Report of Foreign Issuer (6-k)

October 19 2016 - 5:24PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2016

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF n

°

01.545.826/0001-07

NIRE 35.300.147.952

Publicly-Held Company

Minutes of the Board of Directors Meeting held on October 19, 2016

1. Date, Time and Place

: On October 19, 2016, at 10 a.m., by conference call, as expressly authorized by Article 21, Paragraph 2 of the Company’s Bylaws.

2. Call Notice and Attendance

: As all members of the Company’s Board of Directors attended the meeting, the summoning was dismissed and the instatement and approval of the quorum were verified.

3. Composition of the Board

:

Chairman

: Odair Garcia Senra.

Secretary

: Renata de Carvalho Fidale.

4. Agenda:

(1) authorize the sale of registered, book-entry and non-par common shares issued by Construtora Tenda S.A. (“

Shares

” and “

Tenda

”), owned by the Company by means of a secondary offering (“

Offering

”); (2) authorize the Company’s board of executive officers to practice all the acts and take all the measures necessary to implement the Offering; and (3) ratify the acts already practiced by the Company’s board of executive officers, in accordance with previous resolutions.

5. Resolutions:

After analysis and discussion, the attending Board members unanimously resolved:

5.1.

To approve the sale of the Company’s shares, in amount to be appropriately defined by this Board of Directors, by means of Offering with the following main characteristics and conditions:

5.1.1.

The Offering shall consist of a secondary stock offering in Brazil at the non-organized over-the-counter market, pursuant to the Rule nº 400 issued by the Brazilian Securities and Exchange Commission (“

CVM

”) of December 29, 2003 (“

CVM Rule 400

”), under the coordination of Banco Itaú BBA S.A. (“

Itaú BBA

” or “

Lead Manager

”), Banco Bradesco BBI S.A. (“

Bradesco BBI

”), Bank of America Merrill Lynch Banco Múltiplo S.A. (“

BofA Merrill Lynch

”), BB-Banco de Investimento S.A. (“

BB Investimentos

”) and Banco Votorantim S.A. (“

Votorantim

” and, jointly with Lead Manager, Bradesco BBI, BofA Merrill Lynch and BB Investimentos, referred to as the “

Offering Joint Bookrunners

”), with share dilution efforts provided for in the Novo Mercado Listing Rules of BM&FBOVESPA (“

Novo Mercado Rules

”), with participation of certain financial institutions composing the securities distribution system (“Contracted Bookrunners”), as per the case, and the participation of certain brokerage institutions authorized to operate in the Brazilian capital markets, accredited by BM&FBOVESPA S.A. – Securities, Commodities and Futures Exchange (“

BM&FBOVESPA

”), invited to take part in the Offering, solely for Share placement efforts with non-institutional investors (“

Consortium of Institutions

” and, jointly with Offering Joint Bookrunners and jointly with Contracted Bookrunners, the “

Offering Participating Institutions

”).

Concurrently,

Share placement efforts will be made abroad by Itau BBA USA Securities, Inc.,

Bradesco Securities, Inc., Merrill Lynch, Pierce, Fenner & Smith

Incorporated, Banco do Brasil Securities LLC and Banco Votorantim Securities,

Inc. (jointly referred to as, “

International Placement Agents

”) (i) in

the United States of America, exclusively for qualified institutional buyers, residing

and domiciled in the United States of America, as defined in the Rule 144A,

issued by U.S. Securities and Exchange Commission (“

SEC

”), in registration-exempt

operations provided for in the U.S. Securities Act of 1933 (“

Securities Act

”),

and regulations issued under the Securities Act; and (ii) in other countries,

rather than the United States of America and Brazil, for investors considered

neither residing nor domiciled in the United States of America or not

represented according to the laws of such country (non-U.S. persons), pursuant

to the Regulation S, within the scope of the Securities Act and in compliance

with the laws applicable in the country of domicile of each investor (investors

classified into items (i) and (ii) above, jointly referred to as “

Foreign

Investors

”), who invest in Brazil in conformity with investment mechanisms

regulated by Brazilian Monetary Council Resolution n° 4.373 of September 29,

2014 (“

CMN Resolution 4.373

”) and CVM Rule n° 560 of March 27, 2015 (“

CVM

Rule 560

”), or by Law n° 4.131 of September 3, 1962 (“

Law 4.131

”), therefore,

the request and obtainment of registration for distribution and placement of

Shares in agency or capital markets regulatory agency of another country will

not be required, inclusive before SEC. The Share placement efforts with Foreign

Investors, exclusively abroad, shall be endeavored pursuant to the Placement

Facilitation Agreement to be entered into between the Company, Tenda and

International Placement Agents

(“

International Distribution Agreement

”).

5.1.2.

The

sale of Shares shall be made by excluding the preemptive right of current

Company’s shareholders as provided for in Article 253, item I of Law n.º 6.404

of December 15, 1976 (“

Brazilian Corporation Law

”), pursuant to Article 172,

item I of the Brazilian Corporation Law. Within the scope of the Offering, preemptive

right shall be given to current Company’s shareholders, pursuant to Article 21 of

CVM Rule 400 to acquire an amount corresponding to 100% of Shares initially

tendered (excluding the Additional Shares (as defined below) and the

Overallotment Shares (as defined below), and shareholders cannot assign, fully

or partially, respective preemptive right.

5.1.3.

The

Price per Share shall be defined after conclusion of the bookbuilding process

solely executed with Institutional Investors by the Offering Joint Bookrunners

in Brazil, as provided for in the Distribution Agreement (defined below) and by

International Placement Agents, abroad, as provided for in the International

Distribution Agreement, pursuant to provisions in Article 23, Paragraph 1 and

Article 44 of CVM Rule 400 (“

Bookbuilding

”).

5.1.4.

Pursuant

to Article 14, Paragraph 2 of CVM Rule 400, until the release date of Notice of

Commencement of the Secondary Offering of Common Shares Issued by Construtora

Tenda S.A. (“

Notice of Commencement

”), the amount of Shares initially

tendered may (excluding the Overallotment Shares as defined below), at the

Company’s discretion, by common agreement with Offering Joint Bookrunners, be

added by up to 20% of total Shares initially tendered (excluding the

Overallotment Shares), under same conditions and by same price of Shares

initially tendered (“

Additional Shares

”).

5.1.5.

Pursuant to Article 24 of CVM Rule 400, the amount of Shares initially tendered (excluding the Additional Shares) may be added by an overallotment in percentage corresponding up to 15% of total Shares initially tendered (excluding the Additional Shares), to be fully sold by the Company, under same conditions and by same price of Shares initially tendered (“

Overallotment Shares

”), according to the option to be granted by the Company to the stabilization agent, pursuant to the Private Instrument of Coordination, Distribution and Settlement Firm Commitment of Common Shares Issued by Construtora Tenda S.A., to be entered into between the Company, the Offering Joint Bookrunners and, in the capacity of consenting intervening party, BM&FBOVESPA (“

Distribution Agreement

”), which shall be exclusively destined to meet eventual excess demand to be verified during the Offering (“

Greenshoe Option

”).

5.1.6

The partial distribution within the scope of the Offering shall not be accepted.

5.1.7.

The Board members approve eventual conduction of price stabilization activities for common shares issued by Tenda at the BM&FBOVESPA, for a 30-day period as of the starting date of trading of Tenda’s common shares at the BM&FBOVESPA, inclusive, by means of buy and sell trades of Tenda’s common shares, in compliance with applicable legal provisions and provisions of the Private Instrument of Price Stabilization Services Agreement for Common Shares Issued by Construtora Tenda S.A. (“

Stabilization Agreement

”). For the purposes of stabilization activity, the Board members also authorize the lending of Tenda’s common shares and owned by the Company to the stabilization agent, pursuant to the Private Instrument of Lending Agreement of Common Shares Issued by Construtora Tenda S.A. (“

Lending Agreement

”).

5.2.

Authorize the Company’s board of executive officers to practice all the acts and take all the measures necessary to implement the Offering, with powers to sign all and any agreements, notices, notifications, certificates and documents it deems necessary or appropriate to conduct the Offering, for instance: (i) the Distribution Agreement; (ii) the Stabilization Agreement; (iii) the Lending Agreement; (iii) the International Distribution Agreement

;

and

(iv) any other documents related to the Offering or necessary to its implementation, the placement of shares in Brazil or abroad and the completion of the Offering.

5.3.

Ratify all the acts already practiced by the Company’s board of executive officers aiming at conducting the Offering.

6.

Closing:

With no further matters to be discussed, these minutes were prepared and, after revised and unanimously approved by attending Board members, duly executed.

Signatures:

Odair Garcia Senra (Chairman), Renata de Carvalho Fidale (Secretary).

Board members

:

Odair Garcia Senra, Cláudio José Carvalho de Andrade, Francisco Vidal Luna, Guilherme Affonso Ferreira, José Écio Pereira da Costa Júnior, Maurício Marcellini Pereira and Rodolpho Amboss.

I certify that this is a true copy of the minutes drawn up in the appropriate book.

Renata de Carvalho Fidale

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 19, 2016

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

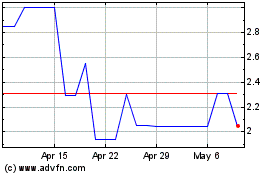

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

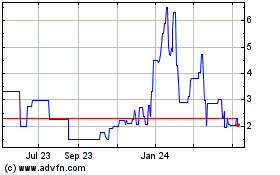

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024