By Barbara Kollmeyer, MarketWatch

Intel falls, but Morgan Stanley is the latest financial to top

forecasts

U.S. stocks on Wednesday fought to sustain early gains as stocks

weighed strong quarterly report from a major financial institution

against weak housing data, which was limiting the market's

advance.

Morgan Stanley (MS) rose 0.7% to $32.52 and was one of the

biggest gainers among S&P 500 stocks after it reported a profit

that beat analyst forecasts

(http://www.marketwatch.com/story/morgan-stanley-profit-boosted-by-trading-revenue-2016-10-19).

The stock was the latest in a string of financials--including

Goldman Sachs Group Inc.(GS) and J.P. Morgan Chase &

Co(JPM)--that topped consensus expectations and boosted equities

(http://www.marketwatch.com/story/wall-street-stocks-point-higher-as-goldman-results-inflation-data-loom-2016-10-18).

The S&P financial sector rose 0.5% and was one of the biggest

gainers of the day.

The early mood has been upbeat.

"Not only have these financials beat, but they've beat pretty

solidly, which has led to some upside," said Randy Frederick,

managing director of trading and derivatives for Charles Schwab in

Austin, Texas.

The Dow Jones Industrial Average rose 17 points, or less than

0.1%, to 18,178, with a 5.4% decline in Intel Corp.(INTC) weighing

on the blue-chip gauge. The S&P 500 index was trading

little-changed, after trading tepidly higher, at 2,139. The energy

sector, up 0.9%, was the best gainer among the S&P 500's 11

sectors as crude-oil prices traded above $51 a barrel

(http://www.marketwatch.com/story/oil-prices-rise-on-signs-crude-inventories-likely-fell-last-week-2016-10-19).

Meanwhile, the Nasdaq Composite Index dipped 6 points, or 0.1%, to

5,237.

Despite the losses, the major stock-market indexes have mostly

been trading within a narrow range ahead of the U.S. presidential

election between Democratic nominee Hillary Clinton and Republican

candidate Donald Trump.

"We're not in a bad position, but we haven't made much progress

since July, and I don't see that changing with the big election we

have coming up, which has a lot of people uneasy."

Also, potentially a focus for some traders, the third and final

presidential debate will take place Wednesday evening.

Read: Wall Street wants Donald Trump to be beaten, but not

crushed

(http://www.marketwatch.com/story/this-is-wall-streets-new-election-black-swan-2016-10-18)

(http://www.marketwatch.com/story/this-is-wall-streets-new-election-black-swan-2016-10-18)Also

read:Irish bookie already paying out on Hillary Clinton victory

bets

(http://www.marketwatch.com/story/irish-bookie-already-paying-out-on-hillary-clinton-victory-bets-2016-10-18)

In the latest economic data, housing stars fell 9% in August

(http://www.marketwatch.com/story/housing-starts-tumble-9-as-sturdy-recovery-remains-elusive-2016-10-19),

reaching the slowest pace since March 2015. The data was a setback

for the housing market, though the starts were offset by a rise in

monthly building permits.

Wednesday also marks the 29th anniversary of Black Monday, when

on Oct. 19, 1987, stock markets crashed around the world.

Read:Chart watcher: stop comparing 2016 stock market to 1987

(http://www.marketwatch.com/story/chart-watcher-stop-comparing-2016-stock-market-to-1987-2016-10-18)

Gains for crude prices

(http://www.marketwatch.com/story/oil-prices-rise-on-signs-crude-inventories-likely-fell-last-week-2016-10-19)came

as Saudi Arabia's oil minister, Khalid A. Al-Falih, spoke at a

London conference. He said improving fundamentals and market

rebalancing will continue to aid the recovery and that many

countries, including those that aren't a member of the Organization

of the Petroleum Exporting Countries, are willing to join a

potential deal to cut global oil output

(http://www.marketwatch.com/story/saudi-oil-minister-many-non-opec-countries-willing-to-join-output-deal-2016-10-19).

Read: The stock market has been losing its grip on rallies at 3

distinct times during the day

(http://www.marketwatch.com/story/the-stock-market-has-been-losing-its-grip-on-rallies-at-3-key-times-during-the-day-2016-10-18)

(http://www.marketwatch.com/story/the-stock-market-has-been-losing-its-grip-on-rallies-at-3-key-times-during-the-day-2016-10-18)

(https://twitter.com/sarasjolin/status/788656012299468800)

In corporate news, Intel Corp. (INTC) fell 5.3% to $35.75 after

it reported a disappointing outlook

(http://www.marketwatch.com/story/intels-earnings-up-but-outlook-disappoints-2016-10-18)

while Reynolds American Inc.(RAI) sank 4.6% after earnings and

revenue fell short

(http://www.marketwatch.com/story/reynolds-american-misses-third-quarter-earnings-revenue-expectations-2016-10-19).

On the upside, Halliburton Co.(HAL)(HAL) rose 3.3% to $48.65 on its

results.

Read:The Intel money pit: Renovations cost more, no results in

sight

(http://www.marketwatch.com/story/the-intel-money-pit-renovations-cost-more-no-results-in-sight-2016-10-18)

Need to know:Sing the Alphabet song--the Google parent's stock

just broke out

(http://www.marketwatch.com/story/sing-the-alphabet-song-the-google-parents-stock-just-broke-out-2016-10-19)

Among other markets, gold rose 0.7% while the ICE dollar index

was flat.

Read:Why gold will rise no matter who becomes the next president

(http://www.marketwatch.com/story/why-gold-will-rise-no-matter-who-becomes-the-next-us-president-2016-10-18)

(http://www.marketwatch.com/story/dollar-slips-though-move-reduced-after-better-than-expected-china-data-2016-10-19)The

Stoxx Europe 600 index

(http://www.marketwatch.com/story/european-stocks-slip-but-energy-shares-track-gains-in-oil-prices-2016-10-19)

logged moderate gains, while Asian stocks

(http://www.marketwatch.com/story/asian-markets-rise-as-china-reports-healthy-growth-2016-10-18)

finished mixed. The Shanghai Composite Index closed flat after data

showed better-than-expected growth

(http://www.marketwatch.com/story/chinas-economy-grows-steadily-in-q3-2016-10-18)

in China, but slower industrial production.

(END) Dow Jones Newswires

October 19, 2016 10:16 ET (14:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

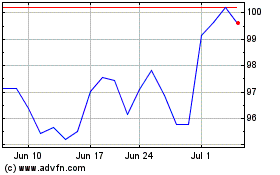

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

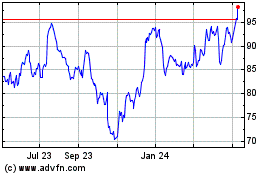

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024