TIDMNHY

Hydro's underlying earnings before financial items and tax declined to

NOK 1,477 million in the third quarter, down from NOK 1,618 million in

the second quarter. The decrease mainly reflected seasonally lower metal

sales and negative currency effects, partly offset by higher realized

aluminium prices.

-- Underlying EBIT of NOK 1 477 million

-- Higher realized aluminium prices, offset by currency

developments

-- Record-high alumina production of 6.5 million mt

-- Seasonally lower metal sales

-- Trial production started at new automotive line in Germany

-- Better improvement program on track for 2019 target of NOK

2.9 billion

-- Global primary aluminium demand growth expected at 4-5% in

2016

"Demand growth for aluminium remains healthy. We are sticking to our

forecast for global aluminium demand growth of 4-5 percent for 2016 and

expect to land in the higher range of this estimate for the full year,"

says President and CEO Svein Richard Brandtzæg. "This comes on the

back of higher-than-expected demand in China and slower restarts of

curtailed capacity", says Brandtzæg.

"I'm pleased to see the positive operational development in our bauxite

and alumina production. Both Paragominas and Alunorte produced above

nameplate capacity in the third quarter, with Hydro Alunorte alumina

production reaching a record-high production level. This is a

demonstration of long-term dedication by a highly competent and

committed organization in Brazil. We have succeeded in lifting the bar

and will continue these efforts to stabilize production at or above

nameplate capacity," says Brandtzæg.

Underlying EBIT for Bauxite & Alumina decreased compared to second

quarter. While the realized alumina price remained stable, alumina

sourcing costs increased somewhat. Further reduction in raw material

consumption and reduced bauxite costs were offset by negative currency

effects, as the Brazilian Real continued to strengthen against the USD.

Annualized production volume at Hydro Alunorte reached a record 6.5

million mt per year, exceeding name-plate capacity of 6.3 million mt per

year. Hydro Paragominas also increased the production after lower

production last quarter due to ball mill maintenance.

Underlying EBIT for Primary Metal declined in the third quarter. Lower

premiums and volumes, in addition to slightly higher raw material costs

and negative currency effects, were largely offset by higher realized

aluminium prices and lower fixed costs. The second quarter was

positively influenced by an insurance refund of NOK 50 million related

to a power outage in Årdal in January 2016, in addition to a

positive effect of NOK 75 million related to a reversal of ICMS tax

accrual on sales of surplus power in Brazil in previous periods.

Underlying EBIT for Metal Markets improved in the third quarter mainly

due to less negative currency and inventory evaluation effects, in

addition to improved results from sourcing and trading activities.

Results from remelters declined mainly due to seasonally lower volumes.

Underlying EBIT for Rolled Products was lower compared to the second

quarter of 2016, mainly due to seasonally lower volumes and changes in

the product mix. The Neuss smelter result was higher due to an increase

in the all-in metal price.

Underlying EBIT for Energy declined compared to the previous quarter due

to higher production cost and higher area cost, partly offset by higher

production. The higher production cost was driven by seasonally higher

property taxes, while area cost increased mainly due to export

restrictions out of Southern Norway during the quarter.

Underlying EBIT for Sapa decreased compared to the previous quarter,

mainly due to seasonally lower market demand.

During the third quarter Hydro made progress in accordance with plan on

its "Better" improvement ambition targeting NOK 2.9 billion of annual

improvements by 2019.

Hydro's net cash position increased during the third quarter by NOK 0.6

billion to NOK 5.4 billion at the end of the quarter. Net cash provided

by operating activities amounted to NOK 2.3 billion. Net cash used in

investment activities, excluding short term investments, amounted to NOK

1.5 billion.

Reported earnings before financial items and tax amounted to NOK 1,376

million in the third quarter. In addition to the factors discussed above,

reported EBIT included net unrealized derivative gains of NOK 100

million and positive metal effects of NOK 48 million. Reported earnings

also included a charge of NOK 124 million related to the demolition of

the Kurri Kurri site and an impairment charge of NOK 140 million related

to the decision to divest the Hannover site. In addition, reported

earnings included a net gain of NOK 15 million in Sapa (Hydro's share

net of tax), relating to unrealized derivative gains, rationalization

charges and net foreign exchange gains.

In the previous quarter reported earnings before financial items and tax

amounted to NOK 1,978 million including net unrealized derivative gains

of NOK 32 million and positive metal effects of NOK 17 million. Reported

EBIT also included a charge of NOK 67 million related to environmental

commitments in Kurri Kurri, a gain of NOK 342 million for the sale of

certain assets in Grenland, including Herøya Industrial Park, and a

negative adjustment of NOK 13 million related to the sale of the Slim

rolling mill in the fourth quarter of 2015. In addition, reported EBIT

included a net gain of NOK 49 million in Sapa (Hydro's share net of tax),

relating to unrealized derivative gains and net foreign exchange gains.

Net income amounted to NOK 1,119 million in the third quarter including

a net foreign exchange gain of NOK 358 million mainly reflecting the

strengthening Norwegian kroner versus Euro affecting liabilities in Euro

in Norway and embedded currency derivatives in power contracts.

In the previous quarter net income was NOK 2,077 million including a net

foreign exchange gain of NOK 904 million mainly reflecting the

strengthening BRL versus US dollars affecting US dollar liabilities in

Brazil, as well as the strengthening Norwegian kroner versus Euro

affecting liabilities in Euro in Norway and embedded currency

derivatives in power contracts.

%change

Third Second %change Third prior First 9 First 9

Key financial information quarter quarter prior quarter year months months Year

NOK million, except per share data 2016 2016 quarter 2015 quarter 2016 2015 2015

Revenue 20,174 20,391 (1) % 21,594 (7) % 60,703 67,320 87,694

Earnings before financial items and tax (EBIT) 1,376 1,978 (30) % 1,630 (16) % 5,047 7,533 8,258

Items excluded from underlying EBIT 101 (360) >100 % 586 (83) % (451) 557 1,398

Underlying EBIT 1,477 1,618 (9) % 2,215 (33) % 4,596 8,090 9,656

Underlying EBIT :

Bauxite & Alumina 153 174 (12) % 628 (76) % 516 1,889 2,421

Primary Metal 637 702 (9) % 762 (16) % 1,657 4,221 4,628

Metal Markets 117 75 57 % 291 (60) % 358 227 379

Rolled Products 211 242 (13) % 331 (36) % 701 938 1,142

Energy 285 301 (5) % 191 49 % 983 752 1,105

Other and eliminations 75 125 (40) % 12 >100 % 380 63 (19)

Underlying EBIT 1,477 1,618 (9) % 2,215 (33) % 4,596 8,090 9,656

Earnings before financial items, tax, depreciation

and amortization (EBITDA) 2,792 3,222 (13) % 2,808 (1) % 8,922 11,154 13,282

Underlying EBITDA 2,753 2,862 (4) % 3,394 (19) % 8,331 11,711 14,680

Net income (loss) 1,119 2,077 (46) % (1,345) >100 % 5,578 1,791 2,333

Underlying net income (loss) 958 1,126 (15) % 1,377 (30) % 2,906 5,413 6,709

Earnings per share 0.53 0.95 (44) % (0.65) >100 % 2.61 0.76 0.99

Underlying earnings per share 0.46 0.52 (11) % 0.61 (25) % 1.37 2.39 2.98

Financial data:

Investments 1,914 1,711 12 % 1,316 45 % 5,596 3,309 5,865

Adjusted net interest-bearing debt (8,072) (8,758) 8 % (9,272) 13 % (8,072) (9,272) (8,173)

Key Operational information

Bauxite production (kmt) 2,777 2,609 6 % 2,735 2 % 8,069 7,101 10,060

Alumina production (kmt) 1,635 1,554 5 % 1,498 9 % 4,706 4,385 5,962

Primary aluminium production (kmt) 526 518 2 % 520 1 % 1,559 1,525 2,046

Realized aluminium price LME (USD/mt) 1,612 1,546 4 % 1,685 (4) % 1,552 1,795 1,737

Realized aluminium price LME (NOK/mt) 13,375 12,826 4 % 13,779 (3) % 13,049 14,032 13,813

Realized USD/NOK exchange rate 8.30 8.30 - 8.18 1 % 8.41 7.82 7.95

Rolled Products sales volumes to external market

(kmt) 231 238 (3) % 248 (7) % 697 719 948

Sapa sales volumes 50% (kmt) 170 183 (7) % 171 - 527 526 682

Power production (GWh) 2,946 2,674 10 % 2,839 4 % 8,781 8,012 10,894

Investor contact

Contact Stian Hasle

Cellular +47 97736022

E-mail Stian.Hasle@hydro.com

Press contact

Contact Halvor Molland

Cellular +47 92979797

E-mail Halvor.Molland@hydro.com

Certain statements included in this announcement contain forward-looking

information, including, without limitation, information relating to (a)

forecasts, projections and estimates, (b) statements of Hydro management

concerning plans, objectives and strategies, such as planned expansions,

investments, divestments, curtailments or other projects, (c) targeted

production volumes and costs, capacities or rates, start-up costs, cost

reductions and profit objectives, (d) various expectations about future

developments in Hydro's markets, particularly prices, supply and demand

and competition, (e) results of operations, (f) margins, (g) growth

rates, (h) risk management, and (i) qualified statements such as

"expected", "scheduled", "targeted", "planned", "proposed", "intended"

or similar.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, these forward-looking

statements are based on a number of assumptions and forecasts that, by

their nature, involve risk and uncertainty. Various factors could cause

our actual results to differ materially from those projected in a

forward-looking statement or affect the extent to which a particular

projection is realized. Factors that could cause these differences

include, but are not limited to: our continued ability to reposition and

restructure our upstream and downstream businesses; changes in

availability and cost of energy and raw materials; global supply and

demand for aluminium and aluminium products; world economic growth,

including rates of inflation and industrial production; changes in the

relative value of currencies and the value of commodity contracts;

trends in Hydro's key markets and competition; and legislative,

regulatory and political factors.

No assurance can be given that such expectations will prove to have been

correct. Hydro disclaims any obligation to update or revise any

forward-looking statements, whether because of new information, future

events or otherwise.

This information is subject to the disclosure requirements pursuant to

section 5-12 of the Norwegian Securities Trading Act.

Q3 Presentasjon: http://hugin.info/106/R/2051008/767309.pdf

Q3 Rapport: http://hugin.info/106/R/2051008/767308.pdf

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Norsk Hydro via Globenewswire

http://www.hydro.com/en/?WT.mc_id=Pressrelease

(END) Dow Jones Newswires

October 25, 2016 01:15 ET (05:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

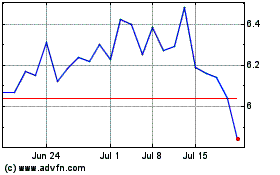

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

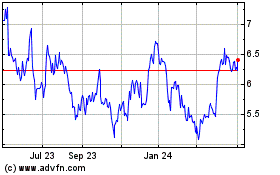

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024