Current Report Filing (8-k)

October 24 2016 - 4:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

October 20, 2016

|

The Goodyear Tire & Rubber Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Ohio

|

1-1927

|

34-0253240

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

200 Innovation Way, Akron, Ohio

|

|

44316-0001

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

330-796-2121

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05 Costs Associated with Exit or Disposal Activities.

On October 20, 2016, The Goodyear Tire & Rubber Company (the "Company") approved a plan that proposes to close Goodyear Dunlop Tires Germany GmbH’s tire manufacturing facility in Philippsburg, Germany that produces passenger car and light truck tires. The proposed plan is in furtherance of the Company’s announced strategy to capture the growing demand for premium, large-rim diameter tires in part by reducing excess capacity in declining, less profitable segments of the tire market. The proposed plan would result in approximately 890 job reductions at the Philippsburg plant. The plan remains subject to consultation with relevant employee representative bodies.

The Company expects to be substantially complete with this rationalization plan by the end of 2017 and estimates total pre-tax charges associated with this action to be between $240 million and $280 million, of which $165 million to $190 million is expected to be cash charges primarily for associate-related and other exit costs and $75 million to $90 million is expected to be non-cash charges related to accelerated depreciation and other asset-related charges. The Company expects to record $116 million of pre-tax charges in the third quarter of 2016 and approximately $20 million of pre-tax charges in the fourth quarter of 2016 associated with this plan. The majority of the remaining charges will be recorded in 2017.

Once completed, this action is expected to improve Europe, Middle East and Africa’s segment operating income by approximately $20 million in 2018 and $30 million on an annualized basis thereafter.

Safe Harbor Statement

Certain information contained in this Current Report on Form 8-K may constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995, including those statements regarding the expected amounts of charges and savings resulting from the proposed plan to close the Philippsburg, Germany manufacturing facility. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. There are a variety of factors, many of which are beyond the Company’s control, which could affect its operations, performance, business strategy and results and could cause its actual results and experience to differ materially from the assumptions, expectations and objectives expressed in any forward-looking statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to the risks and other factors described in the Company’s filings with the Securities and Exchange Commission, including the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, any forward-looking statements represent management’s estimates only as of today and should not be relied upon as representing management’s estimates as of any subsequent date. While the Company may elect to update forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so, even if management’s estimates change.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

The Goodyear Tire & Rubber Company

|

|

|

|

|

|

|

|

October 24, 2016

|

|

By:

|

|

David L. Bialosky

|

|

|

|

|

|

|

|

|

|

|

|

Name: David L. Bialosky

|

|

|

|

|

|

Title: Senior Vice President, General Counsel and Secretary

|

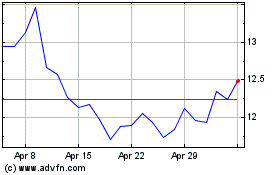

Goodyear Tire and Rubber (NASDAQ:GT)

Historical Stock Chart

From Mar 2024 to Apr 2024

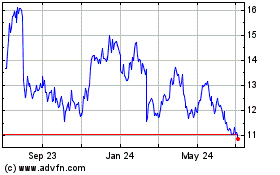

Goodyear Tire and Rubber (NASDAQ:GT)

Historical Stock Chart

From Apr 2023 to Apr 2024