Eagle Materials Inc. (NYSE: EXP) today reported financial

results for the second quarter of fiscal 2017 ended September 30,

2016. Notable items for the quarter include (all comparisons,

unless otherwise noted, are with the prior year’s second

quarter):

Company Second Quarter Results

- Record revenues of $332.7 million, up

1%

- Earnings before income taxes of $89.4

million, up 109%

- Prior year results included certain

charges of $37.8 million (pre-tax)

- Net Earnings of $60.2 million, up

102%

- Net Earnings per diluted share of

$1.25, up 112%

Other Highlights

- Eagle repurchased 263,800 shares of its

common stock

- Net debt-to-capitalization ratio of

27%

Eagle’s construction products and building materials businesses

performed well during the quarter, with the Cement business

reporting record second quarter operating earnings of $50.7

million. Second quarter cash flow from operations improved 22% and

was used to fund capital improvements, pay dividends, reduce debt

and repurchase shares.

As previously announced, on September 11, 2016, Eagle entered

into a definitive agreement with a subsidiary of CEMEX S.A.B. de

C.V. ("Cemex") to purchase Cemex’s Fairborn, Ohio cement plant and

related assets. The purchase price is $400 million, subject to

customary post-closing adjustments. Eagle expects that the

acquisition will increase its U.S. annual cement capacity by

approximately 20% to nearly 6 million tons. The transaction is

expected to close in the fourth quarter of calendar 2016, or

shortly thereafter. Eagle intends to finance the acquisition

through a combination of cash on hand and borrowings under its

existing bank credit facility.

The prior year’s second quarter results include an impairment

charge related to several intangible assets originally recorded in

connection with our acquisition of CRS Proppants and a write-down

of raw sand inventory values. The impairments and inventory

revaluation charges totaled approximately $37.8 million (pre-tax)

and were recorded in Cost of Goods Sold within our Oil and Gas

Proppants segment.

Cement, Concrete and Aggregates

Cement revenues for the second quarter, including joint venture

and intersegment revenues, totaled $166.8 million, which was 1%

higher than the same quarter last year. The average net sales price

for this quarter was $99.95 per ton, 3% higher than the same

quarter last year. Wholly-owned average net sales prices improved

5% from the second quarter last year. The average net cement sales

price at our Joint Venture declined year-over-year reflecting the

shift from oil well cement to construction-grade cement over the

past year; however, profitability improved 4% at the Joint Venture.

Total Cement sales volumes for the quarter were 1.4 million tons,

3% lower than the same quarter a year ago. Cement sales volumes

were negatively impacted during the quarter by above average

rainfall in our Midwestern markets.

Operating earnings from Cement for the second quarter were a

record $50.7 million and 4% greater than the same quarter a year

ago. The earnings improvement was driven primarily by improved

average net cement sales prices.

Concrete and Aggregates reported revenues for the second quarter

of $38.8 million, an increase of 7%. Second quarter operating

earnings were $4.8 million, a 25% improvement from the same quarter

a year ago, reflecting improved aggregates sales volumes and

improved concrete and aggregates sales prices.

Gypsum Wallboard and Paperboard

Gypsum Wallboard and Paperboard revenues for the second quarter

totaled $151.9 million, which were 6% greater than the same quarter

a year ago. The average Gypsum Wallboard net sales price this

quarter was $154.41 per MSF, 2% less than the same quarter a year

ago. Gypsum Wallboard sales volume for the quarter of 650 million

square feet (MMSF) represents a 5% increase from the same quarter

last year. Paperboard sales volumes for the quarter were a record

86,000 tons, 15% greater than the same quarter a year ago. The

average Paperboard net sales price this quarter was $501.84 per

ton, 1% less than the same quarter a year ago.

Gypsum Wallboard and Paperboard reported second quarter

operating earnings of $51.9 million, up 8% from the same quarter

last year. The earnings improvement primarily reflects improved

Gypsum Wallboard and Paperboard sales volumes and lower operating

costs primarily driven by lower energy and maintenance costs during

the quarter.

Oil and Gas Proppants

Oil and Gas Proppants reported second quarter revenues of $6.6

million, a 64% decrease from the prior year primarily reflecting a

45% decline in frac sand sales volumes. The second quarter’s

operating loss of $4.1 million includes depreciation, depletion and

amortization of $4.3 million. Our frac sand business continues to

be impacted by the significant slowdown in oil and gas drilling

activity over the past two years.

Details of Financial Results

We conduct one of our cement plant operations, Texas Lehigh

Cement Company LP, through a 50/50 joint venture (the “Joint

Venture”). We utilize the equity method of accounting for our 50%

interest in the Joint Venture. For segment reporting purposes only,

we proportionately consolidate our 50% share of the Joint Venture’s

revenues and operating earnings, which is consistent with the way

management organizes the segments within the Company for making

operating decisions and assessing performance.

In addition, for segment reporting purposes, we report

intersegment revenues as a part of a segment’s total revenues.

Intersegment sales are eliminated on the income statement. Refer to

Attachment 3 for a reconciliation of the amounts referred to

above.

About Eagle Materials Inc.

Eagle Materials Inc. manufactures and distributes Cement, Gypsum

Wallboard, Recycled Paperboard, Concrete and Aggregates, and Oil

and Gas Proppants from 40 facilities across the US. Eagle is

headquartered in Dallas, Texas.

Eagle’s senior management will conduct a conference call to

discuss the financial results, forward-looking information and

other matters at 8:30 a.m. Eastern Time (7:30 a.m. Central Time) on

October 24, 2016. The conference call will be webcast

simultaneously on the Eagle Web site http://www.eaglematerials.com. A

replay of the webcast and the presentation will be archived on that

site for one year. For more information, contact Eagle at

(214) 432-2000.

Forward-Looking Statements. This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the context of the

statement and generally arise when the Company is discussing its

beliefs, estimates or expectations. These statements are not

historical facts or guarantees of future performance but instead

represent only the Company's belief at the time the statements were

made regarding future events which are subject to certain risks,

uncertainties and other factors, many of which are outside the

Company's control. Actual results and outcomes may differ

materially from what is expressed or forecast in such

forward-looking statements. The principal risks and uncertainties

that may affect the Company's actual performance include the

following: the cyclical and seasonal nature of the Company's

business; public infrastructure expenditures; adverse weather

conditions; the fact that our products are commodities and that

prices for our products are subject to material fluctuation due to

market conditions and other factors beyond our control;

availability of raw materials; changes in energy costs including,

without limitation, natural gas, coal and oil; changes in the cost

and availability of transportation; unexpected operational

difficulties, including unexpected maintenance costs, equipment

downtime and interruption of production; material nonpayment or

non-performance by any of our key customers; fluctuations in

activity in the oil and gas industry, including the level of

fracturing activities and the demand for frac sand; inability to

timely execute announced capacity expansions; difficulties and

delays in the development of new business lines; governmental

regulation and changes in governmental and public policy

(including, without limitation, climate change regulation);

possible outcomes of pending or future litigation or arbitration

proceedings; changes in economic conditions specific to any one or

more of the Company's markets; competition; a cyber-attack or data

security breach; announced increases in capacity in the gypsum

wallboard, cement and frac sand industries; changes in the demand

for residential housing construction or commercial construction;

risks related to pursuit of acquisitions, joint ventures and other

transactions; general economic conditions; and interest rates. For

example, increases in interest rates, decreases in demand for

construction materials or increases in the cost of energy

(including, without limitation, natural gas, coal and oil) could

affect the revenues and operating earnings of our operations. In

addition, changes in national or regional economic conditions and

levels of infrastructure and construction spending could also

adversely affect the Company's result of operations. These and

other factors are described in the Company's Annual Report on Form

10-K for the fiscal year ended March 31, 2016 and the Company’s

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30,

2016. These reports are filed with the Securities and Exchange

Commission. With respect to our proposed acquisition of certain

assets from Cemex as described in this press release, factors,

risks and uncertainties that may cause actual events and

developments to vary materially from those anticipated in such

forward-looking statements include, but are not limited to, the

need to obtain antitrust clearance of the transaction under the

Hart-Scott-Rodino Antitrust Improvements Act and other factors that

may create obstacles for or interfere with our ability to complete

the acquisition within the expected timeframe or at all, failure to

realize any expected synergies from or other benefits of the

transaction, possible negative effects of announcement or

consummation of the transaction, significant transaction or

ownership transition costs, unknown liabilities or other adverse

developments affecting the assets to be acquired and the target

business, including the results of operations of the target

business prior and after the closing, the effect on the target

business of the same or similar factors discussed above to which

our business is subject, including changes in market conditions in

the construction industry and general economic and business

conditions that may affect us following acquisition. All

forward-looking statements made herein are made as of the date

hereof, and the risk that actual results will differ materially

from expectations expressed herein will increase with the passage

of time. The Company undertakes no duty to update any

forward-looking statement to reflect future events or changes in

the Company's expectations.

Attachment 1

Statement of Consolidated Earnings

Attachment 2

Revenues and Earnings by Lines of Business

(Quarter and Six Months)

Attachment 3

Sales Volume, Net Sales Prices and

Intersegment and Cement Revenues

Attachment 4

Consolidated Balance Sheets

Attachment 5

Depreciation, Depletion and Amortization

by Lines of Business

Eagle Materials Inc.

Attachment 1

Eagle Materials Inc. Statement of Consolidated

Earnings (dollars in thousands, except per share data)

(unaudited) Quarter Ended

September 30,

Six Months Ended

September 30,

2016 2015

2016 2015 Revenues

$ 332,658 $ 328,988 $ 630,162 $ 613,951 Cost of Goods Sold

241,448 284,694 466,997

508,560 Gross Profit 91,210 44,294 163,165

105,391 Equity in Earnings of Unconsolidated JV 12,147

11,680 20,127 19,510 Other, net 504 572 1,579 1,007 Acquisition and

Litigation Expense - - - - Corporate General and Administrative

Expenses (8,832 ) (9,364 ) (18,665 )

(18,355 ) Earnings before Interest and Income Taxes 95,029

47,182 166,206 107,553

Interest Expense, net

(5,656 ) (4,342 ) (9,557 ) (8,828 )

Earnings before Income Taxes 89,373 42,840 156,649 98,725

Income Tax Expense

(29,136 ) (13,021 ) (51,068 ) (31,144 )

Net Earnings $ 60,237 $ 29,819 $ 105,581

$ 67,581

EARNINGS PER SHARE Basic $ 1.26 $ 0.60 $ 2.20

$ 1.36 Diluted $ 1.25 $ 0.59 $ 2.18

$ 1.34

AVERAGE SHARES OUTSTANDING Basic

47,809,476 49,828,189 47,911,276

49,797,972 Diluted 48,229,485

50,470,151 48,375,116 50,460,947

Eagle Materials Inc.

Attachment 2

Eagle Materials Inc. Revenues and Earnings by

Lines of Business (dollars in thousands)

(unaudited) Quarter Ended

September 30,

Six Months Ended

September 30,

2016 2015

2016 2015

Revenues* Gypsum Wallboard and Paperboard: Gypsum

Wallboard $ 122,923 $ 119,701 $ 236,185 $ 234,753 Gypsum Paperboard

29,007 23,549 57,316

44,316 151,930 143,250 293,501 279,069 Cement (Wholly

Owned) 135,300 131,022 251,669 229,061 Oil and Gas Proppants

6,631 18,307 11,727 41,132 Concrete and Aggregates

38,797 36,409 73,265 64,689

Total $ 332,658 $ 328,988 $ 630,162

$ 613,951

Segment Operating Earnings Gypsum Wallboard

and Paperboard: Gypsum Wallboard $ 41,698 $ 40,002 $ 81,034 $

80,896 Gypsum Paperboard 10,220 8,138

21,447 14,168 51,918 48,140 102,481

95,064 Cement: Wholly Owned 38,569 36,897 62,189 54,780

Joint Venture 12,147 11,680

20,127 19,510 50,716 48,577 82,316 74,290

Oil and Gas Proppants (4,090 ) (44,600 ) (10,002 ) (50,236 )

Concrete and Aggregates 4,813 3,857 8,497 5,783

Other, net 504 572 1,579

1,007 Sub-total 103,861 56,546 184,871 125,908

Acquisition and Litigation Expenses - - - - Corporate General and

Administrative Expenses (8,832 ) (9,364 )

(18,665 ) (18,355 ) Earnings Before Interest and

Income Taxes $ 95,029 $ 47,182 $ 166,206 $

107,553

* Net of Intersegment and Joint Venture Revenues listed on

Attachment 3

Eagle Materials Inc.

Attachment 3

Eagle Materials Inc. Sales Volume, Net Sales

Prices and Intersegment and Joint Venture Revenues

(unaudited) Sales Volume Quarter Ended

September 30,

Six Months Ended

September 30,

2016 2015 Change 2016 2015 Change

Gypsum Wallboard (MMSF’s) 650 619 +5 % 1,237 1,196 +3 %

Cement (M Tons): Wholly Owned 1,200 1,248 -4 % 2,233 2,239 0

% Joint Venture 242 236 +3 % 460 448 +3 % 1,442 1,484 -3 % 2,693

2,687 0 % Paperboard (M Tons): Internal 30 30 0 % 58 58 0 %

External 56 45 +24 % 111 86 +29 % 86 75 +15 % 169 144 +17 %

Concrete (M Cubic Yards) 315 324 -3 % 602 573 +5 %

Aggregates (M Tons) 1,027 764 +34 % 1,971 1,431 +38 % Frac

Sand (M Tons) 111 203 -45 % 185 434 -57 %

Average Net

Sales Price* Quarter Ended

September 30,

Six Months Ended

September 30,

2016 2015 Change 2016

2015 Change Gypsum Wallboard (MSF) $ 154.41 $

157.88 -2 % $ 155.97 $ 160.57 -3 % Cement (Ton) $ 99.95 $ 97.21 +3

% $ 100.27 $ 97.74 +3 % Paperboard (Ton) $ 501.84 $ 505.12 -1 % $

500.41 $ 504.49 -1 % Concrete (Cubic Yard) $ 95.00 $ 92.07 +3 % $

93.92 $ 92.06 +2 % Aggregates (Ton) $ 8.64 $ 8.50 +2 % $ 8.48 $

8.24 +3 % *Net of freight and delivery costs billed to customers.

Intersegment and Cement Revenues Quarter Ended

September 30,

Six Months Ended

September 30,

2016 2015 2016 2015

Intersegment Revenues: Cement $ 4,536 $ 4,232 $ 8,071 $ 7,358

Paperboard 15,452 15,596 29,958 30,147 Concrete and Aggregates

343 262 626 514 $ 20,331 $ 20,090 $

38,655 $ 38,019 Cement Revenues: Wholly Owned $ 135,300 $

131,022 $ 251,669 $ 229,061 Joint Venture 26,975

29,536 51,863 56,547 $ 162,275 $ 160,558 $ 303,532 $

285,608

Eagle Materials Inc.

Attachment 4

Eagle Materials Inc. Consolidated Balance

Sheets (dollars in thousands) (unaudited)

September 30, March 31, 2016 2015

2016*

ASSETS

Current Assets – Cash and Cash Equivalents $ 54,506 $ 6,348 $ 5,391

Accounts and Notes Receivable, net 155,241 154,959 120,221

Inventories 217,582 224,667 243,595 Federal Income Tax Receivable

1,046 - 5,623 Prepaid and Other Assets 6,761

9,026 5,173 Total Current Assets

435,136 395,000 380,003

Property, Plant and Equipment – 2,089,499 2,041,242 2,072,776 Less:

Accumulated Depreciation (855,148 ) (779,010 )

(817,465 ) Property, Plant and Equipment, net 1,234,351 1,262,232

1,255,311 Investments in Joint Venture 47,852 49,883 49,465 Notes

Receivable 1,158 2,760 2,672 Goodwill and Intangibles 162,506

177,069 165,827 Other Assets 27,132 33,306

30,357 $ 1,908,135 $ 1,920,250 $

1,883,635

LIABILITIES AND

STOCKHOLDERS’ EQUITY

Current Liabilities – Accounts Payable $ 62,481 $ 70,584 $ 66,614

Accrued Liabilities 53,793 50,066 45,975 Federal Income Tax Payable

- 5,108 - Current Portion of Senior Notes 8,000

57,045 8,000 Total Current Liabilities

124,274 182,803 120,589

Long-term Liabilities 59,922 70,425 61,122 Bank Credit Facility -

327,000 382,000 Private Placement Senior Unsecured Notes 117,714

125,714 117,714 4.500% Senior Unsecured Notes due 2026 343,468 - -

Deferred Income Taxes 164,027 144,617 161,679 Stockholders’ Equity

– Preferred Stock, Par Value $0.01; None Issued - - - Common Stock,

Par Value $0.01; Authorized 100,000,000

Shares; Issued and Outstanding 48,223,617;

50,286,652 and

48,526,843 Shares, respectively

482 503 485 Capital in Excess of Par Value 130,638 273,372 168,969

Accumulated Other Comprehensive Losses (10,785 ) (11,428 ) (11,409

) Retained Earnings 978,395 807,244

882,486 Total Stockholders’ Equity 1,098,730

1,069,691 1,040,531 $ 1,908,135

$ 1,920,250 $ 1,883,635 *From audited

financial statements.

Eagle Materials Inc.

Attachment 5

Eagle Materials Inc.

Depreciation, Depletion and

Amortization by Lines of Business

(dollars in thousands)

(unaudited)

The following presents depreciation,

depletion and amortization by segment for the quarters ended

September 30, 2016 and 2015:

Depreciation, Depletion

andAmortization($ in thousands)

Quarter EndedSeptember 30,

2016 2015 Cement $ 8,784 $ 8,629 Gypsum

Wallboard 4,768 4,819 Paperboard 2,106 2,063 Oil and Gas Proppants

4,261 7,205 Concrete and Aggregates 1,920 1,565 Other 547

489 $ 22,386 $ 24,770

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161024005157/en/

Eagle Materials Inc.David B. Powers,

214-432-2000President and Chief Executive OfficerorD. Craig

Kesler, 214-432-2000Executive Vice President and Chief

Financial OfficerorRobert S. Stewart, 214-432-2000Executive

Vice President, Strategy, Corporate Development and

Communications

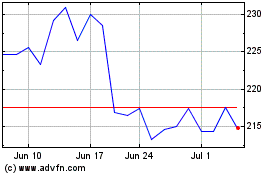

Eagle Materials (NYSE:EXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eagle Materials (NYSE:EXP)

Historical Stock Chart

From Apr 2023 to Apr 2024