Plumas Bancorp (Nasdaq:PLBC), the parent company of Plumas Bank

(the “Bank”), today announced record earnings for the three and

nine months ended September 30, 2016. Earnings during the third

quarter of 2016 totaled $2.0 million an increase of $357 thousand,

or 22%, from $1.6 million during the three months ended September

30, 2015. Earnings per diluted share increased to $0.39 during the

three months ended September 30, 2016 up $0.07 from $0.32 during

the third quarter of 2015. For the nine months ended September 30,

2016, Plumas Bancorp (the “Company”) reported net income of $5.4

million, an increase of $1.2 million, or 29%, from $4.2 million

during the nine months ended September 30, 2015. Earnings per

diluted share increased to $1.06 during the nine months ended

September 30, 2016 up $0.24 from $0.82 during the first nine months

of 2015.

The annualized return on average assets (ROA)

increased to 1.23% for the three months ended September 30, 2016,

up from 1.08% for the three months ended September 30, 2015.

The annualized return on average equity (ROE) increased to 16.3%

during the current quarter up from 15.7% during the third quarter

of 2015. ROA increased to 1.18% for the nine months ended

September 30, 2016, up from 0.99% for the nine months ended

September 30, 2015. ROE increased to 15.7% during the nine

months ended September 30, 2016 up from 14.3% during the first nine

months of 2015. Book value per share increased to $9.91 at

September 30, 2016 up $1.37 from $8.54 at September 30, 2015.

Commenting on the recent quarter’s record

performance, Director, President and Chief Executive Officer,

Andrew J. Ryback, noted, “The Company’s third quarter performance

reflects robust deposit and loan growth, continued strong credit

quality and further improved operating efficiency, contributing to

a 22% increase in diluted earnings per share to $0.39 for the three

months ended September 30, 2016. Our investment in experienced,

productive loan officers continues to pay dividends. Because of

their efforts, net loans increased by over $55 million or 14% from

Septembers 30, 2015. Deposits increased by over $42 million

during the same period. With regard to credit quality,

non-performing loans decreased by $1.9 million and net charge-offs

declined by $233 thousand compared to the same time period one year

ago. Finally, our efficiency ratio, which measures our non-interest

expenses as a percentage of our revenues, declined to 58% during

the three months ended September 30, 2016 compared to 61.5% during

the three months ended September 30, 2015.”

Ryback concluded, “While delivering this record

performance, we remain committed to investing strategically and

building the business for the long-term. Our goal is to continue to

provide outstanding value to our shareholders while creating

significant opportunities and enhanced capabilities for our

clients, colleagues and communities.”

Financial

HighlightsSeptember 30, 2016 compared to September

30, 2015

- Total assets increased by $50.3 million, or 8%, to $657

million.

- Net loans increased by $55.6 million, or 14%, to $442 million

at September 30, 2016 compared to $387 million at September 30,

2015.

- Total deposits increased by $42.7 million to $581 million at

September 30, 2016.

- Total shareholders’ equity increased by $7.1 million to $48.3

million.

- Nonperforming loans decreased by $1.9 million to $3.1 million

at September 30, 2016 from $5.0 million at September 30, 2015.

- Nonperforming assets decreased by $1.7 million to $5.6 million

at September 30, 2016 from $7.3 million at September 30, 2015.

- The ratio of nonperforming loans to total loans decreased to

0.69% from 1.29% and the ratio of nonperforming assets to total

assets decreased to 0.86% from 1.21%.

- Annualized net charges-offs as a percent of average loans

declined to 0.06% from 0.15%.

Three months ended September 30, 2016

compared to September 30, 2015

- Net income increased by $357 thousand, or 22%, to $2.0

million.

- Diluted earnings per share increased by 7 cents or 22%, to 39

cents.

- Annualized return on average assets increased to 1.23% from

1.08%.

- Annualized return on average equity increased to 16.3% from

15.7%.

- Income before provision for taxes increased by $592 thousand,

or 23%, to $3.2 million.

- Net interest income increased by $596 thousand, or 11%, to $6.1

million.

- Net interest margin increased to 4.20% from 4.08%.

Nine months ended September 30, 2016

compared to September 30, 2015

- Net income increased by $1.2 million, or 29%, to $5.4

million.

- Diluted EPS increased by $0.24, or 29%, to $1.06 from

$0.82.

- Annualized return on average assets increased to 1.18% from

0.99%.

- Annualized return on average equity increased to 15.7% from

14.3%.

- Income before provision for taxes increased by $1.9 million, or

28%, to $8.8 million.

- Net interest income increased by $1.9 million, or 12%, to $17.7

million.

- Net interest margin increased to 4.22% from 4.13%.

Asset Quality

Nonperforming loans at September 30, 2016 were

$3.1 million, a decrease of $1.9 million, or 38%, from the $5.0

million balance at September 30, 2015. Nonperforming loans as a

percentage of total loans decreased to 0.69% at September 30, 2016,

down from 1.29% at September 30, 2015. Nonperforming assets

(which are comprised of nonperforming loans, other real estate

owned (“OREO”) and repossessed vehicle holdings (“OVO”)) at

September 30, 2016 were $5.6 million, down $1.7 million, or 23%,

from $7.3 million at September 30, 2015. Nonperforming assets

as a percentage of total assets decreased to 0.86% at September 30,

2016, down from 1.21% at September 30, 2015.

During the nine months ended September 30, 2016

we recorded a provision for loan losses of $600 thousand, down $300

thousand from the $900 thousand recorded during the same period in

2015. Net charge-offs totaled $201 thousand during the nine months

ended September 30, 2016 and $434 thousand during the same period

in 2015. Annualized net charge-offs as a percentage of average

loans decreased from 0.15% during the nine months ended September

30, 2015 to 0.06% during the current period. The allowance for loan

losses totaled $6.5 million at September 30, 2016 and $5.9 million

at September 30, 2015. The allowance for loan losses as a

percentage of total loans decreased from 1.51% at September 30,

2015 to 1.45% at September 30, 2016.

Loans, Deposits, Investments and Cash

Net loans increased by $55.6 million, or 14%, to

$442 million at September 30, 2016 up from $387 million at

September 30, 2015. The three largest areas of growth in the

Company’s loan portfolio were $32.4 million in commercial real

estate loans, $9.2 million in agricultural loans and $9.0 million

in commercial loans.

Total deposits increased by $42.7 million from

$539 million at September 30, 2015 to $581 million at September 30,

2016. This increase includes growth of $24.9 million in

non-interest bearing demand deposits, $6.4 million in interest

bearing transaction accounts and $16.9 million in money market and

savings accounts. Time deposits declined by $5.5 million to $49.6

million or 9% of total deposits. The Company has no brokered

deposits.

Total investment securities were $100.6 million

at September 30, 2016 and $89.4 million at September 30, 2015. Cash

and due from banks was $77.0 million at September 30, 2016 and

$94.0 million at September 30, 2015.

Shareholders’ Equity

Total shareholders’ equity increased by $7.1

million from $41.2 million at September 30, 2015 to $48.3 million

at September 30, 2016. The $7.1 million increase was related to

earnings during the twelve month period of $7.0 million, an

increase in net unrealized gains on investment securities of $0.7

million and an increase of $0.3 million representing stock option

activity. These items were partially offset by the repurchase

of a portion of a warrant, in May of 2016, representing the right

to purchase 150,000 shares of the registrant’s common stock at a

cost of $0.9 million. The remaining warrant represents the

right to purchase 150,000 shares of Plumas Bancorp common stock at

an exercise price of $5.25 per share. The warrant is

associated with the Bancorp’s subordinated debenture, which was

fully paid in April, 2015.

Net Interest Income and Net Interest

Margin

Net interest income, on a nontax-equivalent

basis, was $6.1 million for the three months ended September 30,

2016, an increase of $596 thousand, or 11%, from $5.5 million for

the same period in 2015. The increase in net interest income

includes an increase of $587 thousand in interest income and a

decline of $9 thousand in interest expense. The largest

component of the increase in interest income was a $525 thousand

increase in interest and fees on loans related to growth in the

loan portfolio. The reduction in interest expense is related

a reduction in the average balance of the Bancorp’s note payable

from $5 million during the third quarter of 2015 to $2.6 million

during the current quarter. Net interest margin for the

three months ended September 30, 2016 was 4.20% an increase of

twelve basis points from 4.08% during the three months ended

September 30, 2015.

Net interest income, on a nontax-equivalent

basis, for the nine months ended September 30, 2016 was $17.7

million, an increase of $1.9 million from the $15.8 million earned

during the same period in 2015. Driven mostly by an increase in

average loan balances, interest income increased by $1.7 million

while interest expense, which benefited from the payoff of the

Bancorp’s subordinated debenture in April, 2015, declined by $176

thousand. Net interest margin for the nine months ended

September 30, 2016 increased nine basis points to 4.22%, up from

4.13% for the same period in 2015.

Non-Interest Income and Expense

During the three months ended September 30, 2016

non-interest income decreased by $53 thousand to $2.0 million. The

largest component of this decrease was a decrease in gain on sale

of SBA loans of $112 thousand from $617 thousand during the 2015

quarter to $505 thousand during the three months ended September

30, 2016. During the nine months ended September 30, 2016

non-interest income totaled $5.7 million, a decrease of $212

thousand from the nine months ended September 30, 2015. The

largest components of this change were decreases of $194 thousand

in gain on sale of SBA loans, $79 thousand in FHLB dividends and

$53 thousand in loss/gain on sale of securities. The reduction in

FHLB dividends was related to a June 2015 $88 thousand one-time

special dividend from the FHLB.

During the three months ended September 30,

2016, non-interest expense totaled $4.7 million, an increase of $51

thousand from the third quarter of 2015. Increases in excess of $50

thousand include a $77 thousand increase in occupancy and equipment

cost the largest portions of which were related to upgrading

personal computers and costs associated with our new Reno, Nevada

branch, a $67 thousand increase in marketing and related expenses

and a $62 thousand decrease in gain on sale of OREO from a gain of

$62 thousand during the 2015 quarter to no gain or loss during the

current quarter. The largest decreases in non-interest expense were

a $74 thousand reduction in OREO costs and a $70 thousand reduction

in professional fees.

During the nine months ended September 30, 2016

non-interest expense increased by $29 thousand to $14.0

million. Increases in excess of $75 thousand include $104

thousand in marketing expense, $81 thousand in occupancy and

equipment expense and $77 thousand in gain on sale of OREO from a

gain of $73 thousand during the nine months ended September 30,

2015 to a loss of $4 thousand during the current period. The

increase in marketing costs was mostly related to our Reno, Nevada

branch. These items were mostly offset by a $166 thousand

reduction in OREO costs and an $84 thousand reduction in

professional fees. The decrease in OREO costs includes a reduction

in average OREO balances and in the number of OREO properties

owned. In addition, we are leasing out one of our larger OREO

properties and the related rental income on this property

significantly exceeds our costs associated with the property.

The reduction in professional fees mostly relates to a

decline in legal expense related to loan collection

activities.

Founded in 1980, Plumas Bank is a locally owned

and managed full-service community bank based in Northeastern

California. The Bank operates twelve branches: eleven located in

the California counties of Plumas, Lassen, Placer, Nevada, Modoc

and Shasta and one branch in the Nevada County of Washoe. The Bank

also operates five loan production offices: two located in the

California Counties of Placer and Butte, one located in the Oregon

County of Klamath, one located in the Washington County of King and

one located in the Arizona County of Maricopa. Plumas Bank offers a

wide range of financial and investment services to consumers and

businesses and has received nationwide Preferred Lender status with

the United States Small Business Administration. For more

information on Plumas Bancorp and Plumas Bank, please visit our

website at www.plumasbank.com.

This news release includes forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Exchange Act

of 1934, as amended and Plumas Bancorp intends for such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. Future events are

difficult to predict, and the expectations described above are

necessarily subject to risk and uncertainty that may cause actual

results to differ materially and adversely.

Forward-looking statements can be identified by

the fact that they do not relate strictly to historical or current

facts. They often include the words "believe," "expect,"

"anticipate," "intend," "plan," "estimate," or words of similar

meaning, or future or conditional verbs such as "will," "would,"

"should," "could," or "may." These forward-looking statements are

not guarantees of future performance, nor should they be relied

upon as representing management's views as of any subsequent date.

Forward-looking statements involve significant risks and

uncertainties and actual results may differ materially from those

presented, either expressed or implied, in this news release.

Factors that might cause such differences include, but are not

limited to: the Company's ability to successfully execute its

business plans and achieve its objectives; changes in general

economic and financial market conditions, either nationally or

locally in areas in which the Company conducts its operations;

changes in interest rates; continuing consolidation in the

financial services industry; new litigation or changes in existing

litigation; increased competitive challenges and expanding product

and pricing pressures among financial institutions; legislation or

regulatory changes which adversely affect the Company's operations

or business; loss of key personnel; and changes in accounting

policies or procedures as may be required by the Financial

Accounting Standards Board or other regulatory agencies.

In addition, discussions about risks and

uncertainties are set forth from time to time in the Company’s

publicly available Securities and Exchange Commission filings. The

Company undertakes no obligation to publicly revise these

forward-looking statements to reflect subsequent events or

circumstances.

| |

|

|

| |

PLUMAS BANCORP |

|

| |

CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| |

(In thousands) |

|

| |

(Unaudited) |

|

| |

|

|

| |

|

As of September

30, |

|

|

|

| |

ASSETS |

|

2016 |

|

|

|

2015 |

|

|

Dollar Change |

|

Percentage Change |

|

| |

Cash and due from

banks |

$ |

77,048 |

|

|

$ |

93,964 |

|

|

$ |

(16,916 |

) |

|

|

-18.0 |

% |

|

| |

Investment securities |

|

100,618 |

|

|

|

89,391 |

|

|

|

11,227 |

|

|

|

12.6 |

% |

|

| |

Loans, net of allowance

for loan losses |

|

442,399 |

|

|

|

386,838 |

|

|

|

55,561 |

|

|

|

14.4 |

% |

|

| |

Premises and equipment,

net |

|

11,921 |

|

|

|

12,442 |

|

|

|

(521 |

) |

|

|

-4.2 |

% |

|

| |

Bank owned life

insurance |

|

12,443 |

|

|

|

12,102 |

|

|

|

341 |

|

|

|

2.8 |

% |

|

| |

Real estate acquired

through foreclosure |

|

2,517 |

|

|

|

2,265 |

|

|

|

252 |

|

|

|

11.1 |

% |

|

| |

Accrued interest

receivable and other assets |

|

10,173 |

|

|

|

9,854 |

|

|

|

319 |

|

|

|

3.2 |

% |

|

| |

Total

assets |

$ |

657,119 |

|

|

$ |

606,856 |

|

|

$ |

50,263 |

|

|

|

8.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

LIABILITIES AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Deposits |

$ |

581,421 |

|

|

$ |

538,754 |

|

|

$ |

42,667 |

|

|

|

7.9 |

% |

|

| |

Accrued interest payable

and other liabilities |

|

14,582 |

|

|

|

11,584 |

|

|

|

2,998 |

|

|

|

25.9 |

% |

|

| |

Note payable |

|

2,500 |

|

|

|

5,000 |

|

|

|

(2,500 |

) |

|

|

-50.0 |

% |

|

| |

Junior subordinated

deferrable interest debentures |

|

10,310 |

|

|

|

10,310 |

|

|

|

- |

|

|

|

0.0 |

% |

|

| |

Total

liabilities |

|

608,813 |

|

|

|

565,648 |

|

|

|

43,165 |

|

|

|

7.6 |

% |

|

| |

Common stock |

|

5,818 |

|

|

|

6,422 |

|

|

|

(604 |

) |

|

|

-9.4 |

% |

|

| |

Retained earnings |

|

41,429 |

|

|

|

34,415 |

|

|

|

7,014 |

|

|

|

20.4 |

% |

|

| |

Accumulated other

comprehensive income, net |

|

1,059 |

|

|

|

371 |

|

|

|

688 |

|

|

|

185.4 |

% |

|

| |

Shareholders’ equity |

|

48,306 |

|

|

|

41,208 |

|

|

|

7,098 |

|

|

|

17.2 |

% |

|

| |

Total

liabilities and shareholders’ equity |

$ |

657,119 |

|

|

$ |

606,856 |

|

|

$ |

50,263 |

|

|

|

8.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

PLUMAS BANCORP |

|

| |

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

|

| |

(In thousands, except per share data) |

|

| |

(Unaudited) |

|

| |

|

|

|

|

|

|

|

| |

FOR THE THREE MONTHS ENDED

SEPTEMBER 30, |

|

2016 |

|

|

|

2015 |

|

|

Dollar Change |

|

Percentage Change |

|

| |

Interest income |

$ |

6,380 |

|

|

$ |

5,793 |

|

|

$ |

587 |

|

|

|

10.1 |

% |

|

| |

Interest expense |

|

254 |

|

|

|

263 |

|

|

|

(9 |

) |

|

|

-3.4 |

% |

|

| |

Net

interest income before provision for loan losses |

|

6,126 |

|

|

|

5,530 |

|

|

|

596 |

|

|

|

10.8 |

% |

|

| |

Provision for loan

losses |

|

200 |

|

|

|

300 |

|

|

|

(100 |

) |

|

|

-33.3 |

% |

|

| |

Net

interest income after provision for loan losses |

|

5,926 |

|

|

|

5,230 |

|

|

|

696 |

|

|

|

13.3 |

% |

|

| |

Non-interest income |

|

1,993 |

|

|

|

2,046 |

|

|

|

(53 |

) |

|

|

-2.6 |

% |

|

| |

Non-interest expense |

|

4,709 |

|

|

|

4,658 |

|

|

|

51 |

|

|

|

1.1 |

% |

|

| |

Income

before income taxes |

|

3,210 |

|

|

|

2,618 |

|

|

|

592 |

|

|

|

22.6 |

% |

|

| |

Provision for income

taxes |

|

1,253 |

|

|

|

1,018 |

|

|

|

235 |

|

|

|

23.1 |

% |

|

| |

Net

income |

$ |

1,957 |

|

|

$ |

1,600 |

|

|

$ |

357 |

|

|

|

22.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic earnings

per share |

$ |

0.40 |

|

|

$ |

0.33 |

|

|

$ |

0.07 |

|

|

|

21.2 |

% |

|

| |

Diluted earnings

per share |

$ |

0.39 |

|

|

$ |

0.32 |

|

|

$ |

0.07 |

|

|

|

21.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

FOR THE NINE MONTHS ENDED

SEPTEMBER 30, |

|

2016 |

|

|

|

2015 |

|

|

Dollar Change |

|

Percentage Change |

|

| |

Interest income |

$ |

18,457 |

|

|

$ |

16,764 |

|

|

$ |

1,693 |

|

|

|

10.1 |

% |

|

| |

Interest expense |

|

763 |

|

|

|

939 |

|

|

|

(176 |

) |

|

|

-18.7 |

% |

|

| |

Net

interest income before provision for loan losses |

|

17,694 |

|

|

|

15,825 |

|

|

|

1,869 |

|

|

|

11.8 |

% |

|

| |

Provision for loan

losses |

|

600 |

|

|

|

900 |

|

|

|

(300 |

) |

|

|

-33.3 |

% |

|

| |

Net

interest income after provision for loan losses |

|

17,094 |

|

|

|

14,925 |

|

|

|

2,169 |

|

|

|

14.5 |

% |

|

| |

Non-interest income |

|

5,701 |

|

|

|

5,913 |

|

|

|

(212 |

) |

|

|

-3.6 |

% |

|

| |

Non-interest expense |

|

14,023 |

|

|

|

13,994 |

|

|

|

29 |

|

|

|

0.2 |

% |

|

| |

Income

before income taxes |

|

8,772 |

|

|

|

6,844 |

|

|

|

1,928 |

|

|

|

28.2 |

% |

|

| |

Provision for income

taxes |

|

3,405 |

|

|

|

2,674 |

|

|

|

731 |

|

|

|

27.3 |

% |

|

| |

Net

income |

$ |

5,367 |

|

|

$ |

4,170 |

|

|

$ |

1,197 |

|

|

|

28.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic earnings

per share |

$ |

1.11 |

|

|

$ |

0.87 |

|

|

$ |

0.24 |

|

|

|

27.6 |

% |

|

| |

Diluted earnings

per share |

$ |

1.06 |

|

|

$ |

0.82 |

|

|

$ |

0.24 |

|

|

|

29.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PLUMAS BANCORP |

|

| SELECTED FINANCIAL INFORMATION |

|

| (Dollars in thousands, except per share

data) |

|

| (Unaudited) |

|

| |

September 30, |

|

| |

|

2016 |

|

|

2015 |

|

| QUARTERLY AVERAGE

BALANCES |

|

|

|

|

| Assets |

$ |

632,710 |

|

$ |

588,438 |

|

| Earning assets |

$ |

580,570 |

|

$ |

537,790 |

|

| Investments |

$ |

99,470 |

|

$ |

89,301 |

|

| Loans |

$ |

437,818 |

|

$ |

392,523 |

|

| Deposits |

$ |

559,383 |

|

$ |

522,303 |

|

| Equity |

$ |

47,732 |

|

$ |

40,364 |

|

| |

|

|

|

|

|

|

| CREDIT QUALITY

DATA |

|

|

|

|

|

|

| Allowance for loan

losses |

$ |

6,477 |

|

$ |

5,917 |

|

| Allowance for loan losses

as a percentage of total loans |

|

1.45 |

% |

|

1.51 |

% |

| Nonperforming loans |

$ |

3,100 |

|

$ |

5,024 |

|

| Nonperforming assets |

$ |

5,639 |

|

$ |

7,342 |

|

| Nonperforming loans as a

percentage of total loans |

|

0.69 |

% |

|

1.29 |

% |

| Nonperforming assets as a

percentage of total assets |

|

0.86 |

% |

|

1.21 |

% |

| Year-to-date net

charge-offs |

$ |

201 |

|

$ |

434 |

|

| Year-to-date net

charge-offs as a percentage of average |

|

|

|

|

|

|

| loans,

annualized |

|

0.06 |

% |

|

0.15 |

% |

| |

|

|

|

|

|

|

| SHARE AND PER

SHARE DATA |

|

|

|

|

|

|

| Basic earnings per share

for the quarter |

$ |

0.40 |

|

$ |

0.33 |

|

| Diluted earnings per share

for the quarter |

$ |

0.39 |

|

$ |

0.32 |

|

| Quarterly weighted average

shares outstanding |

|

4,868 |

|

|

4,824 |

|

| Quarterly weighted average

diluted shares outstanding |

|

5,035 |

|

|

5,067 |

|

| Basic earnings per share,

year-to-date |

$ |

1.11 |

|

$ |

0.87 |

|

| Diluted earnings per

share, year-to-date |

$ |

1.06 |

|

$ |

0.82 |

|

| Year-to-date weighted

average shares outstanding |

|

4,856 |

|

|

4,812 |

|

| Year-to-date weighted

average diluted shares outstanding |

|

5,052 |

|

|

5,061 |

|

| Book value per common

share |

$ |

9.91 |

|

$ |

8.54 |

|

| Total shares

outstanding |

|

4,874 |

|

|

4,828 |

|

| |

|

|

|

|

|

|

| QUARTERLY KEY

FINANCIAL RATIOS |

|

|

|

|

|

|

| Annualized return on

average equity |

|

16.3 |

% |

|

15.7 |

% |

| Annualized return on

average assets |

|

1.23 |

% |

|

1.08 |

% |

| Net interest margin |

|

4.20 |

% |

|

4.08 |

% |

| Efficiency ratio |

|

58.0 |

% |

|

61.5 |

% |

| |

|

|

|

|

|

|

| YEAR-TO-DATE KEY

FINANCIAL RATIOS |

|

|

|

|

|

|

| Annualized return on

average equity |

|

15.7 |

% |

|

14.3 |

% |

| Annualized return on

average assets |

|

1.18 |

% |

|

0.99 |

% |

| Net interest margin |

|

4.22 |

% |

|

4.13 |

% |

| Efficiency ratio |

|

59.9 |

% |

|

64.4 |

% |

| Loan to Deposit Ratio |

|

76.9 |

% |

|

72.5 |

% |

| |

|

|

|

|

|

|

| PLUMAS BANK

CAPITAL RATIOS |

|

|

|

|

|

|

| Tier 1 Leverage Ratio |

|

9.3 |

% |

|

9.3 |

% |

| Common Equity Tier 1 Ratio |

|

12.1 |

% |

|

12.6 |

% |

| Tier 1 Risk-Based Capital Ratio |

|

12.1 |

% |

|

12.6 |

% |

| Total Risk-Based Capital Ratio |

|

13.3 |

% |

|

13.9 |

% |

Contact: Elizabeth Kuipers

Vice President, Marketing Manager & Investor Relations Officer

Plumas Bank

35 S. Lindan Ave.

Quincy, CA 95971

530.283.7305 ext.8912

investorrelations@plumasbank.com

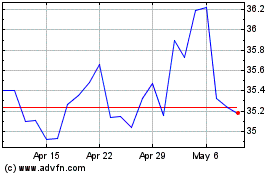

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Apr 2023 to Apr 2024