Stocks Gain, Spurred by Corporate Deals, Earnings

October 24 2016 - 2:10PM

Dow Jones News

By Riva Gold and Daniel Huang

U.S. stocks rose Monday as companies unleashed a fresh round of

deals and earnings.

The Dow Jones Industrial Average rose 64 points, or 0.4%, to

18210. The S&P 500 gained 0.4%, while the Nasdaq Composite rose

0.8%.

Technology shares rose broadly, helping lift the Nasdaq and

leading gains in the S&P 500.

B/E Aerospace surged 16% after Rockwell Collins reached a deal

to buy it. T-Mobile US added 7.9% after announcing increased

profits and market share in the most recent quarter.

Monday's moves came after the S&P 500 snapped a two-week

losing streak on Friday following deal talks and

better-than-expected earnings. By the end of this week, 292

companies in the S&P 500 are expected to have reported

earnings, according to FactSet.

"It's all about earnings right now," said Bill Northey, chief

investment officer at the Private Client Group at U.S. Bank, noting

company performance rather than macroeconomic developments has been

the key driver of stock markets in recent sessions.

Mergers also have been fueling moves.

Shares of TD Ameritrade lost 3.2% after the company said it

agreed to buy Scottrade Financial Services in a $4 billion deal.

Shares of AT&T declined 1.6% after it reached an agreement to

buy Time Warner for $85.4 billion, while shares of Time Warner

dropped 2.7%.

"This is an environment where corporations are looking into the

future -- where interest rates are moving up -- and they're using

this as an opportunity to better position themselves in a low-rate

environment," said Robert Pavlik, chief market strategist at Boston

Private Wealth. Companies can borrow more cheaply at low rates in

order to fund acquisitions.

U.S. government bonds pulled back Monday, with the yield on the

10-year Treasury note rising to 1.768% from 1.740% Friday. Yields

move inversely to prices.

Spanish assets led gains in Europe after the country ended its

10-month leadership impasse on Sunday as Mariano Rajoy was assured

of re-election as prime minister. Spain's IBEX 35 index gained

1.3%.

"It's a mini-step forward potentially in Spain," said David

Lloyd, head of institutional fund management for fixed income at

M&G Investments, but more broadly, "the issue of political

uncertainty is just about everywhere you look," he said.

European bank shares continued to perform well after a strong

week, with the Euro Stoxx Banks index rising 2.7% Monday. Spanish

lenders were among the best performers, with shares of Banco

Popular Español up 4.2% and Banco Santander up 3.7%.

Germany's DAX index added 0.5% and closed at its highest level

of the year, while the Stoxx Europe 600 fell less than 0.1%.

Earlier, stocks in Asia were mostly higher, led by a 1.2% rise

in the Shanghai Composite Index. Shares in Hong Kong climbed 1%,

while Japan's Nikkei Stock Average inched up 0.3% after data showed

Japanese exports fell for a 12th consecutive month, but at a slower

pace.

In commodities, U.S. crude oil fell 2% to $49.86 a barrel after

Iraq signaled it wanted to be excluded from OPEC's production cut

plan.

Write to Riva Gold at riva.gold@wsj.com and Daniel Huang at

dan.huang@wsj.com

(END) Dow Jones Newswires

October 24, 2016 13:55 ET (17:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

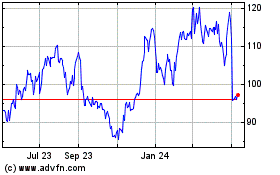

Qorvo (NASDAQ:QRVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

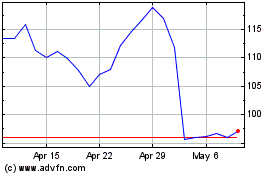

Qorvo (NASDAQ:QRVO)

Historical Stock Chart

From Apr 2023 to Apr 2024