Seagate Earnings Jump on Cost Cuts, Storage Demand

October 19 2016 - 3:30PM

Dow Jones News

Seagate Technology PLC said its profit more than tripled in the

September quarter, boosted by the company's recent cost cuts and

increasing demand for its cloud-storage products.

Seagate, one of the biggest makers of disk drives, has suffered

because of weakening demand for personal computers that use its

storage products. In response, the company has cut jobs and costs,

among other actions.

Wednesday, Seagate pointed to better-than-expected demand for

its high-capacity hard-disk drives for cloud storage by

businesses.

Over all, for the company's fiscal first quarter, Seagate

reported a profit of $167 million, or 55 cents a share, up from $34

million, or 11 cents a share, a year earlier. Excluding certain

items, the company recorded earnings of 99 cents per share, better

than the average analyst estimate of 89 cents on FactSet.

Seagate's total operating expenses fell 9.3% to $2.58 billion in

the first quarter.

Revenue declined 4.4% to $2.8 billion year-over-year, and gross

margin rose to 28.6% from 23.6%, confirming what the company

pre-reported earlier this month.

Shares of Seagate fell 2.2% to $34.55 in morning trading in New

York. The stock has fallen about 10% over the past year.

(END) Dow Jones Newswires

October 19, 2016 15:15 ET (19:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

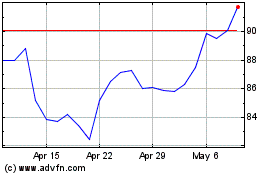

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

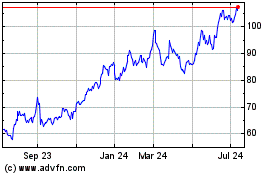

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024