Third Quarter 2016 Summary

- Diluted earnings per share of $0.33

and net income of $9.2 million

- Total loan growth of $169 million,

or 23% annualized

- Non-performing assets to total

assets of 0.17%

- Non-maturity deposit growth of $176

million, or 30% annualized

- Non-interest bearing deposits

account for 37.9% of total deposits, highest in company

history

- Total revenues increase to $45

million, or 28% annualized

- Core net interest margin of

4.18%

- ROAA and ROATCE of 1.00% and 11.52%,

respectively

- Tangible book value per share

increased $0.35 to $12.22

- Efficiency ratio of 57%

Pacific Premier Bancorp, Inc. (NASDAQ: PPBI) (the “Company”),

the holding company of Pacific Premier Bank (the “Bank”), reported

net income for the third quarter of 2016 of $9.2 million, or $0.33

per diluted share, compared with net income of $10.4 million, or

$0.37 per diluted share, for the second quarter of 2016 and net

income of $7.8 million, or $0.36 per diluted share, for the third

quarter of 2015.

For the three months ended September 30, 2016, the

Company’s return on average assets was 1.00% and return on average

tangible common equity was 11.52%. For the three months ended

June 30, 2016, the Company's return on average assets was

1.17% and the return on average tangible common equity was 13.48%.

For the three months ended September 30, 2015, the Company's

return on average assets was 1.19% and its return on average

tangible common equity was 14.25%.

Steve R. Gardner, Chairman and Chief Executive Officer of the

Company, commented on the results, “We are disappointed with our

level of earnings this quarter, as higher credit costs and

non-recurring, non-interest expenses undermined the strong growth

we had in both loans and deposits.

“Following the Security Bank acquisition, we continue to see

improvement in our ability to attract new commercial customers. We

generated $322 million in new loan commitments in the third

quarter, a record level for the Bank. Our loan production is well

diversified with strong growth generated in all of our major

portfolios. The new client acquisition activity is also driving

strong inflows of core deposits, with the largest increases coming

in non-interest bearing deposits. We continue to execute very well

on our efforts to build a highly diversified loan portfolio and a

low cost deposit base.

“Our credit costs were elevated this quarter, which was

primarily driven by a specific reserve of $2.0 million established

for one commercial credit that deteriorated rapidly after several

years of good performance. Aside from this one issue, we continue

to see positive credit trends in the loan portfolio, as

nonperforming assets to total assets was 17 basis points and

delinquency as a percent of total loans was just 18 basis

points.

“We recorded an aggregate of approximately $1.4 million of

one-time costs to certain non-interest expense items in the third

quarter related primarily to compensation, data processing and

marketing expenses, which resulted in higher than expected

non-interest expense. Excluding these items, our non-interest

expense would have been in the $24 million to $25 million range,

which is in line with our expected quarterly non-interest expense

going forward for the foreseeable future. Our third quarter

non-interest expense, excluding these one-time costs, reflects the

full quarter impact of the additions we have made throughout the

organization in 2016 to strengthen our infrastructure and upgrade

personnel in key areas such as business development, finance and

compliance.

“Following the investments we have made in 2016, we believe that

we are well positioned to manage the continued growth of the Bank

and that our business development capabilities are strong. As we

continue to drive quality balance sheet growth, we believe we will

see improved efficiencies and stronger profitability,” said Mr.

Gardner.

FINANCIAL HIGHLIGHTS

Three Months Ended September 30,

June 30,

September 30, 2016 2016 2015

Financial Highlights (dollars in thousands, except per share

data) Net income $ 9,227 $ 10,369 $ 7,837 Diluted EPS $ 0.33 $ 0.37

$ 0.36 Return on average assets 1.00 % 1.17 % 1.19 % Adjusted

return on average assets (1)(2) 1.00 % 1.20 % 1.25 % Adjusted net

income (1)(2) $ 9,227 $ 10,676 $ 8,237 Return on average tangible

common equity (2) 11.52 % 13.48 % 14.25 % Adjusted return on

average tangible common equity (1)(2) 11.52 % 13.86 % 14.96 % Net

interest margin 4.41 % 4.48 % 4.22 % Cost of deposits 0.28 % 0.28 %

0.32 % Efficiency ratio (3) 57.0 % 54.4 % 53.6 %

(1) Adjusted to exclude merger related, net of tax.

(2) A reconciliation of the non-GAAP measures of average tangible

common equity to the GAAP measures of common stockholders' equity

is set forth at the end of this press release. (3) Represents the

ratio of non-interest expense less other real estate owned

operations, core deposit intangible amortization and non-recurring

merger related to the sum of net interest income before provision

for loan losses and total non-interest income, less gains/(loss) on

sale of securities and other-than-temporary impairment

recovery/(loss) on investment securities.

INCOME STATEMENT HIGHLIGHTS

Net Interest Income and Net Interest Margin

Net interest income totaled $39.0 million in the third quarter

of 2016, an increase of $1.4 million or 3.9% from the second

quarter of 2016. The increase in net interest income reflected an

increase in average interest-earning assets of $147 million,

partially offset by a decrease in accretion income. The increase in

average interest-earning assets during the third quarter of 2016

was primarily related to record organic loan originations and the

purchase of $83 million of multi-family loans.

The decrease in the net interest margin from 4.48% to 4.41% was

primarily due to the decrease in accretion income. Excluding the

impact of accretion, the portfolio core net interest margin was

4.18% in the third quarter of 2016 compared to 4.19% in the second

quarter of 2016, with accretion contributing 23 basis points in the

third quarter of 2016 as compared to 29 basis points in the second

quarter of 2016.

Net interest income for the third quarter of 2016 increased

$12.3 million or 46.1% compared to the third quarter of 2015. The

increase was related to an increase in average interest-earning

assets of $1.0 billion, which resulted primarily from our organic

loan growth since the end of the third quarter of 2015 and our

acquisition of Security during the first quarter of 2016. Our net

interest margin for the third quarter of 2016 increased 19 basis

points to 4.41% from the prior year. The expansion of the net

interest margin was driven by a 10 basis point increase in the

yield on earning assets, and a 10 basis point decrease in cost of

funds.

Net interest margin information is presented in the following

table for the periods indicated.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED AVERAGE BALANCES AND YIELD DATA

Three Months Ended Three

Months Ended Three Months Ended

September 30, 2016 June 30, 2016 September 30,

2015

Average

Balance

Interest

Average

Yield/

Cost

Average

Balance

Interest

Average

Yield/

Cost

Average

Balance

Interest

Average

Yield/

Cost

Assets (dollars in thousands) Cash and cash

equivalents $ 201,140 $ 232 0.46 % $ 177,603 $ 189 0.43 % $ 124,182

$ 63 0.20 % Investment securities 316,253 1,710 2.16 299,049 1,650

2.21 306,623 1,749 2.28 Loans receivable, net (1) 2,998,153

40,487 5.37 2,892,236 39,035 5.43

2,080,281 27,935 5.33 Total

interest-earning assets $ 3,515,546 $ 42,429 4.80 % $

3,368,888 $ 40,874 4.88 % $ 2,511,086 $ 29,747

4.70 %

Liabilities Interest-bearing

deposits $ 1,921,741 $ 2,136 0.44 % $ 1,864,253 $ 2,010 0.43 % $

1,464,577 $ 1,719 0.47 % Borrowings 167,531 1,284

3.05 170,065 1,303 3.08 190,408

1,332 2.77 Total interest-bearing liabilities $

2,089,272 $ 3,420 0.65 % $ 2,034,318 $ 3,313

0.66 % $ 1,654,985 $ 3,051 0.73 % Non-interest

bearing deposits $ 1,134,318 $ 1,060,097 $ 674,795

Net interest income $ 39,009 $ 37,561 $ 26,696

Net interest margin (2) 4.41 % 4.48 % 4.22 % (1)

Average balance includes nonperforming loans and is net of deferred

loan origination fees, unamortized discounts and premiums. (2)

Represents net interest income divided by average interest-earning

assets.

Provision for Loan Losses

A provision for loan losses was recorded for the current quarter

in the amount of $4.0 million, compared with a provision for loan

losses of $1.6 million in the quarter ending June 30, 2016.

Specific reserves on two loans totaling $2.4 million were recorded

in the current quarter with the remaining $1.6 million in provision

primarily related to growth in the loan portfolio. Net loan

charge-offs were $1.1 million for the third quarter.

Non-interest income

Non-interest income for the third quarter of 2016 was $6.0

million, an increase of $1.5 million or 34.1% from the second

quarter of 2016. The increase from the second quarter of 2016 was

primarily related to a $1.0 million increase in net gain from the

sale of loans, as well as a $0.5 million increase in recoveries on

previously charged-off, acquired loans. During the current quarter,

$38.8 million in SBA loans and other loans were sold compared to

$22.7 million in the prior quarter.

Compared to the third quarter of 2015, non-interest income for

the third quarter of 2016 increased $1.6 million or 36.3%. The

increase includes an increase of $0.6 million in net gain from

sales of loans, a higher net gain from the sales of investment

securities of $0.5 million, a $0.3 million increase in other income

and a $0.2 million increase in deposit fees.

Three Months Ended September 30,

June 30,

September 30, 2016 2016 2015

NON-INTEREST INCOME (dollars in thousands) Loan servicing

fees $ 288 $ 257 $ 248 Deposit fees 829 817 629 Net gain from sales

of loans 3,122 2,124 2,544 Net gain from sales of investment

securities 512 532 38

Other-than-temporary impairment

recovery/(loss) on investment securities

2 — — Other income 1,215 720 919 Total non-interest

income $ 5,968 $ 4,450 $ 4,378

Non-interest Expense

Non-interest expense totaled $25.9 million for the third quarter

of 2016, an increase of $2.2 million or 9.1%, compared with the

second quarter of 2016. The increase was primarily driven by higher

compensation costs, specifically incentive compensation including

stock-based incentives, increased data processing costs, and higher

marketing costs.

In comparison to the third quarter of 2015, non-interest expense

grew by $8.5 million or 48.8%. The increase in expense was

primarily related to the additional costs from the personnel and

branches retained from the acquisition of Security, combined with

our continued investment in personnel to support our organic growth

in loans and deposits.

Three Months Ended September 30,

June 30,

September 30, 2016 2016 2015

NON-INTEREST EXPENSE (dollars in thousands) Compensation and

benefits $ 14,179 $ 13,098 $ 9,066 Premises and occupancy 2,633

2,559 2,120 Data processing and communications 1,223 887 681 Other

real estate owned operations, net 5 (15 ) 9 FDIC insurance premiums

442 401 355 Legal, audit and professional expense 676 446 505

Marketing expense 1,591 775 567 Office and postage expense 612 573

525 Loan expense 534 540 370 Deposit expense 1,315 1,196 917 Merger

related expense — 497 400 CDI amortization 525 645 344 Other

expense 2,125 2,093 1,515 Total non-interest expense

$ 25,860 $ 23,695 $ 17,374

Three Months Ended September 30,

June 30, September 30,

2016 2016 2015 Operating Metrics

Efficiency ratio (1) 57.0 % 54.4 % 53.6 % Non-interest expense to

average total assets (2) 2.74 % 2.59 % 2.58 % Full-time equivalent

employees, at period end 448 438 332

(1) Represents the ratio of non-interest

expense less other real estate owned operations, core deposit

intangible amortization and non-recurring merger related to the sum

of net interest income before provision for loan losses and total

non-interest income less, gains/(loss) on sale of securities and

other-than-temporary-impairment recovery/(loss) on investment

securities.

(2) Adjusted to exclude CDI amortization.

Income Tax

For the third quarter of 2016, our effective tax rate was 38.9%,

compared with 38.0% for the second quarter of 2016 and 38.0% for

the third quarter of 2015. The increase from the second quarter

reflects a true-up to the Company's anticipated full year tax rate

of 39%.

BALANCE SHEET HIGHLIGHTS

Loans

Loans held for investment totaled $3.09 billion at

September 30, 2016, an increase of $170 million or 5.8% from

June 30, 2016, and an increase of $923 million or 42.6% from

September 30, 2015. The increase from June 30, 2016, was

primarily due to $322 million in organic loan originations and

$85.4 million in loan purchases, partially offset by $173 million

in principal payments and $38.8 million in loan sales. The total

end of period weighted average interest rate on loans, excluding

fees and discounts, at September 30, 2016 was 4.80%, compared

to 4.84% at June 30, 2016 and 4.90% at September 30,

2015.

Loan activity during the third quarter of 2016 included organic

loan originations of $322 million, including commercial real estate

loans of $65.1 million, commercial and industrial loan originations

of $64.1 million, construction loan originations of $52.9 million,

franchise loan originations of $48.4 million and SBA loan

originations of $43.2 million. At September 30, 2016, our loan

to deposit ratio was 101.0%, compared with 99.6% and 101.3% at

June 30, 2016 and September 30, 2015, respectively.

Three Months Ended September 30,

June 30,

September 30, 2016 2016 2015 LOAN

ACTIVITY (dollars in thousands) Loans originated $ 322,405 $

298,742 $ 248,815 Loans purchased 85,395 — — Repayments (172,815 )

(190,026 ) (127,475 ) Loans sold (38,847 ) (22,746 ) (28,039 )

Change in undisbursed (31,915 ) (17,208 ) (45,085 ) Other 4,890

3,260 1,080 Increase in total loans, gross

169,113 72,022 49,296 Change in allowance

(2,888 ) (500 ) (1,045 ) Increase in total loans, net $ 166,225

$ 71,522 $ 48,251

September 30,

June 30, September

30, 2016 2016 2015 Loan Portfolio

(dollars in thousands) Business loans: Commercial and industrial $

537,809 $ 508,141 $ 288,982 Franchise 431,618 403,855 295,965

Commercial owner occupied 460,068 443,060 302,556 SBA 92,195 86,076

70,191 Warehouse facilities — — 144,274 Real estate loans:

Commercial non-owner occupied 527,412 526,362 406,490 Multi-family

689,813 613,573 421,240 One-to-four family 101,377 106,538 78,781

Construction 231,098 215,786 141,293 Land 18,472 18,341 12,758

Other loans 5,678 5,822 5,017 Total Gross

Loans 3,095,540 2,927,554 2,167,547 Less Loans held for sale, net

9,009 10,116 — Total gross loans

held for investment 3,086,531 2,917,438 2,167,547 Less: Deferred

loan origination costs/(fees) and premiums/(discounts) 4,308 3,181

309 Allowance for loan losses (21,843 ) (18,955 ) (16,145 ) Loans

held for investment, net $ 3,068,996 $ 2,901,664 $

2,151,711

Asset Quality and Allowance for Loan Losses

Non-performing assets totaled $6.4 million or 0.17% of total

assets at September 30, 2016, an increase from $4.8 million or

0.13% of total assets at June 30, 2016. During the third

quarter of 2016, non-performing loans increased $1.7 million to

total $5.7 million primarily as a result of two loans, and other

real estate owned remained unchanged at $0.7 million.

At September 30, 2016, the allowance for loan losses was

$21.8 million, an increase of $2.9 million from June 30, 2016.

Loan loss provision for the quarter was $4.0 million while net

charge-offs were $1.1 million. The increase in the allowance for

loan losses at September 30, 2016 was mainly attributable to

$2.4 million of specific reserves for two credits and loan growth

in certain segments of the loan portfolio.

At September 30, 2016, our allowance for loan losses as a

percent of non-accrual loans was 381%, a decrease from 467% at

June 30, 2016. The ratio of allowance for loan losses to total

loans at September 30, 2016 was 0.70%, compared to 0.65% and

0.74% at June 30, 2016 and September 30, 2015. Including

the loan fair market value discounts recorded in connection with

our acquisitions, the allowance for loan losses to total gross

loans ratio was 0.89% at September 30, 2016, compared with

0.89% at June 30, 2016 and 0.93% at September 30,

2015.

September 30, June 30,

September 30, 2016 2016

2015 Asset Quality (dollars in thousands) Non-accrual

loans $ 5,734 $ 4,062 $ 4,095 Other real estate owned 711

711 711 Non-performing assets $ 6,445 $ 4,773

$ 4,806 Allowance for loan losses $ 21,843 $

18,955 $ 16,145 Allowance for loan losses as a percent of total

non-performing loans 381 % 467 % 394 % Non-performing loans as a

percent of gross loans 0.18 % 0.14 % 0.19 % Non-performing assets

as a percent of total assets 0.17 % 0.13 % 0.18 % Net loan

charge-offs (recoveries) for the quarter ended $ 1,125 $ 1,089 $ 17

Net loan charge-offs for quarter to average total loans, net 0.04 %

0.04 % — % Allowance for loan losses to gross loans 0.70 % 0.65 %

0.74 %

Delinquent Loans: 30 - 59 days $ 1,042 $ 1,144 $ 702

60 - 89 days 1,990 2,487 25 90+ days 2,646 1,797

2,214 Total delinquency $ 5,678 $ 5,428 $

2,941 Delinquency as a % of total gross loans 0.18 % 0.19 %

0.14 %

Investment Securities

Investment securities available for sale totaled $313 million at

September 30, 2016, an increase of $67.7 million from

June 30, 2016, and $22.1 million from September 30, 2015.

The increase in the third quarter was primarily the result of $96.9

million in securities purchased, partially offset by $16.1 million

in securities sold.

Estimated Fair Value September 30,

June 30, September 30,

2016 2016 2015 Investment securities

available for sale: (dollars in thousands) Corporate $ 23,330 $

— $ — Municipal bonds 116,838 118,799 130,004 Collateralized

mortgage obligation 33,866 22,844 — Mortgage-backed securities

139,166 103,828 161,143 Total securities available

for sale $ 313,200 $ 245,471 $ 291,147

Investments held to maturity $ 9,004 $ 9,390 $ —

Deposits

At September 30, 2016, deposits totaled $3.06 billion, an

increase of $129 million or 4.4% from June 30, 2016 and $921

million or 43.0% from September 30, 2015. At

September 30, 2016, non-maturity deposits totaled $2.49

billion, an increase of $176 million or 7.62% from June 30,

2016 and an increase of $853 million or 52.2% from

September 30, 2015. During the third quarter of 2016, deposit

increases included $117 million in non-interest bearing deposits

and $57.6 million in money market/savings deposits, partially

offset by decreases of $36.6 million in retail certificate deposits

and $10.7 million in wholesale/brokered certificates of deposits.

The increase in non-maturity deposits was primarily due to

commercial relationship deposit increases and, to a lesser extent,

higher homeowner's association ("HOA") deposits. Due to the

increase in lower cost non-maturity deposits, certain retail and

wholesale/brokered deposits were allowed to mature.

The weighted average cost of deposits for the three month

periods ending September 30, 2016 and June 30, 2016 was

0.28%, compared to 0.32% for the three month period ending

September 30, 2015.

September 30, June 30,

September 30, 2016 2016

2015 Deposit Accounts (dollars in thousands)

Non-interest bearing checking $ 1,160,394 $ 1,043,361 $ 680,937

Interest-bearing: Checking 170,057 168,669 130,671 Money

market/Savings 1,157,086 1,099,445 822,876 Retail certificates of

deposit 384,083 420,673 383,481 Wholesale/brokered certificates of

deposit 188,132 198,853 121,242 Total

interest-bearing 1,899,358 1,887,640 1,458,270

Total deposits

$ 3,059,752 $ 2,931,001 $ 2,139,207

Deposit Mix (% of total deposits) Non-interest bearing

deposits 37.9 % 35.6 % 31.8 % Non-maturity deposits 81.3 % 78.9 %

76.4 %

Borrowings

At September 30, 2016, total borrowings amounted to $206

million, an increase of $15.0 million or 7.9% from June 30,

2016 and a decrease of $56.2 million from September 30, 2015.

At September 30, 2016, total borrowings represented 5.48% of

total assets, compared to 5.30% and 9.60%, as of June 30, 2016

and September 30, 2015, respectively.

September 30, 2016

June 30, 2016 September 30, 2015

Balance Weighted

Average Rate

Balance Weighted

Average Rate

Balance Weighted

Average Rate

(dollars in thousands) FHLB advances $ 90,000 0.38 % $ 75,000 0.59

% $ 144,000 0.38 % Reverse repurchase agreements 46,247 2.01 %

45,252 2.07 % 47,483 1.97 % Subordinated debentures 69,353

5.35 % 70,310 5.35 % 70,310 5.35 % Total borrowings $

205,600 2.44 % $ 190,562 2.65 % $ 261,793 2.00

% Weighted average cost of

borrowings during the quarter

3.05 % 3.08 % 2.77 % Borrowings as a percent of total assets 5.48 %

5.30 % 9.60 %

Capital Ratios

At September 30, 2016, our ratio of tangible common equity

to total assets was 9.28%, with book value per share of $16.27 and

tangible book value of $12.22 per share.

At September 30, 2016, the Bank exceeded all regulatory

capital requirements with a ratio for tier 1 leverage capital of

11.03%, common equity tier 1 risk-based capital of 12.07%, tier 1

risk-based capital of 12.07% and total risk-based capital of

12.77%. These capital ratios exceeded the “well capitalized”

standards defined by the federal banking regulators of 5.00% for

tier 1 leverage capital, 6.5% for common equity tier 1 risk-based

capital, 8.00% for tier 1 risk-based capital and 10.00% for total

risk-based capital. At September 30, 2016, the Company had a

ratio for tier 1 leverage capital of 9.80%, common equity tier 1

risk-based capital of 10.42%, tier 1 risk-based capital of 10.72%

and total risk-based capital of 13.21%.

September 30, June 30,

September 30, 2016 2016

2015 Capital Ratios Pacific Premier Bank Tier

1 leverage ratio 11.03 % 11.17 % 11.44 % Common equity tier 1

risk-based capital ratio 12.07 % 12.32 % 12.54 % Tier 1 risk-based

capital ratio 12.07 % 12.32 % 12.54 % Total risk-based capital

ratio 12.77 % 12.94 % 13.25 %

Pacific Premier Bancorp, Inc.

Tier 1 leverage ratio 9.80 % 9.88 % 9.50 % Common equity tier 1

risk-based capital ratio 10.42 % 10.58 % 10.02 % Tier 1 risk-based

capital ratio 10.72 % 10.90 % 10.40 % Total risk-based capital

ratio 13.21 % 13.45 % 13.65 % Tangible common equity ratio 9.28 %

9.41 % 8.75 %

Share Data Book value per share $ 16.27

$ 15.94 $ 13.52 Tangible book value per share $ 12.22 $ 11.87 $

10.80 Closing stock price $ 26.46 $ 24.00 $ 20.32 Outstanding

shares at period end 27,656,533 27,650,533 21,510,678

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. PT / 12:00

p.m. ET on October 19, 2016 to discuss its financial results.

Analysts and investors may participate in the question-and-answer

session. A live webcast will be available on the Webcasts page of

the Company's investor relations website. An archived version of

the webcast will be available in the same location shortly after

the live call has ended. The conference call can be accessed by

telephone at 866-290-5977 and asking to be joined to the Pacific

Premier Bancorp conference call. Additionally a telephone replay

will be made available through October 26, 2016 at 877-344-7529,

conference ID 10094248.

About Pacific Premier Bancorp, Inc.

Pacific Premier Bancorp, Inc. is the holding company for Pacific

Premier Bank, one of the largest community banks headquartered in

Southern California. Pacific Premier Bank is a business bank

primarily focused on serving small and middle market businesses in

the counties of Los Angeles, Orange, Riverside, San Bernardino and

San Diego, California. Pacific Premier Bank offers a diverse range

of lending products including commercial, commercial real estate,

construction, and SBA loans, as well as specialty banking products

for homeowners associations and franchise lending nationwide.

Pacific Premier Bank serves its customers through its 16

full-service depository branches in Southern California located in

the cities of Corona, Encinitas, Huntington Beach, Irvine, Los

Alamitos, Murrieta, Newport Beach, Orange, Palm Desert, Palm

Springs, Redlands, Riverside, San Bernardino, and San Diego.

FORWARD-LOOKING COMMENTS

The statements contained herein that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Such statements involve inherent

risks and uncertainties, many of which are difficult to predict and

are generally beyond the control of the Company. There can be no

assurance that future developments affecting the Company will be

the same as those anticipated by management. The Company cautions

readers that a number of important factors could cause actual

results to differ materially from those expressed in, or implied or

projected by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: the

strength of the United States economy in general and the strength

of the local economies in which we conduct operations; the effects

of, and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System; inflation, interest rate, market and

monetary fluctuations; the timely development of competitive new

products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to

substitute competitors’ products and services for the Company’s

products and services; the impact of changes in financial services

policies, laws and regulations (including the Dodd-Frank Wall

Street Reform and Consumer Protection Act) and of governmental

efforts to restructure the U.S. financial regulatory system;

technological changes; the effect of acquisitions that the Company

may make, if any, including, without limitation, the failure to

achieve the expected revenue growth and/or expense savings from its

acquisitions; changes in the level of the Company’s nonperforming

assets and charge-offs; any oversupply of inventory and

deterioration in values of California real estate, both residential

and commercial; the effect of changes in accounting policies and

practices, as may be adopted from time-to-time by bank regulatory

agencies, the Securities and Exchange Commission (“SEC”), the

Public Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters; possible

other-than-temporary impairment of securities held by us; changes

in consumer spending, borrowing and savings habits; the effects of

the Company’s lack of a diversified loan portfolio, including the

risks of geographic and industry concentrations; ability to attract

deposits and other sources of liquidity; changes in the financial

performance and/or condition of our borrowers; changes in the

competitive environment among financial and bank holding companies

and other financial service providers; unanticipated regulatory or

judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing. Additional factors that could cause

actual results to differ materially from those expressed in the

forward-looking statements are discussed in the 2015 Annual Report

on Form 10-K of Pacific Premier Bancorp, Inc. filed with the SEC

and available at the SEC’s Internet site (http://www.sec.gov).

The Company specifically disclaims any obligation to update any

factors or to publicly announce the result of revisions to any of

the forward-looking statements included herein to reflect future

events or developments.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (dollars in

thousands) (Unaudited)

September

30, June 30, March

31, December 31,

September 30, ASSETS 2016 2016

2016 2015 2015 Cash and due from banks $

18,557 $ 15,444 $ 18,624 $ 14,935 $ 102,235 Interest-bearing

deposits with financial institutions 85,347 169,855

174,890 63,482 526 Cash and cash

equivalents 103,904 185,299 193,514 78,417 102,761 Interest-bearing

time deposits with financial institutions 3,944 3,944 3,944 1,972 —

Investments held to maturity, at amortized cost 8,900 9,292 9,590

9,642 — Investment securities available for sale, at fair value

313,200 245,471 269,711 280,273 291,147 FHLB, FRB and other stock,

at cost 29,966 26,984 27,103 22,292 22,490 Loans held for sale, at

lower of cost or fair value 9,009 10,116 7,281 8,565 — Loans held

for investment 3,090,839 2,920,619 2,851,432 2,254,315 2,167,856

Allowance for loan losses (21,843 ) (18,955 ) (18,455 )

(17,317 ) (16,145 ) Loans held for investment, net 3,068,996

2,901,664 2,832,977 2,236,998 2,151,711 Accrued interest receivable

11,642 12,143 11,862 9,315 9,083 Other real estate owned 711 711

1,161 1,161 711 Premises and equipment 11,314 11,014 11,963 9,248

9,044 Deferred income taxes, net 20,001 16,552 17,000 11,511 13,059

Bank owned life insurance 40,116 39,824 39,535 39,245 38,953

Intangible assets 9,976 10,500 11,145 7,170 7,514 Goodwill 101,939

101,939 101,939 50,832 50,832 Other assets 21,213 23,200

24,360 24,005 17,993 TOTAL

ASSETS $ 3,754,831 $ 3,598,653 $ 3,563,085 $

2,790,646 $ 2,715,298

LIABILITIES AND

STOCKHOLDERS’ EQUITY LIABILITIES: Deposit accounts:

Non-interest-bearing checking $ 1,160,394 $ 1,043,361 $ 1,064,457 $

711,771 $ 680,937 Interest-bearing: Checking 170,057 168,669

160,707 134,999 130,671 Money market/savings 1,157,086 1,099,445

1,096,334 827,378 822,876 Retail certificates of deposit 384,083

420,673 455,637 365,911 383,481 Wholesale/brokered certificates of

deposit 188,132 198,853 129,129 155,064

121,242 Total interest-bearing 1,899,358 1,887,640

1,841,807 1,483,352 1,458,270 Total

deposits 3,059,752 2,931,001 2,906,264 2,195,123 2,139,207 FHLB

advances and other borrowings 136,213 120,252 124,956 196,125

191,483 Subordinated debentures 69,353 70,310 70,310 70,310 70,310

Accrued expenses and other liabilities 39,548 36,460

32,661 30,108 23,531 TOTAL LIABILITIES

3,304,866 3,158,023 3,134,191 2,491,666

2,424,531 STOCKHOLDERS’ EQUITY: Preferred stock — — — — —

Common stock 273 273 273 215 215 Additional paid-in capital 343,233

342,388 341,660 221,487 220,992 Retained earnings 105,096 95,869

85,500 76,946 68,881 Accumulated other comprehensive income, net of

tax 1,363 2,100 1,461 332 679

TOTAL STOCKHOLDERS’ EQUITY 449,965 440,630

428,894 298,980 290,767 TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY $ 3,754,831 $ 3,598,653

$ 3,563,085 $ 2,790,646 $ 2,715,298

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (dollars in thousands,

except per share data) (Unaudited)

Three Months Ended Nine Months

Ended September 30, June 30,

September 30, September 30,

September 30, 2016 2016 2015

2016 2015 INTEREST INCOME Loans $ 40,487 $

39,035 $ 27,935 $ 114,929 $ 80,917 Investment securities and other

interest-earning assets 1,942 1,839 1,812

5,879 5,527

Total interest income

42,429 40,874 29,747 120,808 86,444

INTEREST EXPENSE Deposits 2,136 2,010 1,719 6,215 4,914 FHLB

advances and other borrowings 314 324 339 963 1,121 Subordinated

debentures 970 979 993 2,859 2,946

Total interest expense 3,420 3,313 3,051

10,037 8,981 NET INTEREST INCOME BEFORE PROVISION FOR LOAN

LOSSES 39,009 37,561 26,696 110,771 77,463 PROVISION FOR LOAN

LOSSES 4,013 1,589 1,062 6,722 4,725

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 34,996

35,972 25,634 104,049 72,738

NON-INTEREST

INCOME Loan servicing fees 288 257 248 769 156 Deposit fees 829

817 629 2,488 1,845 Net gain from sales of loans 3,122 2,124 2,544

7,152 5,265 Net gain from sales of investment securities 512 532 38

1,797 293 Other-than-temporary-impairment recovery/(loss) on

investment securities 2 — — (205 ) — Other income 1,215 720

919 3,279 2,669 Total non-interest income

5,968 4,450 4,378 15,280 10,228

NON-INTEREST EXPENSE Compensation and benefits 14,179 13,098

9,066 39,017 27,439 Premises and occupancy 2,633 2,559 2,120 7,550

5,980 Data processing and communications 1,223 887 681 3,021 2,099

Other real estate owned operations, net 5 (15 ) 9 (2 ) 113 FDIC

insurance premiums 442 401 355 1,225 1,032 Legal, audit and

professional expense 676 446 505 1,987 1,687 Marketing expense

1,591 775 567 2,996 1,785 Office and postage expense 612 573 525

1,666 1,529 Loan expense 534 540 370 1,477 826 Deposit expense

1,315 1,196 917 3,530 2,704 Merger related expense — 497 400 3,616

4,392 CDI amortization 525 645 344 1,514 1,002 Other expense 2,125

2,093 1,515 5,603 4,469 Total

non-interest expense 25,860 23,695 17,374

73,200 55,057 NET INCOME BEFORE INCOME TAX 15,104 16,727

12,638 46,129 27,909 INCOME TAX 5,877 6,358 4,801

17,977 10,459 NET INCOME $ 9,227 $ 10,369

$ 7,837 $ 28,152 $ 17,450

EARNINGS PER

SHARE Basic $ 0.34 $ 0.38 $ 0.36 $ 1.05 $ 0.83 Diluted $ 0.33 $

0.37 $ 0.36 $ 1.03 $ 0.82

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic 27,387,123 27,378,930 21,510,678 26,776,140

21,037,345 Diluted 27,925,351 27,845,490 21,866,840 27,245,108

21,342,204

SELECTED FINANCIAL DATA

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED AVERAGE BALANCES AND YIELD DATA

Three Months Ended Three

Months Ended Three Months Ended

September 30, 2016 June 30, 2016 September 30,

2015

Average

Balance

Interest

Average

Yield/Cost

Average

Balance

Interest

Average

Yield/Cost

Average

Balance

Interest

Average

Yield/Cost

Assets (dollars in thousands) Interest-earning assets: Cash

and cash equivalents $ 201,140 $ 232 0.46 % $ 177,603 $ 189 0.43 %

$ 124,182 $ 63 0.20 % Investment securities 316,253 1,710 2.16

299,049 1,650 2.21 306,623 1,749 2.28 Loans receivable, net (1)

2,998,153 40,487 5.37 2,892,236 39,035

5.43 2,080,281 27,935 5.33 Total

interest-earning assets 3,515,546 42,429 4.80 % 3,368,888 40,874

4.88 % 2,511,086 29,747 4.70 % Non-interest-earning assets 186,778

190,838 125,615 Total assets $ 3,702,324

$ 3,559,726 $ 2,636,701

Liabilities and

Equity Interest-bearing deposits: Interest checking $ 185,344 $

53 0.11 % $ 178,258 $ 50 0.11 % $ 141,747 $ 40 0.11 % Money market

1,036,350 923 0.35 980,806 896 0.37 708,365 616 0.35 Savings 98,496

38 0.15 98,419 38 0.16 91,455 37 0.16 Time 601,551 1,122

0.74 606,770 1,026 0.68 523,010

1,026 0.78 Total interest-bearing deposits

1,921,741 2,136 0.44 % 1,864,253 2,010 0.43 % 1,464,577 1,719 0.47

% FHLB advances and other borrowings 97,547 314 1.28 99,755 324

1.31 120,098 339 1.12 Subordinated debentures 69,984 970

5.54 70,310 979 5.57 70,310

993 5.65 Total borrowings 167,531 1,284

3.05 % 170,065 1,303 3.08 % 190,408

1,332 2.77 % Total interest-bearing liabilities 2,089,272

3,420 0.65 % 2,034,318 3,313 0.66 % 1,654,985 3,051 0.73 %

Non-interest-bearing deposits 1,134,318 1,060,097 674,795 Other

liabilities 35,019 32,969 22,435 Total

liabilities 3,258,609 3,127,384 2,352,215 Stockholders' equity

443,715 432,342 284,486 Total liabilities and

equity $ 3,702,324 $ 3,559,726 $

2,636,701 Net interest income $ 39,009 $

37,561 $ 26,696 Net interest margin (2) 4.41 % 4.48 %

4.22 % Ratio of interest-earning assets to interest-bearing

liabilities 168.27 % 165.60 % 151.73 % (1) Average balance

includes nonperforming loans and is net of deferred loan

origination fees, unamortized discounts and premiums. (2)

Represents net interest income divided by average interest-earning

assets.

PACIFIC PREMIER BANCORP, INC. AND

SUBSIDIARIES LOAN PORTFOLIO COMPOSITION (dollars in

thousands)

September 30, June 30, March

31, December 31, September 30, 2016

2016 2016 2015 2015 Loan

Portfolio Business loans: Commercial and industrial $ 537,809 $

508,141 $ 491,112 $ 309,741 $ 288,982 Franchise 431,618 403,855

371,875 328,925 295,965 Commercial owner occupied 460,068 443,060

424,289 294,726 302,556 SBA 92,195 86,076 78,350 62,256 70,191

Warehouse facilities — — 1,394 143,200 144,274 Real estate loans:

Commercial non-owner occupied 527,412 526,362 522,080 421,583

406,490 Multi-family 689,813 613,573 619,485 429,003 421,240

One-to-four family 101,377 106,538 106,854 80,050 78,781

Construction 231,098 215,786 218,069 169,748 141,293 Land 18,472

18,341 18,222 18,340 12,758 Other loans 5,678 5,822

6,045 5,111 5,017 Total gross loans 3,095,540

2,927,554 2,857,775 2,262,683 2,167,547 Less loans held for sale,

net 9,009 10,116 7,281 8,565 —

Total gross loans held for investment 3,086,531 2,917,438 2,850,494

2,254,118 2,167,547 Plus (less): Deferred loan origination costs

and premiums, net 4,308 3,181 938 197 309 Allowance for loan losses

(21,843 ) (18,955 ) (18,455 ) (17,317 ) (16,145 ) Loans held for

investment, net $ 3,068,996 $ 2,901,664 $ 2,832,977

$ 2,236,998 $ 2,151,711

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES ASSET

QUALITY INFORMATION (dollars in thousands)

September 30, June 30, March 31, December

31, September 30, 2016 2016 2016

2015 2015 Asset Quality Nonaccrual loans $

5,734 $ 4,062 $ 4,823 $ 3,970 $ 4,095 Other real estate owned 711

711 1,161 1,161 711

Nonperforming assets $ 6,445 $ 4,773 $ 5,984 $

5,131 $ 4,806 Allowance for loan losses $

21,843 $ 18,955 $ 18,455 $ 17,317 $ 16,145 Allowance for loan

losses as a percent of total nonperforming loans 381 % 467 % 383 %

436 % 394 % Nonperforming loans as a percent of gross loans 0.18 %

0.14 % 0.17 % 0.18 % 0.19 % Nonperforming assets as a percent of

total assets 0.17 % 0.13 % 0.17 % 0.18 % 0.18 % Net loan

charge-offs for the quarter ended $ 1,125 $ 1,089 $ (18 ) $ 528 $

17 Net loan charge-offs for quarter to average total loans, net

0.04 % 0.04 % — % 0.02 % — % Allowance for loan losses to gross

loans 0.70 % 0.65 % 0.65 % 0.77 % 0.74 %

Delinquent Loans:

30 - 59 days $ 1,042 $ 1,144 $ 247 $ 323 $ 702 60 - 89 days 1,990

2,487 — 355 25 90+ days 2,646 1,797 3,199

1,954 2,214 Total delinquency $ 5,678 $ 5,428

$ 3,446 $ 2,632 $ 2,941 Delinquency as

a % of total gross loans 0.18 % 0.19 % 0.12 % 0.12 % 0.14 %

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

DEPOSIT COMPOSITION (dollars in thousands)

September 30, June 30, March 31, December

31, September 30, 2016 2016 2016

2015 2015 Deposit Accounts Non-interest

bearing checking $ 1,160,394 $ 1,043,361 $ 1,064,457 $ 711,771 $

680,937 Interest-bearing: Checking 170,057 168,669 160,707 134,999

130,671 Money market/savings 1,157,086 1,099,445 1,096,334 827,378

822,876 Retail certificates of deposit 384,083 420,673 455,637

365,911 383,481 Wholesale/brokered certificates of deposit 188,132

198,853 129,129 155,064 121,242

Total interest-bearing 1,899,358 1,887,640 1,841,807

1,483,352 1,458,270 Total deposits $ 3,059,752

$ 2,931,001 $ 2,906,264 $ 2,195,123 $

2,139,207

Deposit Mix (% of total deposits)

Non-interest bearing deposits 37.9 % 35.6 % 36.6 % 32.4 % 31.8 %

Non-maturity deposits 81.3 % 78.9 % 79.9 % 76.3 % 76.4 %

GAAP RECONCILIATIONS

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES GAAP

RECONCILIATIONS (dollars in thousands, except per share data)

GAAP Reconciliations

For periods presented below,

adjusted net income, adjusted diluted earnings per share and

adjusted return on average assets are non-GAAP financial measures

derived from GAAP-based amounts. We calculate these figures by

excluding merger related expenses in the period results. Management

believes that the exclusion of such items from these financial

measures provides useful information to an understanding of the

operating results of our core business. However, these non-GAAP

financial measures are supplemental and are not a substitute for an

analysis based on GAAP measures. As other companies may use

different calculations for these adjusted measures, this

presentation may not be comparable to other similarly titled

adjusted measures reported by other companies.

Three

Months Ended September 30, June 30, September

30, 2016 2016 2015 Net income $ 9,227 $

10,369 $ 7,837 Plus merger related expenses, net of tax — 497 400

Less merger related expenses tax adjustment — (190 ) —

Adjusted net income $ 9,227 $ 10,676 $

8,237 Diluted earnings per share $ 0.33 $ 0.37 $ 0.36 Plus

merger related expenses, net of tax — 0.01 0.02

Adjusted diluted earnings per share $ 0.33 $

0.38 $ 0.38 Return on average assets 1.00 % 1.17 %

1.19 % Plus merger related expenses, net of tax — % 0.03 % 0.06 %

Adjusted return on average assets 1.00 % 1.20 % 1.25 %

For periods presented below, return on average tangible

common equity and adjusted return on average tangible common equity

are non-GAAP financial measures derived from GAAP-based amounts. We

calculate these figures by excluding merger related expenses and/or

CDI amortization expense and exclude the average CDI and average

goodwill from the average stockholders' equity during the period.

Management believes that the exclusion of such items from these

financial measures provides useful information to an understanding

of the operating results of our core business. However, these

non-GAAP financial measures are supplemental and are not a

substitute for an analysis based on GAAP measures. As other

companies may use different calculations for these adjusted

measures, this presentation may not be comparable to other

similarly titled adjusted measures reported by other companies.

Three Months Ended September 30, June

30, September 30, 2016 2016 2015

Net income $ 9,227 $ 10,369 $ 7,837 Plus tax effected CDI

amortization 525 645 344 Less CDI amortization expense tax

adjustment (204 ) (245 ) (131 )

Net income for average tangible

common equity $ 9,548 $ 10,769 $ 8,050 Plus merger related

expenses, net of tax — 497 400 Less merger related expenses tax

adjustment — (190 ) —

Adjusted net income for

average tangible common equity $ 9,548 $ 11,076 $

8,450 Average stockholders' equity $ 443,715 $ 432,342 $

284,486 Less average CDI 10,318 10,876 7,686 Less average goodwill

101,939 101,923 50,832

Average tangible

common equity $ 331,458 $ 319,543 $ 225,968

Return on average tangible common equity 11.52 %

13.48 % 14.25 %

Adjusted return on average tangible common

equity 11.52 % 13.86 % 14.96 % Tangible common equity to

tangible assets (the "tangible common equity ratio") and tangible

book value per share are non-GAAP financial measures derived from

GAAP-based amounts. We calculate the tangible common equity ratio

by excluding the balance of intangible assets from common

stockholders' equity and dividing by tangible assets. We calculate

tangible book value per share by dividing tangible common equity by

common shares outstanding, as compared to book value per share,

which we calculate by dividing common stockholders' equity by

shares outstanding. We believe that this information is consistent

with the treatment by bank regulatory agencies, which exclude

intangible assets from the calculation of risk-based capital

ratios. Accordingly, we believe that these non-GAAP financial

measures provide information that is important to investors and

that is useful in understanding our capital position and ratios.

However, these non-GAAP financial measures are supplemental and are

not a substitute for an analysis based on GAAP measures. As other

companies may use different calculations for these measures, this

presentation may not be comparable to other similarly titled

measures reported by other companies.

September 30, June 30,

March 31, December 31,

September 30, 2016 2016 2016

2015 2015 Total stockholders' equity $ 449,965 $

440,630 $ 428,894 $ 298,980 $ 290,767 Less intangible assets

(111,915 ) (112,439 ) (113,230 ) (58,002 ) (58,346 )

Tangible

common equity $ 338,050 $ 328,191 $ 315,664

$ 240,978 $ 232,421 Book value per share $

16.27 $ 15.94 $ 15.58 $ 13.86 $ 13.52 Less intangible book value

per share (4.05 ) (4.07 ) (4.12 ) (2.69 ) (2.72 )

Tangible book

value per share $ 12.22 $ 11.87 $ 11.46 $

11.17 $ 10.80 Total assets $ 3,754,831 $ 3,598,653 $

3,563,085 $ 2,790,646 $ 2,715,298 Less intangible assets (111,915 )

(112,439 ) (113,230 ) (58,002 ) (58,346 )

Tangible assets $

3,642,916 $ 3,486,214 $ 3,449,855 $ 2,732,644

$ 2,656,952

Tangible common equity ratio 9.28

% 9.41 % 9.15 % 8.82 % 8.75 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161019005441/en/

Pacific Premier Bancorp, Inc.Steve R. GardnerChairman &

Chief Executive Officer949-864-8000orRonald J. Nicolas, Jr.Senior

Executive Vice President & CFO949-864-8000

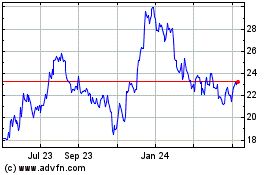

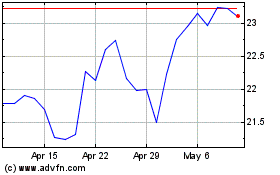

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Apr 2023 to Apr 2024