Additional Proxy Soliciting Materials (definitive) (defa14a)

October 18 2016 - 10:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the

registrant ☒ Filed by a party other than the

registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary proxy statement

|

|

|

|

|

☐

|

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive proxy statement

|

|

|

|

|

☒

|

|

Definitive additional materials

|

|

|

|

|

☐

|

|

Soliciting material pursuant to

Section 240.14a-12

|

THE FEMALE HEALTH COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

YOUR VOTE IS CRUCIAL AS WE’VE ALMOST REACHED OUR TARGET!

LESS THAN 2% AWAY FROM ACHIEVING OUR GOAL. EVERY VOTE COUNTS!

Dear Fellow Shareholders:

We have adjourned the special

shareholders meeting regarding the proposed merger transaction between The Female Health Company (FHC) and Aspen Park Pharmaceuticals, Inc. (APP) to

October 31, 2016

in order to provide additional time for shareholders to vote.

Your vote is crucial as we’ve almost reached our target.

Approximately 65 percent of all the FHC outstanding shares have voted FOR the three proposals that remain subject to voting and we need a little less

than 67 percent for approval.

So we’re basically a little less than two percent away from achieving our goal.

Regardless of how many shares

you own, your vote matters. Please note:

|

|

•

|

|

Of the votes cast to date,

approximately 80% have voted in favor

of each the three proposals requiring a super majority approval;

|

|

|

•

|

|

Two leading independent proxy advisory firms, Institutional Shareholders Services Inc. and Glass, Lewis & Co., LLC

have recommended that shareholders vote

FOR

all three of the proposals still open

for consideration by shareholders; and

|

|

|

•

|

|

Failure to vote will have the same effect as a vote “against”

the three proposals.

|

FHC’s Board of Directors believes the merger is a remarkable opportunity to add multiple near-term products with extremely large market opportunities and

transform our company into a more profitable and rapidly growing entity. We continue to urge shareholders to vote FOR the three proposals requiring a super majority approval.

Below are two convenient ways to vote. We highly recommend you vote electronically or by phone. Please have your control number ready while voting. The

control number is located on your proxy card.

|

|

1.

|

Through the Internet, by visiting a website established for that purpose at www.proxyvote.com and following the instructions; or

|

|

|

2.

|

By calling the toll-free number 1-800-690-6903 in the United States, Puerto Rico or Canada on a touch-tone phone and following the recorded instructions.

|

We need your vote.

For your vote to count, you must vote by proxy before, or in person at, the special meeting of stockholders on October 31,

2016. Any shares for which votes are not cast will be treated as a “no” vote. Shareholders who have already voted do not need to recast their votes. Proxies previously submitted will be voted at the reconvened meeting unless properly

revoked.

If you haven’t received your proxy materials and voting instructions either electronically or in the mail, we urge you to contact your

broker if you have one. Alternatively please feel free to contact Michele Greco at The Female Health Company, 312-213-9859,

mgreco@femalehealthcompany.com

, and we will make certain that you get the proxy materials and voting instructions.

If you need additional assistance, please contact FHC’s proxy solicitor:

D.F. King & Co, Inc.

Toll-Free: 866-751-6309

It is critical that you cast your vote for the future of FHC.

Please vote today.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

O.B. Parrish

|

|

Mitchell Steiner, M.D.

|

|

FHC Chairman and Chief Executive Officer

|

|

APP Chief Executive Officer

|

October 18, 2016

Forward-Looking Statements

This letter contains

forward-looking statements, including those regarding the proposed merger transaction between FHC and APP and the integration of our two businesses. These statements are subject to known and unknown risks, uncertainties and assumptions, and if any

such risks or uncertainties materialize or if any of the assumptions prove incorrect, our actual results could differ materially from those expressed or implied by such statements. These risks and uncertainties include but are not limited to: the

risk that the proposed transaction may not be completed in a timely manner or at all; the satisfaction of conditions to completing the transaction, including the ability to secure approval by a two-thirds vote of FHC’s stockholders; risks that

the proposed transaction could disrupt current plans and operations; costs, fees and expenses related to the proposed transaction; risks related to the development of APP’s product portfolio, including regulatory approvals and time and cost to

bring to market; risks relating to the ability of the combined company to obtain sufficient financing on acceptable terms when needed to fund development and company operations; the risk that, even if it is completed, we may not realize the expected

benefits from the transaction; and other risks described in FHC’s filings with the SEC, including our Annual Report on Form 10-K for the year ended September 30, 2015 and our Quarterly Reports on Form

10-Q

for the quarters ended December 31, 2015, March 31, 2016 and June 30, 2016. These documents are available on the “SEC Filings” section of our website at

http://fhcinvestor.com. All forward-looking statements are based on information available to us as of the date hereof, and FHC does not assume any obligation and does not intend to update any forward-looking statements, except as required by law.

Additional Information about the Proposed Transaction and Where You Can Find It

FHC filed a definitive proxy statement with the SEC relating to a solicitation of proxies from its shareholders in connection with a special meeting of

shareholders of FHC to be held for the purpose of voting on matters relating to the proposed transaction. BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, FHC SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND

OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials, and any other documents filed by FHC with the SEC, may be obtained

free of charge at the SEC’s website at www.sec.gov. In addition, stockholders of FHC may obtain free copies of the documents filed with the SEC by contacting FHC’s Chief Financial Officer at (312) 595-9742, or by writing to Chief

Financial Officer, The Female Health Company, 150 N. Michigan Avenue, Suite 1580, Chicago, Illinois 60601.

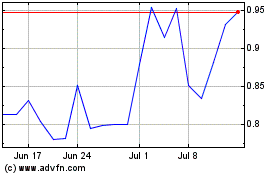

Veru (NASDAQ:VERU)

Historical Stock Chart

From Mar 2024 to Apr 2024

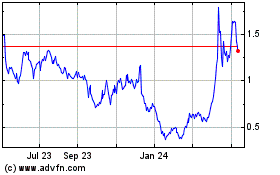

Veru (NASDAQ:VERU)

Historical Stock Chart

From Apr 2023 to Apr 2024