Virtu Announces Opportunistic Refinancing

October 24 2016 - 9:00AM

Virtu Financial, Inc. (NASDAQ:VIRT) a leading technology-enabled

market maker and liquidity provider to the global financial

markets, today announced the opportunistic refinancing of its term

loan resulting in an extended maturity and lower cost.

The new terms include a decrease in the interest rate of

approximately 1.00% per annum and a new maturity of

2022. The new term loan has an interest rate of LIBOR

plus 3.5% with a LIBOR floor of 0.75% and a maturity of 2022.

Terms of Virtu's prior term loan included an interest rate of

LIBOR plus 4.25%, a LIBOR floor 1.00% and a maturity of 2019.

"We are pleased to announce this opportunistic refinancing of

our term loan," said Douglas Cifu, Chief Executive Officer of

Virtu. "Our ability to extend the maturity of our debt

to 2022 while meaningfully reducing the costs of the term loan

demonstrates the confidence our investors have in the long term

stability of our business model."

The transaction is anticipated to be net leverage neutral to

Virtu as the additional principal will be used to offer to

refinance the $34 million loan incurred in connection with the

acquisition of a minority stake in SBI Japannext, Co., Ltd.

Gross proceeds will also be used by Virtu to repay the principal of

existing term loan and to pay fees and expenses related to the

refinance transaction. If the lender in the SBI Japannext

transaction declines the prepayment, the excess cash from the

financing will be used for general corporate purposes.

The principal amount of the new term loan is $540 million.

The bulk of the new term loan is due and payable upon maturity in

2022 with 1% of principal required to be amortized per year, as was

the case with Virtu’s prior term loan. All other material

terms remain the same as the prior term loan.

J.P. Morgan acted as lead bookrunner and arranger in the

transaction.

About Virtu Financial, Inc.

Virtu is a leading technology-enabled market maker and liquidity

provider to the global financial markets. We stand ready, at any

time, to buy or sell a broad range of securities and other

financial instruments, and we generate revenue by buying and

selling securities and other financial instruments and earning

small amounts of money on individual transactions based on the

difference between what buyers are willing to pay and what sellers

are willing to accept, which we refer to as "bid/ask spreads,"

across a large volume of transactions. We make markets by providing

quotations to buyers and sellers in more than 12,000 securities and

other financial instruments on more than 235 unique exchanges,

markets and liquidity pools in 36 countries around the world. We

believe that our broad diversification, in combination with our

proprietary technology platform and low-cost structure, enables us

to facilitate risk transfer between global capital markets

participants by supplying liquidity and competitive pricing while

at the same time earning attractive margins and returns.

Cautionary Note Regarding Forward-Looking

Statements

The foregoing information contains certain forward-looking

statements that reflect the company's current views with respect to

certain current and future events and financial performance. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

company's operations and business environment which may cause the

company's actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the company on the date of this release.

The company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the company's financial results may be found in

the company's filings with the Securities and Exchange

Commission.

Contact:Investor RelationsAndrew SmithVirtu

Financial, Inc.(212) 418-0195investor_relations@virtu.com

Media Relationsmedia@virtu.com

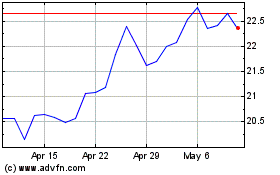

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

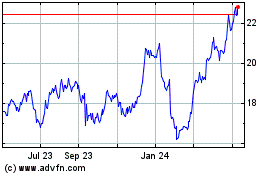

Virtu Financial (NASDAQ:VIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024