Union Pacific Profit Falls 13% on Demand Woes

October 20 2016 - 9:40AM

Dow Jones News

Union Pacific Corp. said its third-quarter earnings fell 13% as

the railroad operator, like others, said it continued to be hit by

weak demand for commodities it transports.

The Omaha, Neb., company's shares, up 24% this year, fell 3.1%

to $94.12 in recent premarket trading as the results missed

expectations.

Union Pacific's total freight volume declined 5.8%, led by a 14%

drop in coal volume. Shipments in its intermodal business, which

moves freight using a combination of trains and trucks, declined

6.7% and industrial products volume dropped 11%. Agricultural

volume, which rose 11%, was the only exception.

Freight revenue dropped 7.2% on the weaker freight volume and

lower fuel surcharge revenue that offset benefits from higher

prices.

The weaker demand was partly offset by lower operating expenses,

which declined 4.2%.

In prepared remarks Thursday, Chief Executive Lance Fritz said

sectors such as grain and energy "are showing signs of life" though

challenges continue from the broader economy, a relatively strong

U.S. dollar and soft demand for consumer goods.

Over all, Union Pacific reported a profit of $1.13 billion, or

$1.36 a share, down from $1.3 billion, or $1.50 a share, a year

earlier. Revenue decreased 7% to $5.17 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$1.40 and revenue of $5.18 billion.

Last week CSX Corp. reported weaker third-quarter results as

slumping coal shipments continued to pressure its results, though

cost-cutting efforts helped the company's performance beat

expectations.

On Tuesday, Kansas City Southern's third-quarter results also

declined as revenue was dented by weak freight volume, led by

declines in crude and frac sand shipments. The company said events

such flooding outages and service disruptions on its Mexican

network also resulted in additional operating costs.

Norfolk Southern Corp. is set to report on Oct. 26.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 20, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

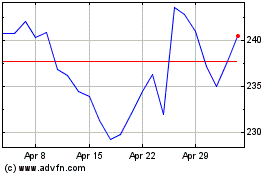

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

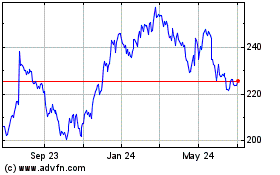

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024