Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-196334

Dated

October 14, 2016

VYCOR

MEDICAL, INC.

3,991,202

Shares of Common Stock Par Value $0.0001 Per Share

This

prospectus relates to the offering by the selling stockholders of

VYCOR MEDICAL

, INC. of up to 3,991,202 shares of our

common stock underlying Series A and Series B warrants, par value $0.0001 per share. We will not receive any proceeds from the

sale of common stock.

The

selling stockholders have advised us that they will sell the shares of common stock from time to time in broker’s transactions,

in the open market, on the OTCQB, in privately negotiated transactions or a combination of these methods, at market prices prevailing

at the time of sale, at prices related to the prevailing market prices or at negotiated prices. We will pay the expenses incurred

to register the shares for resale, but the selling stockholders will pay any underwriting discounts, commissions or agent’s

commissions related to the sale of their shares of common stock.

Our

common stock is traded on the OTCQB under the symbol “VYCO”. On September 29, 2016, the closing sale price of our

common stock was $0.35 per share.

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized

anyone to provide you with different information.

Investing

in these securities involves significant risks. See “Risk Factors” beginning on page 5

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 14, 2016.

The

information contained in this prospectus is not complete and may be changed. This prospectus is included in the registration statement

that was filed by VYCOR MEDICAL, INC. with the Securities and Exchange Commission. The selling stockholders may not sell these

securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TABLE

OF CONTENTS

SUMMARY

INFORMATION AND RISK FACTORS

The

items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected

information and does not contain all the information you should consider before investing in the securities. Before making an

investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial

statements, and the notes to the financial statements.

For

purposes of this prospectus, unless otherwise indicated or the context otherwise requires, all references herein to “Vycor”,

“the Company”, “we,” “us,” and “our,” refer to VYCOR MEDICAL, INC., a Delaware

corporation.

SUMMARY

OF THE COMPANY

This

summary provides an overview of selected information and does not contain all the information on the Company you should consider.

Therefore, this should be read in conjunction with the more detailed information set out in this prospectus, the business and

other information provided in the SEC filings included as Exhibits, and matters set forth under “Risk Factors.”

Business

Overview

The

Company was formed as a limited liability company under the laws of the State of New York on June 17, 2005 as “Vycor Medical

LLC”. On August 14, 2007, we converted into a Delaware corporation and changed our name to “Vycor Medical, Inc.”.

The Company’s listing went effective on February 2009 and on November 29, 2010 Vycor completed the acquisition of substantially

all of the assets of NovaVision, Inc. (“NovaVision”) and on January 4, 2012 Vycor, through its wholly-owned NovaVision

subsidiary, completed the acquisition of all the shares of Sight Science Limited (“Sight Science”), a previous competitor

to NovaVision.

Vycor

is dedicated to providing the medical community with innovative and superior surgical and therapeutic solutions and operates two

distinct business units within the medical device industry. Vycor Medical designs, develops and markets medical devices for use

in neurosurgery. NovaVision provides non-invasive rehabilitation therapies for those who have vision disorders resulting from

neurological brain damage such as that caused by a stroke. Both businesses adopt a minimally or non-invasive approach. Both technologies

have strong sales growth potential, address large potential markets and have the requisite regulatory approvals. The Company has

57 issued or allowed patents and a further 13 pending. The Company leverages joint resources across the divisions to operate in

a cost-efficient manner.

The

Company periodically engages in discussions with potential strategic partners for or purchasers of each or both of our operating

divisions.

Vycor

Medical

Vycor

Medical designs, develops and markets medical devices for use in neurosurgery. Vycor Medical’s ViewSite Brain Access System

(“VBAS”) is a next generation retraction and access system that was fully commercialized in early 2010 and is the

first significant technological change to brain tissue retraction in over 50 years in contrast to significant development in most

other neuro-surgical technologies. Vycor Medical is ISO 13485:2003 compliant, and VBAS has U.S. FDA 510(k) clearance and CE Marking

for Europe (Class III) for brain and spine surgeries, and regulatory approvals in Australia, Brazil, Canada, China, Korea, Japan,

Russia and Taiwan.

We

believe VBAS offers several advantages over other brain retractor systems, commonly known as ribbon or blade retractors that are

metallic, including having the potential to significantly reduce brain tissue trauma that arises from excessive pressure at the

edges of the blade. The design of VBAS can minimize the size of the brain entry access necessary for surgical procedures, and

is believed to significantly reduce the pressure and hence trauma on the surrounding brain tissue.

NovaVision

NovaVision

provides non-invasive, computer-based rehabilitation targeted at a substantial and largely un-addressed market of people who have

lost their sight as a result of stroke or other brain injury. NovaVision addresses a significant target market, estimated at approximately

$2 billion in each of the U.S. and the EU and over $13 billion globally.

NovaVision

has a family of therapies that both restore and compensate for lost vision:

|

●

|

Restoration

of vision: NovaVision’s VRT and Sight Science’s Neuro-Eye Therapy (NeET), aim to improve visual sensitivity in

a person’s blind area. VRT delivers a series of light stimuli along the border of the patient’s visual field loss.

These programmed light sequences stimulate the border zone between the “seeing” and “blind” visual

fields, repetitively challenging the visual cortex in the border zone with a large number of stimuli over the course of time.

NeET targets deep within the blind area by repeated stimulation, allowing patients to detect objects within the blind field.

|

|

|

|

|

●

|

Compensation

and re-training: Normal eye movements are also affected after brain injury adding to the problems of blindness. NeuroEyeCoach

provides a complementary therapy to VRT and NeET, which re-trains a patient to move their eyes, re-integrate left and right

vision and to make the most of their remaining visual field.

|

VRT

and NeuroEyeCoach are therefore highly complementary and are provided in an Internet-delivered suite to ensure broad benefits

to NovaVision’s patients.

NovaVision

also has models of VRT and NeuroEyeCoach for physicians and rehabilitation clinics, as well as VIDIT, a diagnostic program that

enables therapists to perform high-resolution visual field tests in less than ten minutes.

NovaVision’s

VRT is the only medical device aimed at the restoration of vision lost as a result of neurological damage which has FDA 510(k)

clearance to be marketed in the U.S; and NeuroEyeCoach is registered in the US as a Class I 510(k) exempt device. VRT, NEC and

NeET have CE Marking for the EU. NovaVision has 41 granted and 2 pending patents worldwide.

Competition

The

VBAS device is both a brain access system and a retractor and is therefore unique with no direct competitors. Competitive manufacturers

of brain retractors include Cardinal Health (V. Mueller line), Aesculap, Integra Life Science and Codman (Division of Johnson

& Johnson). Nico Corporation has a brain access device specifically designed to work with its Myriad resection and suction

product.

NovaVision

provides restoration therapies (VRT and NeET) and compensation or saccadic therapies (NeuroEyeCoach) for those suffering vision

loss as a result of neurological trauma. The other therapy type for this condition is substitution (optical aids such as prisms)

and is not considered by NovaVision as competition.

In

restoration, competition has been reduced through NovaVision’s acquisition of Sight Science and there are a few very small

companies or entities offering some form of vision rehabilitation product in Germany. Within compensation there are no real direct

competitors. Other companies in the general rehabilitation space include RevitalVision, PositScience and Dynavision. In the professional

market, NovaVision competes with aggregator products or those that provide a range of non-specific therapies, such a Rehacom,

Sanet Vision Integrator and Bioness BITS. NovaVision’s products are dedicated to vision.

The

Market For the Company’s Products And Therapies

VBAS

is used for craniotomy procedures. Based on statistics from the American Association of Neurological Surgeons (AANS), management

estimates 700,000 such procedures are performed in the US annually. Of this, management believe approximately 225,000 (32 percent)

are addressable by the VBAS range currently, with another 100,000 (total of 325,000 or 46 percent) addressable by an expanded

future range. Management estimates, for the global market, there exists a current addressable market of approximately 1,100,000

procedures with another 500,000 addressable by an expanded VBAS range.

The

market for NovaVision’s therapies comprises those suffering from vision loss resulting from neurological trauma such as

stroke or other brain injury. The U.S. Centers for Disease Control (CDC) estimates there are approximately 8 million Americans

who have previously had a stroke incident, with 795,000 additional strokes occurring annually; adjusting for repeat strokes and

deaths, there are 481,000 new stroke survivors each year. Additionally, approximately 5.3 million Americans live with the long-term

effects of a TBI, with 275,000 hospitalizations each year. The most recent scientific research estimates that approximately 28.5%

experience some visual impediment and 20.5% of these patients experience a permanent visual field deficit, reducing mobility and

other activities of daily living. The target market for VRT and NeET is this 20.5% subset of patients who have suffered a permanent

visual field deficit; NeuroEyeCoach addresses all 28.5% of patients who experience visual impediments. Management estimates that

the addressable target market for its therapies is approximately 2.9 million people in the US, approximately 2.8 million people

in Europe and approximately 12.9 million people throughout the rest of the world.

Our

Growth Strategy

Vycor

Medical

Vycor

Medical’s growth strategy includes:

1.

Increasing U.S. market penetration through broader hospital coverage and targeted direct physician marketing. Vycor Medical’s

sales and marketing strategy is to penetrate a well-defined target market of 4,500 neurosurgeons. Vycor markets direct to surgeons

as well as marketing and distributing through independent distributors, with a focus both on adding new hospitals and expanding

to additional surgeons in hospitals where VBAS is already approved, and to expand usage to a broader range of procedures. In order

to expand its direct marketing and deepening its penetration, Vycor is exploring the creation of a Centers of Excellence medical

education campaign and to that end will be finalizing new surgeon education and training materials including detailed videos produced

with surgeons at Weill Cornell. Vycor is pursuing a policy of continually evaluating and upgrading its distributors as well as

adding additional distributors in regions where it has little to no presence.

2.

Provision of more Clinical and Scientific Data supporting the products superiority over the current standard-of-care blade retractors

and to demonstrate VBAS’ potential for cost savings. Clinical and scientific data (in the form of peer reviewed articles,

clinical studies and other reports and case studies) are critical in driving adoption, and in turn revenues, further and faster

by demonstrating VBAS’ superiority as a minimally invasive access system which helps VBAS move further up the hospital cost/benefit

curve. To date the Company has already had 10 Peer Reviewed studies and 4 other clinical papers and anticipates further studies

to be published.

3.

International Market Growth

Vycor

Medical utilizes select medical device distributors with experience in neurosurgical devices in their countries or regions. VBAS

has full regulatory approvals in Australia, Brazil, Canada, China, Europe (EU – Class III), Korea, Japan and Taiwan and

is seeking or has partial regulatory approvals in India, Russia and Vietnam. Vycor Medical is actively pursuing new distribution

agreements in the countries where it does not have any in place.

4.

New Product Development

New

Product Development is targeted at both driving the use of its existing VBAS product range through ancillary products and modalities

that will facilitate the product’s use and through new product extensions to broaden VBAS applicability to procedures currently

not addressed by the existing product line.

Vycor

is modifying its existing VBAS product suite to make it more easy to integrate with Image Guidance Systems (IGS) by re-engineering

VBAS so that the entire range of 12 devices, excluding the VBASmini, will be able to more easily accommodate pointers from all

the main IGS manufacturers. Increasingly, all major neuro centers have image guidance systems, and where this is in place over

90% of surgeries are carried out using IGS and management strongly believes that the existing VBAS rigid structure lends itself

well to being incorporated into this increasing trend.

NovaVision

While

speech, physical, and occupational therapies are the long-standing treatment standards for stroke and TBI survivors, VRT is the

first and only FDA-cleared clinical component of vision restoration to physically enhance the visual field after a stroke or brain

injury. Increasingly the healthcare community, partly driven by strong lobbying by stroke associations worldwide, are recognizing

that vision is not only a significant issue post stroke or brain injury, but that visual field loss can have a significant impact

on the success of other rehabilitation modalities and the quality of life.

Our

strategic vision for NovaVision has been to develop and provide a clinically supported, affordable and scalable visual therapy

solution offering that provides broad benefits to those suffering visual impairment following neurological brain damage; and to

offer solutions for both patients and physicians alike. Following a prolonged development program, aimed at broadening patient

benefits, significantly reducing cost and making our therapies affordable and scalable, NovaVision was able to launch its Internet-delivered

therapy suite in the US in June 2015 and in Europe in December 2015.

NovaVision

has four routes-to-market aimed at patients and professionals, comprising: direct-to-patient; rehabilitation centers and clinics;

stroke associations and support groups; and physicians. Given the company’s limited resources NovaVision is initially focusing

on direct-to-patient, with a website lead-driven inbound and outbound marketing strategy targeted at prospective patients and

relatives. Website metrics – particularly for the US and more recently Germany – are strong, showing good growth in

traffic and rankings, and have been effective in generating leads. Our analysis of the campaign metrics in the US (including Google

Ads) over the last 6 months have highlighted some key improvements that needed to be implemented which we are carrying out and

which we believe could have a material impact on our lead generation.

Following

the pilot launch of our NovaVision Center Model, comprising a vision diagnostics program and the NeuroEyeCoach training program,

we are substantially broadening the delivery and licensing model in response to feedback from clinics. The new Center Model will

have a complete suite for the professional market, including options for software download, CD Rom, Cloud based and Hardware delivery

with flexible and cost-effective pricing options, and will be offered in both the US and Europe.

Manufacturing

Vycor

Medical uses a sub-contract manufacturer to manufacture, package, label and sterilize its VBAS products. The Company is in the

process of migrating all its VBAS manufacturing to Life Science Outsourcing, Inc. in Brea, California that is FDA-registered and

meets ISO standards and certifications.

Intellectual

Property

Patents

Vycor

Medical maintains a portfolio of patent protection on its methods and apparatus for its Brain and Spine products and technology

in the form of issued patents and applications, both domestically and internationally, with a total of 16 granted/allowed and

11 pending patents.

NovaVision

maintains a portfolio of patent protection on its methods and apparatus in the form of issued patents and applications, both domestically

and internationally, with a total of 41 granted and 2 pending patents (including Sight Science).

NovaVision’s

VRT is the only medical device aimed at the restoration of vision lost as a result of neurological damage which has FDA 510(k)

clearance to be marketed in the U.S; and NeuroEyeCoach is registered in the US as a Class I 510(k) exempt device.

Trademarks

VYCOR

MEDICAL

is a registered trademark and

VIEWSITE

is a common law trademark.

NovaVision

maintains a portfolio of registered trademarks for

NOVAVISION, NOVAVISION VRT

,

VRT VISION RESTORATION THERAPY

and

NEUROEYECOACH, amongst others, along with relevant logos, both in the US and internationally.

Employees

We

currently have 12 employees.

Websites

The

Company operates websites at www.vycormedical.com, www.novavision.com,www.novavisionvrt.com, www.neuroeyecoach.com and www.sightscience.com.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. This prospectus includes statements regarding our plans, goals, strategies, intent,

beliefs or current expectations. These statements are expressed in good faith and based upon a reasonable basis when made, but

there can be no assurance that these expectations will be achieved or accomplished. These forward looking statements can be identified

by the use of terms and phrases such as “believe,” “plan,” “intend,” “anticipate,”

“target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions

“may,” “could,” “should,” etc. Items contemplating or making assumptions about, actual or

potential future sales, market size, collaborations, and business opportunities also constitute such forward-looking statements.

Although

forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently

subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially

different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking

statements, which speak only as of the date of this report. We assume no obligation to update any forward- looking statements

in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable

law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed

with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect

our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize,

or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

CORPORATE

ADDRESS AND TELEPHONE NUMBER

The

Company maintains its designated office at 6401 Congress Ave., Suite 140, Boca Raton, FL 33487. The Company’s telephone

number is 561-558-2020.

THE

OFFERING

This

prospectus will be utilized in connection with the re-sale of 3,991,202 shares which could be potentially issued in the future

as of the result of the sale of common stock and the prospective exercise of certain investor warrants and placement agent warrants

which were issued in connection with the Company’s recent stock offering. The Company will not receive any proceeds from

any sales of these shares.

|

Common

stock currently outstanding

|

11,116,077

shares

(1)

|

|

|

|

|

Common

stock offered by the selling stockholders

|

3,991,202

shares

|

(1)

Shares of common stock outstanding as of September 29, 2016.

|

Use

of proceeds

|

We

will not receive any proceeds from the sale of common stock offered by this prospectus.

|

SELECTED

CONSOLIDATED FINANCIAL DATA

The

following selected consolidated statement of operations data contains consolidated statement of operations data and consolidated

balance sheet for the fiscal years ended December 31, 2015, December 31, 2014 and December 31, 2013. The consolidated statement

of operations data and balance sheet data were derived from the audited consolidated financial statements. All share amounts are

restated to reflect a one-for-150 reverse stock split which became effective January 15, 2013. Such financial data should be read

in conjunction with the consolidated financial statements and the notes to the consolidated financial statements and with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

12/31/2015

|

|

|

12/31/2014

|

|

|

12/31/2013

|

|

|

Revenues

|

|

$

|

1,138,634

|

|

|

$

|

1,250,292

|

|

|

$

|

1,089,374

|

|

|

Net comprehensive loss

|

|

$

|

(2,315,379

|

)

|

|

$

|

(4,162,031

|

)

|

|

$

|

(2,410,116

|

)

|

|

Net comprehensive loss per share

|

|

$

|

(0.21

|

)

|

|

$

|

(0.39

|

)

|

|

$

|

(0.39

|

)

|

|

Weighted average no. shares

|

|

|

10,839,335

|

|

|

|

10,270,657

|

|

|

|

6,324,175

|

|

|

Stockholders’

equity (deficit)

|

|

$

|

1,145,722

|

|

|

$

|

2,888,902

|

|

|

$

|

(3,315,243

|

)

|

|

Total assets

|

|

$

|

2,022,731

|

|

|

$

|

3,813,743

|

|

|

$

|

2,115,250

|

|

|

Total liabilities

|

|

$

|

877,009

|

|

|

$

|

924,841

|

|

|

$

|

5,430,492

|

|

The

following selected data contains statement of operations data and balance sheet for the three months ended June 30, 2016 and June

30, 2015. The statement of operations data and balance sheet data were derived from the financial statements for the periods.

Such financial data should be read in conjunction with the unaudited financial statements and the notes to the financial statements

for said periods and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

As

of

June 30, 2016

|

|

|

As

of

June 30, 2015

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

Assets

|

|

$

|

1,682,239

|

|

|

$

|

2,755,089

|

|

|

Liabilities

|

|

$

|

1,024,412

|

|

|

$

|

791,597

|

|

|

Total Stockholders’

Equity

|

|

$

|

657,827

|

|

|

$

|

1,963,492

|

|

|

Statement of Operations

Data

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

379,406

|

|

|

$

|

286,018

|

|

|

Operating Expenses

|

|

$

|

622,822

|

|

|

$

|

710,130

|

|

|

Net Comprehensive Loss

|

|

$

|

(302,442

|

)

|

|

$

|

(401,191

|

)

|

|

Basis and Diluted Loss

Per Share

|

|

$

|

(0.03

|

)

|

|

$

|

(0.04

|

)

|

|

Weighted Average Number of Shares Outstanding

|

|

|

11,007,522

|

|

|

|

10,819,691

|

|

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the following risk factors, as well as the financial

and other information in this Prospectus, before deciding to invest in our securities. If any of the following risks actually

occurs, our business, financial condition and results of operations could be materially adversely affected. In such case, the

value of our securities could decline and you may lose all or part of your investment in our securities.

Risks

Related to Our Financials

We

do not have a significant operating history and have not achieved profitable operations. If we are unable to achieve profitable

operations, you may lose your entire investment.

Our

independent auditors, Paritz & Co., P.A., certified public accountants, have expressed substantial doubt concerning our ability

to continue as a going concern. We have incurred losses since our inception, including a net loss of $2,250,420 for the year ended

December 31, 2015 and of $832,923 for the six months ended June 30, 2016, and we expect to incur additional losses in the future.

We have incurred negative cash flows from operations since inception. As of June 30, 2016 the Company had a stockholders’

equity of $657,827 and cash and cash equivalents of $87,709. Since we have no record of profitable operations, there is high a

possibility that you may suffer a complete loss of your investment.

The

absence of significant operating history for us makes forecasting our revenue and expenses difficult, and we may be unable to

adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As

a result of the absence of profitable operating history for us, it is difficult to accurately forecast our future revenue. In

addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future

expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to

forecast because they generally depend on our ability to promote and sell our products and revenues can fluctuate due the timing

impact of larger orders. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected

revenue shortfall, which would result in further losses. We may also be unable to expand our operations in a timely manner to

adequately meet demand to the extent it exceeds expectations.

Our

limited operating history does not afford investors a sufficient history on which to base an investment decision.

We

were formed on June 17, 2005. Vycor Medical’s products were only fully launched at the beginning of 2010 and NovaVision’s

therapies were re-launched following re-development in June 2015 in the US and December 2015 in Europe.W e are therefore currently

in the relatively early stages of marketing our products and therapies. There can be no assurance at this time that we will ever

operate profitably or that we will have adequate working capital to meet our obligations as they become due. Investors must consider

the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks

include the following:

|

●

|

competition;

|

|

|

|

|

●

|

need

for acceptance of products and therapies — there can be no assured market for our products and therapies and there is

no guarantee of orders or of surgeon, physician or patient acceptance;

|

|

|

|

|

●

|

ability

to continue to develop and extend brand identity;

|

|

|

|

|

●

|

ability

to anticipate and adapt to a competitive market;

|

|

|

|

|

●

|

ability

to effectively manage rapidly expanding operations;

|

|

|

|

|

●

|

amount

and timing of operating costs and capital expenditures relating to expansion of our business, operations, and infrastructure;

and

|

|

|

|

|

●

|

dependence

upon key personnel to market and sell our products and the loss of one of our key managers may adversely affect the marketing

of our products.

|

We

cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event

that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could

be materially and adversely affected.

Our

revenue is dependent upon acceptance of our products and therapies by the market. The failure of such acceptance will cause us

to curtail or cease operations.

Our

revenue comes from the sale of our products and therapies. As a result, we will continue to incur operating losses until such

time as sales of our products and therapies reach a mature level and we are able to generate sufficient revenue from the sale

of our products and therapies to meet our operating expenses. There can be no assurance that customers will adopt our technology

and products, or that businesses and prospective customers will agree to pay for our products and therapies. In the event that

we are not able to significantly increase the number of customers that purchase our products and therapies, or if we are unable

to charge the necessary prices, our financial condition and results of operations will be materially and adversely affected.

We

will need to raise additional funds to continue bring products to market and operate.

Our

current funds are only sufficient to allow us to operate for a limited period of time. We will require additional funds in order

to continue our operations after we exhaust our available funding. For the six months ended June 30, 2016 the aggregate of cash

used in operating activities was $382,882, or an average monthly “burn rate” of approximately $64,000. The cash and

cash equivalent balance of $87,709 at June 30, 2016 is therefore equivalent to a little more than one month of “burn rate”.

This does not take into account any future sales growth and/or future cost cutting. There have been no significant changes in

the operations of the Company since June 30, 2016 and none are anticipated in the next six months which would have a significant

impact on the “burn rate”. Beyond this period the Company believes it will not have enough cash to meet its various

cash needs unless the Company is able to obtain additional cash from the issuance of debt or equity securities. There is no assurance

that additional funds from the issuance of equity or debt will be available for the Company to finance its operations on acceptable

terms, or at all. If adequate funds are not available, the Company may have to further reduce costs (including marketing costs)

or consider ceasing some or all of its operations.

The

majority of the assets on our balance sheet comprise assets that are subject to annual accounting impairment review and therefore

may be subject to write-downs which will affect both the balance sheet and net profit or loss.

The

assets on our balance sheet include patents, software, and trademarks which are reviewed for impairment by the Company annually

in accordance with the authoritative guidance. Impairment is recognized when the estimated undiscounted cash flows associated

with the asset or group of assets is less than their carrying value. If impairment exists, an adjustment is made to write the

asset down to its fair value, and a loss is recorded as the difference between the carrying value and fair value. We will review

these assets as part of the preparation of the financial statements for 2016 and, if an impairment exists, would be required to

recognize an impairment to some or all of these assets which would increase the losses for the year and reduce the value of the

assets on the balance sheet.

Risks

Related to Our Business

Our

existing products and therapies may not gain sufficient acceptance in the marketplace, or may take longer to gain acceptance than

expected or may face regulatory delays.

Uncertainty

exists as to whether our products and therapies will be fully accepted by the market without additional clinical evaluations and

more widespread doctor acceptance, or that the time taken to gain regulatory approval or acceptance may be longer than expected.

A number of factors may limit the market acceptance of our products and therapies, including the availability of alternative products

and therapies and the price of our products and therapies relative to alternative products and therapies.

There

is a risk that development of finalization of development of new products takes longer than expected, or that longer than expected

regulatory processes in certain jurisdictions may slow the time period to full commercialization.

There

is a risk that surgeons will be encouraged to continue to use multiple-use devices, such as standard blade retractors, instead

of our single use devices, or alternative techniques or other tubular constructions or retractors. Our VBAS device is designed

to be used only once and then discarded. Vycor Medical’s competitors include multiple use devices such as metal blade retractors.

The multiple use devices are significantly less expensive on a per use basis than our single use devices. We are assuming that,

notwithstanding the difference in price, surgeons will elect to use our devices because of their perception that our devices will

permit safer and less invasive surgery. However, hospitals, medical insurance providers, health maintenance organizations and

others approving surgical costs may decide that the cost outweighs the benefit. In addition, surgeons may opt to use other devices.

While Vycor Medical intends to continue to build clinical and other scientific data demonstrating the cost benefit of VBAS over

other methodologies, this data may not be conclusive or may be viewed as insufficient by hospitals or physicians.

In

the US, NovaVision’s therapies require physician prescriptions, and physicians may not be persuaded by the effectiveness

of our therapies to prescribe them to their patients, given the price compared to the physician perception of the therapy benefit.

Whilst NovaVision intends to continue to implement strategies to increase awareness of its therapies, and their benefits, and

has significantly reduced their cost to patients through its development program, there is no assurance that this strategy will

be successful, particularly in that the target audience (for both physicians and patients) is very large and diverse and the patient

audience tends to be both medically and financially challenged, requiring multiple methods and routes to access it. In the majority

of cases there is no insurance reimbursement for NovaVision’s therapies, so patients are required to pay themselves.

The

marketing expenditures required to achieve the level of awareness domestically and internationally may also be too high. NovaVision’s

VRT therapy usually takes 6 months to complete, requiring patients to carry out the therapy twice a day (for an hour total), 6

days a week. Patients have to be persuaded that this level of intense therapy is justified for the anticipated benefit, but there

is no assurance that sufficient numbers of patients will be convinced to enable a successful market to develop for the therapy.

Some

of our competitors are more established and better capitalized than we are and we may be unable to establish market share.

Some

of our competitors are well-known, more established and better capitalized than we are. As such, they may have at their disposal

greater marketing strength and economies of scale and, as they may have additional products which they sell to the same customers,

have greater presence with these customer. They may also have more resources to expend on research and development to create more

innovative products in competition with ours. Competition will also likely increase as or when the clinical and cost benefits

of the Company’s products and therapies are established and proven. Accordingly, we may not be successful in competing with

them for market share.

Sales

may not produce profits.

We

may be forced to sell our products and therapies at a lower price than anticipated due to a variety of reasons, including without

limitation selling prices of comparable products by our competitors and budget or financial constraints of our customers. Further,

we may sell fewer products or therapies than anticipated, and the costs associated with each unit, including costs of manufacturing,

delivery and commissions, may be greater than anticipated. As a result, there is a risk that costs associated with the sales of

our products and therapies may be greater than we anticipated and that sales may fail to yield profitability.

International

sales of our VBAS product tend to vary from period-to-period and are less predictable than domestic sales.T his can cause a material

impact (either positive or negative) on VBAS revenues in a given quarter. Although international distributors generally commit

to purchases of minimum quantities of product and we work with them to increase sales in their markets, there is no assurance

that these minimums will be met, or that sales generated in a market in any one year might be repeated in subsequent years. In

addition, Vycor Medical’s realized sales price for international sales tends to be lower than in the US. This is because

Vycor Medical always partners with a distributor in international markets who will take on the marketing and distribution costs

in return for a lower sale price.I n addition, end market pricing in some international markets is lower than in the US. Notwithstanding,

international sales are a key component of Vycor Medical’s growth strategy and the profitability of these sales have yet

to be determined.T he Company may not be able to attract suitable distribution partners in all the markets it wishes to enter.

A

key component of NovaVision’s growth strategy has been the development of a lower cost delivery model which significantly

lowers the price of its therapy to patients. This has also resulted in significantly lower realized sales prices to on a per patient

basis. While management believes that cost to the patient is a key decision factor in utilizing the product, there is no assurance

that lowered cost will automatically lead to more widespread product adoption.

We

might incur substantial expense to develop products that, once commercialized, are never sufficiently successful.

Our

growth strategy requires the successful development and launch of new or updated products for Vycor Medical and new or updated

therapies for NovaVision. Although management will take every precaution to ensure that such expenditure is only on new or updated

products and therapies with a high likelihood of achieving commercial success, there can be no assurance that this will be the

case. The causes for failure of new or updated products and therapies once commercialized are numerous, including:

|

●

|

market

demand for the product or therapy proves to be smaller than market research suggested;

|

|

|

|

|

●

|

competitive

products or therapies with superior performance either on the market or commercialized at the same time or soon after;

|

|

|

|

|

●

|

product

or therapy development turns out to be more costly than anticipated or takes longer;

|

|

|

|

|

●

|

product

or therapy requires significant adjustment post commercialization, rendering the project uneconomic or extending considerably

the likely investment return period;

|

|

|

|

|

●

|

additional

regulatory requirements which extend the time to launch and increase the overall costs of the development;

|

|

|

|

|

●

|

patent

conflicts or unenforceable intellectual property rights;

|

|

|

|

|

●

|

neurosurgeons

and other physicians may be unwilling to adapt to new products and therapies, which will slow new product adoption;

|

|

|

|

|

●

|

new

products and therapies may be dependent, to a greater or lesser extent, on the successful outcomes of clinical studies. These

may cost more, take longer to complete, the outcomes maybe inconclusive, and it may be difficult to achieve publication in

an important journal; and

|

|

|

|

|

●

|

other

factors that could make the product uneconomical.

|

We

might incur substantial expense to develop products that are never successfully developed and commercialized.

We

have incurred and may continue to incur research and development and other expenses in developing new medical devices and therapies.

The potential products and therapies to which we devote resources might never be successfully developed or fully commercialized

by us for numerous reasons, including:

|

●

|

inability

to develop products and therapies that address our customers’ needs;

|

|

|

|

|

●

|

competitive

products with superior performance;

|

|

|

|

|

●

|

additional

regulatory requirements which render the development uneconomic or prevent our ability to gain regulatory approval;

|

|

|

|

|

●

|

patent

conflicts or unenforceable intellectual property rights;

|

|

|

|

|

●

|

demand

for the particular product; and

|

|

|

|

|

●

|

other

factors that could make the product uneconomical.

|

Incurring

significant expenses for a potential product or therapy that is not successfully developed and/or commercialized could have a

material adverse effect on our business, financial condition, prospects and share price.

We

may not be successful in entering into strategic relationships.

One

of the principal elements of our strategy has been to develop the business to the point where they would be attractive for strategic

partnerships with other entities or potential acquirers of either or both of our operating divisions. We may or may not be able

to find suitable partners for or acquirers of either or both of our operating division, or may not be able to enter into transactions

that are on terms which are beneficial to the Company.

We

cannot be certain that we will obtain and be able to maintain patents for our devices and technology or that such patents will

protect us from competitors.

We

believe that our success and competitive position will depend in part on our ability to obtain and maintain patents for our devices,

which is both costly and time consuming. We have 57 issued patents covering both NovaVision, Sight Science and Vycor Medical.

We still are in the process of prosecuting 13 others. Patent Offices typically requires 12-24 months or more to process a patent

application. There can be no assurance that the remainder of our patent applications will be approved. However we have not waited

for the approval of all the patent applications before launching sales of our devices and therapies. There can be no assurance

regarding how long it will take the U.S. Patent and Trademark Office to decide whether to approve our patent applications or how

long it will take foreign patent offices to grant us patents. There can be no assurance that any patent issued or licensed to

us will provide us with protection against competitive products and therapies or otherwise protect our commercial viability, or

that challenges will not be instituted against the validity or enforceability of any of our patents or, if instituted, that such

challenges will not be successful. The cost of litigation to uphold the validity of a patent and enforce it against infringement

can be substantial and we do not have patent insurance. Even issued patents may later be modified or revoked by the Patent and

Trademark Office or in legal proceedings. Patent applications in the United States are maintained in secrecy until the patent

issues and, since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries, we

cannot be certain that we were the first creator of the inventions covered by our pending patent applications or the first to

file patent applications on such inventions.

We

are in the process of finalizing a manufacturing migration for VBAS that could result in unexpected expenses or inventory shortages.

We

are in the process of finalizing a two-year manufacturing migration project for VBAS which will result in all the units being

manufactured by Accent and then packaged and completed by LSO, these suppliers being located close to each other in California.

The process of finalization could result in unexpected additional expenses and could also result in inventory shortages for certain

models if not completed to plan.

Vycor

Medical will be dependent on two key vendors to manufacture our products, once this migration is complete.

Vycor

Medical is dependent on Life Science Outsourcing, Inc. (“LSO”) and Accent Plastics Limited (“Accent”)

to provide engineering, contract manufacturing and logistical support to manufacture our products. We are dependent upon their

manufacture of our products in accordance with our specifications and delivering them on a timely basis.

If

either supplier fails to manufacture and/or deliver our products as specified, or decides to no longer manufacture for the Company,

we may need to locate another manufacturer. We can offer no assurances that we will be successful in finding an alternate manufacturer

and negotiating acceptable terms with them on a timely basis without impact on our manufacturing and delivery schedule.

Both

manufacturers are subject to regulatory requirements and certifications. Loss of such certification would affect our ability to

deliver products.

Vycor

Medical’s relatively low volumes limit the ability to lower manufacturing costs.

Although

the gross margins for Vycor Medical’s products are acceptable, manufacturing costs are volume-dependent. As the VBAS range

comprises 14 different sizes, costs will only reduce further once volumes for each of the 14 sizes increase.

We

will need additional distribution and marketing partners to help us market our products.

At

this time, we have a small number of sales and marketing personnel and limited distribution and marketing channels that we will

need to expand in the future. Vycor Medical has contracted with independent medical device distributors and representatives that

collectively have field salespeople who call on neurosurgery departments both in the US and internationally. To implement our

growth plan we need to expand the US and international scope of our sales and distribution. Given the relatively small size of

our company and the fact that our products and therapies are new with currently limited sales, there is no assurance that we will

be able to attract successful distributors to contract with us. There is also no assurance that the contracted distributors or

potential new distributors will be successful in promoting and selling our products and therapies.

In

addition, monitoring international distributors and interfacing with potential international customers and other partners is made

harder given the size of our company.

We

will need to increase the size of our organization, and may experience difficulties in managing growth.

We

are a small company with minimal employees. Future growth will impose significant added responsibilities on employees and members

of management, including the need to identify, recruit, maintain and integrate new managers and employees. Our future financial

performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

The

loss of our key personnel could adversely affect our business. We may not be able to hire and retain qualified personnel to support

our growth and if we are unable to retain or hire such personnel in the future, our ability to improve our products and implement

our business objectives could be adversely affected.

Our

success depends to a significant extent upon the efforts of our senior management team and other key personnel. The loss of the

services of such personnel could adversely affect our business and our ability to implement our growth plan.W e cannot assure

you that the services of the members of our management team will continue to be available to us, or that we will be able to find

a suitable replacement for any of them. We do not have key man insurance on any members of our management team. If any member

of our management team were to become incapacitated or die and we are unable to replace them for a prolonged period of time, we

may be unable to carry out our long term business plan and our future prospect for growth, and our business, may be harmed.

Also,

because of the nature of our business, our success is dependent upon our ability to attract, train, manage and retain sales, marketing

and other qualified personnel.T here is substantial competition for qualified personnel, and an inability to recruit or retain

qualified personnel may impact our ability to implement our strategy to grow our business and compete effectively in our industry.

Even

though our current products and therapies are approved by regulatory authorities, if we or our suppliers fail to comply with ongoing

regulatory requirements, or if we experience unanticipated problems with our products or therapies, these products or therapies

could be subject to restrictions or withdrawal from the market.

Any

product or therapy which we obtain marketing approval, along with the manufacturing processes, post-approval clinical data and

promotional activities for such product or therapy, will be subject to continual review and periodic inspections by the FDA and

other regulatory bodies. In particular we and our suppliers are required to comply with the Quality System Regulation, or QSR,

for the manufacture of our products and delivery of our therapies which cover the methods and documentation of the design, testing,

production, control, quality assurance, labeling, packaging, storage and shipping of any product or therapy for which we obtain

marketing approval. The FDA enforces the GMP and QSR through unannounced inspections. We and our third party manufacturers and

suppliers will have to successfully complete such inspections. Failure by us or one of our suppliers, with statutes and regulations

administered by the FDA and other regulatory bodies, or failure to take adequate response to any observations, could result in,

among other things, any of the following enforcement actions:

|

●

|

warning

letters or untitled letters;

|

|

|

|

|

●

|

fines

and civil penalties;

|

|

|

|

|

●

|

unanticipated

expenditures;

|

|

|

|

|

●

|

withdrawal

or suspension of approval by the FDA or other regulatory bodies;

|

|

|

|

|

●

|

product

recall or seizure;

|

|

|

|

|

●

|

orders

for physician notification or device repair, replacement or refund;

|

|

|

|

|

●

|

interruption

of production;

|

|

|

|

|

●

|

operating

restrictions;

|

|

|

|

|

●

|

injunctions;

and

|

|

|

|

|

●

|

criminal

prosecution.

|

If

any of these actions were to occur it would harm our reputation and cause our product or therapy sales and profitability to suffer.

Furthermore, our key component suppliers may not currently be or may not continue to be in compliance with applicable regulatory

requirements.

If

the FDA determines that our promotional materials, training or other activities constitutes promotion of an unapproved use, it

could request that we cease or modify our training or promotional materials or subject us to regulatory enforcement actions. It

is also possible that other federal, state or foreign enforcement authorities might take action if they consider our training

or other promotional materials to constitute promotion of an unapproved use, which could result in significant fines or penalties

under other statutory authorities, such as laws prohibiting false claims for reimbursement.

Moreover,

any modification to a device that has received FDA approval that could significantly affect its safety or effectiveness, or that

would constitute a major change in its intended use, design or manufacture, requires a new approval from the FDA. If the FDA disagrees

with any determination by us that new approval is not required, we may be required to cease marketing or to recall the modified

product until we obtain approval. In addition, we could also be subject to significant regulatory fines or penalties.

In

addition, we may be required to conduct costly post-market testing and surveillance to monitor the safety or efficacy of our products,

and we will be required to report adverse events and malfunctions related to our products. Later discovery of previously unknown

problems with our products, including unanticipated adverse events or adverse events of unanticipated severity or frequency, manufacturing

problems, or failure to comply with regulatory requirements such as QSR or GMP, may result in restrictions on such products or

manufacturing processes, withdrawal of the products from the market, voluntary or mandatory recalls, fines, suspension of regulatory

approvals, product seizures, injunctions or the imposition of civil or criminal penalties.

Further,

healthcare laws and regulations may change significantly in the future. Any new healthcare laws or regulations may adversely affect

our business. A review of our business by courts or regulatory authorities may result in a determination that could adversely

affect our operations. Also, the healthcare regulatory environment may change in a way that restricts our operations.

In

Europe, the relevant European authorities could hold imports from us and remove CE marking for violating their rules and regulations.

We could get a warning from a European Competent Authority or its Notified Body and we would be obligated to fix the problem and

follow up with either the Notified Body or Competent Authorities.Similarly, in other international markets for which Vycor Medical’s

products currently have full or partial regulatory approval (Australia, Brazil, Canada, China, Japan, Korea and Russia), the relevant

regulatory body could place a hold on imports from us and could revoke any licenses held for violations of its rules and regulations.

The relevant regulatory body could issue a warning the first time around and we would be obligated to fix the problem and follow

up, or regulations could change invalidating our approvals.

Because

product liability is inherent in the medical devices industry and insurance is expensive and difficult to obtain, we may be exposed

to large lawsuits.

Our

business exposes us to potential product liability risks, which are inherent in the manufacturing, marketing and sale of medical

devices. While we will take precautions we deem to be appropriate to avoid product liability suits against us, there can be no

assurance that we will be able to avoid significant product liability exposure. Product liability insurance for the medical products

industry is generally expensive. While we have product liability coverage for our Vycor Medical devices, and product liability

and professional indemnity insurance for our NovaVision and Sight Science therapies, there can be no assurance that we will be

able to continue to obtain such coverage on acceptable terms, or that any insurance policy will provide adequate protection against

potential claims. A successful product liability claim brought against us may exceed any insurance coverage secured by us and

could have a material adverse effect on our results or ability to continue marketing our products.

The

other insurances we have are Directors and Officers Liability Insurance and certain commercial liability and personal property

insurances at present. We may have exposure in the event of loss or damage to our properties.

We

have not established any reserve funds for potential warranty claims. If we experience an increase in warranty claims or if our

repair and replacement costs associated with warranty claims increase significantly, it would have a material adverse effect on

our financial condition and results of operations.

Because

the healthcare industry is subject to changing policies and procedures, we may find it difficult to continue to compete in an

uncertain environment.

The

health care industry is subject to changing political, economic and regulatory influences that may affect the procurement practices

and operations of healthcare industry participants. During the past several years government regulation of the healthcare industry

has changed significantly in several countries. Healthcare industry participants may react to new policies by curtailing or deferring

use of new treatments for disease, including treatments that would use our devices. This could substantially impair our ability

to successfully marker our products, which would have a material adverse effect on our performance.

The

market success of our products and therapies may be dependent in part upon third-party reimbursement policies that are often subject

to change.

Our

ability to successfully penetrate the market for our products and therapies may to some extent depend on the availability of reimbursement

to individuals for rehabilitation therapies and to hospitals for neurosurgical procedures from third-party payers, such as governmental

programs, private insurance and private health plans. There is no guarantee that this will not change in the future or that applicable

levels of reimbursement to individuals and hospitals, if any, will be high enough to allow us to charge a reasonable profit margin.

Vycor Medical’s products are not specifically reimbursed by third party payers, they are part of the overall procedure cost

and therefore some hospitals may view this as an increase in cost. If levels of reimbursement are decreased in the future, the

demand for our products could diminish or our ability to sell our products on a profitable basis could be adversely affected.

NovaVision’s therapies are not generally reimbursed by third party payers, although this is sometimes available to patients

on a case-by-case basis.

We

may be affected by health care reform.

The

U.S. Government, various state governments and European and Asian governments may enact various types of health care reform in

order to control growing health care costs. We are presently uncertain as to the effects on our business of the certain legislation

which has been previously enacted and are unable to predict what legislative proposals will be adopted in the future, if any.

Risks

Related to Share Ownership

We

are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We

have offered and sold our Common Stock to investors pursuant to certain exemptions from the registration requirements of the Securities

Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is,

the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making

the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration

under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information

provided by investors themselves.

If

any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities

if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation

prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption

from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act

of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect

our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become

subject to significant fines and penalties imposed by the SEC and state securities agencies.

Fountainhead

Capital Management Limited (“Fountainhead”) is a substantial minority shareholder and their interests may differ from

other stockholders.

As

of September 29, 2016, Fountainhead (together with parties affiliated to Fountainhead) beneficially owned, in the aggregate, approximately

45.7% of our Voting Share Capital, including Common Stock and Preferred D Shares convertible into Common Stock. As a result, they

are holders of a substantial minority of the outstanding shares (prior to the Offering) and they may be able to influence the

outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions,

including business combinations. Their interests may differ from other stockholders.F ountainhead has committed to subscribe for

its pro-rata share of the Offering and, dependent on the take-up of the Offering by other shareholders, this may result in Fountainhead

and affiliated parties beneficially owning more than 50% of the Voting Share Capital.T wo of the Company’s members of management

and the board of directors (David Cantor and Peter C. Zachariou) serve as investment managers of Fountainhead and one of the Company’s

members of management and board of directors (Adrian Liddell) serves as an advisor to Fountainhead.

Our

share price could be volatile and our trading volume may fluctuate substantially.

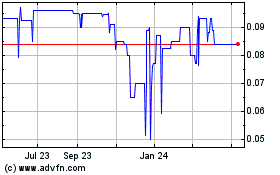

The

price of our common shares has been and may in the future continue to be extremely volatile, with the sale price fluctuating from

a low of $0.20 to a high of $2.65 since September 1, 2014. Many factors could have a significant impact on the future price of

our common shares, including:

|

|

our

inability to raise additional capital to fund our operations, whether through the issuance of equity securities or debt;

|

|

|

our

failure to successfully implement our business objectives and strategic growth plans;

|

|

|

compliance

with ongoing regulatory requirements;

|

|

|

market

acceptance of our products;

|

|

|

changes

in government regulations;

|

|

|

general

economic and market conditions and other external factors;

|

|

|

actual

or anticipated fluctuations in our quarterly financial and operating results; and

|

|

|

the

degree of trading liquidity in our common shares.

|

The

availability of a large number of authorized but unissued shares of Common Stock may, upon their issuance, lead to dilution of

existing stockholders.

We

are authorized to issue 25,000,000 shares of Common Stock, $0.0001 par value per share. As of September 29, 2016, 11,116,077 shares

of Common Stock were issued and outstanding and approximately 8 million shares are reserved for issuance for warrants, options,

preferred shares and deferred compensation. The remaining shares may be issued by our board of directors without further stockholder

approval. The issuance of large numbers of shares, possibly at below market prices, would be likely to result in substantial dilution

to the interests of other stockholders. In addition, issuances of large numbers of shares may adversely affect the market price

of our Common Stock.

Further,

our Certificate of Incorporation authorizes 10,000,000 shares of preferred stock, $0.0001 par value per share of which as of September

30, 2016, 270,307 shares of preferred stock were issued and outstanding. The board of directors is authorized to provide for the

issuance of these unissued shares of preferred stock in one or more series, and to fix the number of shares and to determine the

rights, preferences and privileges thereof. Accordingly, the board of directors may issue preferred stock that convert into large

numbers of shares of Common Stock and consequently lead to further dilution of other shareholders. There is also a large number

of warrants and options outstanding which, if fully exercised, would increase the number of outstanding shares by approximately

6.7 million. The weighted average issue price for the exercise of these warrants and options is $2.32. In addition, if fully converted,

the Company’s outstanding convertible debentures and accrued interest would increase the number of outstanding shares by

approximately 235,926. The Preferred D Shares are convertible into approximately 1.3 million shares.

We

have never paid cash dividends and do not anticipate doing so in the foreseeable future.

We

have never declared or paid cash dividends on our common shares. We currently plan to retain any earnings to finance the growth

of our business rather than to pay cash dividends. Payments of any cash dividends in the future will depend on our financial condition,

results of operations and capital requirements, as well as other factors deemed relevant by our board of directors.

Our

Common Stock is subject to the “Penny Stock” rules of the SEC and the trading market in our securities is limited,

which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The

Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for

the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price

of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules

require:

That

a broker or dealer approve a person’s account for transactions in penny stocks; and The broker or dealer receives from the

investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

Obtain

financial information and investment experience objectives of the person; and Make a reasonable determination that the transactions

in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be

capable of evaluating the risks of transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission

relating to the penny stock market, which, in highlight form:

Sets

forth the basis on which the broker or dealer made the suitability determination; and That the broker or dealer received a signed,

written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make

it more difficult for investors to dispose of our Common Stock and cause a decline in the market value of our stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the

commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the

rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to

be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny

stocks.

Financial

Industry Regulatory Authority, Inc. (“FINRA”) sales practice requirements may limit a shareholder’s ability

to buy and sell our Common Stock.

In

addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an

investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other

information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend

that their customers buy our Common Stock, which may limit your ability to buy and sell our stock and have an adverse effect on

the market for our shares.

Our

stock is thinly traded, so you may be unable to sell your shares at or near the quoted bid prices if you need to sell a significant

number of your shares.

The

shares of our Common Stock are thinly-traded on the OTCQB, meaning that the number of persons interested in purchasing our Common

Stock at or near bid prices at any given time may be relatively small or non-existent.A s a consequence, there may be periods

of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which

has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share

price. We cannot give you any assurance that a broader or more active public trading market for our Common Stock will develop

or be sustained, or that current trading levels will be sustained. Due to these conditions, we can give you no assurance that

you will be able to sell your shares at or near bid prices or at all if you need money or otherwise desire to liquidate your shares.

Shares

eligible for future sale may adversely affect the market.

From

time to time, certain of our stockholders may be eligible to sell all or some of their shares of Common Stock by means of ordinary

brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations.

In general, pursuant to amended Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current

public information requirement. Affiliates may sell after six months subject to the Rule 144 volume, manner of sale (for equity

securities), current public information and notice requirements. Any substantial sales of our Common Stock pursuant to Rule 144

may have a material adverse effect on the market price of our Common Stock.

We

could issue additional Common Stock, which might dilute the book value of our Common Stock.

Our

Board of Directors has authority, without action or vote of our shareholders, to issue all or a part of our authorized but unissued

shares. Such stock issuances could be made at a price that reflects a discount or a premium from the then-current trading price