As Oil Bust Recedes, Is a Barroom Brawl About to Break Out?

October 21 2016 - 1:00PM

Dow Jones News

By Lynn Cook

The worst of the oil bust may be over, but the energy industry's

infighting has just begun.

Paal Kibsgaard, chief executive of Schlumberger Ltd., the

world's largest oil-field services company and a bellwether for the

sector, told investors Friday that from now on, his company will

only focus on work that is profitable.

It was a shot across the bow of U.S. and international energy

companies, which need Schlumberger and companies like it to help

drill new wells and do hydraulic fracturing, but which have been

paying sharply reduced rates for such services amid the plunge in

oil prices.

In the two years since crude prices plunged from over $100 a

barrel down to around $26 earlier this year, Schlumberger and chief

rival Halliburton Co. drastically reduced the amount that they

charge for equipment and crews to help keep the sector afloat and

the oil flowing. Slashing prices meant working on projects while

losing money and laying off more than 80,000 workers between

them.

Now, oil-field services companies are trying to convince

producers that they need to be paid more if the industry is to

fully recover from the oil bust.

"It's critical for us to recover the large pricing concessions

we have made over the past two years," Mr. Kibsgaard said, adding

that most customers understand this and are willing to

renegotiate.

Earlier this week, Halliburton President Jeff Miller likened the

pricing negotiations that oil-field services firms are having to a

"barroom brawl" with customers.

Executives from Chevron Corp., Anadarko Petroleum Corp. and

other big oil companies have said the wildly high prices charged

during the boom years have to come down and stay down.

Schlumberger reported a 82% drop in its third-quarter profits

Thursday. They fell to $176 million, or 13 cents a share, from $989

million on lower sales and expenses related to its acquisition of

Cameron International Corp. earlier this year.

Halliburton managed to eke out a third-quarter profit of $6

million, or a penny a share, compared with a year-earlier loss of

$54 million, or 6 cents a share, the company reported Wednesday.

Total revenue plunged 31% to $3.83 billion.

Crude prices climbed nearly $25 a barrel in the spring to hit

$50 in early June. The rise prompted many producers to rush back

into the oil patch, particularly the Permian Basin of West Texas,

where half of more than 100 U.S. rigs put back to work in the last

four months have been deployed.

But rising prices for the goods and services needed to tap new

wells is already cutting into what little profitability has

re-emerged in the sector, Mr. Kibsgaard said, adding that it

shrouds how healthy the industry can be in 2017.

For instance, U.S. shale companies are using more sand, mixed in

a slurry of water and chemicals, to stimulate oil and gas wells and

boost output. The result: sand prices are already creeping up.

Halliburton executives told investors earlier this week that

they are essentially taking the loss on more expensive sand for

their clients because they have not yet been able to pass along the

costs. Chief Executive David Lesar said that has to change.

Halliburton has the highest U.S. market share for oil services,

but "if we have to give some back to move margins up we might take

that approach, " Mr. Lesar said in a conference call Wednesday.

Companies like Halliburton and Schlumberger will ultimately

answer the question of whether the downturn-induced pricing

concessions were cyclical and fleeting, or structural and lasting,

said James West, an energy analyst at Evercore ISI.

"It's evident that pricing levels remain 'unsustainable'," he

said.

Write to Lynn Cook at lynn.cook@wsj.com

(END) Dow Jones Newswires

October 21, 2016 12:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

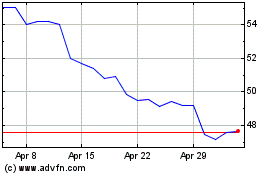

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024