Amended Current Report Filing (8-k/a)

October 18 2016 - 3:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 12,

2016

China Health Industries Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-51060

|

86-0827216

|

|

(State or other jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

168 Binbei Street, Songbei District, Harbin City

|

|

|

Heilongjiang Province, People’s Republic of China

|

150028

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

86-451-88100688

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

[ ] Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a -4(c))

Explanatory Note

On December 31, 2014, China Health Industries Holdings, Inc., a

corporation incorporated under the laws of the state of Delaware (the “Company”)

filed a Current Report on Form 8-K (the “Initial Report”) with the Securities

and Exchange Commission (the “Commission”), with respect to a stock transfer

agreement (the “Original Stock Transfer Agreement”), which the Company entered

through its wholly-owned subsidiary, Harbin Humankind Biology Technology Co.,

Limited, a limited liability company organized under the laws of the People’s

Republic of China (‘Humankind”). On February 13, 2015, the Company filed an

Amendment No. 1 on Form 8-K/A (the “Amendment No. 1”) and amends the Initial

Report, in order to disclose a supplementary agreement which modified the terms

of the Original Stock Transfer Agreement. This Amendment No. 2 on Form 8-K/A

amends the Amendment No. 1, in order to disclose the rescission of the

supplementary agreement and entry into a new stock transfer agreement.

Item 1.01 Entry into a Material Definitive Agreement.

On December 24, 2014, Humankind entered into the Original Stock

Transfer Agreement with Xiuzheng Pharmaceutical Group Co., Ltd. a company

incorporated under the laws of the People’s Republic of China and located in

Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), Mr. Xin Sun, the CEO of the

Company, and Harbin Huimeijia Medicine Company (“Huimeijia”), a 99% owned

subsidiary of Humankind and 1% owned by Mr. Xin Sun, pursuant to which,

Humankind and Mr. Xin Sun (the “Equity Holders”), shall sell their respective

equity interests in Huimeijia to Xiuzheng Pharmacy. The transfer of the 100%

equity interests of Huimeijia to the Buyer was for a total cash consideration of

RMB 8,000,000 (approximately $1,306,186) to the Equity Holders.

On February 9, 2015, the four parties entered into a

supplementary agreement (the “Supplementary Agreement”) to modify the terms of

the Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively

the “Assets Transferors”) shall only sell the 19 drug approval numbers

(including the tablet, capsule, powder, mixture, oral liquid, syrup and oral

solution under the 19 approval numbers; licenses including the original copies

of Business License, Organization Code Certificate, Tax Registration

Certificate, Drug Production Permit and GMP Certificate, and other documents and

original copies related to the production and operation of the 19 drugs) (the

“Assets”) to Xiuzheng Pharmacy. The Equity Holders will retain the equity

interests in Huimeijia, but will have the equity interests pledged to Xiuzheng

Pharmacy until the Assets are transferred, at which time all the cash

consideration shall be paid by the Buyer. The total cash consideration remains

to be the same as under the Agreement, i.e., RMB 8,000,000 (approximately

$1,306,186) to the Assets Transferors. In the event that the Assets are failed

to be transferred to the Buyer due to the fault of the Assets Transferors, the

paid consideration shall be returned to the Buyer with interests accrued. If the

failure of the transfer of the Assets is a result of the government policy

changes or force majeure, the paid cash consideration shall be returned to the

Buyer but without any interests.

On October 12, 2016, the four parties agreed to rescind the

Supplementary Agreement and entered into a stock transfer agreement, pursuant to

which, the Equity Holders shall sell their respective equity interests in

Huimeijia to Xiuzheng Pharmacy. The transfer of the 100% equity interests of

Huimeijia to the Buyer was for a total cash consideration of RMB 8,000,000

(approximately $1,306,186) (the “Purchase Price”) to the Equity Holders. 40% of

the Purchase Price is due within 10 business days after signing the Agreement;

40% of the Purchase Price is due within 10 business days after the completion of

the changes in business registration and Xiuzheng Pharmacy obtains the newly

issued documents evidencing its ownership on Huimeijia; 15% of the Purchase

Price is due within 10 business days after the transfer of all the drugs is

approved by Heilongjiang FDA; and 5% of the Purchase Price is due within 10

business days after all the drugs have been transferred to Xiuzheng Pharmacy or

its designated entity and Humankind and Mr. Xin Sun instructs Xiuzheng Pharmacy

to complete three-batches production of all forms of drugs. As of the date of

this report, 40% of the Purchase Price was paid and the Company has completed

the changes in business registration and Xiuzheng Pharmacy obtained the newly

issued documents evidencing its ownership on Huimeijia, which are evidenced by

the business license issued by the local State Administration of Industry and

Commerce in Harbin (Harbin SAIC) to Huimeijia where the ownership of Huimeijia

has now been recorded as Xiuzheng Pharmacy with Harbin SAIC and the legal person

(a person that is authorized to take most of the corporate actions on behalf of

a company under the corporate laws in China) of Huimeijia has now become a

person designated by the Buyer. The transfer of all the drugs to the Buyer and

the remainder of the Purchase Price are pending to be processed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: October 18, 2016

|

CHINA HEALTH INDUSTRIES HOLDINGS, INC.

|

|

|

|

|

|

|

|

By:

|

/s/

Xin Sun

|

|

Name:

|

Xin Sun

|

|

Title:

|

Chief Executive Officer and Chief Financial

|

|

|

Officer

|

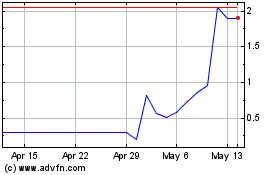

China Health Industries (QB) (USOTC:CHHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

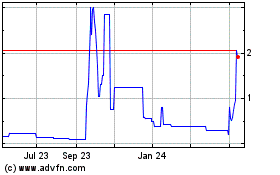

China Health Industries (QB) (USOTC:CHHE)

Historical Stock Chart

From Apr 2023 to Apr 2024