American Airlines' Profit Falls

October 20 2016 - 8:50AM

Dow Jones News

American Airlines Group Inc.'s profit and revenue fell amid

continued overcapacity, which has plagued other U.S. airlines, as

it continued to spend to integrate US Airways Group into the

company.

American has been busy integrating its operations since the late

2013 merger of American Airlines and US Airways. Earlier in

October, the airline brought US Airways pilots onto the American IT

platform.

American said it booked $294 million in net special charges

during the third quarter, mostly on merger integration expenses

relating to rebranding of aircraft, airport facilities and

uniforms, information technology, alignment of labor-union

contracts and fleet restructuring.

Excluding those efforts and other special items, profit beat

Wall Street's views. American Airlines shares rose 1.2% to $41.10,

and several other airline stocks rose premarket as well.

American's unit revenue—the amount the company takes in for each

passenger flown a mile—fell 3.3% in the quarter that ended in

September. The company predicted a 2% to 3% year-over-year

drop.

American, the top U.S. airline by traffic, and other carriers

are struggling with weak unit revenues, caused by too many flights

and seats being offered than demand warrants. Still, their bottom

lines have been cushioned by lower fuel prices.

Delta Air Lines Inc., the nation's No. 2 carrier, reported last

week that revenue fell but said that it expects passenger revenue

per available seat mile to turn positive early next year. United

Continental Holdings Inc., the No. 3 carrier, also reporting

revenue declines.

American in the latest period posted a profit of $737 million,

or $1.40 a share, compared with $1.69 billion, or $2.49 a share, in

the year-ago period. Excluding special items, such as the

merger-related expenses, the company said it earned $1.76 a share,

topping estimates from analysts polled by Thomson Reuters, who

expected $1.69. Excluding items as well as a noncash income tax

provision, the company said it earned $2.80 a share.

Revenue slipped 1% to $10.59 billion. Analysts anticipated

$10.54 billion.

Capacity rose 1.2% during the quarter.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 20, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

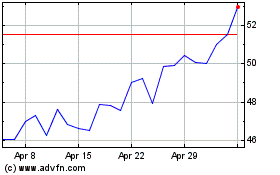

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

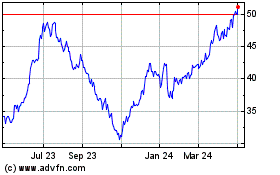

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024