U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2016

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 0-9951

ADVANCED OXYGEN TECHNOLOGIES, INC. |

(Exact name of Registrant as specified in its charter) |

Delaware | | 91-1143622 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

C/O Crossfield, Inc.,

653 VT Route 12A, PO Box 189

Randolph, VT 05060

(212) 727-7085

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: ¨

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $.01per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K(§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "an accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non Accelerated Filer | ¨ | Smaller Reporting Company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Check one: Yes ¨ No x

For the year ended June 30, 2016, Issuer's revenues were $36,227

The aggregate market value of Common Stock at December 31, 2015 held by non-affiliates approximated $77,101, based upon the average bid and asked prices for a share of Common Stock on that date. For purposes of this calculation, persons owning 10% or more of the shares of Common Stock are assumed to be affiliates, although such persons are not necessarily affiliates for any other purpose. As of October 17, 2016, there were 2,292,945 issued shares and outstanding shares of the registrant's Common Stock, $0.01 par value.

Documents incorporated by reference: None.

TABLE OF CONTENTS

Cautionary Language Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K contains “forward-looking statements”. Forward-looking statements are based upon our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. In some cases, you can identify forward-looking statements by the following words: “may,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “approximately,” “estimate,” “predict,” “project,” “potential” or the negative of these terms or other comparable terminology, although the absence of these words does not necessarily mean that a statement is not forward-looking. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

Factors that may cause or contribute actual results to differ from these forward-looking statements include, but are not limited to, the following:

| · | all the risks inherent in the owning, buying, leasing, selling, or developing real estate or the real estate business; |

| | |

| · | the Company’s absence of significant sales or sales revenues, which make it difficult to predict future performance; |

| | |

| · | the need to make multiple assumptions in preparing forecasts and projections of any kind, and significant difficulties in predicting and forecasting accurately the expenses likely to be incurred and the revenues likely to be generated in the Company’s future operations; |

| | |

| · | significant competition in the real estate leasing and development business; |

| | |

| · | the risk that the Company will have difficulties executing its intended business plan; |

| | |

| · | the risk that the Company’s sole source of revenues may discontinue leasing, become insolvent, or not renew its relationship with the Company; |

| | |

| · | potential barriers, risks, uncertainties and obstacles to the Company’s business plans; |

| | |

| · | risks associated with the tightening or other adverse changes in the overall capital and credit markets and decreased availability of investment capital and/or credit, bank financing or other debt financing as and when needed or at favorable terms including fixed and/or low interest rates; and |

| | |

| · | other risks over which we have no control. |

All forward-looking statements speak only as of the date of this report. We undertake no obligation to update any forward-looking statements or other information contained herein. Stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements in this report are reasonable, we cannot assure stockholders and potential investors that these plans, intentions or expectations will be achieved. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements.

PART I

ITEM 1- DESCRIPTION OF BUSINESS

GENERAL:

Advanced Oxygen Technologies, Inc. ("Advanced Oxygen Technologies", "AOXY", or the "Company") sole operations are derived from its wholly owned subsidiary Anton Nielsen Vojens, ApS ("ANV"). ANV is a Danish company that owns commercial real estate in Vojens, Denmark. ANV's revenues are derived solely from the lease revenue from its real estate. StatOil AS leases the facility from ANV. The lease expires in 2026.

AOXY, incorporated in Delaware in 1981 under the name Aquanautics Corporation, was, from 1985 until May 1995, a startup specialty materials company producing new oxygen control technologies. From May of 1995 through December of 1997 AOXY had minimal operations and was seeking funding for operations and companies to which it could merge or acquire. In March of 1998 AOXY began operations in California. From 1998 through 2000, the business consisted of producing and selling CD- ROMS for conference events, advertisement sales on the CD's, database management and event marketing all associated with conference events. From 2000 through March of 2003, the business consisted solely of database management. From 2003 through April 2005, the business operations were derived totally from the Company's wholly owned business, IP Service, ApS, a Danish IP security vulnerability company ("IP Service"). Since then, business operations have been solely derived from ANV.

HISTORY OF THE COMPANY:

THE PATENT SALE

On May 1, 1995, the Company sold its patents, and all related technology and intellectual property rights (collectively the "Patents Rights") to W. R. Grace & Co. Conn., a Connecticut corporation ("Grace"). The price for the Patents Rights was $335,000, in cash, and a royalty until April 30, 2007.

STOCK ACQUISITION AGREEMENT, 12/18/97

Pursuant to a Stock Acquisition Agreement dated as of December 18, 1997, Advanced Oxygen Technologies, Inc. ("AOXY") has issued 23,750,00 shares of its common stock, par value $.01 per share for $60,000 cash plus consulting services rendered valued at $177,500, to Crossland, Ltd., ("Crossland"), Eastern Star, Ltd., ("Eastern Star"), Coastal Oil, Ltd. ("Coastal") and Crossland, Ltd. (Belize) ("CLB"). Crossland and Eastern Star, Ltd. are Bahamas corporations. Coastal Oil and CLB are Belize corporations.

PURCHASE AGREEMENT, 12/18/97

Pursuant to a Purchase Agreement dated as of December 18, 1997, CLB, Triton-International, Ltd., ("Triton"), a Bahamas corporation, and Robert E. Wolfe purchased an aggregate of 800,000 shares of AOXY's common stock from Edelson Technology Partners II, L.P. ("ETPII") for $10,000 cash. AOXY issued 450,000 shares of its capital stock to ETPII in exchange for consulting services to be rendered. The general partner of ETPII is Harry Edelson, Chairman of the Board and Chief Executive Officer of AOXY prior to the transactions resulting in the change of control (the "Transactions"). Prior to the Transactions Mr. Edelson directly or indirectly owned approximately 25% of the issued and outstanding common stock of AOXY, and following the completion of Mr. Edelson's consultancy he will own approximately 1.5%.

Company/Individual | | Number of Shares | | | Percent Ownership | |

Robert E. Wolfe | | | 50,000 | | | | 0.17 | % |

Crossland (Belize) | | | 6,312,500 | | | | 21.30 | % |

Triton International | | | 375,000 | | | | 1.26 | % |

Coastal Oil, Ltd. | | | 5,937,500 | | | | 20.03 | % |

Crossland Ltd. | | | 5,937,500 | | | | 20.03 | % |

Eastern Star, Ltd. | | | 5,937,500 | | | | 20.03 | % |

ACQUISITION OR DISPOSITION OF ASSETS, 03/09/98.

On March 9, 1998, pursuant to an Agreement for Purchase and Sale of Specified Business Assets, a Promissory Note, and a Security Agreement all dated March 9, 1998, Advanced Oxygen Technologies, Inc. (the "Company") purchased certain tangible and intangible assets (the "Assets") including goodwill and rights under certain contracts, from Integrated Marketing Agency, Inc., a California Corporation ("IMA"). The assets purchased from IMA consisted primarily of furniture, fixtures, equipment, computers, servers, software and databases previously used by IMA in its full service telemarketing business. The purchase price was $2,000,000.

PURCHASE AGREEMENT OF 1/29/99

On January 29, 1999, pursuant to the Purchase Agreement of 1/28/99, Advanced Oxygen Technologies, Inc. ("AOXY") purchased 1,670,000 shares of convertible preferred stock of Advanced Oxygen Technologies, Inc. ("STOCK") and a $550,000 promissory note issued by Advanced Oxygen Technologies, Inc. ("Note") from Integrated Marketing Agency, Inc. ("IMA"). The terms of the Purchase Agreement were: AOXY paid $15,000 to IMA, assumed a Citicorp Computer Equipment Lease, #010-0031648-001 from IMA, delivered to IMA certain tangible business property (as listed in Exhibit A of the Purchase Agreement), executed a one year $5,000 promissory note with IMA, and delivered to IMA a Request For Dismissal of case #PS003684 (restraining order) filed in Los Angeles county superior court. IMA sold, transferred, and delivered to AOXY the Stock and the Note. IMA sold, transferred, assigned and delivered the Note and the Stock to AOXY, executed documents with Citicorp Leasing, Inc. to effectuate an express assumption by AOXY of the obligation under lease #010-0031648-001 in the amount of $44,811.26, executed a UCC2 filing releasing UCC-1 filing #9807560696 filed by IMA on March 13, 1998, and delivered such documents as required. In addition, both IMA and AOXY provided mutual liability releases for the other.

ACQUISITION OR DISPOSITION OF ASSETS OF 03/05/2003

Pursuant to a stock acquisition agreement, on March 05, 2003 Advanced Oxygen Technologies, Inc. (AOXY or the Buyer) purchased 100% of the issued and outstanding stock of IP Services, ApS (IP or the Company) from all of its owners (the Shareholders) for value of five hundred thousand dollars (Purchase Price). AOXY issued fourteen million shares of common stock and one share of preferred convertible stock to the Shareholders for payment and consideration of the Purchase Price.

MOBILIGROUP ApS MERGER AGREEMENT OF 04/ 23/2005

Pursuant to a merger agreement attached hereto as exhibit I, ("Merger Agreement"), on April 23, 2005 Mobile Group Inc., ("Mobile “a formerly wholly owned subsidiary of Advanced Oxygen Technologies, Inc. acquired 100% of the issued and outstanding stock of Mobiligroup, ApS in exchange for 800 shares of Mobile representing 80% of the issued and outstanding shares of Mobile.

SALE OF IP SERVICE: STOCK ACQUISITION AGREEMENT OF 04/27/2005

Pursuant to a stock acquisition agreement, on April 27, 2005 Advanced Oxygen Technologies, Inc. sold 100.00% of the stock of IP Service ApS to Securas, Ltd. 7 Stewards Court, Carlisle Close, Kingston Upon Thames, Surrey KT2 7AU, United Kingdom ("SecurAs").

PURCHASE OF ANTON NIELSEN VOJENS, ApS: STOCK ACQUISITION AGREEMENT OF FEBRUARY 3, 2006

Pursuant to a stock acquisition agreement on February 3, 2006 Advanced Oxygen Technologies, Inc. ("AOXY") purchased 100.00% of the stock of Anton Nielsen Vojens ApS ("ANV"), a Danish company from Borkwood Development Ltd. (a current shareholder of AOXY) for Six Hundred and Fifty Thousand US Dollars. The transaction was financed as follows:

1) AOXY executed a promissory note ("Note") for $650,000, payable to the sellers of ANV ("Sellers") payable and amortized monthly and carrying a interest at 5% per year. AOXY has the right to prepay the note at any time with a notice of 14 days. To secure the payment of principal and interest the Sellers will receive a perfect lien and security interest in the Shares in the company ANV until the note with accrued interest is paid in full., and,

2) In the case that the Note has not been repaid within 12 months from the day of closing the Sellers have the right to convert the debt to common stock of Advanced Oxygen Technologies, Inc. in an amount of non diluted shares calculated on the conversion Date, equal to the lesser of : a) Six hundred and Fifty thousand (650,000) or the Purchase Price minus the principal payments made by the buyer, whichever is greater, divided by the previous ten day closing price of AOXY as quoted on the national exchange, or b) Fifteen million shares, whichever is lesser. The Sellers must demand such conversion with a notice of 1 month.

SUBDIVISION AND SALE OF REAL ESTATE OF MARCH 3, 2006

Pursuant to an acquisition agreement attached hereto as exhibit I (Danish original) and Exhibit II (English Translation) ("Acquisition Agreement"), on March 3, 2006 Anton Nielsen Vojens ApS ("ANV"), a wholly owned subsidiary of Advanced Oxygen Technologies, Inc. ("AOXY") entered into an agreement to sub divide and sell a 3,300 M2 portion of its Vojens City property ('Property") for Two Million Three hundred Thousand Danish Krone (2.300.000 DKK) to Ejendomsselskabet Ostergade 67 ApS, a Danish company ("EO"). Under the terms of the Acquisition Agreement: EO purchased the Property in an as is condition, and was responsible for all costs of the transaction including but not limited to: sub division costs, legal, financial, 1/2 the filing costs, deed transfer costs (ANV was responsible for the survey costs and 1/2 the filing costs).

CHANGES IN REGISTRANT'S CERTIFYING ACCOUNTANT

On August 05, 2016 the Company has engaged Sadler, Gibb & Associates, LLC, 2455 E. Parleys Way, Suite 320, Salt Lake City, UT 84109, (801)783-2960 ("New Accountants") as its certified accounting firm/outside auditor from its Danish auditors CHR. Mortensen Revisionsfirma. Additionally, the Company had not consulted the New Accountants regarding: (i) The application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on the small business issuer’s financial statements and either written or oral advice was provided that was an important factor considered by the small business issuer in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a disagreement or event identified in response to paragraph (a)(1)(iv) of Regulation S-B section §228.304 (Item 304).

CHANGE IN ADDRESS OF COMPANY, MARCH 5, 2009

The Company's location, and location of books and records has changed from Advanced Oxygen Technologies, Inc. C/O Crossfield Inc. 100 Maiden Lane, Suite 2003, New York, NY 10038 to Advanced Oxygen Technologies, Inc. c/o Crossfield, Inc. , 653 VT Route 12A, PO Box 189 Randolph, VT 05060 Telephone (212)-727-7085, Fax (802)-332-6100. This location is collocated with a related business of the president, Robert E. Wolfe.

COMPANY OBJECTIVE AND MISSION:

The Company currently shares its location with a related company of the President of the Company. The Company owns 100% of a subsidiary, Anton Nielsen Vojens, ApS ("ANV"). ANV owns and leases commercial real estate to StatOil AS, a Danish company. The lease expires in 2026. Through this lease, the Company believes that the operations of ANV will continue to produce revenues.

The Company continues its efforts to raise capital to support operations and growth, and is actively searching acquisitions or mergers with another company that would complement the Company and increase its earnings potential.

COMPETITION:

The Company's subsidiary ANV revenues are currently derived from its lease revenues of its commercial real estate holding. With the global changes in the economies during the year ended June 30, 2016, the Company's' direct competition would be other vacant commercial real estate entities. The Company believes that there are no identifiable direct competitors.

CUSTOMERS:

The Company's subsidiary ANV currently has one customer, StatOil AS., Copenhagen Denmark.

EMPLOYEES:

As of June 30, 2016 the Company had a total of 1 employee.

ITEM 1A. RISK FACTORS

Risks Specific to Our Company

THE POTENTIAL PROFITABILITY OF COMMERCIAL REAL ESTATE VENTURES DEPENDS UPON FACTORS BEYOND THE CONTROL OF OUR COMPANY.

The potential profitability of commercial real estate properties is dependent upon many factors beyond our control. For instance, world prices and markets for rents and leases of commercial properties are unpredictable, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for maintenance, repair, expansion and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance. These factors cannot be accurately predicted and the combination of these factors may result in our Company not receiving an adequate return on invested capital.

WE ARE SUBJECT TO RISKS ASSOCIATED WITH FOREIGN CURRENCY

ANV is a Danish company with operations only in Denmark. During the year ended June 30, 2016 and 2015, foreign revenues accounted for 100% of our total revenue. As a result, we are subject to risks associated with generating revenue in multiple countries, including:

| · | increased time, effort and attention of our management to manage our foreign operations; |

| | |

| · | balance sheet fluctuations. |

| | |

| · | currency devaluations and fluctuations in currency exchange rates, including impacts of transactions in various currencies and translation of various currencies into dollars for U.S. reporting and financial covenant compliance purposes; |

| | |

| · | language barriers and other difficulties in staffing and managing foreign operations; |

| | |

| · | longer customer payment cycles and greater difficulties in collecting accounts receivable; |

| | |

| · | uncertainties of laws and enforcement relating to the protection of property; |

| | |

| · | imposition of or increases in currency exchange controls, including imposition of or increases in limitations on conversion of various currencies into U.S. dollars; |

| | |

| · | imposition of or increases in revenue, income or earnings taxes and withholding and other taxes; |

| | |

| · | imposition of or increases in investment or trade restrictions and other restrictions or requirements by non-U.S. Governments; |

| | |

| · | inability to definitively determine or satisfy legal requirements, inability to effectively enforce contract or legal rights and inability to obtain complete financial or other information under local legal, judicial, regulatory, disclosure and other systems; and |

| | |

| · | nationalization and other risks, which could result from a change in government or other political, social or economic instability. |

WE ARE SUBJECT TO RISKS ASSOCIATED WITH OPERATIONS THAT HAVE A CONCENTRATION OF CUSTOMERS

ANV has only one customer. There is no guarantee that this customer will remain solvent, and or continue with the Company in the same manner as it is now. As such, if the Company were to lose this customer, 100% of its revenues would be lost.

IN THE FUTURE, WE MAY NEED TO OBTAIN ADDITIONAL FINANCING TO FUND OUR OPERATIONS AND TO ACQUIRE ADDITIONAL BUSINESSES

In the future, we may need to obtain additional financing to fund our operations and to acquire additional businesses. There is no guarantee that we will be able to raise additional capital.

EFFORTS TO COMPLY WITH RECENTLY ENACTED CHANGES IN SECURITIES LAWS AND REGULATIONS HAVE REQUIRED SUBSTANTIAL FINANCIAL AND PERSONNEL RESOURCES AND WE STILL MAY FAIL TO COMPLY

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on our internal controls over consolidated financial reporting in our annual reports on Form 10-K. In addition, the independent registered public accounting firm auditing our consolidated financial statements must attest to and report on management’s assessment of, and the effectiveness of our internal controls over financial reporting. This requirement was to first apply for management’s assessment in our annual report on Form 10-KSB for our fiscal year ending June 30, 2008, and for the independent registered public accounting firm’s assessment for fiscal year ended June 30, 2008. Depending on a number of variables and the significant resources required to comply, uncertainty exists regarding our ability to continue to comply with these rules even though the Company may have complied in the past.

Pursuant to interactive data rules adopted in Securities Act Release No. 9002 (Jan. 30, 2009) and further accepted, there is uncertainty whether the Company will be able to comply with the stated rules as they are phased in, if the Company is able to initially comply, and whether the Company will continue to be able to do so .

PROVISIONS OF OUR CORPORATE DOCUMENTS AND DELAWARE CORPORATE LAW MAY DETER A THIRD PARTY FROM ACQUIRING OUR COMPANY

Provisions of our articles of incorporation and our bylaws, authorize our Board of Directors to, among other things, issue preferred stock and fix the rights, preferences, privileges and restrictions of such shares without any further vote, approval or action by our stockholders. Our Board could take actions that could discourage a third party from attempting to acquire control of us and that could make it more difficult for a third party to acquire us. Our Board could take such actions even if our stockholders consider a change in control to be in their best interests.

WE PLAN TO GROW OUR BUSINESS THROUGH ACQUISITIONS AND JOINT VENTURES, WHICH WILL RESULT IN OUR INCURRING SIGNIFICANT COSTS

The acquisition of new businesses is costly, such new businesses may not enhance our financial condition, and we may face difficulties and be unsuccessful in integrating new businesses. The resources expended in identifying, negotiating and structuring acquisitions and joint ventures may be significant and may not result in any transactions. Any future acquisitions will be subject to a number of challenges in integrating new operations into our existing operations, including but not limited to:

| · | diversion of management time and resources; |

| | |

| · | difficulty of assimilating the operations and personnel of the acquired companies; |

| | |

| · | potential disruption of our ongoing business; |

| | |

| · | difficulties in maintaining uniform standards, controls, procedures and policies; |

| | |

| · | impairment of relationships with employees and customers as a result of any integration of new management personnel; and |

| | |

| · | potential unknown liabilities associated with acquired businesses |

Risks Specific to Our Industry

WE ARE SUBJECT TO RISKS ASSOCIATED WITH GLOBAL DECLINE IN REAL ESTATE

ANV, the Company's subsidiary has only one commercial real estate property. There is no guarantee that the demand for rental of this property will continue and potentially this would affect the Company's performance.

Risks Related to Our Securities

OUR COMMON STOCK IS SUBJECT TO THE “PENNY STOCK” RULES OF THE SEC AND THE TRADING MARKET IN OUR SECURITIES IS LIMITED, WHICH MAKES TRANSACTIONS IN OUR STOCK CUMBERSOME AND MAY REDUCE THE VALUE OF AN INVESTMENT IN OUR STOCK.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: that a broker or dealer approve a person’s account for transactions in penny stocks; and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must: obtain financial information and investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form: sets forth the basis on which the broker or dealer made the suitability determination; and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are none.

ITEM 2. DESCRIPTION OF PROPERTY

The assets of the Company consist of its wholly owned subsidiary, Anton Nielsen Vojens, ApS ("ANV") whose sole asset is commercial real estate in Vojens, Denmark. The commercial real estate is leased to StatOil, AS until 2026. The property is land only and is a 750 square meter parcel currently used as a fuel station and is located at Ostergade 67, 6500 Vojens Denmark.

ITEM 3. LEGAL PROCEEDINGS

During the period ending June 30, 2016, the pending or threatened legal actions as follows:

None

ITEM 4: MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET OF COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASES OF EQUITY SECURITIES.

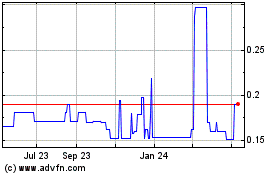

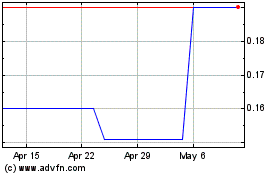

The Company's Common Stock is traded on the Over-The-Counter Pink. The following table sets forth the range of high and low bid quotations on the Common Stock for the quarterly periods indicated, as reported by the National Quotation Bureau, Inc. The quotations are inter-dealer prices without retail mark-ups, mark downs or commissions and may not represent actual transactions.

Fiscal Year Ended June 30, 2016 | | High | | | Low | |

First Quarter | | | 0.080 | | | | 0.060 | |

Second Quarter | | | 0.011 | | | | 0.050 | |

Third Quarter | | | 0.1229 | | | | 0.070 | |

Fourth Quarter | | | 0.150 | | | | 0.060 | |

| | | | | | |

Fiscal Year Ended June 30, 2015 | | High | | | Low | |

First Quarter | | | 0.25 | | | | 0.12 | |

Second Quarter | | | 0.60 | | | | 0.07 | |

Third Quarter | | | 0.35 | | | | 0.14 | |

Fourth Quarter | | | 0.25 | | | | 0.06 | |

HOLDERS

At June 30, 2016 the company had 1,558 shareholders of record. At October 11, 2016, the closing bid price of the Company's Common Stock as reported by the National Quotation Bureau, Inc., was $0.08.

DIVIDENDS

We have not paid or declared any dividends on our common stock since our inception. Our Board of Directors does not expect to declare cash dividends on our common stock in the near future. We anticipate that we will retain our future earnings to finance the continuing development of our business.

RECENT SALES OF UNREGISTERED SECURITIES

During the year ended June 30, 2016, we had no issuances of unregistered securities.

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

The following discussion of our plan of operation, financial condition and results of operations should be read in conjunction with the Company’s consolidated financial statements, and notes thereto, included elsewhere herein. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors including, but not limited to, those discussed in this Annual Report.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of consolidated financial statements in conformity with the Public Company Oversight Accounting Board ("PCAOB") requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Following are accounting policies that we believe are most important to the portrayal of our financial condition and results of operations and that require our most difficult judgments as a result of the need to make estimates and assumptions about the effects of matters that are inherently uncertain.

Recognition of rental income:

Rental income for commercial property leases is recognized on a quarterly basis over the respective lease terms.

Real Estate Accounting Principles:

The Company treats the valuation of its real estate in accordance with FASB ASC 805, Fair Value Measurements, which provides for the companies accounting valuation of real estate. FASB ASC 805 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Company has valued its real estate using the three valuation approaches defined in FASB ASC 805: The market approach, which uses observable prices and other relevant information derived from market transactions involving identical or comparable assets or liabilities, The income approach, which uses valuation technique to convert future benefits or costs, usually in the form of cash flows, into a present-value amount. Examples of an income approach include the discounted cash flow method and the direct capitalization method, and the cost approach, which uses estimates of the cost to replace an asset’s service capacity.

Revenue recognition on the sale of real estate.

Rental revenue from leases on real estate investments is recognized on a straight-line basis over the term of the lease, regardless of when payments are contractually due.

Interest Recognition on Notes Receivable:

Interest income is not recognized on notes receivable that have been delinquent for 60 days or more. In addition, accrued but unpaid interest income is only recognized to the extent that the net realizable value of the underlying collateral exceeds the carrying value of the receivable.

Foreign currency translation:

Foreign currency transactions are translated applying the current rate method. Assets and liabilities are translated at current rates.

Stockholders' equity accounts are translated at the appropriate historical rates and revenue and expenses are translated at weighted average rates for the year. Exchange rate differences that arise between the rate at the transaction date and the one in effect at the payment date, or at the balance sheet date, are recognized in the income statement.

Income Taxes:

The Company accounts for income taxes under the asset and liability method of accounting. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is required when it is less likely than not that the Company will be able to realize all or a portion of its deferred tax assets. Because it is doubtful that the net operating losses of recent years will ever be used, a valuation allowance has been recognized equal to the tax benefit of net operating losses generated.

Net Earnings per Share:

Basic earnings per share is computed by dividing income available to common shareholders by the weighted-average number of common shares available. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

Cash and Cash Equivalents:

For purposes of the statement of cash flows, the Company considers all highly-liquid investments purchased with original maturities of three months or less to be cash equivalents.

The Company maintains its cash in bank deposit accounts which, at June 30, 2016 did not exceed federally insured limits. The Company has not experienced any losses in such accounts and believes that it is not exposed to any significant credit risk on such amounts.

Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reported period. Actual results could differ from those estimates.

Concentrations of Credit Risk:

Financial instruments that potentially subject the Company to major credit risk consist principally of a single subsidiary of Anton Nielsen Vojens ApS.

Subsequent Events:

A report on Form 8-K was filed on August 11, 2016 stating that on August 05, 2016, the Company was notified by CHR. Mortensen Revisionsfirma ("Accountants") that the Accountants have resigned as the Company's independent auditors. The Accountant's audit reports on the Company's consolidated financial statements for the fiscal years ended June 30, 2014 and 2015 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the Company's fiscal years ended June 30, 2014 and 2015 and the subsequent interim period preceding the date of Accountant's resignation, there were no "disagreements," as that term is defined in Item 304(a) of Regulation S-K and the instructions related thereto, with the Accountants on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreement(s), if not resolved to the satisfaction of the Accountants, would have caused the Accountants to make reference to the subject matter of the disagreement(s) in connection with its report. During the Company's fiscal years ended June 30, 2014 and 2015 and the subsequent interim period preceding the date of Accountant's resignation, there were no "reportable events", as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the instructions related thereto. The Company has provided the Accountants with a copy of the disclosures set forth above in Item 4.01 of this Current Report on Form 8-K and has requested that the Accountants furnish the Company with a letter addressed to the Securities and Exchange Commission stating whether the Accountants agree with the statements set forth above in Item 4.01 of this Current Report on Form 8-K and, if not, stating the respects in which the Accountants do not agree. A copy of the letter from the Accountants to the Securities and Exchange Commission dated August 05, 2016 is filed as Exhibit II to this Current Report on Form 8-K. Engagement of Accountants: On August 05, 2016 the Company has engaged Sadler, Gibb & Associates, LLC, 2455 E. Parleys Way, Suite 320, Salt Lake City, UT 84109, (801)783-2960 ("New Accountants") as its certified accounting firm/outside auditor. Additionally, the Company has not consulted the New Accountants regarding:(i) The application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on the issuer's financial statements and either written or oral advice was provided that was an important factor considered by the issuer in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) Any matter that was the subject of a disagreement or event identified in response to paragraph (a)(1)(iv) of Regulation S-B section §228.304 (Item 304). The Company has provided the New Accountants with a copy of the disclosures set forth above in Item 4.01 of this Current Report on Form 8-K.

Recently Issued Accounting Standards:

In February 2015, the FASB issued Accounting Standards Update No. 2015-02 (ASU 2015-02) "Consolidation (Topic 810): Amendments to the Consolidation Analysis." ASU 2015-02 changes the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. It is effective for annual reporting periods, and interim periods within those years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period. We do not anticipate that the adoption of ASU 2015-02 will have any impact on our consolidated financial statements.

Other recent accounting pronouncements issued by the FASB did not or are not believed by management to have a material impact on the Company's present or future financial statements.

RESULTS OF OPERATIONS 2016 COMPARED TO 2015

REVENUES. Revenues from operations were $36,227 in 2016 compared to $38,585 in 2015. The decrease was attributable to the currency fluctuations.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES. G&A expenses were $4,503 in 2016 compared to $4,196 in 2015. The expenses are attributable to ANV's normal operations and the Company's SEC compliance and the fluctuations are attributable to currency fluctuations and accounting costs.

INTEREST EXPENSE. Interest expense was $8,273 in 2016 compared to $10,410 in 2015. Interest expense for 2016 decreased due to currency fluctuations.

NET INCOME (LOSS) ATTRIBUTED TO COMMON STOCKHOLDERS. Net income (loss) attributed to common stockholders was $11,021 or $0.0048 per share for 2016 as compared to $18,164 or $0.0078 per share for 2015 and mainly attributable to the currency fluctuations.

LIQUIDITY AND CAPITAL RESOURCES. As of June 30, 2016 the Company had $46,170 of cash and cash equivalents and working capital deficit of $208,433 compared to June 30, 2015 the Company had $68,260 of cash and cash equivalents and working capital deficit of $194,854. The change in cash is primarily due to the ANV'S payment of debt and normal operations. The decrease in the working capital is primarily related to the operations of ANV.

Net cash provided by (used by) operating activities for 2016 and 2015 was $(11,756) and $2,354 respectively.

Net cash provided from (used for) financing activities for 2016 and 2015 was $(24,963) and $(64,794) respectively. Net cash provided from or used for financing activities for both periods is related to the company's borrowings from banks, officers and directors, and the repayment of debt.

OFF BALANCE SHEET ARRANGEMENTS

We do not currently have any off balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE MARKET DISCLOSURES ABOUT RISK

Not required.

ITEM 8. AUDITED FINANCIAL STATEMENTS

See the consolidated financial statements on Exhibit F for the period ending June 30, 2016 and June30, 2015.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH AUDITORS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURE

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer (CEO) and our Chief Financial Officer (CFO), we conducted an evaluation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (Exchange Act), as of the end of the period covered by this Annual Report on Form 10-K. Based upon that evaluation, our CEO and our CFO have concluded that the design and operation of our disclosure controls and procedures were not effective to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms and (ii) is accumulated and communicated to our management, including our CEO and CFO, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There were no changes to our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during the last quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management's Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934). Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework set forth in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on our evaluation under the framework set forth in Internal Control - Integrated Framework, our management concluded that our internal control over financial reporting was not effective as of June 30, 2016.

Inherent Limitations on Effectiveness of Controls

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all errors and all fraud. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities and Exchange Act of 1934, as amended (“Exchange Act”), means controls and other procedures of a company that are designed to ensure that information required to be disclosed by the company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures also include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Our disclosure controls and procedures and our internal controls over financial reporting have been designed to provide reasonable assurance of achieving their objectives. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected.

ITEM 9B. OTHER INFORMATION.

Not applicable.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, CONTROL PERSONS AND CORPORATE GOVERNANCE: COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Set forth below is information regarding the Company's directors and executive officers, including information furnished by them as to their principal occupations for the last five years, other directorships held by them and their ages as of June 30, 2016. All directors are elected for one-year terms, which expire as of the date of the Company's annual meeting.

Name | | Age | | Position | | Director Since: |

Robert E. Wolfe | | 53 | | Chairman of the Board, CEO, and CFO | | 1997 |

Lawrence Donofrio | | 65 | | Director | | 2003 |

Robert Wolfe has been the Chairman and CEO for Advanced Oxygen Technologies Inc. since 1997. Concurrently he has been the President and CEO of Crossfield, Inc. and Crossfield Investments, llc , both corporate consulting companies. From January 1, 2014 to April 28, 2015, Mr. Wolfe was CFO and Director respectively of Dandrit Biotech USA, Inc., a company that engages in the research and development, manufacturing and clinical trials of pharmaceutical and biological products for the human treatment of cancer using the dendritic cell technology. From 1992-1993 he was Vice President and partner for CFI, NY Ltd. A Subsidiary of Corporate Financial Investments, PLC, London.

Lawrence Donofrio has been a director of the Company and a member of the Compensation Committee since March 2003. He graduated from Hamilton College with a BA in English studies. He then worked at Citibank for three years as a financial analyst, and five years as a private financial consultant. He then took a position with Bankers Trust for two years and since 1982 has been a private consultant in the financial industry.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and persons who beneficially own more than 10% of a registered class of our securities to file with the SEC reports of ownership and changes in ownership of the common stock and other equity securities. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. No officer, director or Section 16(a) officer has sold or acquired any of our stock during the last calendar year, thus not requiring any reports under Section 16(a) to be filed.

Audit Committee Financial Expert

As of June 30, 2016, we do not have an audit committee financial expert, as that term is defined in Item 407(d)(5) of Regulation S-B, because at this time our current level of operations and the cost of retaining such a financial expert are prohibitive. The Board of Directors as a whole fulfilled the duties normally assigned to an audit committee.

Code of Ethics

As of June 30, 2016, we have a code of ethics that applies to our Principal Executive Officer and Principal Financial and Accounting Officer(s) and to all of our staff. While we are a small company we believe that our code of ethics directs the Company to practice its business in an ethical way.

Procedure for Nominating Directors

We have not made any material changes to the procedures by which security holders may recommend nominees to our Board of Directors. The Board does not have a written policy or charter regarding how director candidates are evaluated or nominated for the Board. Our directors annually review all director performance over the prior year and make recommendations to the Board of Directors for future nominations.

ITEM 11. EXECUTIVE COMPENSATION

Robert Wolfe, Chairman and CEO has waived his $350,000 annual salary for the year ending June 30, 2016. No officer or director received any compensation from the Company during the last fiscal year. The Company paid no bonuses in the last three fiscal years ended June 30, 2016 to officers or other employees.

The following table sets forth the total compensation paid or accrued to its Chief Executive Officer and Chief Financial Officer, Robert E. Wolfe during the fiscal year ending June 30, 2016. There were no other corporate officers in any of the last three fiscal years.

EXECUTIVE COMPENSATION

Name | | Yr. | | Salary | | | Bonus | | | Other

Compensation | | | Restricted Awards | | | LTIP Awards | | | Other | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Robert E. Wolfe | | 2016 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

EMPLOYMENT AGREEMENTS

We do not currently have any oral or written employment contracts, severance or change-in-control agreements with any of our executive officers.

OPTION GRANTS DURING 1999; VALUE OF OPTIONS AT YEAR-END

The following tables set forth certain information covering the grant of options to the Company's Chief Executive Officer and Chief Financial Officer, Robert E. Wolfe during the fiscal year ended June 30, 2016 and unexercised options held as of that date. Mr. Wolfe did not exercise any options during fiscal 2016.

Name | | # of Securities | | | % Total Options | | | Option Price | | | Exercise

Price | | | Expiration Date | |

| | | | | | | | | | | | | | | | | | | | |

Robert E. Wolfe | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Compensation Committee Report

The Compensation Committee of the Board of Directors was responsible for reviewing and approving the Company's compensation policies and the compensation paid to executive officers. Mr. Wolfe and Mr. Donofrio, who comprise the Compensation Committee are employee and non-employee directors respectively.

Compensation Philosophy

The general philosophy of the Company's compensation program, which has been reviewed and endorsed by the Committee, was to provide overall competitive compensation based on each executive's individual performance and the Company's overall performance.

There are two basic components in the Company's executive compensation program: (i) base salary and (ii) stock option awards.

Base Salary

Executive Officers' salaries are targeted at the median range for rates paid by competitors in comparably sized companies. The Company recognizes the need to attract and retain highly skilled and motivated executives through a competitive base salary program, while at the same time considering the overall performance of the Company and returns to stockholders.

Stock Option Awards

With respect to executive officers, stock options are generally granted on an annual basis, usually at the commencement of the new fiscal year. Generally, stock options vest ratably over a four-year period and the executive must be employed by the Company in order to vest the options. The Compensation Committee believes that the stock option grants provide an incentive that focuses the executives' attention on managing the Company from the perspective of an owner with an equity stake in the business. The option grants are issued at no less than 85% of the market price of the stock at the date of grant, hence there is incentive on the executive's part to enhance the value of the stock through the overall performance of the Company.

Compensation Pursuant to Plans

The Company has three plans (the "Plans") under which its directors, executive officers and employees may receive compensation. The principal features of the 1981 Long-Term Incentive Plan (the "1981 Plan"), the 1988 Stock Option Plan (the "1988 Plan"), and the Non-Employee Director Plan (the "Director Plan") are described below. During the fiscal year ended June 30, 1994, the Company terminated its tax qualified cash or deferred profit-sharing plan (the "401(k) Plan"). During fiscal 2014, no executive officer received compensation pursuant to any of the Plans.

The 1981 and 1988 Plans

The purpose of the 1981 Plan and 1988 Plan (the "Option Plans") is to provide an incentive to eligible directors, consultants and employees whose present and potential contributions to the Company are or will be important to the success of the Company by affording them an opportunity to acquire a proprietary interest in the Company and to enable the Company to enlist and retain in its employ the best available talent for the successful conduct of its business.

The 1981 Plan

The 1981 Plan was adopted by the Board of Directors in May 1981 and approved by the Company's stockholders in March 1982. A total of 500,000 shares have been authorized for issuance under the 1981 Plan. With the adoption of the 1988 Plan, no additional awards may be made under the 1981 Plan. As a result, the shares remaining under the 1981 Plan are now available solely under the 1988 Plan. Prior to its termination, the 1981 Plan provided for the grant of the following five types of awards to employees (including officers and directors) of the Company and any subsidiaries: (a) incentive stock rights, (b) incentive stock options, (c) non-statutory stock options, (d) stock appreciation rights, and (e) restricted stock. The 1981 Plan is administered by the Compensation Committee of the Board of Directors.

The 1988 Plan

The 1988 Plan provides for the grant of options to purchase Common Stock to employees (including officers) and consultants of the Company and any parent or subsidiary corporation. The aggregate number of shares which remained available for issuance under the 1981 plan as of the effective date of the 1988 Plan plus an additional 500,000 shares of Common Stock.

Options granted under the 1988 Plan may either be immediately exercisable for the full number of shares purchasable thereunder or may become exercisable in cumulative increments over a period of months or years as determined by the Compensation Committee. The exercise price of options granted under the 1988 Plan may not be less than 85% of the fair market value of the Common Stock on the date of the grant and the maximum period during which any option may be paid in cash, in shares if the Company's Common Stock or through a broker-dealer same-day sale program involving a cash-less exercise of the option. One or more optionees may also be allowed to finance their option exercises through Company loans, subject to the approval of the Compensation Committee.

Issuable Shares

As of September 20, 1995, approximately 374,000 shares of Common Stock had been issued upon the exercise of options granted under the Option Plans, no shares of Common Stock were subject to outstanding options under the Options Plans and 626,000 shares of Common Stock were available for issuance under future option grants. From July 1, 1991 to September 20, 1995, options were granted at exercise prices ranging from $1.22 to $8.15 per share. The exercise price of each option was equal to 85% of the closing bid price of Company's Common Stock as reported on the NASDAQ Over the Counter Bulletin Board Exchange. Due to employee terminations, all options became void in August 1995. As of September 30, 2001, 1,000,000 shares of Common Stock were available for issuance under future option grants and were still available at June 30, 2016.

Board of Directors Compensation

As of June 30, 2016 the directors did not receive any compensation for serving as members of the Board.

In addition to any cash compensation, non-employee directors also are eligible to participate in the Non-Employee Director Stock Option Plan and to receive automatic option grants thereunder. The Director Plan provides for periodic automatic option grants to non-employee members of the Board. An individual who is first elected or appointed as a non-employee Board member receives an annual automatic grant of 25,000 shares plus the first annual grant of 5,000 shares, and will be eligible for subsequent 5,000 share grants at the second Annual Meeting following the date of his initial election or appointment as a non-employee Board member.

During the fiscal year ended June 30, 2016, no options were granted to non-employee Board members.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of June 30, 2016, by (i) all those known by the Company to be beneficial owners of more than 5% of its Common Stock; (ii) all directors; and (iii) all officers and directors of the Company as a group.

Name and Address of Beneficial Owner | | No. Shares

fully diluted | | | Percent ownership | |

Hennistone Projects Ltd.2 Eastglade Northwood Middlessex, HA6 3LD UK | | | 588,000 | | | | 25.65 | % |

Crossland, ltd. 104B Saffrey Square, Nassau, Bahamas | | | 296,876 | | | | 12.94 | % |

Crossland Ltd. Belize, 60 Market Square, PO Box 364, Belize City, Belize, Central America | | | 306,626 | | | | 13.77 | % |

Eastern Star, Ltd, Bay Street Nassau Bahamas | | | 135,600 | | | | 5.91 | % |

Robert E. Wolfe, New York, NY | | | 4,500 | | | | 0.196 | % |

Lawrence Donofrio, San Diego CA | | | 0 | | | | 0.00 | % |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

The Company's transactions with its officers, directors and affiliates have been and such future transactions will be, on terms no less favorable to the Company than could have been realized by the Company in arms-length transactions with non-affiliated persons and will be approved by a majority of the independent disinterested directors.

On February 3, 2006 the Company purchased 100.00% of the stock of Anton Nielsen Vojens ApS ("ANV"), a Danish company from Borkwood Development Ltd. , a prior shareholder of AOXY. At the time of the transaction, a director of Borkwood Development, Ltd., Aage Madsen was also a director of Anton Nielsen Vojens ApS. As of May 25, 2007, Mr. Madsen is not a director, owner, beneficiary or affiliate of the Company or its wholly owned subsidiary Anton Nielsen Vojens, ApS.

Director Independence

During the year ended June 30, 2016, Robert Wolfe and Lawrence Donofrio served as our directors and only Mr. Donofrio is an independent director as he has no ownership, employment, or business interaction with the Company. We are currently traded on the Over-the-Counter Bulletin Board system and specifically the OTCQB. The OTCQB does not require that a majority of the Board be independent.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Company's auditors for the period ending June 30, 2016 was Sadler Gibb & Associates, LLC, 22455 East Parleys Way, Suite 320, Salt Lake City, UT 84109, tel)(901)783-2950. The Company's auditors for the periods ending June 30, 2015, June 30, 2014, June 30, 2013 and June 30, 2012 was CHR. Mortensen Revisionsfirma. The Company's wholly owned subsidiary's local Danish accountant is IN-REVISION STATSAUTORISEREDE REVISORER A/S, Gersonsvej 7, 2900 Hellerup. The local auditors, IN-REVISION have performed work for ANV that included tax work and Danish Standards auditing work on ANV's yearly balance sheet and the profit/loss statement for the Danish Tax Authority and the Danish Ministry of Commerce. We have paid or expect to pay the following fees to Sadler Gibb & Associates and CHR. Mortensen Revisionsfirma for work performed for the fiscal years ending Junes 30, 2016, and June 30, 2015, attributable to the audits of financial statements and Internal Control over Financial Reporting for the same periods:

Year ending June 30, | | 2016 | | | 2015 | |

Audit-Related Fees | | $ | 5,739 | | | $ | 8,884 | |

Tax and consulting Fees | | $ | 1,489 | | | $ | 6,543 | |

Other fees | | | - | | | | - | |

The aggregate fees billed include amounts for an interim review of Form 10Q, review of SEC correspondence, the audit of the consolidated financial statements for 2016, and the Internal Control over Financial Reporting.

In January 2003, the SEC released final rules to implement Title II of the Sarbanes-Oxley Act of 2003. The rules address auditor independence and have modified the proxy fee disclosure requirements. Audit fees include fees for services that normally would be provided by the accountant in connection with statutory and regulatory filings or engagements and that generally only the independent accountant can provide. In addition to fees for an audit or review in accordance with generally accepted auditing standards, this category contains fees for comfort letters, statutory audits, consents, and assistance with and review of documents filed with the SEC. Audit-related fees are assurance-related services that traditionally are performed by the independent accountant, such as employee benefit plan audits, due diligence related to mergers and acquisitions, internal control reviews, attest services that are not required by statute or regulation, and consultation concerning financial accounting and reporting standards.

The board has reviewed the fees paid to Sadler Gibb & Associates LLC and CHR. Mortensen Revisionsfirma and has considered whether the fees paid for non-audit services are compatible with maintaining Sadler Gibb & Associates LLC independence. The board has also adopted policies and procedures to approve audit and non-audit services provided in the fiscal year 2016 by Sadler Gibb & Associates LLC and CHR. Mortensen Revisionsfirma in accordance with the Sarbanes-Oxley Act and rules of the SEC promulgated thereunder. These policies and procedures involve annual pre-approval by the board of the types of services to be provided by our independent auditor and fee limits for each type of service on both a per-engagement and aggregate level. The board may additionally ratify certain de minimis services provided by the independent auditor without prior board approval, as permitted by the Sarbanes-Oxley Act and rules of the SEC promulgated thereunder.

PART IV

ITEM 15: EXHIBITS AND REPORTS ON FORMS 8K,

Reports filed on Form 8-K for the year ending June 30, 2016:

None.

Exhibits

Exhibit Number | | Description of the Document |

3.1 | | Certificate of Incorporation as Amended and filed with the Secretary of State of Delaware effective on December 5, 2014(1) |

3.2 | | Bylaws.(1) |

31.1 | | Certification of Chief Executive Officer pursuant to Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

31.2 | | Certification of Chief Financial Officer pursuant to Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

32.1 | | Certification of Chief Executive Officer in accordance with 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

32.2 | | Certification of Chief Financial Officer in accordance with 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

101.INS | | XBRL Instance |

101.SCH | | XBRL Taxonomy Extension Schema Document |

101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB | | XBRL Taxonomy Extension Labels Linkbase Document |

101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document |

Reports Filed on Form 8-K

A report on Form 8-K was filed on December 5, 2014, stating that the Company effected a reverse stock split of all the outstanding shares of our common stock at an exchange ratio of one for twenty (1:20) (the “Reverse Stock Split”) and changed the number our authorized shares of common stock, par value $0.01 per share, from 90,000,000 to 60,000,000 while maintaining the number of authorized shares of preferred stock, par value $0.01 per share, at 10,000,000 (the “Amendment”). Immediately prior to the effectiveness of the Amendment, we had outstanding 45,853,585 shares of common stock. As a result of the Amendment, the 45,853,585 shares of common stock outstanding have been reduced to approximately 2,292,945 shares of common stock (taking into account the rounding up of fractional share interests). The Reverse Stock Split described hereunder became market effective on December 8, 2014. FINRA has placed a “D” on the ticker symbol for 20 business days to signify that the Reverse Stock Split has occurred. As a result, effective as of December 8, 2014 and for the next 20 business days, our stock will trade under the symbol “AOXYD”. Our new CUSIP number is 00754B301.

A report on Form 8-K was filed on August 11, 2016 stating that on August 05, 2016, the Company was notified by CHR. Mortensen Revisionsfirma ("Accountants") that the Accountants have resigned as the Company's independent auditors. The Accountant's audit reports on the Company's consolidated financial statements for the fiscal years ended June 30, 2014 and 2015 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the Company's fiscal years ended June 30, 2014 and 2015 and the subsequent interim period preceding the date of Accountant's resignation, there were no "disagreements," as that term is defined in Item 304(a) of Regulation S-K and the instructions related thereto, with the Accountants on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreement(s), if not resolved to the satisfaction of the Accountants, would have caused the Accountants to make reference to the subject matter of the disagreement(s) in connection with its report. During the Company's fiscal years ended June 30, 2014 and 2015 and the subsequent interim period preceding the date of Accountant's resignation, there were no "reportable events", as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the instructions related thereto. The Company has provided the Accountants with a copy of the disclosures set forth above in Item 4.01 of this Current Report on Form 8-K and has requested that the Accountants furnish the Company with a letter addressed to the Securities and Exchange Commission stating whether the Accountants agree with the statements set forth above in Item 4.01 of this Current Report on Form 8-K and, if not, stating the respects in which the Accountants do not agree. A copy of the letter from the Accountants to the Securities and Exchange Commission dated August 05, 2016 is filed as Exhibit II to this Current Report on Form 8-K. Engagement of Accountants: On August 05, 2016 the Company has engaged Sadler, Gibb & Associates, LLC, 2455 E. Parleys Way, Suite 320, Salt Lake City, UT 84109, (801)783-2960 ("New Accountants") as its certified accounting firm/outside auditor. Additionally, the Company has not consulted the New Accountants regarding:(i) The application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on the issuer's financial statements and either written or oral advice was provided that was an important factor considered by the issuer in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) Any matter that was the subject of a disagreement or event identified in response to paragraph (a)(1)(iv) of Regulation S-B section §228.304 (Item 304). The Company has provided the New Accountants with a copy of the disclosures set forth above in Item 4.01 of this Current Report on Form 8-K.

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant): ADVANCED OXYGEN TECHNOLOGIES, INC. |

| |

| Date: October 17, 2016 | |

| |

| By (Signature and Title): | |

| |

/s/ Robert E. Wolfe /s/ | |

Robert E. Wolfe, President | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Date: October 17, 2016

By (Signature and title):

/s/ Lawrence Donofrio /s/

Lawrence Donofrio, Director

EXHIBIT F

FINANCIAL STATEMENTS AND REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ADVANCED OXYGEN TECHNOLOGIES, INC. AND SUBSIDIARY June 30, 2016 |

|

Table of Contents |

| | Page | |

| | | |

Report of Independent Registered Public Accounting Firm for period ending June 30, 2016 | | F-2 | |

| | | |

Report of Independent Registered Public Accounting Firm for period ending June 30, 2015 | | F-3 | |

| | | |

Consolidated Balance Sheet as of June 30, 2016, and June 30, 2015 | | F-4 | |

| | | |

Consolidated Statements of Operations for the period ending June 30, 2016 and June 30, 2015 | | F-5 | |

| | | |

Consolidated Statements of Stockholders' Equity (Capital Deficiency) for the period ending June 30, 2016 and June 30, 2015 | | F-6 | |

| | | |

Consolidated Statements of Cash Flows for the period ending June 30, 2016 and June 30, 2015 | | F-7 | |

| | | |

Notes to Consolidated Financial Statements | | F-8 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Advanced Oxygen Technologies, Inc. and subsidiary

We have audited the accompanying consolidated balance sheets of Advanced Oxygen Technologies, Inc. and subsidiary (“the Company”) as of June 30, 2016, and the related consolidated statements of operations and comprehensive loss, stockholders’ deficit and cash flows for the year-ended June 30, 2016. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Advanced Oxygen Technologies, Inc. and subsidiary as of June 30, 2016, and the results of its operations and its cash flows for each of the year in the one year period ended June 30, 2016, in conformity with accounting principles generally accepted in the United States of America.

/s/Sadler,Gibb&Associates,LLC

Salt Lake City, UT

October 17, 2016

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareowners and Directors of Advanced Oxygen Technologies Inc.