Reliance Steel & Aluminum Co. (NYSE:RS) today reported its

financial results for the third quarter ended September 30, 2016.

Third Quarter 2016 Financial Highlights

- Sales were $2.19 billion, down 4.4% from $2.29 billion in the

third quarter of 2015 and down 0.8% from $2.20 billion in the

second quarter of 2016.

- Tons sold were down 2.7% from the third quarter of 2015 and

down 4.9% from the second quarter of 2016, with the average selling

price per ton sold down 1.8% from the third quarter of 2015 and up

4.4% from the second quarter of 2016.

- Net income attributable to Reliance was $49.5 million, compared

to $51.4 million in the third quarter of 2015 and $100.9 million in

the second quarter of 2016. Net income attributable to Reliance

included a pre-tax impairment and restructuring charge of $67.3

million, or $0.57 per diluted share, in the third quarter of 2016,

and $55.5 million, or $0.47 per diluted share, in the third quarter

of 2015. These charges were primarily related to certain of

the Company’s businesses serving the energy industry.

- Earnings per diluted share were $0.68, compared to $0.69 in the

third quarter of 2015 and $1.38 in the second quarter of 2016.

- Non-GAAP earnings per diluted share were $1.25, compared to

$1.16 in the third quarter of 2015 and $1.36 in the second quarter

of 2016.

- Reliance recorded a pre-tax LIFO inventory valuation credit

adjustment, or income, of $11.3 million in the third quarter of

2016, compared to $35.0 million in the third quarter of 2015,

included in cost of sales. In the second quarter of 2016,

Reliance did not record a LIFO inventory valuation adjustment.

- The effective tax rate was 28.2%, compared to 32.1% in the

third quarter of 2015, and 32.7% in the second quarter of

2016.

- Cash flow from operations was $182.4 million in the third

quarter of 2016 and net debt-to-total capital was 32.2% at

September 30, 2016.

- A quarterly cash dividend of $0.425 per share was declared on

October 19, 2016 for stockholders of record as of November 18, 2016

and will be payable on December 16, 2016.

Management Commentary “I continue to be very

pleased with our operational performance,” said Gregg Mollins,

President and Chief Executive Officer of Reliance. “Although

our Non-GAAP FIFO gross profit margin declined slightly from 31.1%

in the prior quarter to 30.0% in the third quarter of 2016, our

managers in the field continued to execute our business model

effectively, despite both metals demand and pricing softening more

than we had originally expected. We anticipated a decline in

our FIFO gross profit margin as we were able to capitalize on mill

price increases during the second quarter that were not present in

the third quarter. Given this environment, we are very proud of our

managers’ ability to achieve these strong gross profit margin

levels, which are supported by our diligent inventory management

and significant investments in innovative, value-added processing

equipment.”

Mr. Mollins continued, “As a result of the multiple price

increases that were announced throughout the second quarter of

2016, our third quarter average selling price per ton sold was up

4.4% over the prior quarter, though still below 2015 levels. That

said, the positive metals pricing environment began to lose

momentum as the third quarter progressed and prices have continued

to decline thus far into the fourth quarter. The trade cases

filed by U.S. producers coupled with production capacity discipline

by these same mills continue to be supportive of domestic

pricing. However, overall softer demand and the normal

seasonal factors heading into the fourth quarter have contributed

to current pricing pressure.”

“We continuously evaluate each of our 300 plus operations to

determine if they meet our profitability standards. Given our

updated long-term outlook for the energy market, we recorded a

pre-tax impairment and restructuring charge of $67.3 million in the

third quarter of 2016 primarily related to certain of our

operations servicing the energy end market. The

charge includes the planned closure of a few of our locations,

which we believe is necessary to enhance our overall operating

efficiencies and long-term profitability,” Mr. Mollins further

stated.

Mr. Mollins concluded, “I commend our managers for their

phenomenal ability to execute throughout all cycles. I am

pleased with our financial performance for the quarter which

benefitted from our ongoing pricing discipline as well as effective

expense and inventory management. For the balance of the year

and into 2017, we plan to continue our strong operational execution

of our successful business model, while also maintaining our focus

on growth through both organic investments and acquisitions.”

| Third Quarter 2016 Business

Metrics |

|

|

|

|

|

| (tons in thousands; percentage

change) |

|

|

Q3 2016 |

Q2 2016 |

Sequential Quarter Change |

Q3 2015 |

Year-Over- Year Change |

|

Tons sold |

|

1,445.5 |

|

|

1,519.4 |

|

|

(4.9 |

%) |

|

1,485.9 |

|

|

(2.7 |

%) |

|

Tons sold (same-store) |

|

1,426.3 |

|

|

1,501.6 |

|

|

(5.0 |

%) |

|

1,485.9 |

|

|

(4.0 |

%) |

|

Average selling price per ton sold |

$ |

1,501 |

|

$ |

1,438 |

|

|

4.4 |

% |

$ |

1,529 |

|

|

(1.8 |

%) |

|

Average selling price per ton sold

(same-store) |

$ |

1,494 |

|

$ |

1,431 |

|

|

4.4 |

% |

$ |

1,529 |

|

|

(2.3 |

%) |

|

Third Quarter 2016 Major Commodity Metrics |

|

|

|

|

Tons Sold (tons in thousands; percentage

change) |

Average Selling Price per Ton Sold (percentage

change) |

|

|

Q3 2016 Tons Sold |

Q2 2016 Tons Sold |

Sequential Quarter Change |

Q3 2015 Tons Sold |

Year-Over- Year Change |

Sequential Quarter Change |

Year-Over- Year Change |

|

Carbon steel |

1,167.4 |

1,233.9 |

|

(5.4 |

%) |

1,216.0 |

|

(4.0 |

%) |

|

6.7 |

% |

|

0.8 |

% |

|

Aluminum |

86.3 |

91.9 |

|

(6.1 |

%) |

85.7 |

|

0.7 |

% |

|

1.1 |

% |

|

(2.2 |

%) |

|

Stainless steel |

78.0 |

80.9 |

|

(3.6 |

%) |

76.3 |

|

2.2 |

% |

|

4.0 |

% |

|

(6.2 |

%) |

|

Alloy |

44.6 |

41.7 |

|

7.0 |

% |

56.0 |

|

(20.4 |

%) |

|

(3.4 |

%) |

|

(4.1 |

%) |

|

|

Sales ($'s in millions; percentage

change) |

|

|

Q3 2016 Sales |

Q2 2016 Sales |

Sequential Quarter Change |

Q3 2015 Sales |

Year-Over- Year Change |

|

Carbon steel |

$ |

1,183.9 |

|

$ |

1,172.6 |

|

|

1.0 |

% |

$ |

1,223.4 |

|

|

(3.2 |

%) |

|

Aluminum |

$ |

439.2 |

|

$ |

462.8 |

|

|

(5.1 |

%) |

$ |

446.2 |

|

|

(1.6 |

%) |

|

Stainless steel |

$ |

311.0 |

|

$ |

310.1 |

|

|

0.3 |

% |

$ |

324.4 |

|

|

(4.1 |

%) |

|

Alloy |

$ |

114.2 |

|

$ |

110.6 |

|

|

3.3 |

% |

$ |

149.6 |

|

|

(23.7 |

%) |

|

Year-to-Date (9 months) 2016 Business Metrics |

|

| (tons in thousands; percentage

change) |

|

|

|

2016 |

|

|

2015 |

|

Year-Over- Year Change |

|

Tons sold |

|

4,467.9 |

|

|

4,538.6 |

|

|

(1.6 |

%) |

|

Tons sold (same-store) |

|

4,415.8 |

|

|

4,538.6 |

|

|

(2.7 |

%) |

|

Average selling price per ton sold |

$ |

1,454 |

|

$ |

1,607 |

|

|

(9.5 |

%) |

|

Average selling price per ton sold

(same-store) |

$ |

1,447 |

|

$ |

1,607 |

|

|

(10.0 |

%) |

| Year-to-Date (9 months) 2016

Major Commodity Metrics |

|

|

|

Tons Sold (tons in thousands; percentage

change) |

Average Selling Price per Ton Sold (percentage

change) |

|

|

2016 Tons Sold |

2015 Tons Sold |

Year-Over- Year Change |

Year-Over-Year Change |

|

Carbon steel |

3,617.9 |

3,703.8 |

|

(2.3 |

%) |

|

(9.7 |

%) |

|

Aluminum |

268.3 |

261.7 |

|

2.5 |

% |

|

(4.3 |

%) |

|

Stainless steel |

237.1 |

231.9 |

|

2.2 |

% |

|

(14.7 |

%) |

|

Alloy |

135.3 |

183.1 |

|

(26.1 |

%) |

|

(5.6 |

%) |

|

|

Sales ($'s in millions; percentage

change) |

|

|

2016 Sales |

2015 Sales |

Year-Over-Year Change |

|

Carbon steel |

$ |

3,483.4 |

|

$ |

3,946.9 |

|

|

(11.7 |

%) |

|

Aluminum |

$ |

1,359.1 |

|

$ |

1,385.1 |

|

|

(1.9 |

%) |

|

Stainless steel |

$ |

921.4 |

|

$ |

1,056.5 |

|

|

(12.8 |

%) |

|

Alloy |

$ |

356.2 |

|

$ |

510.5 |

|

|

(30.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

End Market CommentaryConsistent with normal

seasonal patterns, Reliance’s shipments declined in the third

quarter of 2016 compared to the second quarter of 2016. In

addition, overall metals demand weakened more than expected.

Despite these factors, however, Reliance continues to benefit from

its strategy of serving diverse end markets and providing superior

quality and processing services through its extensive capital

investments. The Company’s same-store tons sold were down

2.7% in the nine months ended September 30, 2016, compared to the

MSCI industry decline of 6.8%.

- Automotive demand remains strong. Reliance supports the

automotive market mainly through the Company’s toll processing

operations in the U.S. and Mexico and continues to increase its

toll processing volume through investments in new facilities and

processing equipment primarily to support incremental demand from

the increased usage of aluminum by the automotive industry.

- Aerospace demand also remains strong. Reliance maintains

its positive outlook in aerospace and expects to continue growing

its market share in this end market given the capital investments

and key acquisitions it has made in this space.

- Heavy industry demand declined further. However, the

Company remains optimistic that the five year infrastructure bill,

which was passed in December 2015, should help improve future

demand trends in the infrastructure and road construction equipment

markets.

- Non-residential construction demand remains relatively

steady. Reliance believes that this important end market will

continue to experience gradual, positive growth in the coming

quarters and that Reliance is well positioned to absorb increased

volume into its existing cost structure as this market improves

over time.

- Energy (oil and gas) demand for the products Reliance sells

remains weak. Reliance expects drilling activity levels to remain

under pressure for the foreseeable future but has recently begun to

see early signs of new activity in the market.

Balance Sheet & LiquidityThe Company

generated cash flow from operations of $387.6 million in the first

nine months of 2016. Total debt outstanding was $2.1 billion

at September 30, 2016, for a net debt-to-total capital ratio of

32.2%. The Company had $1.1 billion available for borrowings

on its $1.5 billion revolving credit facility at September 30,

2016.

As previously announced, on September 30, 2016, Reliance entered

into a new $2.1 billion credit agreement comprised of a $1.5

billion unsecured revolving credit facility and a $600 million

unsecured term loan. The new credit agreement, which has a term of

five years, replaces the Company's existing credit agreement with

substantially consistent terms. Both facilities allow for

prepayments, and the credit agreement includes an option to

increase the revolving credit facility for up to an additional $500

million.

“We are very pleased with our overall liquidity position which

provides us with the flexibility and resources to continue

investing in the growth of our business, both organically and

through M&A opportunities, as well as to return value to our

stockholders,” commented Karla Lewis, Senior Executive Vice

President and Chief Financial Officer of Reliance. “During

the first nine months of the year, we were able to use our strong

cash from operations and borrowings on our credit facility to fund

$110.6 million of capital expenditures and $349.0 million for our

three acquisitions, as well as to pay $89.5 million in dividends to

our valued stockholders. In addition, we intend to use

proceeds from the revolving credit facility to retire $350.0

million of 6.2% senior unsecured notes when they mature on November

15, 2016, which will result in pro forma interest savings of

approximately $15.0 million per year.”

Impairment and RestructuringReliance recorded a

pre-tax impairment and restructuring charge of $67.3 million, or

$0.57 per diluted share, in the third quarter of 2016 mainly due to

the Company's long-term outlook for the energy market, as well as

the Company's planned closure or sale of certain locations.

In the third quarter of 2015, the Company recorded a pre-tax

impairment and restructuring charge of $55.5 million, or $0.47 per

share, also related mainly to its businesses serving the energy

market.

Corporate DevelopmentsAs previously announced,

effective August 1, 2016, Reliance acquired all of the capital

stock of Alaska Steel Company (“Alaska Steel”), a full-line metal

distributor founded in 1982 and headquartered in Anchorage, Alaska.

Alaska Steel represents Reliance's entry into the significant

Alaskan market and furthers Reliance’s geographic, customer and

product diversification. The Company provides steel, aluminum,

stainless and specialty metals and related processing services to a

variety of customers in diverse industries throughout Alaska

including infrastructure, energy and mining. Alaska Steel's net

sales were approximately $33 million for the year ended December

31, 2015.

During the nine months ended September 30, 2016, the Company did

not repurchase any shares of its common stock under its existing

share repurchase program. In 2015, Reliance repurchased 6.2

million shares at an average price of $57.39 per share, for a total

of $355.5 million. At September 30, 2016, approximately 8.4

million shares remained available for repurchase under the share

repurchase program. The Company expects to opportunistically

repurchase shares of its common stock going forward.

On October 4, 2016, the Company expanded its Board of Directors

from nine to 11 members with the appointment of Karen W. Colonias

and Douglas W. Stotlar as independent directors. Both Ms. Colonias

and Mr. Stotlar were also appointed to the Audit Committee and the

Compensation Committee of Reliance’s Board of Directors. Ms.

Colonias and Mr. Stotlar have extensive board and management

experience which complements Reliance’s existing Board membership.

Reliance believes Ms. Colonias and Mr. Stotlar will provide

valuable perspectives and insights to enhance the execution of the

Company’s successful growth and operational strategies.

Business Outlook Reliance management continues

to believe the U.S. economy is generally healthy and anticipates a

continued slow recovery. However, given increased uncertainty in

the market at this time, along with normal seasonal patterns that

result in fewer shipping days in the fourth quarter due to

holiday-related customer closures, the Company is cautious in

regard to both business activity levels and metals pricing in the

fourth quarter of 2016. Reliance management estimates

tons sold to be down 5% to 7% in the fourth quarter of 2016

compared to the third quarter of 2016. Further, management believes

that metals pricing for most of the Company’s products will

experience continued downward pressure in the fourth quarter of

2016 and therefore expects its average selling price will be down

1% to 3% from the third quarter of 2016. As a result, management

currently expects Non-GAAP earnings per diluted share to be in the

range of $0.65 to $0.75 for the fourth quarter of 2016.

Conference Call DetailsA conference call and

simultaneous webcast to discuss the third quarter 2016 financial

results and business outlook will be held today, October 20, 2016

at 11:00 a.m. Eastern Time / 8:00 a.m. Pacific Time. To

listen to the live call by telephone, please dial (877) 407-0789

(U.S. and Canada) or (201) 689-8562 (International) approximately

10 minutes prior to the start time and use conference ID:

13645950. The call will also be broadcast live over the

Internet hosted on the Investors section of the Company's website

at investor.rsac.com.

For those unable to participate during the live broadcast, a

replay of the call will also be available beginning that same day

at 2:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on

Thursday, November 3, 2016 by dialing (844) 512-2921 (U.S. and

Canada) or (412) 317-6671 (International) and entering the

conference ID: 13645950. The webcast will remain posted on the

Investors section of Reliance’s web site at investor.rsac.com for

90 days.

About Reliance Steel & Aluminum Co.Reliance

Steel & Aluminum Co., headquartered in Los Angeles, California,

is the largest metals service center company in North America.

Through a network of more than 300 locations in 40 states and

twelve countries outside of the United States, Reliance provides

value-added metals processing services and distributes a full line

of over 100,000 metal products to more than 125,000 customers in a

broad range of industries. Reliance focuses on small orders

with quick turnaround and increasing levels of value-added

processing. In 2015, Reliance’s average order size was

$1,660, approximately 47% of orders included value-added processing

and approximately 40% of orders were delivered within 24 hours.

Reliance Steel & Aluminum Co.’s press releases and additional

information are available on the Company’s web site at

www.rsac.com.

Forward-Looking StatementsThis press release

contains certain statements that are, or may be deemed to be,

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may include, but are not limited to, discussions of

Reliance’s business strategies and its expectations concerning

future demand and metals pricing and the Company’s results of

operations, margins, profitability, impairment charges, liquidity,

litigation matters and capital resources. In some cases, you

can identify forward-looking statements by terminology such as

"may," "will," "should," "could," "would," "expect," "plan,"

"anticipate," "believe," "estimate," "predict," "potential" and

"continue," the negative of these terms, and similar

expressions.

These forward-looking statements are based on management's

estimates, projections and assumptions as of today’s date that may

not prove to be accurate. Forward-looking statements involve

known and unknown risks and uncertainties and are not guarantees of

future performance. Actual outcomes and results may differ

materially from what is expressed or forecasted in these

forward-looking statements as a result of various important

factors, including, but not limited to, those disclosed in reports

Reliance has filed with the Securities and Exchange Commission (the

"SEC"). As a result, these statements speak only as of the

date that they are made, and Reliance disclaims any and all

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Important risks and uncertainties about

Reliance’s business can be found in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2015, filed with the

SEC.

(Tables to follow)

| RELIANCE STEEL & ALUMINUM

CO.SELECTED UNAUDITED FINANCIAL

DATA(in millions, except share and per share

amounts) |

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Income Statement Data: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

|

2,185.2 |

|

|

$ |

|

2,286.2 |

|

|

$ |

|

6,551.8 |

|

|

$ |

|

7,324.3 |

|

| Gross profit1 |

|

|

654.6 |

|

|

|

|

638.3 |

|

|

|

|

1,976.4 |

|

|

|

|

1,964.9 |

|

| Operating income |

|

|

93.5 |

|

|

|

|

101.7 |

|

|

|

|

396.4 |

|

|

|

|

431.2 |

|

| Pre-tax income |

|

|

70.5 |

|

|

|

|

77.7 |

|

|

|

|

331.3 |

|

|

|

|

364.2 |

|

| Net income attributable to Reliance |

|

|

49.5 |

|

|

|

|

51.4 |

|

|

|

|

242.6 |

|

|

|

|

242.9 |

|

| Diluted earnings per share attributable to |

|

|

|

|

|

|

|

|

|

|

|

| Reliance

stockholders |

$ |

|

0.68 |

|

|

$ |

|

0.69 |

|

|

$ |

|

3.32 |

|

|

$ |

|

3.21 |

|

| Non-GAAP diluted earnings per share |

|

|

|

|

|

|

|

|

|

|

|

| attributable

to Reliance stockholders2 |

$ |

|

1.25 |

|

|

$ |

|

1.16 |

|

|

$ |

|

3.64 |

|

|

$ |

|

3.67 |

|

| Weighted average shares outstanding – |

|

|

|

|

|

|

|

|

|

|

|

| diluted |

|

|

73,280,797 |

|

|

|

|

74,136,193 |

|

|

|

|

73,034,938 |

|

|

|

|

75,673,596 |

|

| Gross profit margin1 |

|

|

30.0 |

% |

|

|

|

27.9 |

% |

|

|

|

30.2 |

% |

|

|

|

26.8 |

% |

| Operating income margin |

|

|

4.3 |

% |

|

|

|

4.4 |

% |

|

|

|

6.1 |

% |

|

|

|

5.9 |

% |

| Pre-tax income margin |

|

|

3.2 |

% |

|

|

|

3.4 |

% |

|

|

|

5.1 |

% |

|

|

|

5.0 |

% |

| Net income margin – Reliance |

|

|

2.3 |

% |

|

|

|

2.2 |

% |

|

|

|

3.7 |

% |

|

|

|

3.3 |

% |

| Cash dividends per share |

$ |

|

0.425 |

|

|

$ |

|

0.400 |

|

|

$ |

|

1.225 |

|

|

$ |

|

1.200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

September

30, |

|

December

31, |

|

|

|

|

| |

2016 |

|

2015* |

|

|

|

|

|

|

| Balance Sheet and Other

Data: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

$ |

|

2,848.9 |

|

|

$ |

|

2,554.2 |

|

|

|

|

|

|

|

| Working capital |

|

|

1,845.2 |

|

|

|

|

1,564.5 |

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

|

1,665.4 |

|

|

|

|

1,635.5 |

|

|

|

|

|

|

|

| Total assets |

|

|

7,584.9 |

|

|

|

|

7,121.6 |

|

|

|

|

|

|

|

| Current liabilities |

|

|

1,003.7 |

|

|

|

|

989.7 |

|

|

|

|

|

|

|

| Long-term debt |

|

|

1,679.7 |

|

|

|

|

1,427.9 |

|

|

|

|

|

|

|

| Total Reliance stockholders’ equity |

|

|

4,123.4 |

|

|

|

|

3,914.1 |

|

|

|

|

|

|

|

| Capital expenditures

(year-to-date) |

|

|

110.6 |

|

|

|

|

172.2 |

|

|

|

|

|

|

|

| Cash provided by

operations (year-to-date) |

|

|

387.6 |

|

|

|

|

1,025.0 |

|

|

|

|

|

|

|

| Net debt-to-total

capital3 |

|

|

32.2 |

% |

|

|

|

31.8 |

% |

|

|

|

|

|

|

| Return on Reliance

stockholders' equity4 |

|

|

8.0 |

% |

|

|

|

7.6 |

% |

|

|

|

|

|

|

| Current ratio |

|

|

2.8 |

|

|

|

|

2.6 |

|

|

|

|

|

|

|

| Book value per

share5 |

$ |

|

56.80 |

|

|

$ |

|

54.59 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| * Amounts were derived from audited financial statements. |

|

________________________ |

| 1 Gross

profit, calculated as net sales less cost of sales, and gross

profit margin, calculated as gross profit divided by net sales, are

non-GAAP financial measures as they exclude depreciation and

amortization expense associated with the corresponding sales. The

majority of our orders are basic distribution with no processing

services performed. For the remainder of our sales orders, we

perform “first-stage” processing which is generally not labor

intensive as we are simply cutting the metal to size. Because

of this, the amount of related labor and overhead, including

depreciation and amortization, is not significant and is excluded

from our cost of sales. Therefore, our cost of sales is primarily

comprised of the cost of the material we sell. We use gross

profit and gross profit margin as shown above as measures of

operating performance. Gross profit and gross profit margin

are important operating and financial measures, as their

fluctuations can have a significant impact on our earnings.

Gross profit and gross profit margin, as presented, are not

necessarily comparable with similarly titled measures for other

companies. |

| 2 See

accompanying Non-GAAP earnings reconciliation. |

| 3 Net

debt-to-total capital is calculated as total debt (net of cash)

divided by total Reliance stockholders’ equity plus total debt (net

of cash). |

| 4

Calculations are based on the latest twelve months net income

attributable to Reliance and beginning total Reliance stockholders’

equity. |

| 5 Book value

per share is calculated as total Reliance stockholders’ equity

divided by outstanding common shares. |

| RELIANCE

STEEL & ALUMINUM CO.UNAUDITED CONSOLIDATED

BALANCE SHEETS(in millions, except share

amounts) |

| |

| |

September 30, |

|

December 31, |

| |

2016 |

|

2015* |

| ASSETS |

| |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and cash equivalents |

$ |

|

143.3 |

|

|

$ |

|

104.3 |

|

| Accounts receivable, less allowance

for doubtful accounts of |

|

|

|

|

|

| $17.2 at September 30, 2016 and

$16.3 at December 31, 2015 |

|

|

1,042.9 |

|

|

|

|

916.6 |

|

| Inventories |

|

|

1,600.1 |

|

|

|

|

1,436.0 |

|

| Prepaid expenses and other current

assets |

|

|

57.5 |

|

|

|

|

60.8 |

|

| Income taxes receivable |

|

|

5.1 |

|

|

|

|

36.5 |

|

| Total current assets |

|

|

2,848.9 |

|

|

|

|

2,554.2 |

|

|

Property, plant and equipment: |

|

|

|

|

|

| Land |

|

|

226.8 |

|

|

|

|

196.2 |

|

| Buildings |

|

|

1,045.7 |

|

|

|

|

1,006.3 |

|

| Machinery and equipment |

|

|

1,643.4 |

|

|

|

|

1,569.8 |

|

| Accumulated depreciation |

|

|

(1,250.5 |

) |

|

|

|

(1,136.8 |

) |

| |

|

|

1,665.4 |

|

|

|

|

1,635.5 |

|

| |

|

|

|

|

|

|

Goodwill |

|

|

1,828.9 |

|

|

|

|

1,724.8 |

|

|

Intangible assets, net |

|

|

1,166.2 |

|

|

|

|

1,125.4 |

|

| Cash

surrender value of life insurance policies, net |

|

|

36.8 |

|

|

|

|

45.8 |

|

| Other

assets |

|

|

38.7 |

|

|

|

|

35.9 |

|

| Total assets |

$ |

|

7,584.9 |

|

|

$ |

|

7,121.6 |

|

| |

|

|

|

|

|

| LIABILITIES

AND EQUITY |

| |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

| Accounts payable |

$ |

|

312.2 |

|

|

$ |

|

247.0 |

|

| Accrued expenses |

|

|

101.8 |

|

|

|

|

83.0 |

|

| Accrued compensation and retirement

costs |

|

|

120.0 |

|

|

|

|

118.7 |

|

| Accrued insurance costs |

|

|

43.5 |

|

|

|

|

40.2 |

|

| Current maturities of long-term

debt and short-term borrowings |

|

|

426.2 |

|

|

|

|

500.8 |

|

| Total current liabilities |

|

|

1,003.7 |

|

|

|

|

989.7 |

|

|

Long-term debt |

|

|

1,679.7 |

|

|

|

|

1,427.9 |

|

|

Long-term retirement costs |

|

|

105.9 |

|

|

|

|

103.8 |

|

| Other

long-term liabilities |

|

|

14.8 |

|

|

|

|

30.4 |

|

|

Deferred income taxes |

|

|

627.6 |

|

|

|

|

627.1 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Equity: |

|

|

|

|

|

| Preferred stock, $0.001 par

value: |

|

|

|

|

|

| Authorized shares — 5,000,000 |

|

|

|

|

|

| None issued or outstanding |

|

|

- |

|

|

|

|

- |

|

| Common stock and additional paid-in

capital, $0.001 par value: |

|

|

|

|

|

| Authorized shares —

200,000,000 |

|

|

|

|

|

| Issued and outstanding shares –

72,563,344 at September 30, 2016 and 71,739,072 |

|

|

|

|

|

| at December 31, 2015 |

|

|

582.2 |

|

|

|

|

533.8 |

|

| Retained earnings |

|

|

3,633.2 |

|

|

|

|

3,480.0 |

|

| Accumulated other comprehensive

loss |

|

|

(92.0 |

) |

|

|

|

(99.7 |

) |

| Total Reliance

stockholders’ equity |

|

|

4,123.4 |

|

|

|

|

3,914.1 |

|

| Noncontrolling interests |

|

|

29.8 |

|

|

|

|

28.6 |

|

| Total equity |

|

|

4,153.2 |

|

|

|

|

3,942.7 |

|

| Total liabilities and equity |

$ |

|

7,584.9 |

|

|

$ |

|

7,121.6 |

|

| |

|

|

|

|

|

| * Amounts

were derived from audited financial statements. |

| RELIANCE STEEL & ALUMINUM

CO.UNAUDITED CONSOLIDATED STATEMENTS OF

INCOME(in millions, except per share

amounts) |

|

|

| |

Three Months

Ended |

|

Nine

Months Ended |

| |

September 30, |

|

September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

|

2,185.2 |

|

|

$ |

|

2,286.2 |

|

|

$ |

|

6,551.8 |

|

|

$ |

|

7,324.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales (exclusive of

depreciation |

|

|

|

|

|

|

|

|

|

|

|

| and amortization shown below) |

|

|

1,530.6 |

|

|

|

|

1,647.9 |

|

|

|

|

4,575.4 |

|

|

|

|

5,359.4 |

|

| Warehouse, delivery, selling,

general and |

|

|

|

|

|

|

|

|

|

|

|

| administrative |

|

|

454.3 |

|

|

|

|

428.9 |

|

|

|

|

1,361.6 |

|

|

|

|

1,315.8 |

|

| Depreciation and amortization |

|

|

55.1 |

|

|

|

|

54.4 |

|

|

|

|

166.7 |

|

|

|

|

164.6 |

|

| Impairment of long-lived

assets |

|

|

51.7 |

|

|

|

|

53.3 |

|

|

|

|

51.7 |

|

|

|

|

53.3 |

|

| |

|

|

2,091.7 |

|

|

|

|

2,184.5 |

|

|

|

|

6,155.4 |

|

|

|

|

6,893.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

93.5 |

|

|

|

|

101.7 |

|

|

|

|

396.4 |

|

|

|

|

431.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

| Interest |

|

|

(22.2 |

) |

|

|

|

(21.2 |

) |

|

|

|

(65.6 |

) |

|

|

|

(63.3 |

) |

| Other (expense) income, net |

|

|

(0.8 |

) |

|

|

|

(2.8 |

) |

|

|

|

0.5 |

|

|

|

|

(3.7 |

) |

| Income before income taxes |

|

|

70.5 |

|

|

|

|

77.7 |

|

|

|

|

331.3 |

|

|

|

|

364.2 |

|

| Income tax provision |

|

|

19.9 |

|

|

|

|

24.9 |

|

|

|

|

85.1 |

|

|

|

|

116.9 |

|

| Net income |

|

|

50.6 |

|

|

|

|

52.8 |

|

|

|

|

246.2 |

|

|

|

|

247.3 |

|

| Less: Net income attributable

to noncontrolling |

|

|

|

|

|

|

|

|

|

|

|

| interests |

|

|

1.1 |

|

|

|

|

1.4 |

|

|

|

|

3.6 |

|

|

|

|

4.4 |

|

| Net income attributable to Reliance |

$ |

|

49.5 |

|

|

$ |

|

51.4 |

|

|

$ |

|

242.6 |

|

|

$ |

|

242.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share attributable to Reliance

stockholders: |

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

$ |

|

0.68 |

|

|

$ |

|

0.69 |

|

|

$ |

|

3.32 |

|

|

$ |

|

3.21 |

|

| Basic |

$ |

|

0.68 |

|

|

$ |

|

0.70 |

|

|

$ |

|

3.36 |

|

|

$ |

|

3.24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends per share |

$ |

|

0.425 |

|

|

$ |

|

0.400 |

|

|

$ |

|

1.225 |

|

|

$ |

|

1.200 |

|

| RELIANCE

STEEL & ALUMINUM CO.UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS(in

millions) |

| |

| |

Nine Months

Ended |

| |

September 30, |

| |

2016 |

|

2015 |

| Operating activities: |

|

|

|

|

|

| Net income |

$ |

|

246.2 |

|

|

$ |

|

247.3 |

|

| Adjustments to reconcile net income to net cash

provided by operating activities: |

|

|

|

|

|

| Depreciation and amortization

expense |

|

|

166.7 |

|

|

|

|

164.6 |

|

| Impairment of long-lived

assets |

|

|

51.7 |

|

|

|

|

53.3 |

|

| Deferred income tax provision

(benefit) |

|

|

0.5 |

|

|

|

|

(3.2 |

) |

| Gain on sales of property, plant

and equipment |

|

|

(1.1 |

) |

|

|

|

(1.9 |

) |

| Stock-based compensation

expense |

|

|

17.8 |

|

|

|

|

17.6 |

|

| Other |

|

|

5.9 |

|

|

|

|

7.7 |

|

| Changes in operating assets and

liabilities (excluding effect of businesses acquired): |

|

|

|

|

|

| Accounts receivable |

|

|

(112.0 |

) |

|

|

|

65.4 |

|

| Inventories |

|

|

(95.5 |

) |

|

|

|

156.8 |

|

| Prepaid expenses and other

assets |

|

|

35.2 |

|

|

|

|

(16.1 |

) |

| Accounts payable and other

liabilities |

|

|

72.2 |

|

|

|

|

24.8 |

|

| Net cash provided by operating

activities |

|

|

387.6 |

|

|

|

|

716.3 |

|

| |

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

| Purchases of property, plant and

equipment |

|

|

(110.6 |

) |

|

|

|

(119.4 |

) |

| Acquisitions, net of cash

acquired |

|

|

(349.0 |

) |

|

|

|

— |

|

| Other |

|

|

1.6 |

|

|

|

|

5.6 |

|

| Net cash used in investing activities |

|

|

(458.0 |

) |

|

|

|

(113.8 |

) |

| |

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

| Net short-term debt (repayments)

borrowings |

|

|

(11.9 |

) |

|

|

|

9.9 |

|

| Proceeds from long-term debt

borrowings |

|

|

1,713.0 |

|

|

|

|

510.0 |

|

| Principal payments on long-term

debt |

|

|

(1,525.2 |

) |

|

|

|

(729.0 |

) |

| Debt issuance costs |

|

|

(6.8 |

) |

|

|

|

— |

|

| Dividends and dividend equivalents

paid |

|

|

(89.5 |

) |

|

|

|

(90.7 |

) |

| Exercise of stock

options |

|

|

31.3 |

|

|

|

|

11.0 |

|

| Share repurchases |

|

|

— |

|

|

|

|

(313.9 |

) |

| Other |

|

|

(4.1 |

) |

|

|

|

(5.5 |

) |

| Net cash provided by (used in) financing

activities |

|

|

106.8 |

|

|

|

|

(608.2 |

) |

| Effect of exchange rate changes on

cash |

|

|

2.6 |

|

|

|

|

(6.4 |

) |

| Increase (decrease) in cash and cash

equivalents |

|

|

39.0 |

|

|

|

|

(12.1 |

) |

| Cash and cash equivalents at beginning of

year |

|

|

104.3 |

|

|

|

|

106.2 |

|

| Cash and cash equivalents at end of period |

$ |

|

143.3 |

|

|

$ |

|

94.1 |

|

| |

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

| Interest paid during the period |

$ |

|

47.0 |

|

|

$ |

|

46.5 |

|

| Income taxes paid during the period, net |

$ |

|

67.2 |

|

|

$ |

|

168.3 |

|

| |

|

|

|

|

|

| Non-cash

investing and financing activities: |

|

|

|

|

|

| Debt assumed in

connection with acquisition |

$ |

|

6.1 |

|

|

$ |

|

— |

|

| RELIANCE STEEL & ALUMINUM

CO.NON-GAAP EARNINGS AND GROSS PROFIT

RECONCILIATION(in millions, except per share

amounts) |

|

|

| |

Net Income |

|

Diluted EPS |

| |

Three Months Ended |

|

Three Months Ended |

| |

September

30, |

|

June 30, |

|

September

30, |

|

September

30, |

|

June 30, |

|

September

30, |

| |

2016 |

|

2016 |

|

2015 |

|

2016 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Reliance |

$ |

|

49.5 |

|

|

$ |

|

100.9 |

|

|

$ |

|

51.4 |

|

|

$ |

|

0.68 |

|

|

$ |

|

1.38 |

|

|

$ |

|

0.69 |

|

| Non-recurring settlement gain |

|

|

- |

|

|

|

|

(2.2 |

) |

|

|

|

- |

|

|

|

|

- |

|

|

|

|

(0.03 |

) |

|

|

|

- |

|

| Impairment and restructuring charges |

|

|

67.3 |

|

|

|

|

- |

|

|

|

|

55.5 |

|

|

|

|

0.91 |

|

|

|

|

- |

|

|

|

|

0.75 |

|

| Income tax (benefit) expense, related

to above items |

|

(25.0 |

) |

|

|

|

0.8 |

|

|

|

|

(21.1 |

) |

|

|

|

(0.34 |

) |

|

|

|

0.01 |

|

|

|

|

(0.28 |

) |

| Non-GAAP net income attributable to Reliance |

$ |

|

91.8 |

|

|

$ |

|

99.5 |

|

|

$ |

|

85.8 |

|

|

$ |

|

1.25 |

|

|

$ |

|

1.36 |

|

|

$ |

|

1.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net Income |

|

Diluted EPS |

|

|

|

| |

|

|

|

Nine Months Ended |

|

Nine Months Ended |

|

|

|

| |

|

|

|

September

30, |

|

September

30, |

|

September

30, |

|

September

30, |

|

|

|

| |

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Reliance |

|

|

|

$ |

|

242.6 |

|

|

$ |

|

242.9 |

|

|

$ |

|

3.32 |

|

|

$ |

|

3.21 |

|

|

|

|

| Non-recurring settlement gain |

|

|

|

|

|

(2.2 |

) |

|

|

|

- |

|

|

|

|

(0.03 |

) |

|

|

|

- |

|

|

|

|

| Impairment and restructuring charges |

|

|

|

|

|

67.3 |

|

|

|

|

56.3 |

|

|

|

|

0.92 |

|

|

|

|

0.74 |

|

|

|

|

| Income tax benefit, related to above items |

|

|

|

|

|

(24.2 |

) |

|

|

|

(21.4 |

) |

|

|

|

(0.33 |

) |

|

|

|

(0.28 |

) |

|

|

|

| Resolution of certain tax matters |

|

|

|

|

|

(17.6 |

) |

|

|

|

- |

|

|

|

|

(0.24 |

) |

|

|

|

- |

|

|

|

|

| Non-GAAP net income attributable to Reliance |

|

|

|

$ |

|

265.9 |

|

|

$ |

|

277.8 |

|

|

$ |

|

3.64 |

|

|

$ |

|

3.67 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

|

|

| |

September

30, |

|

June 30, |

|

September

30, |

|

September

30, |

|

September

30, |

|

|

|

| |

2016 |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

|

|

| Gross profit -

LIFO |

$ |

|

654.6 |

|

|

$ |

|

685.1 |

|

|

$ |

|

638.3 |

|

|

$ |

|

1,976.4 |

|

|

$ |

|

1,964.9 |

|

|

|

|

| LIFO/LCM income |

|

|

(11.3 |

) |

|

|

|

- |

|

|

|

|

(35.0 |

) |

|

|

|

(11.3 |

) |

|

|

|

(75.0 |

) |

|

|

|

| Gross profit -

FIFO |

|

|

643.3 |

|

|

|

|

685.1 |

|

|

|

|

603.3 |

|

|

|

|

1,965.1 |

|

|

|

|

1,889.9 |

|

|

|

|

| Restructuring

charges |

|

|

11.7 |

|

|

|

|

- |

|

|

|

|

1.6 |

|

|

|

|

11.7 |

|

|

|

|

1.6 |

|

|

|

|

| Non-GAAP gross profit -

FIFO |

$ |

|

655.0 |

|

|

$ |

|

685.1 |

|

|

$ |

|

604.9 |

|

|

$ |

|

1,976.8 |

|

|

$ |

|

1,891.5 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit margin -

LIFO |

|

|

30.0 |

% |

|

|

|

31.1 |

% |

|

|

|

27.9 |

% |

|

|

|

30.2 |

% |

|

|

|

26.8 |

% |

|

|

|

| LIFO/LCM income as a %

of sales |

|

|

(0.6 |

%) |

|

|

|

0.0 |

% |

|

|

|

(1.5 |

%) |

|

|

|

(0.2 |

%) |

|

|

|

(1.0 |

%) |

|

|

|

| Gross profit margin -

FIFO |

|

|

29.4 |

% |

|

|

|

31.1 |

% |

|

|

|

26.4 |

% |

|

|

|

30.0 |

% |

|

|

|

25.8 |

% |

|

|

|

| Restructuring

charges |

|

|

0.6 |

% |

|

|

|

0.0 |

% |

|

|

|

0.1 |

% |

|

|

|

0.2 |

% |

|

|

|

0.0 |

% |

|

|

|

| Non-GAAP gross profit

margin - FIFO |

|

|

30.0 |

% |

|

|

|

31.1 |

% |

|

|

|

26.5 |

% |

|

|

|

30.2 |

% |

|

|

|

25.8 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reliance Steel & Aluminum Co.'s presentation of adjusted

net income, EPS, gross profit and gross profit margin over certain

time periods is an attempt to provide meaningful comparisons to the

Company's historical performance for its existing and future

stockholders. Adjustments include a settlement gain, impairment and

restructuring charges related to certain of the Company's energy

related-businesses and the anticipated closure or sale of some of

its locations, a debt restructuring-related charge, and the

resolution of certain tax matters, which make comparisons to the

Company's operating results between periods difficult using GAAP

measures. Reliance Steel & Aluminum Co.'s presentation of gross

profit - FIFO, which is calculated as gross profit plus LIFO

expense (or minus LIFO income) divided by net sales, is presented

in order to provide a means of comparison amongst its competitors

who may not use the same inventory valuation method. Gross profit

and gross profit margin, as presented, are not necessarily

comparable with similarly titled measures for other companies. |

CONTACT:

Brenda Miyamoto

Investor Relations

(213) 576-2428

investor@rsac.com

or Addo Investor Relations

(310) 829-5400

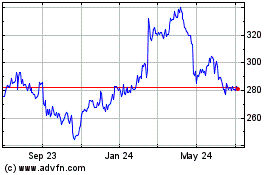

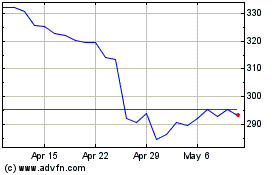

Reliance (NYSE:RS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reliance (NYSE:RS)

Historical Stock Chart

From Apr 2023 to Apr 2024