Current Report Filing (8-k)

October 24 2016 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2016 (October 21, 2016)

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Nevada

|

|

001-36643

|

|

35-2496142

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

200 Powell Place

Brentwood, Tennessee

|

|

37027

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(615) 732-1231

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On October 24, 2016, AAC Holdings, Inc.

(“Holdings”) issued a press release (the “Press Release”) announcing that certain of its subsidiaries had reached an agreement with the Bureau of Medi-Cal Fraud and Elder Abuse of the Office of the Attorney General of the State

of California on a Permanent Injunction and Final Judgment, as further described in Item 8.01 of this Current Report on Form 8-K. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Pursuant to the rules and regulations of the Securities and Exchange Commission, the information in this Item 7.01 disclosure, including

Exhibit 99.1 and information set forth therein, is deemed to have been furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934, as amended.

On October 21, 2016, American Addiction Centers, Inc. (formerly known as

Forterus, Inc.), Forterus Health Care Services, Inc., and ABTTC, Inc. (collectively, the “Defendants,” each of which is a direct or indirect subsidiary of Holdings) agreed to the entry of a Permanent Injunction and Final Judgment (the

“PIFJ”) with the Bureau of Medi-Cal Fraud and Elder Abuse of the Office of the Attorney General of the State of California (“BMFEA”) relating to the criminal charges filed against the Defendants in connection with the death of a

client in 2010 at one of the Company’s former locations. The PIFJ generally provides, among other things and subject to certain limitations, that the State of California (i) dismiss all criminal charges against the Defendants in connection with

the case entitled

People v. McCausland, et al.

(Case No. SWF1501351) and not file or seek to file any other criminal charges against the Defendants in connection with the death of such client or in connection with such client’s admission

or care; (ii) release all civil claims against the Defendants and their officers, directors and employees for conduct, acts or omissions arising out of or in connection with the quality of resident care or resident admissions and occurring prior to

the effective date of the PIFJ at any California facility owned, licensed, operated, managed or controlled by Defendants, and (iii) release such parties from any civil false claims and claims for fraud (both statutory and common law) under

California law.

Pursuant to the terms of the PIFJ, among other things and subject to certain limitations, Defendants shall (i) institute a

three-year compliance program (the “Compliance Program”) with respect its California facilities that includes, to the extent not already established, that certain policies and procedures are maintained or developed and implemented to

promote each covered facility’s compliance with applicable statutes, regulations and the PIFJ, under the responsibility of Holdings’ Chief Compliance Officer; (ii) establish a Compliance Committee composed of the Compliance Officer and

senior personnel responsible for overseeing clinical operations to address issues raised by the Compliance Officer in connection with the Compliance Program; and (iii) establish an oversight committee of its board of directors (the

“Board”), or a committee of the Board, to review the adequacy and responsiveness of the Compliance Program. In addition, for a period of 30 months following the effective date of the PIFJ, the Defendants shall retain a qualified

independent monitor, appointed by BMFEA after consultation with the Defendants, to assess the effectiveness of the Defendants’ quality control systems and patient care. The PIFJ also provides that the Defendants will pay $549,986 toward the

costs of the investigation and $200,000 as a civil monetary penalty.

The foregoing description of the PIFJ does not purport to be a

complete description of the parties’ rights and obligations under the PIFJ. The above description is qualified in its entirety by reference to the complete text of the PIFJ, a copy of which is filed herewith as Exhibit 99.2 and is

incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated October 24, 2016

|

|

|

|

|

99.2

|

|

Permanent Injunction and Final Judgment, entered October 21, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

AAC HOLDINGS, INC.

|

|

|

|

|

By:

|

|

/s/ Michael T. Cartwright

|

|

|

|

Michael T. Cartwright

|

|

|

|

Chief Executive Officer and Chairman

|

Date: October 24, 2016

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated October 24, 2016

|

|

|

|

|

99.2

|

|

Permanent Injunction and Final Judgment, entered October 21, 2016

|

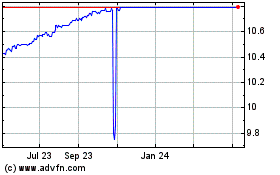

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024