Penn National Gaming Refinances Development and Construction Funding Advances for Hollywood Casino Jamul – San Diego

October 20 2016 - 4:15PM

Business Wire

Penn National to Apply Approximately $274

Million to Debt Reduction

Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or

the “Company”) announced today that an affiliate of the Jamul

Indian Village of California (“JIV” or the “Tribe”) has completed

an approximately $460 million refinancing related to the recently

opened Hollywood Casino Jamul – San Diego (the “Casino”). Since

2012, Penn National has provided approximately $331 million in

financing to the project to develop and construct the Casino and to

purchase certain Tribal debt. JIV intends to use the net proceeds

from the refinancing to repay development costs (including those

advanced by Penn National), to retire tribal debt and for working

capital. Penn National has been repaid approximately $274 million

of the capital that it advanced for the development and

construction of the property, the acquisition of Tribal debt and

accrued interest. The Company intends to primarily use these funds

to reduce borrowings under its credit facilities. Penn National is

continuing to provide a portion of the project’s financing,

including a Term Loan C facility of up to $108 million and a Term

Loan C delayed draw commitment of up to $15 million. These loans

are due in 2022 and are priced at LIBOR plus 8.50% with a 1% LIBOR

floor. Penn National has also agreed to fund up to $5 million of

subordinated debt to cover incremental project costs at a higher

interest rate.

Timothy J. Wilmott, President and Chief Executive Officer of

Penn National, commented, “We are proud to have funded the

construction and opening of Hollywood Casino Jamul – San Diego, and

to support the JIV in securing a post-opening financing facility

that, combined with the Casino operations, will help the Tribe

realize its goal of becoming economically self-sufficient. The

financing package we are announcing today reflects Penn National’s

continued focus on actively and conservatively managing our capital

structure to provide the financial flexibility to support our near-

and long-term growth initiatives.

“We intend to use the approximately $274 million of proceeds we

are receiving to reduce borrowings under our credit facilities and

further strengthen our liquidity position. Pro forma for the recent

debt repayments, our total gross leverage ratio at September 30

declined to approximately 5.76x. Furthermore, with the addition of

fees resulting from the Jamul management and licensing agreements

to our existing operating base and our other recently announced

accretive transactions, Penn National has further diversified our

free cash flow mix, allowing us to continue to reduce leverage and

maintain high levels of liquidity.”

In addition to providing the revolving credit facility, Citizens

Bank, Fifth Third Bank and Goldman Sachs acted as joint lead

arrangers.

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests

in gaming and racing facilities and video gaming terminal

operations with a focus on slot machine entertainment. At June 30,

2016, the Company operated twenty-six facilities in sixteen

jurisdictions, including Florida, Illinois, Indiana, Kansas, Maine,

Massachusetts, Mississippi, Missouri, Nevada, New Jersey, New

Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario. At

June 30, 2016, in aggregate, Penn National Gaming operated

approximately 33,400 gaming machines, 800 table games and 4,600

hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of forward

looking terminology such as “expects,” “believes,” “estimates,”

“projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or

“anticipates” or the negative or other variations of these or

similar words, or by discussions of future events, strategies or

risks and uncertainties, including future plans, strategies,

performance, developments, acquisitions, capital expenditures, and

operating results. Actual results may vary materially from

expectations. Although the Company believes that our expectations

are based on reasonable assumptions within the bounds of our

knowledge of our business, there can be no assurance that actual

results will not differ materially from our expectations.

Meaningful factors that could cause actual results to differ from

expectations include, but are not limited to, risks related to the

repayment or subordination of the loans described herein, sovereign

immunity, local opposition (including several pending lawsuits),

access, regional competition and property performance and other

factors as discussed in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2015, subsequent Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K, each as filed with

the United States Securities and Exchange Commission. The Company

does not intend to update publicly any forward-looking statements

except as required by law. In light of these risks, uncertainties

and assumptions, the forward-looking events discussed in this press

release may not occur.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161020006513/en/

Penn National Gaming, Inc.Saul V. ReibsteinChief Financial

Officer610-373-2400orJCIRJoseph N. Jaffoni, Richard

Land212-835-8500penn@jcir.com

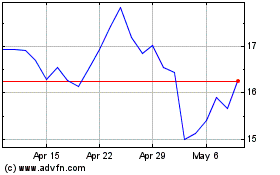

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024