ITW Reports Record Third Quarter 2016 Financial Results

October 20 2016 - 8:00AM

Illinois Tool Works Inc. (NYSE:ITW) today reported third quarter

2016 diluted earnings per share (EPS) of $1.50, an 8% increase

compared to the year-ago period. Currency translation reduced EPS

by $0.02 in the quarter. Operating margin increased 40 basis points

to 23.1%, including 80 basis points of margin dilution from the

third quarter 2016 acquisition of Engineered Fasteners &

Components (EF&C). Excluding the EF&C dilution impact,

third quarter operating margin was 23.9%. Operating income of $808

million was up 6%, and after-tax return on invested capital

increased by 140 basis points to 23%. Organic revenue increased 2%

and the company’s ongoing Product Line Simplification (PLS)

activities reduced organic revenue growth by approximately 1

percentage point.

"The ITW team delivered another quarter of quality execution and

earnings growth marked by all-time record operating income and

continued strong margin expansion driven by our Enterprise Strategy

initiatives. In addition, continued progress in executing our pivot

to growth in combination with our diversified portfolio of seven

highly differentiated businesses allowed us to deliver positive

organic growth in the third quarter despite a macro environment

that remains challenging,” said E. Scott Santi, Chairman and Chief

Executive Officer.

Third Quarter Highlights

- Total revenue was $3.5 billion, an increase of 4%. Organic

revenue grew 2% with 1% growth in North America and 3% in

International.

- Operating margin improved 40 basis points to 23.1%, an all-time

record for the company, as enterprise initiatives contributed 120

basis points. The acquisition of EF&C diluted operating margin

by 80 basis points. Excluding the EF&C dilution impact, third

quarter operating margin was 23.9%.

- Operating income grew 6% to an all-time quarterly record of

$808 million.

- GAAP EPS of $1.50 increased 8% due to strong margin

performance. Currency translation reduced EPS by $0.02 in the

quarter.

- After-tax return on invested capital was 23%, an all-time high

and an increase of 140 basis points.

- Free cash flow was solid at 101% of net income. Share

repurchases totaled $500 million and the company announced an 18%

dividend increase on August 5, 2016.

- Six of seven segments achieved positive organic revenue growth

as Automotive OEM and Test & Measurement/Electronics both grew

7%, Construction Products grew 2%, Polymers & Fluids and Food

Equipment Group both grew 1% and Specialty Products grew

0.1%. Welding declined by 9%.

- All seven segments achieved operating margin at or above 21%

with Food Equipment at 27.4%, Welding at 26.5%, Specialty Products

at 26.1%, Automotive OEM at 21.8% (25.5% excluding EF&C),

Construction at 22.6%, Test & Measurement/Electronics and

Polymers & Fluids both at 21%.

2016 Guidance

ITW is raising its 2016 full-year GAAP EPS guidance range to

$5.56 to $5.66, a year-over-year increase of 9% at the mid-point.

Consistent with prior guidance the full-year organic growth

forecast is 1 to 2% and includes approximately 1 percentage point

of PLS impact. Operating margin is forecast to exceed 22.5%.

For the fourth quarter 2016, the company expects GAAP EPS to be

in a range of $1.31 to $1.41, an increase of 11% at the mid-point.

Organic revenue is forecast to be 0 to 2%, and operating margin to

be approximately 21.5%. Guidance is based on current foreign

exchange rates.

Forward-looking StatementThis earnings release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including,

without limitation, statements regarding diluted earnings per

share, organic revenue growth, the impact of product line

simplification activities and enterprise initiatives, operating

margin, after-tax return on invested capital and the expected

impact of acquisitions on financial results. These statements are

subject to certain risks, uncertainties and other factors that

could cause actual results to differ materially from those

anticipated. Such factors include those contained in ITW's Form

10-K for 2015 and Form 10-Q for the second quarter of 2016.

About ITWITW (NYSE:ITW) is a Fortune 200 global

multi-industrial manufacturing leader with revenues totaling $13.4

billion in 2015. The company’s seven industry-leading segments

leverage the unique ITW Business Model to drive solid growth with

best-in-class margins and returns in markets where highly

innovative, customer-focused solutions are required. ITW has more

than 51,000 dedicated colleagues in operations around the world who

thrive in the company’s unique decentralized and entrepreneurial

culture. To learn more about the company and the ITW Business

Model, visit www.itw.com.

| |

| ILLINOIS TOOL WORKS INC. and

SUBSIDIARIES |

| STATEMENT OF INCOME (UNAUDITED) |

| |

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| In millions

except per share amounts |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Operating Revenue |

$ |

3,495 |

|

|

$ |

3,354 |

|

|

$ |

10,200 |

|

|

$ |

10,130 |

|

| Cost of revenue |

2,027 |

|

|

1,953 |

|

|

5,890 |

|

|

5,947 |

|

| Selling, administrative, and

research and development expenses |

604 |

|

|

581 |

|

|

1,818 |

|

|

1,819 |

|

| Amortization and impairment of

intangible assets |

56 |

|

|

59 |

|

|

170 |

|

|

176 |

|

| Operating Income |

808 |

|

|

761 |

|

|

2,322 |

|

|

2,188 |

|

| Interest expense |

(58 |

) |

|

(59 |

) |

|

(174 |

) |

|

(168 |

) |

| Other income (expense) |

13 |

|

|

23 |

|

|

34 |

|

|

65 |

|

| Income Before

Taxes |

763 |

|

|

725 |

|

|

2,182 |

|

|

2,085 |

|

| Income Taxes |

228 |

|

|

214 |

|

|

654 |

|

|

636 |

|

| Net Income |

$ |

535 |

|

|

$ |

511 |

|

|

$ |

1,528 |

|

|

$ |

1,449 |

|

| |

|

|

|

|

|

|

|

| Net Income Per

Share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.51 |

|

|

$ |

1.40 |

|

|

$ |

4.28 |

|

|

$ |

3.92 |

|

| Diluted |

$ |

1.50 |

|

|

$ |

1.39 |

|

|

$ |

4.25 |

|

|

$ |

3.90 |

|

| |

|

|

|

|

|

|

|

| Cash Dividends Per

Share: |

|

|

|

|

|

|

|

| Paid |

$ |

0.55 |

|

|

$ |

0.485 |

|

|

$ |

1.65 |

|

|

$ |

1.455 |

|

| Declared |

$ |

0.65 |

|

|

$ |

0.55 |

|

|

$ |

1.75 |

|

|

$ |

1.52 |

|

| |

|

|

|

|

|

|

|

| Shares of Common Stock

Outstanding During the Period: |

|

|

|

|

|

|

|

| Average |

353.5 |

|

|

365.1 |

|

|

357.3 |

|

|

369.3 |

|

| Average assuming dilution |

355.5 |

|

|

367.1 |

|

|

359.3 |

|

|

371.6 |

|

| |

| ILLINOIS TOOL WORKS INC. and

SUBSIDIARIES |

| STATEMENT OF FINANCIAL POSITION

(UNAUDITED) |

| |

| In

millions |

September 30, 2016 |

|

December 31, 2015 |

|

Assets |

|

|

|

| Current Assets: |

|

|

|

| Cash and equivalents |

$ |

2,299 |

|

|

$ |

3,090 |

|

| Trade receivables |

2,496 |

|

|

2,203 |

|

| Inventories |

1,167 |

|

|

1,086 |

|

| Prepaid expenses and other current

assets |

223 |

|

|

341 |

|

| Total current assets |

6,185 |

|

|

6,720 |

|

| |

|

|

|

| Net plant and

equipment |

1,702 |

|

|

1,577 |

|

| Goodwill |

4,711 |

|

|

4,439 |

|

| Intangible assets |

1,480 |

|

|

1,560 |

|

| Deferred income

taxes |

467 |

|

|

346 |

|

| Other assets |

1,164 |

|

|

1,087 |

|

| |

$ |

15,709 |

|

|

$ |

15,729 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current

Liabilities: |

|

|

|

| Short-term debt |

$ |

1,364 |

|

|

$ |

526 |

|

| Accounts payable |

582 |

|

|

449 |

|

| Accrued expenses |

1,180 |

|

|

1,136 |

|

| Cash dividends payable |

228 |

|

|

200 |

|

| Income taxes payable |

132 |

|

|

57 |

|

| Total current liabilities |

3,486 |

|

|

2,368 |

|

| |

|

|

|

| Noncurrent

Liabilities: |

|

|

|

| Long-term debt |

6,329 |

|

|

6,896 |

|

| Deferred income taxes |

131 |

|

|

256 |

|

| Other liabilities |

970 |

|

|

981 |

|

| Total noncurrent liabilities |

7,430 |

|

|

8,133 |

|

| |

|

|

|

| Stockholders’

Equity: |

|

|

|

| Common stock |

6 |

|

|

6 |

|

| Additional paid-in-capital |

1,174 |

|

|

1,135 |

|

| Income reinvested in the

business |

19,223 |

|

|

18,316 |

|

| Common stock held in treasury |

(14,147 |

) |

|

(12,729 |

) |

| Accumulated other comprehensive

income (loss) |

(1,468 |

) |

|

(1,504 |

) |

| Noncontrolling interest |

5 |

|

|

4 |

|

| Total stockholders’ equity |

4,793 |

|

|

5,228 |

|

| |

$ |

15,709 |

|

|

$ |

15,729 |

|

|

|

| ILLINOIS TOOL WORKS INC. and

SUBSIDIARIES |

| GAAP to NON-GAAP RECONCILIATIONS

(UNAUDITED) |

| |

| ADJUSTED AFTER-TAX RETURN ON AVERAGE INVESTED

CAPITAL (UNAUDITED) |

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

Twelve Months

EndedDecember 31, |

| |

September 30, |

|

September 30, |

|

| Dollars in

millions |

2016 |

|

2015 |

|

2016 |

|

2015 |

|

2015 |

| Operating income |

$ |

808 |

|

|

$ |

761 |

|

|

$ |

2,322 |

|

|

$ |

2,188 |

|

|

$ |

2,867 |

|

| Tax rate |

30.0 |

% |

|

29.6 |

% |

|

30.0 |

% |

|

30.5 |

% |

|

30.1 |

% |

| Income taxes |

(243 |

) |

|

(225 |

) |

|

(697 |

) |

|

(668 |

) |

|

(864 |

) |

| Operating income after

taxes |

$ |

565 |

|

|

$ |

536 |

|

|

$ |

1,625 |

|

|

$ |

1,520 |

|

|

$ |

2,003 |

|

| |

|

|

|

|

|

|

|

|

|

| Invested capital: |

|

|

|

|

|

|

|

|

|

| Trade receivables |

$ |

2,496 |

|

|

$ |

2,339 |

|

|

$ |

2,496 |

|

|

$ |

2,339 |

|

|

$ |

2,203 |

|

| Inventories |

1,167 |

|

|

1,153 |

|

|

1,167 |

|

|

1,153 |

|

|

1,086 |

|

| Net plant and equipment |

1,702 |

|

|

1,601 |

|

|

1,702 |

|

|

1,601 |

|

|

1,577 |

|

| Goodwill and intangible assets |

6,191 |

|

|

6,088 |

|

|

6,191 |

|

|

6,088 |

|

|

5,999 |

|

| Accounts payable and accrued

expenses |

(1,762 |

) |

|

(1,635 |

) |

|

(1,762 |

) |

|

(1,635 |

) |

|

(1,585 |

) |

| Other, net |

393 |

|

|

313 |

|

|

393 |

|

|

313 |

|

|

280 |

|

| Total invested

capital |

$ |

10,187 |

|

|

$ |

9,859 |

|

|

$ |

10,187 |

|

|

$ |

9,859 |

|

|

$ |

9,560 |

|

| |

|

|

|

|

|

|

|

|

|

| Average invested

capital |

$ |

9,973 |

|

|

$ |

10,038 |

|

|

$ |

9,821 |

|

|

$ |

10,039 |

|

|

$ |

9,943 |

|

| Adjustment for

Wilsonart (formerly the Decorative Surfaces segment) |

(116 |

) |

|

(121 |

) |

|

(114 |

) |

|

(126 |

) |

|

(123 |

) |

| Adjusted average

invested capital |

$ |

9,857 |

|

|

$ |

9,917 |

|

|

$ |

9,707 |

|

|

$ |

9,913 |

|

|

$ |

9,820 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted return on

average invested capital |

23.0 |

% |

|

21.6 |

% |

|

22.3 |

% |

|

20.5 |

% |

|

20.4 |

% |

| FREE CASH FLOW |

| |

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| Dollars in

millions |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Net cash provided by

operating activities |

$ |

624 |

|

|

$ |

706 |

|

|

$ |

1,638 |

|

|

$ |

1,596 |

|

| Less: Additions to

plant and equipment |

(81 |

) |

|

(62 |

) |

|

(202 |

) |

|

(209 |

) |

| Free cash flow |

$ |

543 |

|

|

$ |

644 |

|

|

$ |

1,436 |

|

|

$ |

1,387 |

|

| |

|

|

|

|

|

|

|

| Net income |

$ |

535 |

|

|

$ |

511 |

|

|

$ |

1,528 |

|

|

$ |

1,449 |

|

| Free cash flow to net

income conversion rate |

101 |

% |

|

126 |

% |

|

94 |

% |

|

96 |

% |

| |

| ILLINOIS

TOOL WORKS INC. and SUBSIDIARIES |

| SEGMENT DATA

(UNAUDITED) |

| |

| Three Months Ended September 30,

2016 |

|

Dollars in millions |

Total Revenue |

Operating Income |

Operating Margin |

|

Automotive OEM |

$ |

765 |

|

$ |

166 |

|

21.8 |

% |

|

Food Equipment |

544 |

|

149 |

|

27.4 |

% |

|

Test & Measurement and Electronics |

516 |

|

108 |

|

21.0 |

% |

|

Welding |

361 |

|

95 |

|

26.5 |

% |

|

Polymers & Fluids |

422 |

|

89 |

|

21.0 |

% |

|

Construction Products |

415 |

|

94 |

|

22.6 |

% |

|

Specialty Products |

477 |

|

125 |

|

26.1 |

% |

|

Intersegment |

(5 |

) |

— |

|

— |

% |

|

Total Segments |

3,495 |

|

826 |

|

23.7 |

% |

|

Unallocated |

— |

|

(18 |

) |

— |

% |

|

Total Company |

$ |

3,495 |

|

$ |

808 |

|

23.1 |

% |

| Nine Months Ended September 30,

2016 |

|

Dollars in millions |

Total Revenue |

Operating Income |

Operating Margin |

|

Automotive OEM |

$ |

2,091 |

|

$ |

512 |

|

24.5 |

% |

|

Food Equipment |

1,578 |

|

405 |

|

25.7 |

% |

|

Test & Measurement and Electronics |

1,487 |

|

274 |

|

18.4 |

% |

|

Welding |

1,125 |

|

282 |

|

25.1 |

% |

|

Polymers & Fluids |

1,283 |

|

266 |

|

20.7 |

% |

|

Construction Products |

1,223 |

|

278 |

|

22.7 |

% |

|

Specialty Products |

1,429 |

|

373 |

|

26.1 |

% |

|

Intersegment |

(16 |

) |

— |

|

— |

% |

|

Total Segments |

10,200 |

|

2,390 |

|

23.4 |

% |

|

Unallocated |

— |

|

(68 |

) |

— |

% |

|

Total Company |

$ |

10,200 |

|

$ |

2,322 |

|

22.8 |

% |

| ILLINOIS

TOOL WORKS INC. and SUBSIDIARIES |

| SEGMENT

DATA (UNAUDITED) |

| |

| Q3 2016 vs. Q3 2015

Favorable/(Unfavorable) |

|

Operating Revenue |

Automotive OEM |

Food Equipment |

Test & Measurement and

Electronics |

Welding |

Polymers & Fluids |

Construction Products |

Specialty Products |

Total ITW |

|

Organic |

6.6 |

% |

0.7 |

% |

6.6 |

% |

(8.5 |

)% |

0.8 |

% |

1.5 |

% |

0.1 |

% |

1.6 |

% |

|

Acquisitions/Divestitures |

19.2 |

% |

— |

% |

— |

% |

— |

% |

— |

% |

(0.2 |

)% |

— |

% |

3.5 |

% |

|

Translation |

(1.0 |

)% |

(2.0 |

)% |

(1.3 |

)% |

(0.4 |

)% |

(0.8 |

)% |

0.3 |

% |

(0.7 |

)% |

(0.9 |

)% |

|

Operating Revenue |

24.8 |

% |

(1.3 |

)% |

5.3 |

% |

(8.9 |

)% |

— |

% |

1.6 |

% |

(0.6 |

)% |

4.2 |

% |

| Q3 2016 vs. Q3 2015

Favorable/(Unfavorable) |

|

Change in Operating Margin |

Automotive OEM |

Food Equipment |

Test & Measurement and

Electronics |

Welding |

Polymers & Fluids |

Construction Products |

Specialty Products |

Total ITW |

|

Operating Leverage |

90 bps |

10 bps |

190 bps |

(160) bps |

20 bps |

30 bps |

|

- |

|

30 bps |

|

Changes in Variable Margin & OH Costs |

(60) bps |

110 bps |

230 bps |

290 bps |

120 bps |

110 bps |

180 bps |

100 bps |

|

Total Organic |

30 bps |

120 bps |

420 bps |

130 bps |

140 bps |

140 bps |

180 bps |

130 bps |

|

Acquisitions/Divestitures |

(370) bps |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

(80) bps |

|

Restructuring/Other |

(20) bps |

(10) bps |

20 bps |

40 bps |

60 bps |

(190) bps |

30 bps |

(10) bps |

|

Total Operating Margin Change |

(360) bps |

110 bps |

440 bps |

170 bps |

200 bps |

(50) bps |

210 bps |

40 bps |

|

|

|

|

|

|

|

|

|

|

|

Total Operating Margin % * |

|

21.8 |

% |

|

27.4 |

% |

|

21.0 |

% |

|

26.5 |

% |

|

21.0 |

% |

|

22.6 |

% |

|

26.1 |

% |

|

23.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

*Includes unfavorable operating margin impact of amortization

expense from acquisition-related intangible assets |

80 bps |

80 bps |

360 bps |

60 bps |

430 bps |

60 bps |

140 bps |

170 bps |

| |

| ILLINOIS

TOOL WORKS INC. and SUBSIDIARIES |

| SEGMENT

DATA (UNAUDITED) |

| |

| YTD 2016 vs YTD 2015

Favorable/(Unfavorable) |

|

Operating Revenue |

Automotive OEM |

Food Equipment |

Test & Measurement and

Electronics |

Welding |

Polymers & Fluids |

Construction Products |

Specialty Products |

Total ITW |

|

Organic |

4.4 |

% |

2.8 |

% |

2.5 |

% |

(9.4 |

)% |

1.1 |

% |

3.1 |

% |

1.2 |

% |

1.2 |

% |

|

Acquisitions/Divestitures |

6.1 |

% |

— |

% |

— |

% |

— |

% |

(0.3 |

)% |

(0.2 |

)% |

— |

% |

1.1 |

% |

|

Translation |

(1.3 |

)% |

(1.8 |

)% |

(1.3 |

)% |

(1.0 |

)% |

(2.8 |

)% |

(1.7 |

)% |

(1.1 |

)% |

(1.6 |

)% |

|

Operating Revenue |

9.2 |

% |

1.0 |

% |

1.2 |

% |

(10.4 |

)% |

(2.0 |

)% |

1.2 |

% |

0.1 |

% |

0.7 |

% |

| YTD 2016 vs YTD 2015

Favorable/(Unfavorable) |

|

Change in Operating Margin |

Automotive OEM |

Food Equipment |

Test & Measurement and

Electronics |

Welding |

Polymers & Fluids |

Construction Products |

Specialty Products |

Total ITW |

|

Operating Leverage |

60 bps |

60 bps |

70 bps |

(190) bps |

40 bps |

80 bps |

20 bps |

20 bps |

|

Changes in Variable Margin & OH Costs |

20 bps |

100 bps |

190 bps |

180 bps |

20 bps |

200 bps |

210 bps |

120 bps |

|

Total Organic |

80 bps |

160 bps |

260 bps |

(10) bps |

60 bps |

280 bps |

230 bps |

140 bps |

|

Acquisitions/Divestitures |

(140) bps |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

(10) bps |

|

- |

|

(20) bps |

|

Restructuring/Other |

10 bps |

40 bps |

|

- |

|

(80) bps |

10 bps |

10 bps |

40 bps |

|

- |

|

|

Total Operating Margin Change |

(50) bps |

200 bps |

260 bps |

(90) bps |

70 bps |

280 bps |

270 bps |

120 bps |

|

|

|

|

|

|

|

|

|

|

|

Total Operating Margin % * |

|

24.5 |

% |

|

25.7 |

% |

|

18.4 |

% |

|

25.1 |

% |

|

20.7 |

% |

|

22.7 |

% |

|

26.1 |

% |

|

22.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

*Includes unfavorable operating margin impact of amortization

expense from acquisition-related intangible assets |

40 bps |

80 bps |

390 bps |

90 bps |

430 bps |

60 bps |

150 bps |

170 bps |

| Total ITW Operating Revenue |

|

Operating Revenue |

YTD 2016 |

Full Year 2015 |

Favorable/(Unfavorable) |

|

Organic |

1.2 |

% |

(0.4 |

)% |

160 bps |

|

Acquisitions/Divestitures |

1.1 |

% |

(0.2 |

)% |

130 bps |

|

Translation |

(1.6 |

)% |

(6.8 |

)% |

520 bps |

|

Operating Revenue |

0.7 |

% |

(7.4 |

)% |

810 bps |

Investors Contact: Mike Drazin 224.661.7433 mdrazin@itw.com

Media Contact: Mallory Ramp 224.661.7431 mramp@itw.com

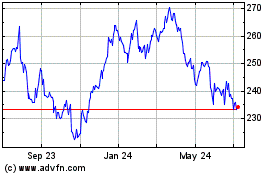

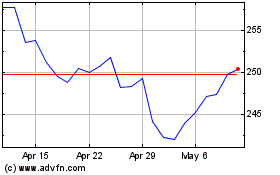

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Apr 2023 to Apr 2024