LCNB Corp. (LCNB) today announced net income of $2,896,000

(total basic and diluted earnings per share of $0.29) and

$8,828,000 (total basic and diluted earnings per share of $0.89 and

$0.88, respectively) for the three and nine months ended September

30, 2016, respectively. This compares to net income of $2,633,000

(total basic and diluted earnings per share of $0.26) and

$8,590,000 (total basic and diluted earnings per share of $0.89 and

$0.88, respectively) for the same three and nine-month periods in

2015. Results for 2016 were significantly affected by the

acquisition of BNB Bancorp, Inc. ("BNB") on April 30, 2015. In

addition, LCNB sold impaired loans with a carrying value of

approximately $4.5 million during the second quarter 2015.

Commenting on the financial results, LCNB Chief Executive

Officer Steve Foster said, "We are pleased to present our financial

results for the three and nine months ended September 30, 2016. Net

income for the three and nine-month periods of 2016 was $263,000

and $238,000 greater than the comparable periods in 2015,

respectively, despite several one-time charges that were recognized

during 2016. The first of which was a $251,000 penalty incurred

during the first quarter for the early payoff of a now high-rate

Federal Home Loan Bank ("FHLB") borrowing, which will decrease

future interest expense. The second was write-downs totaling

$576,000 recognized during the second and third quarters for a

commercial other real estate owned property. Organic loan growth

during the nine-month period in 2016 was $40.7 million, which

significantly contributed to increases in net interest income of

$513,000 and $482,000 for the three and nine months ended September

30, 2016, respectively, as compared to the same periods in

2015."

The provision for loan losses for the three months ended

September 30, 2016 was $132,000 greater than the comparable period

in 2015. The provision for the nine-month period of 2016 was

$128,000 less than the comparable period in 2015. Net loan

charge-offs for the nine months ended September 30, 2016 and 2015

totaled $189,000 and $1,148,000, respectively. The 2015 balance

includes charge-offs recognized as a result of the impaired loan

sale mentioned above. Non-accrual loans and loans past due 90 days

or more and still accruing interest increased $2,357,000, from

$2,282,000 or 0.30% of total loans at December 31, 2015, to

$4,639,000 or 0.57% of total loans at September 30, 2016, primarily

due to two loans to the same borrower totaling $1,307,000 that were

newly classified as non-accrual during the first quarter 2016 and

two loans to same borrower totaling $1,217,000 that were newly

classified as non-accrual during the third quarter 2016. Other real

estate owned (which includes property acquired through foreclosure

or deed-in-lieu of foreclosure) decreased from $846,000 at December

31, 2015 to $270,000 at September 30, 2016 due to write-downs

totaling $576,000 recognized on commercial property.

Non-interest income for the three and nine months ended

September 30, 2016 was $460,000 and $715,000 greater than the

comparable periods in 2015, respectively, primarily due to

increases in gains from sales of investment securities, reflecting

a higher volume of securities sales.

Non-interest expense for the three and nine months ended

September 30, 2016 was $505,000 and $1,190,000 greater than the

comparable periods in 2015, respectively. The increase for the

quarter was largely due to increases in salaries and employee

benefits. The increase for the nine-month period was primarily due

to increases in salaries and employee benefits, increases in other

real estate owned expenses, and a $251,000 penalty for the early

payoff of a $5 million FHLB advance recognized during the first

quarter 2016. The FHLB advance had an interest rate of 5.25% and

was paid off to reduce interest expense on long-term debt. Salaries

and employee benefits increased primarily due to salary and wage

increases, employees retained from the BNB acquisition, and an

increase in the number of employees in addition to the acquisition.

These increases were partially offset by the absence of

merger-related expenses during the 2016 period.

LCNB Corp. is a financial holding company headquartered in

Lebanon, Ohio. Through its subsidiary, LCNB National Bank (the

“Bank”), it serves customers and communities in Southwest and South

Central Ohio. A financial institution with a long tradition for

building strong relationships with customers and communities, the

Bank offers convenient banking locations in Butler, Clermont,

Clinton, Fayette, Hamilton, Montgomery, Preble, Ross and Warren

Counties, Ohio. The Bank continually strives to exceed customer

expectations and provides an array of services for all personal and

business banking needs including checking, savings, online banking,

personal lending, business lending, agricultural lending, business

support, deposit and treasury, investment services, trust and IRAs

and stock purchases. LCNB Corp. common shares are traded on the

NASDAQ Capital Market Exchange® under the symbol “LCNB.” Learn more

about LCNB Corp. at www.lcnb.com.

Certain statements made in this news release regarding LCNB’s

financial condition, results of operations, plans, objectives,

future performance and business, are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are identified by the fact they

are not historical facts and include words such as “anticipate”,

“could”, “may”, “feel”, “expect”, “believe”, “plan”, and similar

expressions.

These forward-looking statements reflect management's current

expectations based on all information available to management and

its knowledge of LCNB’s business and operations. Additionally,

LCNB’s financial condition, results of operations, plans,

objectives, future performance and business are subject to risks

and uncertainties that may cause actual results to differ

materially. These factors include, but are not limited to:

- the success, impact, and timing of the

implementation of LCNB’s business strategies;

- LCNB may incur increased charge-offs in

the future;

- LCNB may face competitive loss of

customers;

- changes in the interest rate

environment may have results on LCNB’s operations materially

different from those anticipated by LCNB’s market risk management

functions;

- changes in general economic conditions

and increased competition could adversely affect LCNB’s operating

results;

- changes in other regulations and

government policies affecting bank holding companies and their

subsidiaries, including changes in monetary policies, could

negatively impact LCNB’s operating results;

- LCNB may experience difficulties

growing loan and deposit balances;

- the current economic environment poses

significant challenges for us and could adversely affect our

financial condition and results of operations;

- deterioration in the financial

condition of the U.S. banking system may impact the valuations of

investments LCNB has made in the securities of other financial

institutions resulting in either actual losses or other than

temporary impairments on such investments; and

- the effects of the Wall Street Reform

and Consumer Protection Act (the “Dodd-Frank Act”) and the

regulations promulgated and to be promulgated thereunder, which may

subject LCNB and its subsidiaries to a variety of new and more

stringent legal and regulatory requirements which adversely affect

their respective businesses.

Forward-looking statements made herein reflect management's

expectations as of the date such statements are made. Such

information is provided to assist shareholders and potential

investors in understanding current and anticipated financial

operations of LCNB and is included pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

LCNB undertakes no obligation to update any forward-looking

statement to reflect events or circumstances that arise after the

date such statements are made.

LCNB Corp. and Subsidiaries Financial

Highlights

(Dollars in thousands, except per share

amounts)

(Unaudited)

Three Months Ended Nine Months Ended

9/30/2016 6/30/2016 3/31/2016

12/31/2015 9/30/2015 9/30/2016

9/30/2015

Condensed Income

Statement

Interest income $ 10,895 11,008 10,621 10,812 10,409 32,524 31,847

Interest expense 885 883 849 906 912

2,617 2,422 Net interest income 10,010 10,125

9,772 9,906 9,497 29,907 29,425 Provision for loan losses 372

396 90 380 240 858 986

Net interest income after provision 9,638 9,729 9,682 9,526

9,257 29,049 28,439 Non-interest income 2,846 2,750 2,642 2,600

2,386 8,238 7,523 Non-interest expense 8,593 8,468

8,292 8,229 8,088 25,353 24,163

Income before income taxes 3,891 4,011 4,032 3,897 3,555 11,934

11,799 Provision for income taxes 995 1,043 1,068

1,013 922 3,106 3,209 Net income

$ 2,896 2,968 2,964 2,884 2,633

8,828 8,590 Accreted income on acquired loans $ 223

304 343 292 255 870 1,934 Amortization of acquired deposit premiums

$ 0 0 27 34 46 27 443 Tax-equivalent net interest income $ 10,432

10,538 10,166 10,298 9,874 31,136 30,500

Per Share

Data

Dividends per share $ 0.16 0.16 0.16 0.16 0.16 0.48 0.48 Basic

earnings per share $ 0.29 0.30 0.30 0.29 0.26 0.89 0.89 Diluted

earnings per share $ 0.29 0.29 0.30 0.29 0.26 0.88 0.88 Book value

per share $ 14.70 14.66 14.39 14.12 14.22 14.70 14.22 Tangible book

value per share $ 11.24 11.17 10.88 10.58 10.66 11.24 10.66 Average

basic shares outstanding 9,962,571 9,922,024 9,916,114 9,905,612

9,898,233 9,930,182 9,637,344 Average diluted shares outstanding

9,977,592 9,943,797 9,998,516 10,014,908 10,005,788 9,974,319

9,742,839 Shares outstanding at period end 9,993,695 9,937,262

9,931,788 9,925,547 9,903,294 9,993,695 9,903,294

Selected

Financial Ratios

Return on average assets 0.87 % 0.92 % 0.93 % 0.89 % 0.82 % 0.91 %

0.95 % Return on average equity 7.82 % 8.28 % 8.37 % 8.07 % 7.51 %

8.15 % 8.55 % Dividend payout ratio 55.17 % 53.33 % 53.33 % 55.17 %

61.54 % 53.93 % 53.93 % Net interest margin (tax equivalent) 3.42 %

3.55 % 3.49 % 3.46 % 3.37 % 3.49 % 3.71 % Efficiency ratio (tax

equivalent) 64.71 % 63.73 % 64.74 % 63.80 % 65.97 % 64.39 % 63.55 %

Selected Balance

Sheet Items

Investment securities and stock $ 394,798 399,345 393,976 406,981

391,430

Loans: Commercial and industrial $ 40,097

45,153 45,324 45,275 45,325 Commercial, secured by real estate

467,512 455,654 430,179 419,633 407,264 Residential real estate

268,574 266,625 271,812 273,139 274,054 Consumer 18,752 18,545

17,925 18,510 19,283 Agricultural 15,872 13,605 12,589 13,479

16,016 Other, including deposit overdrafts 619 635 643 665 676

Deferred net origination costs 236 248 242 237

215 Loans, gross 811,662 800,465 778,714 770,938

762,833 Less allowance for loan losses 3,798 3,373

3,150 3,129 2,958 Loans, net $ 807,864

797,092 775,564 767,809 759,875

Total earning assets $ 1,222,614 1,201,563 1,180,719 1,178,750

1,168,629 Total assets 1,333,536 1,312,635 1,285,922 1,280,531

1,275,171 Total deposits 1,158,921 1,124,698 1,120,208 1,087,160

1,103,513 Short-term borrowings 16,989 30,541 11,668 37,387 14,931

Long-term debt 662 726 789 5,947 6,016

Three Months Ended Six Months Ended 9/30/2016

6/30/2016 3/31/2016 12/31/2015

9/30/2015 9/30/2016 9/30/2015

Selected Balance

Sheet Items, continued

Total shareholders’ equity 146,906 145,710 142,933 140,108 140,851

Equity to assets ratio 11.02 % 11.10 % 11.12 % 10.94 % 11.05 %

Loans to deposits ratio 70.04 % 71.17 % 69.52 % 70.91 % 69.13 %

Tangible common equity (TCE) $ 111,946 110,541 107,567

104,529 105,063 Tangible common assets (TCA) 1,298,576 1,277,466

1,250,556 1,244,952 1,239,383 TCE/TCA 8.62 % 8.65 % 8.60 % 8.40 %

8.48 %

Selected Average

Balance Sheet Items

Investment securities and stock $ 396,620 396,130 389,648 406,423

385,353 394,141 353,391 Loans $ 800,729 784,324 772,204

764,440 760,159 785,807 732,600 Less allowance for loan losses

3,382 3,103 3,130 2,929 2,885

3,206 2,873 Net loans $ 797,347 781,221 769,074

761,511 757,274 782,601 729,727 Total earning assets $

1,212,232 1,193,585 1,171,709 1,181,594 1,160,768 1,192,580

1,099,351 Total assets 1,323,532 1,303,073 1,278,014 1,285,114

1,267,171 1,301,620 1,204,909 Total deposits 1,147,981 1,133,403

1,104,330 1,107,214 1,099,730 1,128,642 1,042,879 Short-term

borrowings 16,328 14,355 20,710 20,290 13,450 17,128 13,358

Long-term debt 684 747 1,256 5,970 6,040 895 6,247 Total

shareholders’ equity 147,371 144,185 142,447 141,751 139,032

144,678 134,256 Equity to assets ratio 11.13 % 11.06 % 11.15 %

11.03 % 10.97 % 11.12 % 11.14 % Loans to deposits ratio 69.75 %

69.20 % 69.93 % 69.04 % 69.12 % 69.62 % 70.25 %

Asset

Quality

Net charge-offs $ (53 ) 173 69 209 161 Other real estate owned 270

682 846 846 1,208 Non-accrual loans 4,619 2,697 3,328 1,723

2,254 Loans past due 90 days or more and still accruing 20

369 99 559 130 Total nonperforming

loans $ 4,639 3,066 3,427 2,282 2,384 Net charge-offs to

average loans (0.03 )% 0.09 % 0.04 % 0.11 % 0.08 % Allowance for

loan losses to total loans 0.47 % 0.42 % 0.40 % 0.41 % 0.39 %

Nonperforming loans to total loans 0.57 % 0.38 % 0.44 % 0.30 % 0.31

% Nonperforming assets to total assets 0.37 % 0.29 % 0.33 % 0.24 %

0.28 %

Assets Under

Management

LCNB Corp. total assets $ 1,333,536 1,312,635 1,285,922 1,280,531

1,275,171 Trust and investments (fair value) 293,808 284,118

274,297 283,193 258,675 Mortgage loans serviced 105,018 107,189

107,992 111,837 113,610 Business cash management 7,647 8,551 6,773

7,271 6,809 Brokerage accounts (fair value) 179,244 163,596

157,713 148,956 142,151 Total assets

managed $ 1,919,253 1,876,089 1,832,697

1,831,788 1,796,416

Non-GAAP

Financial Measures

Net income $ 2,896 2,968 2,964 2,884 2,633 8,828 8,590 Less (add)

net gain (loss) on sales of securities, net of tax 202 183 245 108

0 630 219 Add merger-related expenses, net of tax 0 0

0 2 32 0 461 Core net income $

2,694 2,785 2,719 2,778 2,665 8,198 8,832 Basic core earnings per

share $ 0.27 0.28 0.27 0.28 0.27 0.83 0.92 Diluted core earnings

per share $ 0.27 0.28 0.27 0.28 0.27 0.82 0.91 Adjusted return on

average assets 0.81 % 0.86 % 0.85 % 0.86 % 0.83 % 0.84 % 0.98 %

Adjusted return on average equity 7.27 % 7.77 % 7.66 % 7.77 % 7.60

% 7.57 % 8.80 % Core efficiency ratio (tax equivalent) 66.24 %

65.09 % 66.67 % 64.60 % 65.57 % 65.99 % 62.41 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161019006004/en/

LCNB Corp.Steve P. Foster, CEO & President,

800-344-BANKRobert C. Haines II, Executive Vice President and CFO,

800-344-BANK

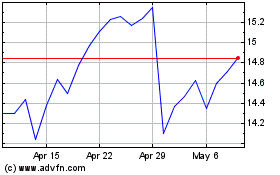

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

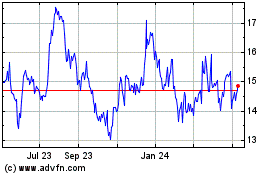

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Apr 2023 to Apr 2024