other

revenues |

45 |

50 |

57 |

- |

- |

| Of which: |

|

|

|

|

|

| Spain |

1,288 |

1,194 |

1,216 |

7.8 % |

5.9 % |

| Mobile services |

696 |

634 |

631 |

9.8

% |

10.2

% |

| Mobile equipment sales |

127 |

116 |

128 |

9.5

% |

(1.4)% |

| Fixed services |

465 |

444 |

451 |

4.6

% |

3.1

% |

| Other

revenues |

1 |

1 |

6 |

- |

- |

| Poland |

657 |

684 |

709 |

(3.9)% |

(7.4)% |

| Mobile services |

308 |

318 |

330 |

(3.1)% |

(6.8)% |

| Mobile equipment sales |

59 |

39 |

41 |

51.2

% |

45.7

% |

| Fixed services |

266 |

292 |

302 |

(8.6)% |

(11.6)% |

| Other

revenues |

23 |

35 |

36 |

- |

- |

| Belgium &

Luxembourg |

311 |

306 |

306 |

1.7 % |

1.7 % |

| Mobile services |

258 |

258 |

258 |

(0.1)% |

(0.1)% |

| Mobile equipment sales |

28 |

26 |

26 |

9.0

% |

9.0

% |

| Fixed services |

18 |

19 |

19 |

(7.2)% |

(7.2)% |

| Other

revenues |

8 |

3 |

3 |

- |

- |

| Central European

countries |

417 |

414 |

421 |

0.8 % |

(1.1)% |

| Mobile services |

343 |

342 |

349 |

0.3

% |

(1.8)% |

| Mobile equipment sales |

28 |

27 |

28 |

4.6

% |

2.6

% |

| Fixed services |

33 |

34 |

34 |

(2.8)% |

(2.8)% |

| Other

revenues |

13 |

11 |

11 |

- |

- |

| Intra-Europe eliminations |

(3) |

(1) |

(1) |

- |

- |

| Africa & Middle

East |

1,371 |

1,338 |

1,304 |

2.5 % |

5.1 % |

| Mobile services |

1,135 |

1,097 |

1,063 |

3.5

% |

6.8

% |

| Mobile equipment sales |

17 |

21 |

17 |

(17.2)% |

1.0

% |

| Fixed services |

192 |

198 |

201 |

(3.2)% |

(4.6)% |

| Other

revenues |

26 |

22 |

22 |

- |

- |

| Enterprise |

1,567 |

1,556 |

1,577 |

0.7 % |

(0.6)% |

| Voice services |

371 |

377 |

378 |

(1.5)% |

(1.8)% |

| Data services |

708 |

710 |

739 |

(0.3)% |

(4.3)% |

| IT and

integration services |

488 |

469 |

459 |

4.1 % |

6.3 % |

| International Carriers &

Shared Services |

456 |

479 |

486 |

(4.7)% |

(6.1)% |

| International Carriers |

386 |

406 |

406 |

(5.0)% |

(5.0)% |

| Shared

Services |

70 |

73 |

80 |

(3.6)% |

(11.9)% |

| Intra-Group eliminations |

(510) |

(527) |

(528) |

- |

- |

| Group total |

10,323 |

10,240 |

10,284 |

0.8 % |

0.4 % |

Appendix 2: analysis of restated consolidated EBITDA

| |

|

|

|

| |

2016 |

2015 |

change |

| |

|

|

comparable basis |

comparable basis |

| In millions

of euros |

|

|

(in %) |

| |

|

|

|

|

| September 30 |

|

|

|

| Revenues |

30,401 |

30,258 |

0.5 % |

| External purchases |

(13,315) |

(13,109) |

1.6

% |

| as % of revenues |

43.8

% |

43.3

% |

0.5

pt. |

| of which: |

|

|

|

|

|

Interconnection costs |

(4,052) |

(4,027) |

0.6

% |

|

|

as % of

revenues |

13.3

% |

13.3

% |

0.0

pt. |

|

|

Other

network and IT expenses |

(2,190) |

(2,123) |

3.2

% |

|

|

as % of

revenues |

7.2

% |

7.0

% |

0.2

pt. |

|

|

Property,

overheads, other expenses and capitalised costs |

(2,298) |

(2,323) |

(1.1)% |

|

|

as % of

revenues |

7.6

% |

7.7

% |

(0.1)

pt. |

|

|

Commercial expenses and content costs |

(4,774) |

(4,636) |

3.0

% |

| |

as % of

revenues |

15.7 % |

15.3 % |

0.4

pt. |

| Labour expenses |

(6,240) |

(6,330) |

(1.4)% |

| as % of

revenues |

20.5 % |

20.9 % |

(0.4)

pt. |

| Operating

taxes and levies |

(1,568) |

(1,466) |

6.9 % |

| Other

operating income and expenses |

232 |

137 |

- |

| Restated EBITDA* |

9,510 |

9,491 |

0.2 % |

| as % of

revenues |

31.3 % |

31.4 % |

(0.1)

pt. |

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

| |

2016 |

2015 |

change |

| |

|

|

comparable basis |

comparable basis |

| In millions

of euros |

|

|

(in %) |

| |

|

|

|

|

| 3rd

quarter |

|

|

|

| Revenues |

10,323 |

10,240 |

0.8 % |

| External purchases |

(4,497) |

(4,440) |

1.3

% |

| as % of revenues |

43.6

% |

43.4

% |

0.2

pt. |

| of which: |

|

|

|

|

|

Interconnection costs |

(1,364) |

(1,363) |

0.1% |

|

|

as % of

revenues |

13.2

% |

13.3

% |

(0.1)

pt. |

|

|

Other

network and IT expenses |

(720) |

(722) |

(0.3)% |

|

|

as % of

revenues |

7.0

% |

7.1

% |

(0.1)

pt. |

|

|

Property,

overheads, other expenses and capitalised costs |

(770) |

(770) |

(0.0)% |

|

|

as % of

revenues |

7.5

% |

7.5

% |

(0.1)

pt. |

|

|

Commercial expenses and content costs |

(1,642) |

(1,585) |

3.6

% |

| |

as % of

revenues |

15.9 % |

15.5 % |

0.4

pt. |

| Labour expenses |

(1,920) |

(1,973) |

(2.7)% |

| as % of

revenues |

18.6 % |

19.3 % |

(0.7)

pt. |

| Operating

taxes and levies |

(350) |

(321) |

8.9 % |

| Other

operating income and expenses |

42 |

33 |

- |

| Restated EBITDA* |

3,597 |

3,540 |

1.6 % |

| as % of

revenues |

34.9 % |

34.6 % |

0.3

pt. |

|

|

|

|

|

|

| |

|

|

|

|

* EBITDA restatements are described

on the following page.

Bridge table of restated data to consolidated

income statement

| 2016 data |

3rd quarter

2016 |

|

September 30, 2016 |

| In millions of euros |

Restated

data |

Presentation restatements |

Income

statement |

|

Restated

data |

Presentation restatements |

Income

statement |

| Revenues |

10,323 |

- |

10,323 |

|

30,401 |

- |

30,401 |

| External

purchases |

(4,497) |

- |

(4,497) |

|

(13,315) |

- |

(13,315) |

| Other

operating income |

162 |

- |

162 |

|

525 |

7 |

532 |

| Other

operating expense |

(120) |

(1) |

(121) |

|

(293) |

(62) |

(355) |

| Labour

expenses |

(1,920) |

(36) |

(1,957) |

|

(6,240) |

(121) |

(6,361) |

| Operating

taxes and levies |

(350) |

- |

(350) |

|

(1,568) |

90 |

(1,478) |

| Gains

(losses) on disposal |

- |

1 |

1 |

|

- |

68 |

68 |

|

Restructuring costs |

- |

(10) |

(10) |

|

- |

(350) |

(350) |

| Restated EBITDA |

3,597 |

(46) |

|

|

9,510 |

(367) |

|

|

Significant litigation |

(3) |

3 |

- |

|

37 |

(37) |

- |

| Specific

labour expenses |

(34) |

34 |

- |

|

(114) |

114 |

- |

| Review of

the investments and business portfolio |

1 |

(1) |

- |

|

68 |

(68) |

- |

|

Restructuring costs |

(10) |

10 |

- |

|

(350) |

350 |

- |

| Other

specific items * |

- |

- |

- |

|

(8) |

8 |

- |

| Reported EBITDA |

3,551 |

|

3,551 |

|

9,143 |

|

9,143 |

| |

|

|

|

|

|

|

|

| 2015 pro forma data |

3rd

quarter 2015 |

|

September 30, 2015 |

| In millions of euros |

Restated

data |

Presentation restatements |

Income

statement |

|

Restated

data |

Presentation restatements |

Income

statement |

| Revenues |

10,240 |

- |

10,240 |

|

30,258 |

- |

30,258 |

| External

purchases |

(4,440) |

- |

(4,440) |

|

(13,109) |

- |

(13,109) |

| Other

operating income |

129 |

- |

129 |

|

454 |

- |

454 |

| Other

operating expense |

(96) |

- |

(96) |

|

(317) |

(413) |

(730) |

| Labour

expenses |

(1,973) |

(40) |

(2,013) |

|

(6,330) |

(148) |

(6,477) |

| Operating

taxes and levies |

(321) |

- |

(321) |

|

(1,466) |

- |

(1,466) |

| Gains

(losses) on disposal |

- |

- |

- |

|

- |

- |

- |

|

Restructuring costs |

- |

(49) |

(49) |

|

- |

(93) |

(94) |

| Restated EBITDA |

3,540 |

(89) |

|

|

9,491 |

(654) |

|

|

Significant litigation |

- |

- |

- |

|

(413) |

413 |

- |

| Specific

labour expenses |

(40) |

40 |

- |

|

(148) |

148 |

- |

| Review of

the investments and business portfolio |

- |

- |

- |

|

- |

- |

- |

|

Restructuring costs |

(49) |

49 |

- |

|

(93) |

93 |

- |

| Other

specific items |

- |

- |

- |

|

- |

- |

- |

| Reported EBITDA |

3,451 |

|

3,451 |

|

8,837 |

|

8,837 |

| |

|

|

|

|

|

|

|

| 2015 historical data |

3rd

quarter 2015 |

|

September 30, 2015 |

| In millions of euros |

Restated

data |

Presentation restatements |

Income

statement |

|

Restated

data |

Presentation restatements |

Income

statement |

| Revenues |

10,284 |

- |

10,284 |

|

29,841 |

- |

29,841 |

| External

purchases |

(4,452) |

- |

(4,452) |

|

(12,838) |

- |

(12,838) |

| Other

operating income |

128 |

- |

128 |

|

445 |

- |

445 |

| Other

operating expense |

(99) |

- |

(99) |

|

(290) |

(525) |

(815) |

| Labour

expenses |

(1,987) |

(40) |

(2,026) |

|

(6,350) |

(148) |

(6,497) |

| Operating

taxes and levies |

(313) |

- |

(313) |

|

(1,457) |

- |

(1,457) |

| Gains

(losses) on disposal |

- |

(1) |

(1) |

|

- |

184 |

184 |

|

Restructuring costs |

- |

(49) |

(49) |

|

- |

(83) |

(83) |

| Restated EBITDA |

3,561 |

(90) |

|

|

9,351 |

(571) |

|

|

Significant litigation |

- |

- |

- |

|

(413) |

413 |

- |

| Specific

labour expenses |

(40) |

40 |

- |

|

(148) |

148 |

- |

| Review of

the investments and business portfolio |

(1) |

1 |

- |

|

73 |

(73) |

- |

|

Restructuring costs |

(49) |

49 |

- |

|

(83) |

83 |

- |

| Other

specific items |

- |

- |

- |

|

- |

- |

- |

| Reported EBITDA |

3,471 |

|

3,471 |

|

8,780 |

|

8,780 |

*Transaction costs related to the negotiations with Bouygues

Telecom which were incurred in Q1 2016 during discussions regarding

a possible consolidation between the two companies. |

Appendix 3: key performance indicators

| |

September 30, 2016 |

September 30, 2015 |

| Orange Group |

|

historical basis |

| Total number of customers*

(millions) |

255.515 |

263.335 |

| Mobile customers* (millions) |

194.458 |

201.675 |

| - of which contract customers (millions) |

68.485 |

70.861 |

| Fixed broadband customers

(millions) |

18.059 |

17.942 |

| - of which FTTH customers (millions) |

2.898 |

1.487 |

| TV customers (millions) |

8.200 |

7.658 |

| France |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

29.508 |

28.226 |

| - of which contract customers (millions) |

25.759 |

23.706 |

| Total ARPU (euros) |

22.2 |

22.6 |

| Fixed services |

|

|

| Number of broadband customers (millions) |

11.056 |

10.613 |

| - of which FTTH customers (millions) |

1.308 |

0.827 |

| Broadband market share at end of period (%) |

40.2 ** |

39.9 |

| Number of TV customers (millions) |

6.512 |

6.270 |

| Broadband ARPU (euros) |

33.2 |

33.1 |

| Number of fixed line subscribers (millions) |

16.062 |

16.285 |

| Number of wholesale lines (millions) |

14.021 |

13.898 |

| Europe*** |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

51.421 |

50.174 |

| - of which contract customers (millions) |

32.867 |

30.830 |

| Number of MVNO customers (millions) |

3.921 |

3.193 |

| Fixed services |

|

|

| Number of broadband customers (millions) |

6.119 |

6.001 |

| - of which FTTH customers (millions) |

1.544 |

0.640 |

| Number of TV customers (millions) |

1.635 |

1.341 |

| Number of fixed lines (millions) |

8.842 |

9.179 |

| Spain |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

15.846 |

15.169 |

| - of which contract customers (millions) |

12.545 |

11.901 |

| Total ARPU (euros) |

13.7 |

14.1 |

| Number of MVNO customers (millions) |

1.923 |

1.487 |

| Fixed services |

|

|

| Number of broadband customers (millions) |

3.886 |

3.689 |

| - of which FTTH customers (millions) |

1.411 |

0.563 |

| Number of TV customers (thousands) |

458 |

215 |

| Broadband ARPU (euros) |

30.9 |

28.5 |

| |

|

|

| * Excluding customers of MVNOs |

| ** Company estimate. |

| *** Europe: Spain, Poland, Belgium &

Luxembourg, and Central European countries. |

|

|

|

|

| The customer base of the Orange Group at 30

September 2015 on an historical basis included 50% of the EE

customer base, which was consolidated into the Group's customer

base. Orange and Deutsche Telekom finalised the sale of EE to BT

Group in January 2016. |

| |

September 30, 2016 |

September 30, 2015 |

| Poland |

|

historical basis |

| Mobile services |

|

|

| Number of customers* (millions) |

16.394 |

15.693 |

| - of which contract customers (millions) |

9.085 |

8.087 |

| Total ARPU (PLN) |

28.7 |

30.5 |

| Fixed services |

|

|

| Number of broadband customers (millions) |

2.025 |

2.131 |

| - of which VHBB customers (VDSL and FTTH,

thousands) |

436 |

271 |

| Number of TV customers (thousands) |

761 |

774 |

| Broadband ARPU (PLN) |

60.5 |

61.0 |

| Number of fixed lines (millions) |

4.797 |

5.295 |

| Belgium & Luxembourg |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

3.925 |

3.974 |

| - of which contract customers (millions) |

3.164 |

3.112 |

| Total ARPU - Belgium (euros) |

24.3 |

23.9 |

| Number of MVNO customers (millions) |

1.992 |

1.699 |

| Fixed services |

|

|

| Number of broadband customers (thousands) |

43 |

32 |

| Number of TV customers (thousands) |

22 |

2 |

| Number of telephone lines (thousands) |

159 |

196 |

| Central European countries |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

15.255 |

15.338 |

| - of which contract customers (millions) |

8.073 |

7.730 |

| Fixed services |

|

|

| Number of broadband customers (thousands) |

165 |

150 |

| Number of TV customers (thousands) |

394 |

350 |

| Africa & Middle East |

|

|

| Mobile services |

|

|

| Number of customers* (millions) |

113.530 |

111.177 |

| - of which contract customers (millions) |

9.859 |

8.726 |

| Fixed services |

|

|

| Number of broadband customers (thousands) |

884 |

865 |

| Total number of telephone lines (thousands) |

1,110 |

1,152 |

| Enterprise |

|

|

| France |

|

|

| Number of legacy telephone lines (thousands) |

2,857 |

3,001 |

| Number of IP-VPN accesses (thousands) |

295 |

294 |

| Number of XoIP connections (thousands) |

93 |

87 |

| World |

|

|

| Number of IP-VPN accesses worldwide (thousands) |

351 |

349 |

| * Excluding customers of MVNOs. |

|

|

Appendix 4: glossary

Key figures

Comparable basis: data based on comparable accounting principles,

scope of consolidation and exchange rates are presented for

previous periods. The transition from data on an historical basis

to data on a comparable basis consists of keeping the results for

the period ended and then restating the results for the

corresponding period of the preceding year for the purpose of

presenting, over comparable periods, financial data with comparable

accounting principles, scope of consolidation and exchange rate.

The method used is to apply to the data of the corresponding period

of the preceding year, the accounting principles and scope of

consolidation for the period just ended as well as the average

exchange rate used for the income statement for the period

ended.

Reported EBITDA: operating income before

depreciation and amortisation, before revaluation related to

acquisitions of controlling interests, before impairment of

goodwill and assets, and before income from associates. EBITDA is

not a financial aggregate as defined by IFRS standards and may not

be directly comparable to similarly named indicators in other

companies.

Restated EBITDA: Reported EBITDA (see definition),

adjusted for the impacts of key disputes, specific labour expenses,

the review of the portfolio of shares and operations, the cost of

restructuring and, as applicable, other specific and systematically

identified items. Since the 1st quarter of 2016, restated EBITDA

excludes all income from the disposal of shares and operations,

regardless of the amount, and the restated EBITDA for past periods

was revised accordingly. Restated EBITDA is not a financial

aggregate as defined by IFRS standards and may not be directly

comparable to similarly named indicators in other companies.

CAPEX: capital expenditure on tangible and

intangible assets excluding telecommunication licences and

investments through finance leases. CAPEX is not a financial

performance indicator as defined by IFRS standards and may not be

directly comparable to indicators referenced by the same name in

other companies.

Mobile services

Revenues from mobile services: include revenues generated by

incoming and outgoing calls (voice, SMS and data services), network

access fees, added-value services, machine to machine, roaming

revenues from customers of other networks (national and

international roaming), revenues with mobile virtual network

operators (MVNO) and revenues from network sharing.

Mobile ARPU: the annual average revenues per user

(ARPU) are calculated by dividing the revenues from incoming and

outgoing calls (voice, SMS and data services), network access fees,

added-value services and visitor roaming over the past twelve

months, by the weighted average number of customers over the same

period, excluding "machine to machine" customers. The weighted

average number of customers is the average of the monthly averages

during the period in question. The monthly average is the

arithmetic mean of the number of customers at the start and end of

the month. Mobile ARPU is expressed as monthly revenues per

customer.

Roaming: use of a mobile service on the network of

an operator other than that of the subscriber.

MVNO: Mobile Virtual Network Operator. These are

operators that do not have their own radio network and thus use the

infrastructure of third-party networks.

Fixed services

Includes traditional fixed telephony, fixed broadband services,

enterprise solutions and networks[9] and carrier

services (notably national and international interconnections,

unbundling and wholesale telephone line rentals).

Fixed broadband ARPU (ADSL, FTTH, VDSL, satellite

and WiMAX): the average revenues per user (ARPU) of broadband

services per year are calculated by dividing the revenues generated

by retail broadband services over the past twelve months by the

weighted average number of accesses over the same period. The

weighted average number of accesses is the average of the monthly

averages during the period in question. The monthly average is the

arithmetic mean of the number of accesses at the start and end of

the month. Fixed broadband ARPU is expressed as monthly revenues

per access.

[1] Excluding

machine-to-machine.

[2] Subject to

approval at the annual shareholders meeting.

[3] The

ex-dividend date is set at 5 December 2016 and the recording date

at 6 December 2016.

[4] On an

historical basis, revenues at 30 September 2016 recorded an

increase of 1.9% in relation to the previous year, which

included:

- the impact of changes in consolidation scope (+2.3

percentage points), in particular with the acquisition of Jazztel

and the full consolidation of Méditel from 1 July 2015; the

acquisition of Cellcom in Liberia and Tigo in the Democratic

Republic of the Congo, which were fully consolidated at 30

September 2016 retroactively to the date of acquisition (6 months

and 5 months of operations respectively); the sale of 80% of

Dailymotion on 30 June 2015 (+10% on 30 July); and the sale

of Orange Armenia on 3 September 2015;

- the impact of variations in foreign exchange (-0.9

percentage points), in particular with the decline in the Polish

zloty and the Egyptian pound.

[5] Including

the acquisitions of telecommunication licences (1.054 billion

euros) and investments financed by capital leases (84 million

euros), total CAPEX on tangible and intangible assets was 5.871

billion euros in the first nine months of 2016. In the 3rd quarter of

2016, CAPEX on tangible and intangible assets was 1.683 billion

euros, including 79 million euros related to acquisitions of

telecommunication licences and 38 million euros related to

investments financed by capital leases.

[6] Excluding

machine-to-machine.

[7] Excluding

machine-to-machine contracts.

[8] Pursuant to

the agreement with Telekom Romania for the use of its fibre optic

network in urban areas.

[9] With the

exception of France, where entreprise solutions and networks are

listed under the Enterprise business segment.

Third quarter 2016 financial

information

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Orange via Globenewswire

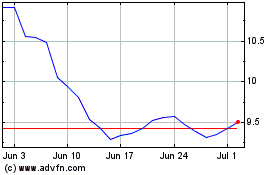

Orange (EU:ORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orange (EU:ORA)

Historical Stock Chart

From Apr 2023 to Apr 2024