Business Watch -- WSJ

October 24 2016 - 3:03AM

Dow Jones News

PETROBRAS

Suits Are Settled With Pimco, Others

Brazilian state oil company Petróleo Brasileiro SA has agreed to

settle lawsuits from Pacific Investment Management Co. and three

other investors who alleged they were harmed by a corruption scheme

that funneled billions of dollars from the company.

Petrobras's board approved agreements with investment funds

managed by Allianz SE unit Pimco, Dodge & Cox, Janus Capital

Group and Al Shams Investments Ltd., the company said late Friday,

marking the first time it has settled with investors who sued in

the wake of the so-called Car Wash scandal. The company added that

it expects to take a provision of $353 million against its

third-quarter earnings to cover these and other deals that are

being discussed.

Though Pimco, a unit of German insurer Allianz SE, is one of

Petrobras' largest bondholders and Dodge & Cox is among its

biggest private stockholders, the oil company has a lot of

negotiating left to do. It is still defending itself against 23

individual lawsuits. In addition, it faces one class-action suit

claiming tens of billions of dollars in damages on behalf of dozens

of plaintiffs, including the New York City firefighters' pension

fund.

Petrobras said it "will continue firmly defending itself in the

remaining lawsuits under way and has the objective of eliminating

the uncertainties, onus and costs associated with continuing these

disputes."

--Paul Kiernan

--Paul Kiernan

GOLFSMITH INTERNATIONAL

Dick's Wins Auction For U.S. Stores

Dick's Sporting Goods Inc. was named the winner at a

bankruptcy-run auction for Golfsmith International Holdings Inc.'s

U.S. stores, people familiar with the matter said.

Dick's plans to keep open at least 30 stores, and liquidators

Tiger Capital Group, Gordon Brothers Retail Partners and Hilco

Merchant Resources will close the rest of the locations, the people

added. Golfsmith has about 90 U.S. locations.

A Golfsmith representative didn't immediately respond to

comment.

--Lillian Rizzo

--Lillian Rizzo

NINTENDO

Investors Are Cool To New Videogame

Nintendo Co.'s shares fell Friday after its new videogame

platform failed to impress investors, but analysts say it is too

soon to call the much-awaited console a disappointment.

The company Thursday unveiled a new console hand-held hybrid

called Switch, a tablet-style unit that comes with separate

controllers and a television-docking base.

Investors on Friday shrugged off the announcement, sending the

company's share price down 6.5%.

Some investors blamed a lack of surprise in the announcement for

the lukewarm market response, saying the company raised high

expectations by withholding details about the hardware for more

than a year.

Nintendo hinted it still has unannounced surprises to reveal.

"We haven't shown everything," a Nintendo spokesman said.

--Takashi Mochizuki

(END) Dow Jones Newswires

October 24, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

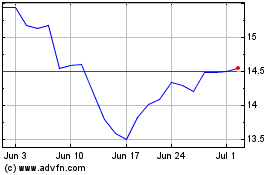

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

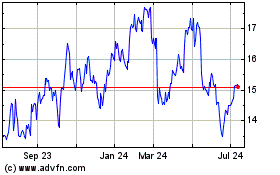

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024