Current Report Filing (8-k)

October 20 2016 - 7:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 14, 2016

First Acceptance Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

|

1-12117

|

|

75-1328153

|

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

3813 Green Hills Village Drive

|

|

|

|

|

|

Nashville, Tennessee

|

|

37215

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

(615) 844-2800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Section 3 – Securities and Trading Markets

|

|

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

The common stock of First Acceptance Corporation (the “

Company

”) is listed on the New York Stock Exchange (the “

NYSE

”). On October 14, 2016, the Company received notice from the NYSE (the “

NYSE Notice

”) that it was not in compliance with the NYSE’s continued listing standards set forth in the NYSE Listed Company Manual, which require the average closing price of Company common stock to be at least $1.00 per share over a consecutive 30 trading-day period. As of October 12, 2016, the 30 trading-day average closing price of Company common stock was $0.99 per share.

Upon receipt of the notice of non-compliance from the NYSE, the Company became subject to the procedures set forth in Sections 801 and 802 of the NYSE Listed Company Manual. As required by the NYSE, the Company will respond, acknowledging the notification, within 10 days following receipt of the NYSE Notice. Under the NYSE rules, the Company has six months from receipt of the NYSE Notice to regain compliance with the minimum share price rule. The Company expects that its common stock will continue to be listed on the NYSE during this period, subject to the Company’s continued compliance with the NYSE’s other continued listing standards.

Section 5 – Corporate Governance and Management

|

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On October 19, 2016, Joseph Borbely

resigned as President and Chief Executive Officer of the Company effective immediately. The Board of Directors of the Company has appointed Kenneth D. Russell, a director of the Company since May 2014, to serve as interim President and Chief Executive Officer of the Company. Mr. Russell, age 68, is a Principal of Ford Financial Fund II, L.P., a private equity fund based in Dallas, Texas. Gerald J. Ford, the Company’s largest shareholder, is the Co-Managing Member of Ford Financial Fund II, L.P. Most recently, Mr. Russell served as President and Chief Executive Officer of Mechanics Bank from June 2015 until October 1, 2016. Over a long career at KPMG, he rose from a staff accountant in the U.S. division to become a member of KPMG Germany’s managing Board of Directors. During 20 years in the Dallas office, he led the engagement efforts with the firm’s regional banking, thrift and other financial service clients. In 1993, Mr. Russell joined KPMG’s national office in New York and led their financial services advisory unit, which supported many of the nation’s largest banks. In 2001, he joined the Managing Board for KPMG in Germany, where he served as the global lead partner in the firm’s relationship with Deutsche Bank. That position entailed managing and consulting on banking operations in over 50 countries for the multi-national German bank. Mr. Russell retired from the KPMG Germany Managing Board in 2008 in order to lead a new Partner Mentoring Program for KPMG’s offices throughout Europe, working to help young professionals become category and practice leaders. He joined Ford Financial Fund, L.P. in 2010 as a Principal. He also serves on the Board of Directors of Hilltop Holdings Inc. and Mechanics Bank.

2

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

FIRST ACCEPTANCE CORPORATION

|

|

|

|

a Delaware corporation

|

|

|

|

|

|

Date:

October 20, 2016

|

|

By:

|

/s/ Brent J. Gay

|

|

|

|

|

Name: Brent J. Gay

|

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

3

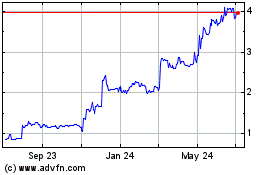

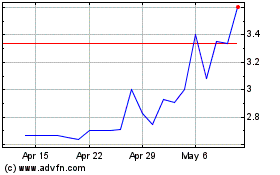

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Apr 2023 to Apr 2024