Company Introduces Plan for Returns-Focused

Growth

Sets Three-Year Financial Targets Including

Housing Revenues Greater than $5 Billion;

Return on Invested Capital in Excess of

10%;

Net Debt-to-Capital Ratio of 40% to

50%

KB Home (NYSE: KBH) held its 2016 Investor Conference in Los

Angeles yesterday, where management outlined its roadmap for

accelerating the Company’s profitable growth, increasing its return

on invested capital and achieving its targeted net leverage

ratio.

“Our core strategy is to establish a top five position in our

served markets by building communities that offer a compelling

combination of affordability, choice and personalization,” said

Jeffrey Mezger, chairman, president and chief executive officer.

“As we grow our business, we intend to remain focused on our

current geographic footprint, offering products in desirable

locations and at price points that are primarily designed to appeal

to first-time and first move-up buyers, which together have

represented more than 80% of our deliveries over the past 15

years.”

“As housing market conditions continue to improve, we are seeing

demand strengthen among our core customer segments, and we believe

we are well positioned to capitalize on this trend,” continued

Mezger. Our target is to grow annual deliveries and achieve

revenues in excess of $5 billion by 2019. As a result and along

with our plans to realize substantial tax cash savings from our

deferred tax asset, sell certain land positions and continue to

reactivate communities, we are confident that we can internally

generate the cash flow needed to support our future growth,

increase our return on invested capital and achieve our leverage

ratio objective. We have a compelling strategy, and an achievable

set of targets with the potential to produce a meaningful increase

in long-term stockholder value,” concluded Mezger.

At the Investor Conference, the Company presented financial

targets for its 2019 and 2017 fiscal years, as well as an update to

its expectations for the 2016 fourth quarter.

2019 Targets

The Company’s three-year targets are as follows:

- Housing revenues greater than $5

billion.

- Operating income margin of 8% to

9%.

- Return on invested capital in excess of

10%.

- Return on equity in the low-to-mid

double-digit range.

- Net debt-to-capital ratio of 40% to

50%.

2017 Targets

The Company’s financial targets for 2017, representing the first

milestone toward achieving its three-year targets, are as

follows:

- Housing revenues of $3.8 billion to

$4.2 billion.

- Average selling price of $370,000 to

$385,000.

- Operating income margin of 5.7% to

6.3%.

- Average community count approximately

flat relative to 2016.

2016 Fourth Quarter

Update

The Company reaffirmed its previously disclosed financial

targets for the 2016 fourth quarter. The Company also announced its

decision to sell more than 20 land parcels (over 2,000 lots) that

no longer fit into its business plans, rather than sell and build

homes on the parcels as previously intended. These parcels include

land in excess of near-term requirements; land where the Company

now believes the necessary incremental investment in development is

not justified; land located in areas outside of the Company’s

served markets; and land entitled for certain product types that

are not aligned with the Company’s primary offerings. The majority

of these land parcels are located in the Company’s Southeast

region. In light of this decision, the Company provided a range of

estimated 2016 fourth quarter inventory-related charges of $30

million to $40 million.

In addition, the Company announced that net orders for the first

six weeks of its 2016 fourth quarter increased 14% year over year.

The Company noted that net order growth for the full 2016 fourth

quarter may vary from its quarter-to-date performance due to, among

other factors, its previously stated expectation for average

community count to decline by 8% year over year for its 2016 fourth

quarter.

Webcast Replay

Information

A replay of the Investor Conference webcast and copies of slide

presentations are available in the Investor Relations section of

the Company’s website at www.kbhome.com. To access the materials,

select the 2016 Investor Conference link under the Events and

Presentations section. The webcast and slide presentations will be

available until November 18, 2016.

About KB Home

KB Home (NYSE: KBH) is one of the largest and most recognized

homebuilders in the United States and an industry leader in

sustainability, building innovative and highly energy- and

water-efficient new homes. Founded in 1957 and the first

homebuilder listed on the New York Stock Exchange, the Company has

built nearly 600,000 homes for families from coast to coast.

Distinguished by its personalized homebuilding approach, KB Home

lets each buyer choose their lot location, floor plan, décor

choices, design features and other special touches that matter most

to them. To learn more about KB Home, call 888-KB-HOMES, visit

www.kbhome.com or connect on Facebook.com/KBHome or

Twitter.com/KBHome.

Forward-Looking and Cautionary Statements

Certain matters discussed in this press release, including any

statements that are predictive in nature or concern future market

and economic conditions, business and prospects, our future

financial and operational performance, or our future actions and

their expected results are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on current expectations and

projections about future events and are not guarantees of future

performance. We do not have a specific policy or intent of updating

or revising forward-looking statements. Actual events and results

may differ materially from those expressed or forecasted in

forward-looking statements due to a number of factors. The most

important risk factors that could cause our actual performance and

future events and actions to differ materially from such

forward-looking statements include, but are not limited to the

following: general economic, employment and business conditions;

population growth, household formations and demographic trends;

conditions in the capital, credit and financial markets; our

ability to access external financing sources and raise capital

through the issuance of common stock, debt or other securities,

and/or project financing, on favorable terms; material and trade

costs and availability; changes in interest rates; our debt level,

including our ratio of debt to capital, and our ability to adjust

our debt level and maturity schedule; our compliance with the terms

of our revolving credit facility; volatility in the market price of

our common stock; weak or declining consumer confidence, either

generally or specifically with respect to purchasing homes;

competition from other sellers of new and resale homes; weather

events, significant natural disasters and other climate and

environmental factors, including the severe prolonged drought and

related water-constrained conditions in the southwest United States

and California; government actions, policies, programs and

regulations directed at or affecting the housing market (including

the Dodd-Frank Act, tax benefits associated with purchasing and

owning a home, and the standards, fees and size limits applicable

to the purchase or insuring of mortgage loans by

government-sponsored enterprises and government agencies), the

homebuilding industry, or construction activities; the availability

and cost of land in desirable areas; our warranty claims experience

with respect to homes previously delivered and actual warranty

costs incurred; costs and/or charges arising from regulatory

compliance requirements or from legal, arbitral or regulatory

proceedings, investigations, claims or settlements, including

unfavorable outcomes in any such matters resulting in actual or

potential monetary damage awards, penalties, fines or other direct

or indirect payments, or injunctions, consent decrees or other

voluntary or involuntary restrictions or adjustments to our

business operations or practices that are beyond our current

expectations and/or accruals; our ability to use/realize the net

deferred tax assets we have generated; our ability to successfully

implement our current and planned strategies and initiatives

related to our product, geographic and market positioning

(including our plans to transition out of the Metro Washington,

D.C. area); gaining share and scale in our served markets; our

operational and investment concentration in markets in California;

consumer interest in our new home communities and products,

particularly from first-time and first move-up homebuyers and

higher-income consumers; our ability to generate orders and convert

our backlog of orders to home deliveries and revenues, particularly

in key markets in California; our ability to successfully implement

our returns-focused growth strategy and achieve the associated

revenue, margin, profitability, cash flow, community reactivation,

land sales, business growth, asset efficiency, return on invested

capital, return on equity, net debt-to-capital ratio and other

financial and operational targets and objectives; the ability of

our homebuyers to obtain residential mortgage loans and mortgage

banking services; the performance of mortgage lenders to our

homebuyers; completing the wind-down of Home Community Mortgage as

planned, and the management of its assets and operations during the

wind-down process; whether we can establish a joint venture or

other relationship with a mortgage banking services provider;

information technology failures and data security breaches; and

other events outside of our control. Please see our periodic

reports and other filings with the Securities and Exchange

Commission for a further discussion of these and other risks and

uncertainties applicable to our business.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161019005415/en/

KB HomeJill Peters, Investor Relations Contact(310) 893-7456 or

jpeters@kbhome.comorSusan Martin, Media Contact(310) 231-4142 or

smartin@kbhome.com

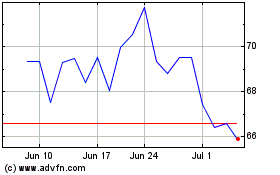

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

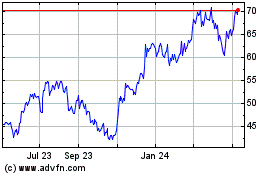

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024