AMC Entertainment Holdings, Inc. (“AMC” or “the Company”), one

of the world’s leading theatrical exhibition companies and an

industry leader in innovation and operational excellence, today

previewed results for the third quarter ended September 30, 2016.

AMC is providing these third quarter 2016 results in connection

with the proposed financing previously announced on October 20,

2016. The financial results are subject to finalization of the

Company’s quarterly financial and accounting procedures.

AMC expects third quarter 2016 total revenues to be between

$777.0 million and $780.0 million compared to

$688.8 million in the third quarter of 2015. Operating income

for the third quarter is expected to be between $63.5 million and

$66.5 million compared to $35.5 million in the same

period a year ago. Net earnings are expected to be between $28.5

million and $31.5 million compared to $12.2 million for

the third quarter of 2015, and diluted earnings per share for the

third quarter of 2016 are expected to be between $0.29 and $0.32

compared to $0.12 for the third quarter of last year.

AMC expects third quarter 2016 Adjusted EBITDA to be between

$142.0 million and $145.0 million compared to $109.0 million in the

same quarter a year ago. Adjusted EBITDA is a non-GAAP financial

measure, and a table reconciling expected net earnings to Adjusted

EBITDA is included in this release.

Total attendance for the third quarter of 2016 increased

approximately 10% to 51.9 million guests compared to the third

quarter a year ago. Average ticket price for the 2016 third quarter

increased 2.6% to $9.57 compared to the third quarter of 2015. Food

and beverage revenue per patron for the third quarter 2016

increased 4.8% to $4.80 compared to the same period a year ago.

“AMC continues to deliver on our key priorities. Even at the low

end of our projected range, Adjusted EBITDA grew 30% with a

substantial improvement in margin, and we are very proud of that

growth,” said Adam Aron, AMC Chief Executive Officer and President.

“The recent relaunch of our AMC Stubs loyalty program in July was

overwhelmingly received by guests who have signed up at rates 11

times faster than the same period a year ago - far faster than we

had anticipated. Total active memberships now exceed four million

households and are still growing rapidly. Through world class

marketing efforts like our AMC Stubs program, and our

soon-to-be-relaunched website and mobile app, guests are

discovering and returning to our theatres to enjoy our proven

innovations, including new recliner seating, MacGuffins Bars, and

premium large format offerings like IMAX® at AMC and Dolby Cinema™

at AMC. We believe that when we integrate these organic growth

initiatives with a disciplined acquisition strategy, as we move

toward completion of the Odeon & UCI and Carmike Cinemas

acquisitions, we are positioning AMC to leverage the record

potential of the 2017 and 2018 box office to create even greater

value for our customers and shareholders alike.”

AMC expects to report its complete financial results for the

third quarter ended September 30, 2016, after the market

closes on Monday, November 7, 2016. The Company will host a

conference call for investors and interested parties at 4:00 p.m.

CDT/5:00 p.m. EDT the same day. All interested parties are invited

to access a live audio broadcast of the call via webcast. To listen

to the conference call via the internet, please visit the investor

relations section of the AMC website at

www.investor.amctheatres.com for a link to the webcast. Investors

and interested parties should go to the website at least 15 minutes

prior to the call to register, and/or download and install any

necessary audio software.

Information Regarding Preliminary Results

The preliminary estimated financial information contained in

this press release reflects management’s estimates based solely

upon information available to it as of the date of this press

release and is not a comprehensive statement of our financial

results for the three months ended September 30, 2016. In addition,

the preliminary estimated financial information presented above has

not been audited, reviewed or compiled by our independent

registered public accounting firm, KPMG LLP. Accordingly, KPMG LLP

does not express an opinion on or any other form of assurance with

respect thereto and assumes no responsibility for this information.

We have provided ranges for the preliminary estimated financial

results described above primarily because our financial closing

procedures for the three months ended September 30, 2016 are not

yet complete. The information presented above should not be

considered a substitute for full unaudited financial statements for

the three months ended September 30, 2016 once they become

available and should not be regarded as a representation by us or

our management as to our actual financial results for the three

months ended September 30, 2016. The ranges for the preliminary

estimated financial results described above constitute

forward-looking statements. The preliminary estimated financial

information presented above is subject to change, and our actual

financial results may differ from such preliminary estimates and

such differences could be material. Accordingly, you should not

place undue reliance upon these preliminary estimates.

Acquisitions

Odeon & UCI Cinemas Holdings

Limited: As previously announced on July 12, 2016, AMC

entered into a Share Purchase Agreement to acquire the film

exhibition business of Odeon and UCI Cinemas Holdings Limited,

referred to as "Odeon/UCI," for total consideration of (i) cash in

the amount of GBP £375.0 million ($460.8 million), (ii) shares of

AMC Class A common stock valued at GBP £125.0 million ($153.6

million) and (iii) the repayment of indebtedness of approximately

GBP £478.6 million ($588.1 million) as of October 19, 2016. The US

Dollar amounts set forth in the preceding sentence assume a

Euro/USD exchange rate of 1.0973 and a GBP/USD exchange rate of

1.2289 as of October 19, 2016. Odeon/UCI is a leading European

cinema operator with 242 cinemas and 2,236 screens. Odeon/UCI

operates in four major markets: the United Kingdom, Spain, Italy

and Germany; and three smaller markets: Austria, Portugal, and

Ireland. For the year ended December 31, 2015 and six months ended

June 30, 2016, Odeon/UCI had revenues of $1,142.0 million and

$526.0 million respectively. The closing of the Share Purchase

Agreement is subject to clearance by the European Commission and

the UK Competition and Markets Authority.

Carmike Cinemas, Inc. (NASDAQ:

CKEC): As previously announced on July 24, 2016, AMC entered

into an amended and restated agreement and plan of merger to

acquire all of the outstanding shares of Carmike Cinemas, Inc.

(NASDAQ: CKEC) (“Carmike”) for $33.06 per share, representing an

approximate 32% premium to Carmike’s March 3, 2016, closing stock

price. Carmike stockholders can elect to receive $33.06 in cash or

1.0819 AMC shares per Carmike share, subject to a customary

proration mechanism to achieve an aggregate consideration mix of

70% cash and 30% in shares of AMC stock. A shareholder meeting to

allow Carmike shareholders the opportunity to vote on the

transaction has been scheduled for November 15, 2016. The

transaction is valued at approximately $1.2 billion, including

the assumption of Carmike’s net indebtedness, based on the closing

trading price of AMC’s common stock on the New York Stock Exchange

on July 22, 2016.

About AMC Entertainment Holdings, Inc.

AMC (NYSE:AMC) is the guest experience leader with 388 locations

and 5,295 screens located primarily in the United States. AMC has

propelled innovation in the theatrical exhibition industry and

continues today by delivering more comfort and convenience,

enhanced food & beverage, greater engagement and loyalty,

premium sight & sound, and targeted programming. AMC operates

the most productive theatres in the country’s top markets,

including No. 1 market share in the top three markets (NY, LA,

Chicago). www.amctheatres.com.

Website Information

This press release, along with other news about AMC, is

available at www.amctheatres.com . We routinely post information

that may be important to investors in the Investor Relations

section of our website, www.investor.amctheatres.com. We use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD, and we encourage investors to consult that section of our

website regularly for important information about AMC. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document. Investors interested in automatically receiving

news and information when posted to our website can also visit

www.investor.amctheatres.com to sign up for E-mail Alerts.

Important Additional Information Regarding the Merger

This communication may be deemed to be solicitation material in

respect of the proposed merger of Carmike with and into a

wholly-owned subsidiary of AMC. In connection with the proposed

merger, a Registration Statement on Form S-4 (the “Registration

Statement”) has been filed with the Securities and Exchange

Commission (“SEC”) containing a prospectus with respect to the AMC

Class A common stock to be issued in the proposed merger and a

proxy statement of Carmike in connection with the proposed merger

(the “Proxy Statement/Prospectus”). The proxy statement of Carmike

contained in the Proxy Statement/Prospectus replaces the definitive

proxy statement which Carmike previously filed with the SEC on May

23, 2016 and mailed to its stockholders on or about May 25, 2016.

Each of AMC and Carmike intends to file other documents with the

SEC regarding the proposed merger. The definitive Proxy

Statement/Prospectus was mailed to stockholders of Carmike on or

about October 13, 2016 and contains important information about the

proposed merger and related matters.

BEFORE MAKING ANY INVESTMENT OR VOTING DECISION, CARMIKE’S

STOCKHOLDERS ARE URGED TO READ CAREFULLY THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS IN ITS ENTIRETY (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT AMC OR

CARMIKE HAS FILED OR MAY FILE WITH THE SEC IN CONNECTION WITH THE

PROPOSED MERGER, OR WHICH ARE INCORPORATED BY REFERENCE IN THE

DEFINITIVE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Carmike’s stockholders may obtain, free of charge, copies of the

definitive Proxy Statement/Prospectus and Registration Statement

and other relevant documents filed by AMC and Carmike with the SEC,

at the SEC’s website at www.sec.gov. In addition, Carmike’s

stockholders may obtain free copies of the Proxy

Statement/Prospectus and other relevant documents filed by Carmike

with the SEC from Carmike’s website at

http://www.carmikeinvestors.com/.

This communication does not constitute an offer to buy or

exchange, or the solicitation of an offer to sell or exchange, any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, sale or exchange would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This communication is not

a substitute for any prospectus, proxy statement or any other

document that AMC or Carmike may file with the SEC in connection

with the proposed merger.

Participants in the Solicitation

This communication does not constitute a solicitation of a proxy

from any stockholder with respect to the proposed merger. However,

each of AMC, Carmike and their respective directors and executive

officers may be deemed to be participants in the solicitation of

proxies from Carmike’s stockholders with respect to the proposed

merger. More detailed information regarding the identity of these

potential participants, and any direct or indirect interests they

may have in the proposed merger, by security holdings or otherwise,

is set forth in the Proxy Statement/Prospectus. Additional

information concerning AMC’s directors and executive officers is

set forth in the definitive proxy statement filed by AMC with the

SEC on March 15, 2016 and in the Annual Report on Form 10-K filed

by AMC with the SEC on March 8, 2016. These documents are available

to Carmike stockholders free of charge from the SEC’s website at

www.sec.gov and from the investor relations section of AMC’s

website at amctheatres.com. Additional information concerning

Carmike’s directors and executive officers and their ownership of

Carmike common stock is set forth in the proxy statement for

Carmike’s most recent annual meeting of stockholders, which was

filed with the SEC on April 15, 2016 and in the Annual Report on

Form 10-K filed by Carmike with the SEC on February 29, 2016. These

documents are available to Carmike stockholders free of charge from

the SEC’s website at www.sec.gov and from Carmike’s website at

http://www.carmikeinvestors.com/.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “plan,” “estimate,” “will,” “would,” “project,”

“maintain,” “intend,” “expect,” “anticipate,” “strategy,” “future,”

“likely,” “may,” “should,” “believe,” “continue,” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. Estimates regarding

our preliminary results are forward-looking statements. Similarly,

statements made herein and elsewhere regarding the expected ranges

of revenues, operating income, net earnings, diluted earnings per

share, Adjusted EBITDA and other financial measures included

herein, the pending acquisitions of Odeon & UCI and Carmike

Cinemas (collectively “the targets”) and the anticipated financing

of the pending acquisitions are also forward-looking statements,

including statements regarding the anticipated closing date of the

acquisitions, the source and structure of financing, management’s

statements about effect of the acquisitions on AMC’s future

business, operations and financial performance and AMC’s ability to

successfully integrate the targets into its operations. These

forward-looking statements are subject to risks, trends,

uncertainties and other facts that could cause actual performance

or results to differ materially from those expressed in or

suggested by the forward-looking statements. See “Information

Regarding Preliminary Results” above for a description of these

risks and uncertainties. These risks, trends, uncertainties and

facts include, but are not limited to, risks related to: the fact

that accounting adjustments may be made in connection with the

final closing of the books for the quarter; the parties’ ability to

satisfy closing conditions in the anticipated time frame or at all;

obtaining regulatory approval, including the risk that any approval

may be on terms, or subject to conditions, that are not

anticipated; obtaining the Carmike stockholders approval for the

Carmike transaction; the possibility that these acquisitions do not

close, including in circumstances in which AMC would be obligated

to pay a termination fee or other damages or expenses; related to

financing these transactions, including AMC’s ability to finance

the transactions on acceptable terms; responses of activist

stockholders to the transactions; AMC’s ability to realize expected

benefits and synergies from the acquisitions; AMC’s effective

implementation, and customer acceptance, of its marketing

strategies; disruption from the proposed transactions making it

more difficult to maintain relationships with customers, employees

or suppliers; the diversion of management time on

transaction-related issues; the negative effects of this

announcement or the consummation of the proposed acquisitions on

the market price of AMC’s common stock; unexpected costs, charges

or expenses relating to the acquisitions; unknown liabilities;

litigation and/or regulatory actions related to the proposed

transactions; AMC’s significant indebtedness, including the

indebtedness incurred to acquire the targets; execution risks

related to the integration of Starplex Cinemas into our business;

our ability to achieve expected synergies and performance from our

acquisition of Starplex Cinemas; AMC’s ability to utilize net

operating loss carry-forwards to reduce future tax liability;

increased competition in the geographic areas in which we operate

and from alternative film-delivery methods and other forms of

entertainment; continued effectiveness of AMC’s strategic

Initiatives; the impact of shorter theatrical exclusive release

windows; our ability to attract and retain senior executives and

other key personnel; the impact of governmental regulation,

including anti-trust investigations concerning potentially

anticompetitive conduct, including film clearances and

participation in certain joint ventures; unexpected delays and

costs related to our optimization of our theatre circuit; failure,

unavailability or security breaches of our information systems;

operating a business in markets AMC is unfamiliar with; the United

Kingdom’s exit from the European Union; and other business effects,

including the effects of industry, market, economic, political or

regulatory conditions, future exchange or interest rates, changes

in tax laws, regulations, rates and policies; and risks, trends,

uncertainties and other facts discussed in the reports AMC has

filed with the SEC. Should one or more of these risks, trends,

uncertainties or facts materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results, and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. For a detailed discussion of risks,

trends and uncertainties facing AMC, see the section entitled “Risk

Factors” in AMC’s Annual Report on Form 10-K, filed with the SEC on

March 8, 2016, and the risks, trends and uncertainties

identified in its other public filings. AMC does not intend, and

undertakes no duty, to update any information contained herein to

reflect future events or circumstances, except as required by

applicable law.

(tables follow)

AMC Entertainment Holdings, Inc.

Reconciliation of Adjusted EBITDA (Unaudited, dollars in

thousands) Three Months Ended

September, 30 2016(Preliminary

Estimates)

Three Months Ended Low High September, 30

2015 Reconciliation of Adjusted EBITDA: Net Earnings $

28,500 $ 31,500 $ 12,178 Plus: Income tax provision 19,600 20,300

9,080 Interest expense 26,250 27,000 24,968 Depreciation and

amortization 62,500 63,300 58,008 Certain operating expenses (2)

5,000 5,800 3,899 Equity in earnings of non-consolidated entities

(9,500 ) (13,500 ) (10,850 ) Cash distributions from

non-consolidated entities 3,300 3,500 8,557 Investment loss 150 200

163 Other expense 50 150 — General and administrative

expense-unallocated: Merger, acquisition and transaction costs (3)

4,500 5,000 751 Stock-based compensation expense (4) 1,650

1,750 2,199 Adjusted EBITDA (1)

$ 142,000 $ 145,000 $ 108,953 (1) We

present Adjusted EBITDA as a supplemental measure of our

performance. We define Adjusted EBITDA as net earnings plus (i)

income tax provision, (ii) interest expense and (iii) depreciation

and amortization, as further adjusted to eliminate the impact of

certain items that we do not consider indicative of our ongoing

operating performance and to include any cash distributions of

earnings from our equity method investees. These further

adjustments are itemized above. You are encouraged to evaluate

these adjustments and the reasons we consider them appropriate for

supplemental analysis. In evaluating Adjusted EBITDA, you should be

aware that in the future we may incur expenses that are the same as

or similar to some of the adjustments in this presentation. Our

presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items. Adjusted EBITDA is a non-GAAP financial

measure and should not be construed as an alternative to net

earnings as an indicator of operating performance or as an

alternative to cash flow provided by operating activities as a

measure of liquidity (as determined in accordance with U.S. GAAP).

Adjusted EBITDA may not be comparable to similarly titled measures

reported by other companies. We have included Adjusted EBITDA

because we believe it provides management and investors with

additional information to measure our performance and estimate our

value. Adjusted EBITDA has important limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for analysis of our results as reported under U.S.

GAAP. For example, Adjusted EBITDA:

• does not reflect our capital

expenditures, future requirements for capital expenditures or

contractual commitments;

• does not reflect changes in, or cash

requirements for, our working capital needs;

• does not reflect the significant

interest expenses, or the cash requirements necessary to service

interest or principal payments, on our debt;

• excludes income tax payments that

represent a reduction in cash available to us; and

• does not reflect any cash requirements

for the assets being depreciated and amortized that may have to be

replaced in the future.

(2) Amounts represent preopening expense related to

temporarily closed screens under renovation, theatre and other

closure expense for the permanent closure of screens including the

related accretion of interest, non-cash deferred digital equipment

rent expense, and disposition of assets and other non-operating

gains or losses included in operating expenses. We have excluded

these items as they are non-cash in nature, include components of

interest cost for the time value of money or are non-operating in

nature. (3) Merger, acquisition and transition costs is

excluded as it is non-operating in nature. (4) Non-cash

expense included in General and Administrative: Other

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161024005416/en/

AMC Entertainment Holdings, Inc.INVESTOR

RELATIONS:John Merriwether,

866-248-3872InvestorRelations@amctheatres.comorMEDIA

CONTACTS:Ryan Noonan, 913-213-2183rnoonan@amctheatres.com

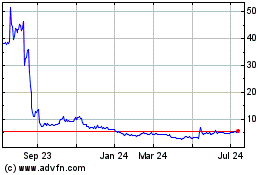

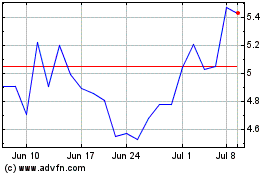

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024