By Saabira Chaudhuri

LONDON -- British American Tobacco PLC made a $47 billion

takeover offer for the roughly 58% of American peer Reynolds

American Inc. that it doesn't already own -- a move that would

cement the two cigarette giants' longstanding trans-Atlantic ties

and create the world's largest listed tobacco company by revenue

and market value.

BAT already owns 42.2% of Reynolds, and is offering cash and BAT

stock worth $56.50 a share for the rest of the company,

representing a roughly 20% premium to Reynolds's closing share

price Thursday. BAT said it hadn't had previous discussions with

Reynolds's management about the offer before going directly to its

board.

Reynolds said Friday that it acknowledges BAT's proposal and its

board will now evaluate the offer and respond.

The combined company would also be the world's largest by

operating profit in both tobacco and so-called next-generation

products -- largely e-cigarettes and other vaping products. It

would have a sprawling footprint across developed markets such as

the U.S. and Western Europe, as well as emerging markets such as

Russia, Turkey, Pakistan and Brazil.

BAT and Reynolds don't have overlapping footprints, however,

meaning a merger is unlikely to face the sort of steep antitrust

hurdles typical of such large deals. The U.K. company has been a

shareholder in Reynolds since the U.S. firm was created in 2004,

and its stake accounts for a hefty chunk of BAT's profits.

BAT, the world's No. 2 publicly traded tobacco company by

volume, behind Philip Morris International Inc., owns cigarette

brands including Dunhill, Lucky Strike and Pall Mall. Reynolds, the

world's No. 6 by volume, owns Camel and Newport.

The move comes after a wave of consolidation in the industry.

While the world's tobacco giants are still encumbered with years of

pending litigation and liabilities, the industry has enjoyed steady

returns and profits.

Last year, Reynolds completed its own $25 billion acquisition of

Lorillard Inc. after yearlong scrutiny by regulators. That deal

upended and further consolidated the U.S. tobacco industry,

prompting Reynolds to sell its Kool, Salem and Winston cigarette

brands and Lorillard's Maverick to Imperial Tobacco Group PLC (now

Imperial Brands PLC) for $7.1 billion.

The announcement's timing took some by surprise, with Citigroup

analyst Adam Spielman noting that BAT could have bought Reynolds

before it bought Lorillard, when shares were 57% lower.

BAT Chief Executive Nicandro Durante said BAT's board regularly

reviews the shares of Reynolds it doesn't already own and had

determined that "current unique industry and market conditions"

made now a good time for the acquisition.

BAT's shares have jumped 13% since Britain's June 23 vote to

leave the European Union, while Reynolds's have fallen about 7.5%,

bringing the companies' valuations measured by their

price-to-earnings ratios more in line. That, coupled with low

interest rates, helped inform BAT's thinking, according to a person

familiar with the transaction.

The U.K. company's shares were up 3.9% late Friday morning.

BAT expects the deal to lead to relatively modest cost savings

of $400 million, but said the deal would give it a major position

in the U.S. tobacco market in addition to high-growth emerging

markets across South America, Africa, the Middle East and Asia.

Analysts have said Reynolds is perhaps the best-placed tobacco

company in the U.S., given that its brands such as Newport and

Natural American Spirit are attractive to younger smokers, while

its fastest-growing brands are also its most profitable.

A merger would allow the companies to pool their research and

development in tobacco alternatives, widely seen as the next big

frontier for the tobacco industry. BAT makes vaping, medicinal

licensed products and tobacco-heating products with its Vype

e-cigarettes, Voke nicotine inhaler and iFuse, respectively.

Reynolds also has its own e-cigarette product, called Vuse. The two

companies already collaborate on this front, last year announcing a

technology-sharing agreement for their vapor products.

The deal will hinge on the approval of Reynolds's board --

outside of BAT's own nominees -- which is expected to appoint a

seven-person committee to consider the deal, according to a person

familiar with the matter. Five people on Reynolds's 14-member board

are BAT nominees. BAT said it also expects the deal to seek the

approval of the majority of Reynolds shareholders outside of its

own stake. Reynolds's top 10 shareholders own about 20% of BAT.

"We would have preferred to present this proposal to the board

of Reynolds confidentially," Mr. Durante said. U.S. regulations

require the company to announce the merger proposal promptly, which

BAT said left it unable to hold prior negotiations with Reynolds

regarding the merger.

Citigroup's Mr. Spielman said: "We expect this deal to go

through quickly as there are no antitrust issues and the two boards

are on friendly terms."

BAT's offer comes at a moment of transition for Reynolds, which

earlier this week said its chief executive, Susan Cameron, would

step down next year. The company has struggled with declining

tobacco volumes as well as slowing sales of e-cigarettes, although

the U.S. is still seen as an attractive market for tobacco

companies, with demand stronger than it has been in decades.

Merging with BAT -- which has stronger revenue growth prospects

according to analysts -- could brighten Reynolds's prospects now

that it has digested the Lorillard deal. The Winston-Salem,

N.C.-based company reported results that fell short of analyst

estimates for the quarter ended June 30.

Meanwhile, London-based BAT, with its more diversified

footprint, has successfully grown its cigarette volumes. On Friday,

it reported organic revenue growth for the first nine months of the

year at constant rates of exchange of 6.2%, with cigarette volumes

up 0.9%. BAT also said it was launching a new variant of Vype and

will test launch a new electronic tobacco-heating system called Glo

in December.

BAT has long been rumored to be interested in buying rival

Imperial, but a deal to acquire Reynolds likely would take that off

the table, at least for now. BAT Chief Financial Officer Ben

Stevens in an interview earlier this year said he didn't expect any

major industry consolidation in the short to medium term.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 21, 2016 07:19 ET (11:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

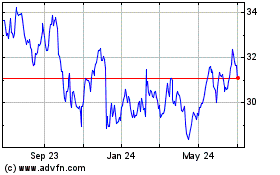

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

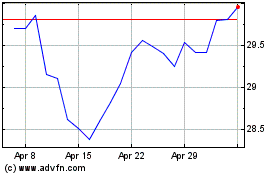

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024