UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

American Cannabis Company, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

8742

(Primary Standard Industrial Classification Code Number)

94-2901715

(I.R.S. Employer Identification Number)

5690 Logan Street, Unit A

Denver CO. 80216

Telephone: (303) 974-4470

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Corey Hollister

American Cannabis Company, Inc.

5690 Logan Street, Unit A

Denver CO. 80216

Telephone: (303) 974-4470

(Name, address, including zip code, and telephone number, including area code, of agent for service)

From time to time after the effective

date of this registration statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form

are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant

to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting

company

|

[X]

|

|

(Do not

check if a smaller reporting company)

|

|

|

Calculation of Registration Fee

Title

of Each Class

of Securities to be

Registered

|

|

Amount

to be

Registered

(1)

|

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

|

Proposed

Maximum

Aggregate Offering

Price

|

|

|

Amount

of

Registration Fee

|

|

|

Common

stock to be offered for resale by selling stockholders

|

|

|

5,917,442

|

|

|

$

|

0.10

|

(2)

|

|

$

|

591,744

|

|

|

$

|

59.59

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Consists of up to

5,829,842 shares of common stock to be sold to Tangiers Global, LLC under the amended and restated investment agreement dated

August 4, 2016, and 87,600 shares of commons stock owned by a selling stockholder.

|

|

|

|

|

(2)

|

Estimated solely for

the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933.

|

|

|

|

|

(3)

|

Based on the closing

price per share of $0.10 for American Cannabis Company, Inc.’s common stock on September 2, 2016 as reported by the OTC

Markets Group.

|

The registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that

this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

|

The

information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is

not permitted.

|

Subject to Completion, Dated October ___, 2016

American Cannabis Company, Inc.

5690 Logan Street, Unit A

Denver CO. 80216

Telephone: (303) 974-4470

PRELIMINARY PROSPECTUS

This prospectus relates to the resale of 5,917,442 shares

of our common stock, par value $0.00001 per share, including (i) 5,829,842 shares of common stock (the “Common Shares”),

shares issuable to Tangiers Global, LLC (defined below) and, (ii) 87,600 shares previously issued to an individual shareholder.

This prospectus relates to the resale of up to 5,829,842

shares of the Common Shares, issuable to Tangiers Global, LLC (“Tangiers”), a selling stockholder pursuant to a “put

right” under an amended and restated investment agreement (the “Investment Agreement”), dated August 4, 2016, that

we entered into with Tangiers. The Investment Agreement permits us to “put” up to five million dollars ($5,000,000)

in shares of our common stock to Tangiers over a period of up to thirty-six (36) months or until $5,000,000 of such shares have

been “put.”

The selling stockholders may sell all or a portion of the

shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying

prices or at negotiated prices.

The total amount of shares of common stock which may be sold pursuant to this

prospectus would constitute approximately 32.77% of the Company’s issued and outstanding common stock held by

non-affiliates as of September 2, 2016, assuming that the selling security holders will sell all of the shares offered

for sale.

Tangiers Global, LLC is an underwriter within the meaning

of the Securities Act of 1933 and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such

broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions

or discounts under the Securities Act of 1933.

Our common stock is quoted by the OTC Markets Group under

the symbol “AMMJ”. On September 2, 2016, the closing price of our common stock was $0.10 per share.

We will not receive any proceeds from the sale of shares

of our common stock by the selling stockholder. However, we will receive proceeds from the sale of shares of our common stock

pursuant to our exercise of the put right offered by Tangiers Global, LLC. We will pay for expenses of this offering, except that

the selling stockholder will pay any broker discounts or commissions or equivalent expenses and expenses of its legal counsel

applicable to the sale of its shares.

Investing in our common stock involves risks. See “Risk Factors” beginning

on page 5.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is October ___, 2016

Table of Contents

|

|

|

Page

Number

|

|

About

This Prospectus

|

|

1

|

|

Prospectus Summary

|

|

1

|

|

Risk Factors

|

|

5

|

|

Risks

Related to Our Business

|

|

5

|

|

Risks

Related to Our Company

|

|

7

|

|

Risks

Related to Our Common Stock

|

|

13

|

|

Forward-Looking Statements

|

|

15

|

|

Use of Proceeds

|

|

15

|

|

Dilution

|

|

16

|

|

The Offering

|

|

17

|

|

Selling Stockholders

|

|

17

|

|

Plan of Distribution

|

|

18

|

|

Description of Securities

|

|

19

|

|

Experts and Counsel

|

|

20

|

|

Interest of Named

Experts and Counsel

|

|

21

|

|

Information With Respect

to Our Company

|

|

21

|

|

Description of Business

|

|

21

|

|

Description of Property

|

|

27

|

|

Legal Proceedings

|

|

27

|

|

Market Price of and

Dividends on Our Common Equity and Related Stockholder Matters

|

|

27

|

|

Financial Statements

|

|

30

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

|

|

61

|

|

Changes in and Disagreements

with Accountants on Accounting and Financial Disclosure

|

|

70

|

|

Directors and Executive

Officers

|

|

70

|

|

Executive Compensation

|

|

74

|

|

Security Ownership

of Certain Beneficial Owners and Management

|

|

75

|

|

Transactions with

Related Persons, Promoters and Certain Control Persons and Corporate Governance

|

|

76

|

|

Where You Can Find

More Information

|

|

78

|

About This Prospectus

You should rely only on the information that we have provided

in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus

and any applicable prospectus supplement. You must not rely on any unauthorized information or representation. This prospectus

is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. You should assume that the information in this prospectus and any applicable prospectus supplement is accurate only as

of the date on the front of the document, regardless of the time of delivery of this prospectus, any applicable prospectus supplement,

or any sale of a security.

As used in this prospectus, the terms “we”,

“us”, the “Company”, “American Cannabis”, and our subsidiary “Hollister & Blacksmith,

Inc.” mean American Cannabis Company, Inc., unless otherwise indicated. All dollar amounts refer to U.S. dollars unless

otherwise indicated.

PROSPECTUS SUMMARY

The Offering

This prospectus relates to the resale of 5,917,442 shares

of our common stock, par value $0.00001 per share, including (i) 5,829,842 shares of common stock (the “Common Shares”),

shares issuable to Tangiers Global, LLC (defined below) and, (ii) 87,600 shares previously issued to an individual shareholder.

This prospectus relates to the resale of up to 5,829,842

shares of the Common Shares, issuable to Tangiers Global, LLC (“Tangiers”), a selling stockholder pursuant to a “put

right” under an amended and restated investment agreement (the “Investment Agreement”), dated August 4, 2016, that

we entered into with Tangiers. The Investment Agreement permits us to “put” up to five million dollars ($5,000,000)

in shares of our common stock to Tangiers over a period of up to thirty-six (36) months or until $5,000,000 of such shares have

been “put.”

Our Business

American Cannabis Company, Inc. and

subsidiary company, Hollister & Blacksmith, Inc., doing business as American Cannabis Consulting (“American Cannabis

Consulting”), (collectively “the “Company”, “we”, “us”, or “our”)

are based in Denver, Colorado and operate a fully-integrated business model that features end-to-end solutions for businesses

operating in the regulated cannabis industry in states and countries where cannabis is regulated and/or has been de-criminalized

for medical use and/or legalized for recreational use. We provide advisory and consulting services specific to this industry,

design industry-specific products and facilities, and manage a strategic group partnership that offers both exclusive and non-exclusive

customer products commonly used in the industry.

We are a publicly listed company quoted

on the OTCQB under the symbol “AMMJ”.

We were incorporated in the State of

Delaware on September 24, 2001 under the name Naturewell, Inc. to develop and market clinical diagnostic products using immunology

and molecular biologic technologies.

On March 13, 2013, Naturewell, Inc.

completed a merger transaction whereby it acquired 100% of the issued and outstanding share capital of Brazil Interactive Media,

Inc. (“BIMI”), which operated as a Brazilian interactive television company and television production company through

its wholly owned Brazilian subsidiary company, EsoTV Brasil Promoção Publicidade Licenciamento e Comércio

Ltda. (“EsoTV”). Naturewell’s Certificate of Incorporation were amended to reflect a new name: Brazil Interactive

Media, Inc.

On May 15, 2014, BIMI entered into

a merger agreement (“the Merger Agreement”) to acquire 100% of the issued and outstanding American Cannabis Consulting

while simultaneously disposing of 100% of the issued share capital EsoTV (“the Separation Agreement”). Both the merger

with American Cannabis Consulting and disposal of EsoTV were completed on September 29, 2014. BIMI subsequently amended its Certificate

of Incorporation to change its name to American Cannabis Company, Inc. On October 10, 2014, American Cannabis Company, Inc. changed

its stock symbol from BIMI to AMMJ.

Immediately following the completion

of the Merger Agreement, former shareholders of American Cannabis Consulting owned 31,710,628 shares of American Cannabis Company,

Inc.’s common stock, representing 78.4% of American Cannabis Company, Inc.’s issued and outstanding share capital.

Accordingly, American Cannabis Consulting was deemed to have been the accounting acquirer in a Reverse Merger which resulted in

a recapitalization of the Company. Consequently, the Company’s consolidated financial statements reflect the results

of American Cannabis Consulting since Inception (March 5, 2013) and of American Cannabis Company, Inc. (formerly BIMI) since September

29, 2014.

Government Regulation of Cannabis

The United States federal government regulates drugs through

the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances, including cannabis, in a schedule. Cannabis

is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value. The United States Federal

Drug Administration has not approved the sale of marijuana for any medical application. Doctors may not prescribe cannabis for

medical use under federal law, however, they can recommend its use under the First Amendment. In 2010, the United States Veterans

Affairs Department clarified that veterans using medicinal cannabis will not be denied services or other medications that are

denied to those using illegal drugs.

As of June 27, 2016, 25 states,

the District of Columbia and Guam allow their citizens to use medical cannabis through de-criminalization. Voters in the States

of Oregon, Colorado, Washington, and Alaska have legalized cannabis for adult recreational use; Oregon’s law took effect

on July 1, 2015; Alaska’s law was effective February 24, 2015; both the Colorado and Washington programs were enacted as

of December 31, 2014. In 2016, Nevada, California, Vermont, Arizona, Connecticut and Michigan have legislative bills in various

stages of progress concerning cannabis legalization.

Additionally, there are active efforts

by many advocacy groups seeking to expand the legalization of cannabis, including, but not limited to the Marijuana Policy Project,

a leading advocate for major state-level marijuana policy reforms that have resulted in successful efforts to pass 10 of the 15

most recent state medical marijuana laws (in Arizona, Delaware, Illinois, Maryland, Michigan, Minnesota, Montana, New Hampshire,

Rhode Island, and Vermont) and five of the seven most recent decriminalization laws (in Delaware, Maryland, Massachusetts, Rhode

Island, and Vermont).

These advocacy groups and others

are devoting significant resources to ending prohibition in 12 more states by 2019, including in the States of Arizona, California, Massachusetts,

and Nevada, as well as lobbying and building coalitions to regulate marijuana in several states that do not have the option of voter initiatives, including Delaware, Illinois, Maryland, New Hampshire, Rhode Island, Texas, and Vermont,

and they are also advocating for medical marijuana-related bills in several other states, including Georgia, Texas, and West

Virginia.

These noted state laws, both proposed

and enacted, are in conflict with the federal Controlled Substances Act, which makes cannabis use and possession illegal on a

national level. However, on August 29, 2013, the U.S. Department of Justice issued a memorandum providing that where states and

local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory and enforcement systems,

the federal government will rely upon states and local enforcement agencies to address cannabis activity through the enforcement

of their own state and local narcotics laws. The memorandum further stated that the U.S Justice Department’s limited investigative

and prosecutorial resources will be focused on eight priorities to prevent unintended consequences of the state laws, including

distribution of cannabis to minors, preventing the distribution of cannabis from states where it is legal to states where it is

not, and preventing money laundering, violence and drugged driving.

On December 11, 2014, the U.S. Department

of Justice issued another memorandum with regard to its position and enforcement protocol with regard to Indian Country, stating

that the eight priorities in the previous federal memo would guide the United States Attorneys' cannabis enforcement efforts in

Indian Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted regulations

that prohibits the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

As of September 2, 2016, in addition

to the 25 states, the District of Columbia and Guam which had already passed legislation allowing citizens to use cannabis in

some form, an additional 13 states had pending legislation or ballot measures to legalize medical cannabis.

Where You Can Find Us

The principal offices of our company are located at 5690

Logan St., Unit A, Denver, CO 80216. Our telephone number is (303) 974-4770.

The Offering

|

Common

Stock Offered by the Selling Security Holders

|

|

5,917,442

shares of common stock, including (i) 5,829,842 shares of common stock that may be put to Tangiers and (ii) 87,600 shares

of common stock previously issued to an individual stockholder.

|

|

|

|

|

|

Common Stock Outstanding

Before the Offering

|

|

46,751,074

shares of common stock as of September 2, 2016.

|

|

|

|

|

|

Common Stock Outstanding

After the Offering

|

|

52,580,916

shares of common stock. (1)

|

|

|

|

|

|

Terms of the Offering

|

|

The

selling security holder will determine when and how they will sell the common stock offered in this prospectus.

|

|

|

|

|

|

Termination of

the Offering

|

|

The

offering will conclude upon such time as all of the common stock has been sold pursuant to the registration statement.

|

|

Use

of Proceeds

|

|

We

are not selling any shares of common stock in this offering and, as a result, will not receive any proceeds from this offering. See

“Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

The

common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the

loss of their entire investment. See “Risk Factors” beginning on page 7.

|

|

|

|

|

|

OTCQB Symbol

|

|

AAMJ

|

|

|

|

|

|

|

(1)

|

This

total shows how many shares of common stock will be outstanding assuming 5,829,842 shares of common stock to be put to Tangiers.

|

Summary of Financial Data

The following information represents selected audited financial information for our

company for the years ended December 31, 2015 and 2014 and selected unaudited financial information for our company for the six

month period ended June 30, 2016. The summarized financial information presented below is derived from and should be read in conjunction

with our audited and unaudited financial statements, as applicable, including the notes to those financial statements which are

included elsewhere in this prospectus along with the section entitled Management’s Discussion and Analysis of Financial

Condition and Results of Operations beginning on page 61 of this prospectus.

|

Statements

of Operations Data

|

|

Six

Month Period Ended June 30, 2016

|

|

|

Six

Month Period Ended June 30, 2015

|

|

|

Year

Ended December 31, 2015

|

|

|

Year

Ended December 31, 2014

|

|

|

Revenue

|

|

$

|

984,052

|

|

|

$

|

912,412

|

|

|

$

|

2,799,877

|

|

|

$

|

1,259,012

|

|

|

Cost of

Revenue

|

|

$

|

480,657

|

|

|

$

|

548,481

|

|

|

$

|

2,000,113

|

|

|

$

|

771,476

|

|

|

Net Operating Expenses

|

|

$

|

591,398

|

|

|

$

|

689,531

|

|

|

$

|

1,352,740

|

|

|

$

|

3,878,340

|

|

|

Net Income (Loss)

|

|

$

|

(98,332)

|

|

|

$

|

(270,452)

|

|

|

$

|

(515,653)

|

|

|

$

|

(3,619,192

|

)

|

|

Basic and Diluted

Net Income (Loss) per Share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01)

|

|

|

$

|

(0.01)

|

|

|

$

|

(0.11

|

)

|

|

Balance

Sheets Data

|

|

As

of June 30, 2016

|

|

|

As

of June 30, 2015

|

|

|

As

of December 31, 2015

|

|

|

Cash and

Cash Equivalents

|

|

$

|

228,654

|

|

|

$

|

227,513

|

|

|

$

|

555,780

|

|

|

Total Current Assets

|

|

$

|

505,381

|

|

|

$

|

545,525

|

|

|

$

|

712,962

|

|

|

Total Current Liabilities

|

|

$

|

398,208

|

|

|

$

|

265,412

|

|

|

$

|

593,020

|

|

|

Working Capital (deficit)

|

|

$

|

107,173

|

|

|

$

|

280,113

|

|

|

$

|

119,942

|

|

|

Total Stockholders’

Equity

|

|

$

|

124,306

|

|

|

$

|

339,386

|

|

|

$

|

137,890

|

|

|

Accumulated Deficit

|

|

$

|

(4,229,598

|

)

|

|

$

|

(3,886,065

|

)

|

|

$

|

(4,131,266

|

)

|

RISK FACTORS

An investment in our common stock involves a number of very

significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this

prospectus in evaluating our company and our business before purchasing our securities. Our business, operating results and financial

condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of

your investment due to any of these risks. You should invest in our common stock only if you can afford to lose your entire investment.

Risks Related to Our Business

Marijuana remains illegal under federal law

Marijuana is a Schedule

I controlled substance and is illegal under federal law. Even in states that have legalized the use of marijuana, its sale and

use remain violations of federal law. The illegality of marijuana under federal law preempts state laws that legalize its use.

Therefore, strict enforcement of federal law regarding marijuana would likely result in our inability to proceed with our business

plan.

Our business is dependent on laws pertaining to the

marijuana industry

The United States federal government regulates drugs through

the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances, including cannabis, in a schedule. Cannabis

is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value. The United States Federal

Drug Administration has not approved the sale of marijuana for any medical application. Doctors may not prescribe cannabis for

medical use under federal law, however they can recommend its use under the First Amendment. In 2010, the United States Veterans

Affairs Department clarified that veterans using medicinal cannabis will not be denied services or other medications that are

denied to those using illegal drugs.

As of September 2, 2016, 25 states,

the District of Columbia and Guam allow their citizens to use medical cannabis through de-criminalization. Voters in the States

of Oregon, Colorado, Washington, and Alaska have legalized cannabis for adult recreational use; Oregon’s law took effect

on July 1, 2015; Alaska’s law was effective February 24, 2015; both the Colorado and Washington programs were enacted as

of December 31, 2014. In 2016, Nevada, California, Vermont, Arizona, Connecticut and Michigan have legislative bills in various

stages of progress concerning cannabis legalization.

These noted state laws, both proposed

and enacted, are in conflict with the federal Controlled Substances Act, which makes cannabis use and possession illegal on a

national level. However, on August 29, 2013, the U.S. Department of Justice issued a memorandum providing that where states and

local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory and enforcement systems,

the federal government will rely upon states and local enforcement agencies to address cannabis activity through the enforcement

of their own state and local narcotics laws. The memorandum further stated that the U.S Justice Department’s limited investigative

and prosecutorial resources will be focused on eight priorities to prevent unintended consequences of the state laws, including

distribution of cannabis to minors, preventing the distribution of cannabis from states where it is legal to states where it is

not, and preventing money laundering, violence and drugged driving.

On December 11, 2014, the U.S. Department

of Justice issued another memorandum with regard to its position and enforcement protocol with regard to Indian Country, stating

that the eight priorities in the previous federal memo would guide the United States Attorneys' cannabis enforcement efforts in

Indian Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted regulations

that prohibit the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

Laws and regulations

affecting our industry are constantly changing

The constant evolution

of laws and regulations affecting the marijuana industry could detrimentally affect our operations. Local, state and federal medical

marijuana laws and regulations are broad in scope and subject to changing interpretations. These changes may require us to incur

substantial costs associated with legal and compliance fees and ultimately require us to alter our business plan. Furthermore,

violations of these laws, or alleged violations, could disrupt our business and result in a material adverse effect on our operations.

In addition, we cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible

that regulations may be enacted in the future that will be directly applicable to our business.

Risk of government action

While we will use our best efforts to comply with all laws,

including federal, state and local laws and regulations, there is a possibility that governmental action to enforce any alleged

violations may result in legal fees and damage awards that would adversely affect us.

Because our business is dependent upon continued market

acceptance by consumers, any negative trends will adversely affect our business operations

We are substantially dependent on continued market acceptance

and proliferation of consumers of medical marijuana and recreational marijuana. We believe that as marijuana becomes more accepted

the stigma associated with marijuana use will diminish and as a result consumer demand will continue to grow. While we believe

that the market and opportunity in the marijuana space continues to grow, we cannot predict the future growth rate and size of

the market. Any negative outlook on the marijuana industry may adversely affect our business operations.

In addition, it is believed by many that large well-funded

businesses may have a strong economic opposition to the cannabis industry. We believe that the pharmaceutical industry clearly

does not want to cede control of any product that could generate significant revenue. For example, medical marijuana will likely

adversely impact the existing market for the current "marijuana pill" Marinol, sold by the mainstream pharmaceutical

industry, should marijuana displace other drugs or encroach upon the pharmaceutical industry's products. The pharmaceutical industry

is well funded with a strong and experienced lobby that eclipses the funding of the medical marijuana movement. Any inroads the

pharmaceutical could make in halting the impending cannabis industry could have a detrimental impact on our business.

FDA Regulation of marijuana and the possible registration

of facilities where medical marijuana is grown could negatively affect the cannabis industry which would directly affect our financial

condition

Should the federal government legalize marijuana for medical

use, it is possible that the U.S. Food and Drug Administration ("FDA") would seek to regulate it under the Food, Drug

and Cosmetics Act of 1938. Additionally, the FDA may issue rules and regulations including cGMPs (certified good manufacturing

practices) related to the growth, cultivation, harvesting and processing of medical marijuana. Clinical trials may be needed to

verify efficacy and safety. It is also possible that the FDA would require that facilities where medical marijuana is grown be

registered with the FDA and comply with certain federally prescribed regulations. In the event that some or all of these regulations

are imposed, we do not know what the impact would be on the medical marijuana industry and what costs, requirements and possible

prohibitions may be enforced. If we are unable to comply with the regulations and/or registration as prescribed by the FDA, we

may be unable to continue to operate our business.

Our clients may have difficulty accessing the service

of banks

On February 14, 2014, the U.S. government issued rules allowing

banks to legally provide financial services to state-licensed marijuana businesses. A memorandum issued by the Justice Department

to federal prosecutors re-iterated guidance previously given, this time to the financial industry that banks can do business with

legal marijuana businesses and "may not" be prosecuted. The Treasury Department's Financial Crimes Enforcement Network

(FinCEN) issued guidelines to banks that "it is possible to provide financial services"" to state-licensed marijuana

businesses and still be in compliance with federal anti-money laundering laws. The guidance falls short of the explicit legal

authorization that banking industry officials had pushed the government to provide and to date, it is not clear if any banks have

relied on the guidance and taken on legal marijuana companies as clients. The aforementioned policy may be administration dependent

and a change in presidential administrations may cause a policy reversal and retraction of current policies, wherein legal marijuana

businesses may not have access to the banking industry. Also, the inability of potential clients in our target market to open

accounts and otherwise use the service of banks may make it difficult for them to contract with us.

Due to our involvement in the cannabis industry, we

may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional

risk and financial liability

Insurance that is otherwise readily available, such as general liability, and directors

and officer’s insurance, is more difficult for us to find, and more expensive, because we are service providers to companies

in the cannabis industry. There are no guarantees that we will be able to find such insurances in the future, or that the cost

will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business

sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

Risks Related to the Company

Uncertainty of profitability

Our business strategy may result in increased volatility

of revenues and earnings. As we will only develop a limited number of products and services at a time, our overall success will

depend on a limited number of products and services, which may cause variability and unsteady profits and losses depending on

the products and services offered.

Our revenues and our profitability may be adversely affected

by economic conditions and changes in the market for medical and recreational marijuana. Our business is also subject to general

economic risks that could adversely impact the results of operations and financial condition.

Because of the anticipated nature of the products and services

that we will attempt to develop, it is difficult to accurately forecast revenues and operating results and these items could fluctuate

in the future due to a number of factors. These factors may include, among other things, the following:

|

|

|

|

·

|

Our ability to raise

sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses.

|

|

·

|

Our ability to source

strong opportunities with sufficient risk adjusted returns.

|

|

·

|

Our ability to manage

our capital and liquidity requirements based on changing market conditions generally and changes in the developing legal medical

marijuana and recreational marijuana industries.

|

|

·

|

The acceptance of

the terms and conditions of our licenses and/or the acceptance of our royalties and fees.

|

|

·

|

The amount and timing

of operating and other costs and expenses.

|

|

·

|

The nature and extent

of competition from other companies that may reduce market share and create pressure on pricing and investment return expectations.

|

|

·

|

Adverse changes in

the national and regional economies in which we will participate, including, but not limited to, changes in our performance,

capital availability, and market demand.

|

|

·

|

Adverse changes in

the projects in which we plan to invest which result from factors beyond our control, including, but not limited to, a change

in circumstances, capacity and economic impacts.

|

|

·

|

Adverse developments

in the efforts to legalize marijuana or increased federal enforcement.

|

|

·

|

Changes in laws, regulations,

accounting, taxation, and other requirements affecting our operations and business.

|

|

·

|

Our operating results

may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations may be

significant.

|

Management of growth will be necessary for us to be

competitive

Successful expansion of our business will depend on our ability

to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will need to hire

skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic environment.

Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure to expand

will inhibit our profitability goals.

We are entering a potentially highly competitive market

The markets for ancillary businesses in the medical marijuana

and recreational marijuana industries are competitive and evolving. In particular, we face strong competition from larger companies

that may be in the process of offering similar products and services to ours. Many of our current and potential competitors have

longer operating histories, significantly greater financial, marketing and other resources and larger client bases than we have

(or may be expected to have).

Given the rapid changes affecting the global, national, and

regional economies generally and the medical marijuana and recreational marijuana industries, in particular, we may not be able

to create and maintain a competitive advantage in the marketplace. Our success will depend on our ability to keep pace with any

changes in its markets, especially with legal and regulatory changes. Our success will depend on our ability to respond to, among

other things, changes in the economy, market conditions, and competitive pressures. Any failure by us to anticipate or respond

adequately to such changes could have a material adverse effect on our financial condition, operating results, liquidity, cash

flow and our operational performance.

There could be unidentified risks involved with an investment

in our securities

The foregoing risk factors are

not a complete list or explanation of the risks involved with an investment in our securities. Additional risks will likely be

experienced that are not presently foreseen by the Company. Prospective investors must not construe this the information provided

herein as constituting investment, legal, tax or other professional advice. Before making any decision to invest in our securities,

you should read this entire prospectus and consult with your own investment, legal, tax and other professional advisors. An investment

in our securities is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite

period of time and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind

with respect to the likelihood of the success or the business of the Company, the value of our securities, any financial returns

that may be generated or any tax benefits or consequences that may result from an investment in the Company.

The Company’s failure to continue to attract, train,

or retain highly qualified personnel could harm the Company’s business.

The Company’s success also

depends on the Company’s ability to attract, train, and retain qualified personnel, specifically those with management and

product development skills. In particular, the Company must hire additional skilled personnel to further the Company’s research

and development efforts. Competition for such personnel is intense. If the Company does not succeed in attracting new personnel

or retaining and motivating the Company’s current personnel, the Company’s business could be harmed.

The Company may be unable to

respond to the rapid technological change in its industry and such change may increase costs and competition that may adversely

affect its business

Rapidly changing technologies,

frequent new product and service introductions and evolving industry standards characterize the Company’s market. The continued

growth of the Internet and intense competition in the Company’s industry exacerbate these market characteristics. The Company’s

future success will depend on its ability to adapt to rapidly changing technologies by continually improving the performance features

and reliability of its products and services. The Company may experience difficulties that could delay or prevent the successful

development, introduction or marketing of its products and services. In addition, any new enhancements must meet the requirements

of its current and prospective users and must achieve significant market acceptance. The Company could also incur substantial costs

if it needs to modify its products and services or infrastructures to adapt to these changes.

The Company also expects that

new competitors may introduce products, systems or services that are directly or indirectly competitive with the Company. These

competitors may succeed in developing products, systems and services that have greater functionality or are less costly than the

Company’s products, systems and services, and may be more successful in marketing such products, systems and services. Technological

changes have lowered the cost of operating communications and computer systems and purchasing software. These changes reduce the

Company’s cost of providing services but also facilitate increased competition by reducing competitors’ costs in providing

similar services. This competition could increase price competition and reduce anticipated profit margins.

The Company’s services are new and its industry

is evolving.

You should consider the Company’s

prospects in light of the risks, uncertainties and difficulties frequently encountered by companies in their early stage of development,

particularly companies in the rapidly evolving legal cannabis industry. To be successful in this industry, the Company must, among

other things:

|

|

●

|

develop

and introduce functional and attractive service offerings;

|

|

|

●

|

attract

and maintain a large base of consumers;

|

|

|

●

|

increase

awareness of the Company brand and develop consumer loyalty;

|

|

|

●

|

establish

and maintain strategic relationships with distribution partners and service providers;

|

|

|

●

|

respond

to competitive and technological developments;

|

|

|

●

|

build

an operations structure to support the Company business; and

|

|

|

●

|

attract,

retain and motivate qualified personnel.

|

The Company cannot guarantee that

it will succeed in achieving these goals, and its failure to do so would have a material adverse effect on its business, prospects,

financial condition and operating results.

Some of the Company’s products

and services are new and are only in early stages of commercialization. The Company is not certain that these products and services

will function as anticipated or be desirable to its intended market. Also, some of the Company’s products and services may

have limited functionalities, which may limit their appeal to consumers and put the Company at a competitive disadvantage. If the

Company’s current or future products and services fail to function properly or if the Company does not achieve or sustain

market acceptance, it could lose customers or could be subject to claims which could have a material adverse effect on the Company

business, financial condition and operating results.

As is typical in a new and rapidly

evolving industry, demand and market acceptance for recently introduced products and services are subject to a high level of uncertainty

and risk. Because the market for the Company is new and evolving, it is difficult to predict with any certainty the size of this

market and its growth rate, if any. The Company cannot guarantee that a market for the Company will develop or that demand for

Company services will emerge or be sustainable. If the market fails to develop, develops more slowly than expected or becomes saturated

with competitors, the Company’s business, financial condition and operating results would be materially adversely affected.

If we fail to establish and

maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud.

Any ability to report and file our financial results accurately and timely could harm our reputation and adversely impact the future

trading price of our common stock.

Effective internal control is

necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent

fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our

business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies

may adversely affect our financial condition, results of operation and access to capital.

We currently have insufficient

written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP

and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing the books and records

at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather, analyze and report

information relative to the financial statements.

Because of the Company’s

limited resources, there are limited controls over information processing. There is inadequate segregation of duties consistent

with control objectives. Our Company’s management is composed of a small number of individuals resulting in a situation where

limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional staff. Currently,

the Company is unable to hire additional staff to facilitate greater segregation of duties but will reassess its capabilities after

completion of the Offering.

If

we fail to protect our intellectual property, our business could be adversely affected

Our viability will

depend, in part, on our ability to develop and maintain the proprietary aspects of our technology and brands to distinguish our

products and services from our competitors' products and services. We rely on patents, copyrights, trademarks, trade secrets,

and confidentiality provisions to establish and protect our intellectual property.

Any infringement or

misappropriation of our intellectual property could damage its value and limit our ability to compete. We may have to engage in

litigation to protect the rights to our intellectual property, which could result in significant litigation costs and require

a significant amount of our time. In addition, our ability to enforce and protect our intellectual property rights may be limited

in certain countries outside the U.S., which could make it easier for competitors to capture market position in such countries

by utilizing technologies that are similar to those developed or licensed by us.

Competitors may also

harm our sales by designing products that mirror the capabilities of our products or technology without infringing on our intellectual

property rights. If we do not obtain sufficient protection for our intellectual property, or if we are unable to effectively enforce

our intellectual property rights, our competitiveness could be impaired, which would limit our growth and future revenue.

We may also find it

necessary to bring infringement or other actions against third parties to seek to protect our intellectual property rights. Litigation

of this nature, even if successful, is often expensive and time-consuming to prosecute and there can be no assurance that we will

have the financial or other resources to enforce our rights or be able to enforce our rights or prevent other parties from developing

similar technology or designing around our intellectual property.

Our trade secrets

may be difficult to protect

Our success depends upon the skills,

knowledge and experience of our scientific and technical personnel, our consultants and advisors, as well as our licensors

and contractors. Because we operate in a highly competitive industry, we rely in part on trade secrets to protect our

proprietary technology and processes. However, trade secrets are difficult to protect. We enter into confidentiality or

non-disclosure agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers

and other advisors. These agreements generally require that the receiving party keep confidential and not disclose to third

party’s

confidential information developed by the receiving party or made known to the receiving party by us

during the course of the receiving party's relationship with us. These agreements also generally provide that inventions

conceived by the receiving party in the course of rendering services to us will be our exclusive property, and we enter into

assignment agreements to perfect our rights.

These confidentiality,

inventions and assignment agreements may be breached and may not effectively assign intellectual property rights to us. Our trade

secrets also could be independently discovered by competitors, in which case we would not be able to prevent the use of such trade

secrets by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets

could be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the U.S.

may be less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely

affect our competitive position.

Our lack of patent and/or copyright protection and

any unauthorized use of our proprietary information and technology may affect our business

We currently rely on a combination of protections by contracts,

including confidentiality and nondisclosure agreements, and common law rights, such as trade secrets, to protect our intellectual

property. However, we cannot assure you that we will be able to adequately protect our technology or other intellectual property

from misappropriation in the U.S. and abroad. This risk may be increased due to the lack of any patent and/or copyright protection.

Any patent issued to us could be challenged, invalidated or circumvented or rights granted thereunder may not provide a competitive

advantage to us. Furthermore, patent applications that we file may not result in issuance of a patent, or, if a patent is issued,

the patent may not be issued in a form that is advantageous to us. Despite our efforts to protect our intellectual property rights,

others may independently develop similar products, duplicate our products or design around our patents and other rights. In addition,

it is difficult to monitor compliance with, and enforce, our intellectual property rights on a worldwide basis in a cost-effective

manner. In jurisdictions where foreign laws provide less intellectual property protection than afforded in the U.S., our technology

or other intellectual property may be compromised, and our business could be materially adversely affected. If any of our proprietary

rights are misappropriated or we are forced to defend our intellectual property rights, we will have to incur substantial costs.

Such litigation could result in substantial costs and diversion of our resources, including diverting the time and effort of our

senior management, and could disrupt our business, as well as have a material adverse effect on our business, prospects, financial

condition and results of operations. We can provide no assurance that we will have the financial resources to oppose any actual

or threatened infringement by any third party. Furthermore, any patent or copyrights that we may be granted may be held by a court

to infringe on the intellectual property rights of others and subject us to the payment of damage awards.

Risks Related to Our Common Stock

Because we will likely issue additional shares of

our common stock, investment in our company could be subject to substantial dilution.

Investors’ interests in our Company will be diluted and investors may suffer

dilution in their net book value per share when we issue additional shares. We are authorized to issue 100,000,000 shares of

common stock, $0.00001 par value per share. As of September 2, 2016, there were 46,751,074 shares of our common stock

issued and outstanding. We anticipate that all or at least some of our future funding, if any, will be in the form of equity

financing from the sale of our common stock. If we do sell more common stock, investors’ investment in our company will

likely be diluted. Dilution is the difference between what you pay for your stock and the net tangible book value per share

immediately after the additional shares are sold by us. If dilution occurs, any investment in our company’s

common stock could seriously decline in value.

The sale of our stock under the convertible notes

and the common share purchase warrants could encourage short sales by third parties, which could contribute to the future decline

of our stock price.

In many circumstances, the provision of financing based

on the distribution of equity for companies that are traded on the OTCQB has the potential to cause a significant downward pressure

on the price of common stock. This is especially the case if the shares being placed into the market exceed the market’s

ability to take up the increased stock or if we have not performed in such a manner to show that the equity funds raised will

be used to grow our business. Such an event could place further downward pressure on the price of our common stock. Regardless

of our activities, the opportunity exists for short sellers and others to contribute to the future decline of our stock price.

If there are significant short sales of our common stock, the price decline that would result from this activity will cause the

share price to decline more, which may cause other stockholders of the stock to sell their shares, thereby contributing to sales

of common stock in the market. If there are many more shares of our common stock on the market for sale than the market will absorb,

the price of our common shares will likely decline.

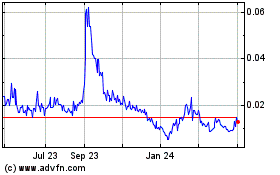

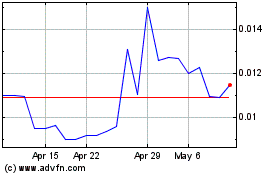

Trading in our common stock on the OTCQB has been

subject to wide fluctuations.

Our common stock is currently quoted for public trading

on the OTCQB. The trading price of our common stock has been subject to wide fluctuations. Trading prices of our common stock

may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced

extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies

with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced

by our common stock will be matched or maintained. These broad market and industry factors may adversely affect the market price

of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price

of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted,

could result in substantial costs for us and a diversion of management’s attention and resources.

Our Certificate of Incorporation and by-laws provides

for indemnification of officers and directors at our expense and limit their liability which may result in a major cost to us

and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Certificate of Incorporation and By-Laws include provisions

that eliminate the personal liability of our directors for monetary damages to the fullest extent possible under the laws of the

State of Delaware or other applicable law. These provisions eliminate the liability of our directors and our shareholders for

monetary damages arising out of any violation of a director of his fiduciary duty of due care. Under Delaware law, however, such

provisions do not eliminate the personal liability of a director for (i) breach of the director's duty of loyalty, (ii) acts or

omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases

of stock other than from lawfully available funds, or (iv) any transaction from which the director derived an improper benefit.

These provisions do not affect a director's liabilities under the federal securities laws or the recovery of damages by third

parties.

We do not intend to pay dividends on any investment

in the shares of stock of our Company and any gain on an investment in our Company will need to come through an increase in our

stock’s price, which may never happen.

We have never paid any cash dividends and currently do not

intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided

for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends,

any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen

and investors may lose all of their investment in our company.

Because our securities are subject to penny stock

rules, you may have difficulty reselling your shares.

Our shares as penny stocks, are covered by Section 15(g)

of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell our company’s

securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure

of compensation the broker/dealer receives; and, furnishing monthly account statements. These rules apply to companies whose shares

are not traded on a national stock exchange, trade at less than $5.00 per share, or who do not meet certain other financial requirements

specified by the Securities and Exchange Commission. These rules require brokers who sell “penny stocks” to persons

other than established customers and “accredited investors” to complete certain documentation, make suitability inquiries

of investors, and provide investors with certain information concerning the risks of trading in such penny stocks. These rules

may discourage or restrict the ability of brokers to sell our shares of common stock and may affect the secondary market for our

shares of common stock. These rules could also hamper our ability to raise funds in the primary market for our shares of common

stock.

FINRA sales practice requirements may also limit a

stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described

above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require that in recommending

an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other

information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend

that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect

on the market for our shares.

Tangiers Global, LLC will pay less than the then-prevailing

market price for our common stock.

Our common stock to be issued to Tangiers Global, LLC pursuant

to the Investment Agreement dated August 4, 2016 will be purchased at 80% of the average of the two lowest closing bid prices

of our common stock during the pricing period applicable to the put notice, provided, however, an additional 10% will be added

to the discount of each put if (i) we are not DWAC eligible and (ii) an additional 15% will be added to the discount of each put

if we are under DTC “chill” status on the applicable date of the put notice. Tangiers Global, LLC has a financial

incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between

the discounted price and the market price. If Tangiers Global, LLC sells the shares, the price of our common stock could decrease.

If our stock price decreases, Tangiers Global, LLC may have a further incentive to sell the shares of our common stock that it

holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value

of our common stock may decline by exercising the put right pursuant to the investment agreement with Tangiers Global, LLC.

Pursuant to the investment agreement with Tangiers Global,

LLC, when we deem it necessary, we may raise capital through the private sale of our common stock to Tangiers Global, LLC at a

discounted price. Because the put price is lower than the prevailing market price of our common stock, to the extent that the

put right is exercised, your ownership interest may be diluted.

We may not have access to the full amount available

under the investment agreement with Tangiers Global, LLC.

Our ability to draw down funds and sell shares under the

investment agreement with Tangiers Global, LLC requires that the registration statement of which this prospectus forms a part

to be declared effective and continue to be effective. The registration statement of which this prospectus forms a part registers

the resale of 5,829,842 shares issuable under the investment agreement with Tangiers Global, LLC, and our ability to sell any

remaining shares issuable under the investment with Tangiers Global, LLC is subject to our ability to prepare and file one or

more additional registration statements registering the resale of these shares. These registration statements may be subject to

review and comment by the staff of the Securities and Exchange Commission, and will require the consent of our independent registered

public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness

of these registration statements is a condition precedent to our ability to sell all of the shares of our common stock to Tangiers

Global, LLC under the investment agreement. Even if we are successful in causing one or more registration statements registering

the resale of some or all of the shares issuable under the investment agreement with Tangiers Global, LLC to be declared effective

by the Securities and Exchange Commission in a timely manner, we may not be able to sell the shares unless certain other conditions

are met. For example, we might have to increase the number of our authorized shares in order to issue the shares to Tangiers Global,

LLC. Increasing the number of our authorized shares will require board and stockholder approval. Accordingly, because our ability

to draw down any amounts under the investment agreement with Tangiers Global, LLC is subject to a number of conditions, there

is no guarantee that we will be able to draw down any portion or all of the proceeds of $5,000,000 under the investment with Tangiers

Global, LLC.

Certain restrictions on the extent of puts and the

delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with

the investment agreement with Tangiers Global, LLC, and as such, Tangiers Global, LLC may sell a large number of shares, resulting

in substantial dilution to the value of shares held by existing stockholders.

Tangiers Global, LLC has agreed, subject to certain exceptions

listed in the investment agreement with Tangiers Global, LLC, to refrain from holding an amount of shares which would result in

Tangiers Global, LLC or its affiliates owning more than 9.99% of the then-outstanding shares of our common stock at any one time.

These restrictions, however, do not prevent Tangiers Global, LLC from selling shares of our common stock received in connection

with a put, and then receiving additional shares of our common stock in connection with a subsequent put. In this way, Tangiers

Global, LLC could sell more than 9.99% of the outstanding common stock in a relatively short time frame while never holding more

than 9.99% at one time.

Use of Proceeds

We will not receive any proceeds from the sale of shares

of our common stock by the selling stockholders. However, we will receive proceeds from the sale of shares of our common stock

pursuant to our exercise of the put right offered by Tangiers Global, LLC. We will use these proceeds for general corporate and

working capital purposes and acquisitions or assets, businesses or operations or for other purposes that our board of directors,

in its good faith, deems to be in the best interest of the Company.

We will pay for expenses of this offering, except that the

selling stockholder will pay any broker discounts or commissions or equivalent expenses and expenses of its legal counsel applicable

to the sale of its shares.

Dilution

The sale of our common stock to Tangiers Global, LLC in

accordance with the Investment Agreement dated August 4, 2016 will have a dilutive impact on our stockholders. As a result, our

net loss per share could increase in future periods and the market price of our common stock could decline. In addition, the lower

our stock price is at the time we exercise our put option, the more shares of our common stock we will have to issue to Tangiers

Global, LLC in order to drawdown pursuant to the investment agreement. If our stock price decreases during the pricing period,

then our existing stockholders would experience greater dilution.

Investment Agreement with Tangiers Global, LLC

On August 4, 2016, we entered into an amended and restated

investment agreement with Tangiers Global, LLC, a Wyoming limited liability company (“Tangiers”). Pursuant to the

terms of the investment agreement, Tangiers committed to purchase up to $5,000,000 of our common stock over a period of up to

36 months. From time to time during the 36 month period commencing from the effectiveness of the registration statement, we may

deliver a put notice to Tangiers which states the dollar amount that we intend to sell to Tangiers on a date specified in the

put notice. The maximum investment amount per notice must be no more than 200% of the average daily trading dollar volume of our

common stock for the eight (8) consecutive trading days immediately prior to date of the applicable put notice and such amount

must not exceed an accumulative amount of $250,000. The minimum put amount is $5,000. The purchase price per share to be paid

by Tangiers will be the 80% of the of the average of the two lowest closing bid prices of the Common Stock during the pricing

period applicable to the put notice, provided, however, an additional 10% will be added to the discount of each put if (i) we

are not DWAC eligible and (ii) an additional 15% will be added to the discount of each put if we are under DTC “chill”

status on the applicable date of the put notice.

In connection with the investment agreement with Tangiers,

we also entered into a registration rights agreement with Tangiers, pursuant to which we agreed to use our best efforts to, within

30 days of August 4, 2016, file with the Securities and Exchange Commission a registration statement, covering the resale of 5,829,842

shares of our common stock underlying the investment agreement with Tangiers.

The Company also issued a fixed convertible promissory

note to Tangiers for the principal sum of $50,000 as a commitment fee. The promissory note maturity date is February 14,

2017.

If this registration statement is

declared effective within 90 days of the execution date of the Investment Agreement, the Company and Holder agree the principal

balance of the Note will immediately be reduced by $25,000. If this registration statement is declared effective within 135

days, but no more than 90 days of the execution date of the Investment Agreement, the Company and Holder agree the principal balance

of the Note will immediately be reduced by $15,000.

The 5,829,842 shares being offered

pursuant to the investment agreement with Tangiers represents12.49% of the shares issued and outstanding, assuming that the selling

stockholders will sell all of the shares offered for sale. The 5,829,842 shares being offered pursuant to this prospectus represent

27.38% of the shares issued and outstanding held by non-affiliates of our company. The investment agreement with Tangiers is not

transferable and any benefits attached thereto may not be assigned.

At an assumed purchase price under the Investment Agreement of $0.08 (equal to 80%

of the closing price of our common stock of $0.10 on September 2, 2016), we will be able to receive up to $466,387 in gross

proceeds, assuming the sale of the entire 5,829,842 Put Shares being registered hereunder pursuant to the Investment

Agreement. At an assumed purchase price of $0.08 under the Investment Agreement, we would be required to register 566,701,625

additional shares to obtain the balance of $4,533,613 under the Investment Agreement. Due to the floating offering price, we

are not able to determine the exact number of shares that we will issue under the Investment Agreement.

There are substantial risks to investors as a result of

the issuance of shares of our common stock under the investment agreement with Tangiers. These risks include dilution of stockholders’

percentage ownership, significant decline in our stock price and our inability to draw sufficient funds when needed.

We intend to sell Tangiers periodically our common stock

under the investment agreement and Tangiers will, in turn, sell such shares to investors in the market at the market price. This

may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Tangiers to raise

the same amount of funds, as our stock price declines.

The proceeds received from any “puts” tendered to Tangiers under

the investment agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses

or operations or for other purposes that our board of directors, in its good faith deem to be in the best interest of the Company.

We may have to increase the number of our authorized shares

in order to issue the shares to Tangiers if we reach our current amount of authorized shares of common stock. Increasing the number

of our authorized shares will require board and stockholder approval. Accordingly, because our ability to draw down any amounts

under the investment agreement with Tangiers is subject to a number of conditions, there is no guarantee that we will be able

to draw down any portion or all of the proceeds of $5,000,000 under the investment agreement with Tangiers.

Selling Stockholders

This prospectus relates to the resale of 5,917,442 shares

of our common stock, par value $0.00001 per share, including (i) 5,829,842 shares of common stock (the “Common Shares”),

shares issuable to Tangiers Global, LLC (defined below) and, (ii) 87,600 shares previously issued to an individual shareholder.

This prospectus relates to the resale of up to 5,829,842

shares of the Common Shares, issuable to Tangiers Global, LLC (“Tangiers”), a selling stockholder pursuant to a “put

right” under an amended and restated investment agreement (the “Investment Agreement”), dated August 4, 2016, that

we entered into with Tangiers. The Investment Agreement permits us to “put” up to five million dollars ($5,000,000)

in shares of our common stock to Tangiers over a period of up to thirty-six (36) months or until $5,000,000 of such shares have

been “put.”

The selling stockholder may offer and sell, from time to