UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SAFE BULKERS, INC.

(Exact Name of Registrant as Specified in

its Charter)

Not Applicable

(Translation of Registrant’s Name

into English)

Republic of the Marshall Islands

(State or other Jurisdiction of

Incorporation or Organization)

|

|

98-0614567

(I.R.S. Employer Identification No.)

|

Apt. D11,

Les Acanthes

6, Avenue des Citronniers

MC98000 Monaco

011-377-97988181

(Address of principal executive office)

30-32 Avenue Karamanli

16673 Voula

Athens, Greece

011-30-211-1888400

(Address of representation office in Greece)

C T Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number of agent for service)

With copies to:

Richard M. Brand, Esq.

Cadwalader, Wickersham & Taft LLP

One World Financial Center

New York, New York 10281

(212) 504-5757

Approximate Date of

Commencement of Proposed Sale of the Securities to the Public: From time to time after the effective date of this Registration

Statement.

If only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, check the following box.

x

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered

(1)

|

|

Proposed

Maximum

Offering

Price Per Unit

(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

(3)

|

|

Amount of

Registration

Fee

(3)

|

|

Common Stock, including preferred stock purchase rights, par value $0.001 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, par value $0.01 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

200,000,000

|

|

|

|

100

|

%

|

|

$

|

200,000,000

|

|

|

$

|

23,180

|

|

|

|

(1)

|

There are being registered hereunder such indeterminate number of the securities of each identified

class being registered as may be sold from time to time at indeterminate prices, with any initial aggregate public offering price

not to exceed $200,000,000. Separate consideration may or may not be received for shares that are issuable on exercise, conversion

or exchange of other securities or that are issued in units. Rights to purchase preferred stock initially will trade together with

the common stock. The value attributable to the rights, if any, will be reflected in the price of the common stock.

|

|

|

(2)

|

The proposed maximum aggregate offering price of each class of securities will be determined from

time to time by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder and is

not specified as to each class of securities pursuant to the General Instruction II.C. of Form F-3 under the Securities Act of

1933.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under

the Securities Act of 1933, as amended, with respect to the securities to be sold by the Registrant. In no event will the aggregate

initial offering price of the securities registered hereby exceed $200,000,000 (unless a post-effective amendment is filed), or,

if any securities are in any foreign currency units, the U.S. dollar equivalent of $200,000,000 and if any securities are issued

at original issue discount, such greater amount as shall result in an aggregate offering price not to exceed $200,000,000. Of the

$23,180 due as a registration fee for the securities being registered hereby, $14,982.24 is being offset as it reflects the fee

associated with unsold securities from registration statement on Form F-3 (333-186977) that Safe Bulkers, Inc. initially filed

on March 1, 2013.

|

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 17,

2016.

PROSPECTUS

$200,000,000

Safe Bulkers, Inc.

Common Stock

Preferred Stock

Warrants

Subscription Rights

Debt Securities

Through this prospectus,

we may offer common stock, preferred stock, warrants, subscription rights and debt securities from time to time. When we decide

to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus supplement.

The securities offered by the Registrant pursuant to this prospectus will have an aggregate public offering price of up to $200,000,000.

The securities covered

by this prospectus may be offered and sold from time to time in one or more offerings, which may be through one or more underwriters,

dealers and agents, or directly to the purchasers. The names of any underwriters, dealers or agents, if any, will be included in

a supplement to this prospectus.

This prospectus describes

some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific

terms of any securities to be offered, and the specific manner in which they may be offered, will be described in one or more supplements

to this prospectus. A prospectus supplement may also add, update or change information contained in this prospectus.

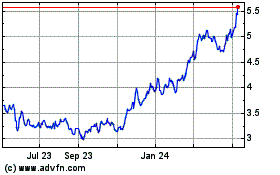

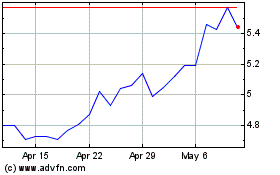

Our common stock is

traded on the New York Stock Exchange under the symbol “SB.”

Our principal executive

offices are located at Apt. D11, Les Acanthes 6, Avenue des Citronniers MC98000 Monaco. Our telephone number at such address is

011-377-97988181.

Our representative offices

in Greece are located at 30-32 Avenue Karamanli, P.O. Box 70837, 16605 Voula, Athens, Greece. Our telephone number at such address

is 011-30-2 111 888 400.

Investing in our

securities involves risks. Before buying any securities you should carefully read the section entitled “Risk Factors”

on page 5 of this prospectus.

Neither the Securities

and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

TABLE OF CONTENTS

You should rely only

on the information provided in this prospectus, the documents incorporated by reference herein and any prospectus supplements filed

hereafter. We have not authorized anyone to provide you with additional or different information. If any person provides you with

different or inconsistent information, you should not rely upon it. We are not making an offer of these securities in any jurisdiction

where an offer or sale is not permitted. You should assume that the information in this prospectus is accurate as of the date on

the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed

since that date. Information contained on our website does not constitute part of this prospectus.

FORWARD-LOOKING

STATEMENTS

All statements in this

prospectus that are not statements of historical fact are “forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995. The disclosure and analysis set forth in this prospectus includes assumptions,

expectations, projections, intentions and beliefs about future events in a number of places, particularly in relation to our operations,

cash flows, financial position, plans, strategies, business prospects, changes and trends in our business and the markets in which

we operate. These statements are intended as forward-looking statements. In some cases, predictive, future-tense or forward-looking

words such as “believe,” “intend,” “anticipate,” “hope,” “estimate,”

“project,” “forecast,” “plan,” “potential,” “may,” “will,”

“likely to,” “could,” “should” and “expect” and other similar expressions are intended

to identify forward-looking statements, but are not the exclusive means of identifying such statements. In addition, we and our

representatives may from time to time make other oral or written statements which are forward-looking statements, including in

our periodic reports that we file with the Securities and Exchange Commission (“SEC”), other information sent to our

security holders and other written materials.

Forward-looking statements

include, but are not limited to, such matters as:

|

|

·

|

future operating or financial results and future revenues and expenses;

|

|

|

·

|

future, pending or recent acquisitions, business strategy, areas of possible expansion and expected

capital spending or operating expenses;

|

|

|

·

|

availability of key employees, crew, length and number of off-hire days, drydocking requirements

and fuel and insurance costs;

|

|

|

·

|

general market conditions and shipping industry trends, including charter rates, vessel values

and factors affecting supply and demand;

|

|

|

·

|

our financial condition and liquidity, including our ability to make required payments under our

credit facilities, comply with our loan covenants and obtain additional financing in the future to fund capital expenditures, acquisitions

and other corporate activities;

|

|

|

·

|

the overall health and condition of the U.S. and global financial markets, including the value

of the U.S. dollar relative to other currencies;

|

|

|

·

|

our expectations about availability of vessels to purchase, the time that it may take to construct

and deliver new vessels or the useful lives of our vessels;

|

|

|

·

|

our continued ability to enter into period time charters with our customers and secure profitable

employment for our vessels in the spot market;

|

|

|

·

|

our future capital expenditures and investments in the construction, acquisition and refurbishment

of our vessels (including the amount and nature thereof and the timing of completion thereof, the delivery and commencement of

operations dates, expected downtime and lost revenue);

|

|

|

·

|

our expectations relating to dividend payments and ability to make such payments;

|

|

|

·

|

our ability to leverage our Managers’ relationships and reputation within the drybulk shipping

industry to our advantage;

|

|

|

·

|

our anticipated general and administrative expenses;

|

|

|

·

|

environmental and regulatory conditions, including changes in laws and regulations or actions taken

by regulatory authorities;

|

|

|

·

|

risks inherent in vessel operation, including terrorism (including cyber terrorism), piracy and

discharge of pollutants;

|

|

|

·

|

potential liability from future litigation; and

|

|

|

·

|

other factors discussed in “Risk Factors” of this prospectus.

|

We caution that the

forward-looking statements included in this prospectus represent our estimates and assumptions only as of the date of this prospectus

and are not intended to give any assurance as to future results. Assumptions, expectations, projections, intentions and beliefs

about future events may, and often do, vary from actual results and these differences can be material. The reasons for this include

the risks, uncertainties and factors described under “Risk Factors.” As a result, the forward-looking events discussed

in this prospectus might not occur and our actual results may differ materially from those anticipated in the forward-looking statements.

Accordingly, you should not unduly rely on any forward-looking statements.

We undertake no obligation

to update or revise any forward-looking statements contained in this prospectus, whether as a result of new information, future

events, a change in our views or expectations or otherwise. New factors emerge from time to time, and it is not possible for us

to predict all of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which

any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking

statement.

PROSPECTUS

SUMMARY

This summary highlights

information contained elsewhere in this prospectus and should be read together with the information contained in other parts of

this prospectus, any prospectus supplement and the documents we incorporate by reference. Unless otherwise indicated, references

in this prospectus to “Safe Bulkers,” the “Company,” “we,” “our,” “us,”

or similar terms when used in a historical context refer to Safe Bulkers, Inc. and/or its subsidiaries. For a more complete understanding

of the terms of a particular issuance of offered securities, and before making your investment decision, you should carefully read

the prospectus and the documents referred to in “Where You Can Find Additional Information” for information about us,

including our financial statements. Unless otherwise indicated, all references to currency amounts in this prospectus are in U.S.

dollars.

Our Company

Safe Bulkers, Inc. is

an international provider of marine drybulk transportation services, transporting bulk cargoes, particularly coal, grain and iron

ore, along worldwide shipping routes for some of the world’s largest consumers of marine drybulk transportation services.

As of October 5, 2016, we had a fleet of 37 drybulk vessels, with an aggregate carrying capacity of 3,339,800 dwt and an average

age of 6.44 years, making us one of the world’s youngest fleets of Panamax, Kamsarmax, Post-Panamax and Capesize class vessels.

Our fleet is expected to grow through 2018 as the result of the delivery of two further contracted newbuilds, comprised of one

Japanese Kamsarmax class vessel and one Chinese Kamsarmax class vessel. Upon delivery of the last of our contracted newbuilds,

assuming we do not acquire any additional vessels or dispose of any of our vessels, our fleet will be comprised of 39 vessels,

12 of which will be eco-design vessels, having an aggregate carrying capacity of 3,503,400 million dwt.

We employ our vessels

on both period time charters and spot time charters, according to our assessment of market conditions, with some of the world’s

largest consumers of marine drybulk transportation services. The vessels we deploy on period time charters provide us with relatively

stable cash flow and high utilization rates, while the vessels we deploy in the spot market allow us to maintain our flexibility

in low charter market conditions.

We maintain our principal

executive offices at Apt. D11, Les Acanthes 6, Avenue des Citronniers MC98000 Monaco. Our telephone number at that address is 011-377-97988181.

We maintain our representative offices in Greece at 30-32 Avenue Karamanli, P.O. Box 70837, 16605 Voula, Athens, Greece. Our telephone

number at that address is 011-30-2 111 888 400. Our registered address in the Marshall Islands is Trust Company Complex, Ajeltake

Road, Ajeltake Island, Majuro, Marshall Islands MH96960. The name of our registered agent at such address is The Trust Company

of the Marshall Islands, Inc.

The Securities That May

Be Offered

An aggregate public

offering price of $200,000,000 of:

|

|

·

|

subscription rights; and

|

A prospectus supplement

will describe the specific types, amounts, prices, and detailed terms of any of these offered securities and may describe certain

risks associated with an investment in the securities. Terms used in the prospectus supplement will have the meanings described

in this prospectus, unless otherwise specified.

We may issue shares

of our common stock, par value $0.001 per share. Holders of our common stock are entitled to receive dividends when declared by

our board of directors. Each holder of common stock is entitled to one vote per share. The holders of shares of common stock have

no cumulative voting or preemptive rights. Common stock may also be sold by us or by entities controlled by Polys Hajioannou, which,

own approximately 58.20% of our outstanding common stock.

We may issue preferred

stock, par value $0.01 per share, the terms of which will be established by our board of directors or a committee designated by

the board. Each series of preferred stock will be more fully described in the prospectus supplement that will accompany this prospectus,

including the terms of the preferred stock dealing with dividends, redemption provisions, rights in the event of liquidation, dissolution

or winding up, voting rights and conversion rights. Generally, each series of preferred stock will rank on an equal basis with

each other series of preferred stock and will rank prior to our common stock.

For any particular warrants

that we offer, the applicable prospectus supplement will describe the underlying securities into which the warrant is exercisable;

the expiration date; the exercise price or the manner of determining the exercise price; the amount and kind, or the manner of

determining the amount and kind, of property or cash to be delivered by you or us upon exercise; and any other specific terms.

We will issue the warrants under warrant agreements between us and one or more warrant agents.

For any particular subscription

rights that we offer, the applicable prospectus supplement will describe the number of subscription rights issued to each stockholder;

the expiration date; the exercise price or the manner of determining the exercise price; and any other specific terms. These subscription

rights may be issued independently or together with any other security offered by this prospectus and may or may not be transferable

by the stockholders receiving the rights in the rights offering.

For any particular debt

securities that we offer, the applicable prospectus supplement will describe the amount being offered and any other specific terms.

Payment Currencies

Amounts payable in respect

of the securities, including the purchase price, will be payable in U.S. dollars, unless the prospectus supplement states otherwise.

Our common stock is

listed on the New York Stock Exchange. If any securities are to be listed or quoted on any other securities exchange or quotation

system, the applicable prospectus supplement will so state.

RISK

FACTORS

Investing in the securities

to be offered pursuant to this prospectus may involve a high degree of risk. You should carefully consider the important factors

set forth under the heading “Risk Factors” in our most recent Annual Report on Form 20-F filed with the SEC and incorporated

herein by reference and in the accompanying prospectus supplement for such issuance before investing in any securities that may

be offered. For further details, see the section entitled “Where You Can Find Additional Information.”

Any of the risk factors

referred to above could significantly and negatively affect our business, results of operations or financial condition, which may

reduce our ability to pay dividends and lower the trading price of our common stock. The risks referred to above are not the only

ones that may exist. Additional risks not currently known by us or that we deem immaterial may also impair our business operations.

You may lose all or a part of your investment.

SERVICE

OF PROCESS AND ENFORCEMENT OF LIABILITIES

We are a Marshall Islands

corporation and our offices are located outside of the United States in Athens, Greece. A majority of our directors and officers

and some of the experts in this prospectus reside outside the United States. In addition, a substantial portion of our assets and

the assets of our directors, officers and experts are located outside of the United States. As a result, you may have difficulty

serving legal process within the United States upon us or any of these persons. You may also have difficulty enforcing, both in

and outside of the United States, judgments you may obtain in U.S. courts against us or these persons in any action, including

actions based upon the civil liability provisions of U.S. Federal or state securities laws.

Furthermore, there is

substantial doubt that the courts of the Marshall Islands or Greece would enter judgments in original actions brought in those

courts predicated on U.S. Federal or state securities laws.

ABOUT

THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities Exchange Commission, or the “SEC,” using a shelf registration

process. Under this shelf registration process, we may, from time to time, sell up to an aggregate public offering price of $200,000,000

of any combination of the securities described in this prospectus in one or more offerings. This prospectus provides you with a

general description of the securities we may offer. Each time we sell securities, we will provide you with this prospectus, as

well as a prospectus supplement that will contain specific information about the terms of that offering. That prospectus supplement

may include additional risk factors or other special considerations applicable to those particular securities. Any prospectus supplement

may also add, update or change information contained in this prospectus. If there is any inconsistency between the information

contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus

supplement. You should read both this prospectus and any prospectus supplement together with additional information described under

the heading “Where You Can Find Additional Information.”

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

As required by the Securities

Act of 1933, as amended (the “Securities Act”), we have filed a registration statement relating to the securities offered

by this prospectus with the SEC. This prospectus is a part of that registration statement, which includes additional information.

We file annual and other

reports with the SEC. You may read and copy any document we file at the SEC’s public reference room located at 100 F Street,

N.E., Washington, D.C. 20549. The public may obtain information on the operation of the SEC’s Public Reference Room by calling

the SEC in the United States at 1-800-SEC-0330. The SEC also maintains a web site at

http://www.sec.gov

that contains

reports, proxy statements and other information regarding registrants that file electronically with the SEC.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to

“incorporate by reference” the information we file with the SEC. This means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered

to be part of this prospectus. Any information that we file later with the SEC and that is deemed incorporated by reference will

automatically update and supersede the information in this prospectus. In all such cases, you should rely on the later information

over different information included in this prospectus.

This prospectus incorporates

by reference the following documents:

|

|

·

|

our Annual Report on Form 20-F for the year ended December 31, 2015, filed with the SEC on March

4, 2016;

|

|

|

·

|

our Reports on Form 6-K furnished to the SEC on July 5, 2016, July 12, 2016, July 18, 2016, July

21, 2016 (with regard to the amendment of Term Loan Facility with Royal Bank of Scotland plc), August 3, 2016, August 10, 2016,

September 23, 2016, October 4, 2016, October 17, 2016, and October 17, 2016;

|

|

|

·

|

the description of our common stock contained in our registration statement on Form 8-A (File No.

001-34077), filed with the SEC on May 22, 2008 which incorporates by reference the description of our common stock contained in

our Registration Statement on Form F-1 (File No. 333-150995), as amended, filed with the SEC on May 16, 2008, and any amendments

or reports filed updating that description;

|

|

|

·

|

the description of our 8.00% Series B Cumulative Redeemable Perpetual Preferred Shares (“Series

B Preferred Shares”) contained in our registration statement on Form 8-A (File No. 001-34077), filed with the SEC on June

18, 2013 which incorporates by reference the description of the Series B Preferred Shares contained in our prospectus filed with

the SEC on June 7, 2013, pursuant to Rule 424(b) under the Securities Act, and any amendments or reports filed updating that description;

|

|

|

·

|

the description of our 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares (“Series

C Preferred Shares”) contained in our registration statement on Form 8-A (File No. 001-34077), filed with the SEC on May

7, 2014 which incorporates by reference the description of the Series C Preferred Shares contained in our prospectus filed with

the SEC on May 1, 2014, pursuant to Rule 424(b) under the Securities Act, and any amendments or reports filed updating that description;

and

|

|

|

·

|

the description of our 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares (“Series

D Preferred Shares”) contained in our registration statement on Form 8-A (File No. 001-34077), filed with the SEC on June

30, 2014 which incorporates by reference the description of the Series D Preferred Shares contained in our prospectus filed with

the SEC on June 24, 2014, pursuant to Rule 424(b) under the Securities Act, and any amendments or reports filed updating that description.

|

We will also incorporate

by reference any future filings made with the SEC under Sections 13(a), 13(c) or 15(d) of the Exchange Act until we terminate the

offering contemplated by any prospectus supplement. In addition, we will incorporate by reference certain future materials furnished

to the SEC on Form 6-K, but only to the extent specifically indicated in those submissions or in a future prospectus supplement.

You may request a copy

of these filings, at no cost, by writing or telephoning us at the following address:

Safe Bulkers, Inc.

30-32 Avenue Karamanli

P.O. Box 70837

16605 Voula

Athens, Greece

011-30-211-1888400

Attention: Dr. Loukas Barmparis, Secretary

RATIO OF EARNINGS/(LOSS) TO FIXED CHARGES

AND PREFERRED DIVIDENDS

|

|

|

Year Ended December 31,

|

|

Six Months

Ended June

30,

|

|

|

|

2011

|

|

2012

|

|

2013

|

|

2014

|

|

2015

|

|

2016

|

|

Ratio of Earnings/(Loss) to Fixed Charges

(1)

|

|

|

13.0

|

|

|

|

9.4

|

|

|

|

8.7

|

|

|

|

2.4

|

|

|

|

(2.2

|

)

(2)

|

|

|

(1.2

|

)

(3)

|

|

Ratio of Earnings/(Loss) to Fixed Charges and Preferred Dividends

(1)

|

|

|

13.0

|

|

|

|

9.4

|

|

|

|

8.7

|

|

|

|

1.3

|

|

|

|

(1.1

|

)

(2)

|

|

|

(0.8

|

)

(3)

|

|

|

|

|

|

|

(1)

|

For the purpose of computing the consolidated ratio of earnings/(loss) to fixed charges, earnings/(loss)

consist of net income/(loss) plus fixed charges less interest capitalized. Fixed charges consist of interest expensed and capitalized,

amortization and write-off of capitalized expenses relating to indebtedness. For the purpose of computing the consolidated ratio

of earnings/(loss) to fixed charges and preferred dividends, earnings/(loss) consist of net income/(loss) plus fixed charges less

interest capitalized and preferred dividends. Fixed charges consist of interest expensed and capitalized, amortization and write-off

of capitalized expenses relating to indebtedness. Preferred Dividends refers to the amount of earnings that is required to pay

the cash dividends on outstanding preference securities. It also includes the redemption of preferred stock.

|

|

|

(2)

|

For the year ended December 31, 2015, earnings were inadequate to cover total fixed charges by

approximately $48.6 million and the sum of total fixed charges and preferred dividends by approximately $62.8 million.

|

|

|

(3)

|

For the six months ended June 30, 2016, earnings were inadequate to cover total fixed charges by

approximately $27.3 million and the sum of total fixed charges and preferred dividends by approximately $34.3 million.

|

USE

OF PROCEEDS

The use of proceeds

from any offering will be set forth in a prospectus supplement to this prospectus or in a report on Form 6-K subsequently furnished

to the SEC and specifically incorporated herein by reference.

CAPITALIZATION

AND INDEBTEDNESS

Our capitalization and

indebtedness will be set forth in a prospectus supplement to this prospectus or in a report on Form 6-K subsequently furnished

to the SEC and specifically incorporated herein by reference.

DESCRIPTION

OF CAPITAL STOCK

Under our first amended

and restated articles of incorporation (as further amended through the date hereof) (“articles of incorporation”),

our authorized capital stock consists of 200,000,000 shares of common stock, par value $0.001 per share, of which, as of as of

December 31, 2015, there were 83,486,194 shares of the registrant’s common stock issued and outstanding and fully paid, and

20,000,000 shares of blank check preferred stock, par value $0.01 per share, of which, as of December 31, 2015, 1,569,526 shares

of Series B Preferred Shares, 2,300,000 shares of Series C Preferred Shares and 3,200,000 shares of Series D Preferred Shares were

issued and outstanding. Of this blank check preferred stock, 1,000,000 shares have been designated Series A Participating Preferred

Stock in connection with our adoption of a stockholder rights plan as described below under “—Stockholder Rights Plan.”

All of our shares of stock are in registered form.

Common Stock

Each outstanding share

of common stock entitles the holder to one vote on all matters submitted to a vote of stockholders. Subject to preferences that

may be applicable to any outstanding shares of preferred stock, holders of shares of common stock are entitled to receive ratably

all dividends, if any, declared by our board of directors out of funds legally available for dividends. Upon our dissolution or

liquidation or the sale of all or substantially all of our assets, after payment in full of all amounts required to be paid to

creditors and to the holders of preferred stock having liquidation preferences, if any, the holders of our common stock will be

entitled to receive pro rata our remaining assets available for distribution. Holders of common stock do not have conversion, redemption

or preemptive rights to subscribe to any of our securities. All outstanding shares of common stock are fully paid and nonassessable.

The rights, preferences and privileges of holders of common stock are subject to the rights of the holders of any shares of preferred

stock which we may issue in the future. Our common stock is not subject to any sinking fund provisions and no holder of any shares

will be required to make additional contributions of capital with respect to our shares in the future. There are no provisions

in our articles of incorporation or first amended and restated bylaws (“bylaws”) discriminating against a stockholder

because of his or her ownership of a particular number of shares.

We are not aware of

any limitations on the rights to own our common stock, including rights of non-resident or foreign stockholders to hold or exercise

voting rights on our common stock, imposed by foreign law or by our articles of incorporation or bylaws.

Preferred Stock

Our articles of incorporation

authorize our board of directors, without any further vote or action by our stockholders, to issue up to 20,000,000 shares of blank

check preferred stock, and to determine, with respect to any series of preferred stock established by our board of directors, the

terms and rights of that series, including:

|

|

·

|

the designation of the series;

|

|

|

·

|

the number of shares of the series which our board of directors may, except where otherwise provided

in the preferred shares designation, increase or decrease, but not below the number of shares then outstanding;

|

|

|

·

|

whether

dividends, if any, will be cumulative or non-cumulative and the dividend rate of the series;

|

|

|

·

|

the dates at which dividends, if any, will be payable; the redemption rights and price or prices,

if any, for shares of the series;

|

|

|

·

|

the terms and amounts of any sinking fund provided for the purchase or redemption of shares of

the series;

|

|

|

·

|

the amounts payable on shares of the series in the event of any voluntary or involuntary liquidation,

dissolution or winding-up of the affairs of our company;

|

|

|

·

|

whether the shares of the series will be convertible into shares of any other class or series,

or any other security, of our company or any other corporation, and, if so, the specification of the other class or series or other

security, the conversion price or prices or rate or rates, any rate adjustments, the date or dates as of which the shares will

be convertible and all other terms and conditions upon which the conversion may be made;

|

|

|

·

|

restrictions on the issuance of shares of the same series or of any other class or series;

|

|

|

·

|

the preferences and relative, participating, optional or other special rights, if any, and any

qualifications, limitations or restrictions of such series; and

|

|

|

·

|

the voting powers, if any, of the holders of the series.

|

Series A Participating Preferred

Stock

There are no shares

of Series A Participating Preferred Stock issued and outstanding, although 1,000,000 shares have been designated Series A Participating

Preferred Stock in connection with our adoption of a stockholder rights plan.

Series B Preferred Shares

In June 2013,

we issued 1,600,000 shares of our Series B Preferred Shares, of which 1,501,477 Series B Preferred Shares were outstanding as

of October 13, 2016. The initial liquidation preference of the Series B Preferred Shares is $25.00 per share. The shares are

redeemable by us at any time on or after July 30, 2016. The shares carry an annual dividend rate of 8.00% per $25.00 of

liquidation preference per share. The Series B Preferred Shares represents perpetual equity interests in us and, unlike our

indebtedness but like our Series C Preferred Shares and our Series D Preferred Shares, do not give rise to a claim of payment

of a principal amount at a particular date. As such, the Series B Preferred Shares rank junior to all of our indebtedness

and other liabilities with respect to assets available to satisfy claims against us, and pari passu with the Series C

Preferred Shares and with the Series D Preferred Shares. Upon any liquidation and dissolution of us, holders of the Series B

Preferred Shares will generally be entitled to receive the cash value of the liquidation preference of the Series B Preferred

Shares, plus an amount equal to accumulated and unpaid dividends, after satisfaction of all liabilities to our creditors, but

before any distribution is made to or set aside for the holders of junior stock, including common stock. The Series B

Preferred Shares are not convertible into common stock or other of our securities, do not have exchange rights and are not

entitled to preemptive or similar rights. A description of our Series B Preferred Shares can be found in our registration

statement on Form 8-A (File No. 001-34077), filed with the SEC on June 18, 2013 which incorporates by reference the

description of the Series B Preferred Shares contained in our prospectus filed with the SEC on June 7, 2013, pursuant to Rule

424(b) under the Securities Act, and any amendments or reports filed updating that description.

Series C Preferred Shares

In May 2014, we issued

2,300,000 shares of our Series C Preferred Shares. The initial liquidation preference of the Series C Preferred Shares is $25.00

per share. The shares are redeemable by us at any time on or after May 31, 2019. The shares carry an annual dividend rate of 8.00%

per $25.00 of liquidation preference per share. The Series C Preferred Shares represent perpetual equity interests in us and, unlike

our indebtedness but like our Series B Preferred Shares and our Series D Preferred Shares, do not give rise to a claim of payment

of a principal amount at a particular date. As such, the Series C Preferred Shares rank junior to all of our indebtedness and other

liabilities with respect to assets available to satisfy claims against us, and pari passu with the Series B Preferred Shares and

with the Series D Preferred Shares. Upon any liquidation and dissolution of us, holders of the Series C Preferred Shares will generally

be entitled to receive the cash value of the liquidation preference of the Series C Preferred Shares, plus an amount equal to accumulated

and unpaid dividends, after satisfaction of all liabilities to our creditors, but before any distribution is made to or set aside

for the holders of junior stock, including common stock. The Series C Preferred Shares are not convertible into common stock or

other of our securities, do not have exchange rights and are not entitled to preemptive or similar rights. A description of our

Series C Preferred Shares can be found in our registration statement on Form 8-A (File No. 001-34077), filed with the SEC on May

7, 2014 which incorporates by reference the description of the Series C Preferred Shares contained in our prospectus filed with

the SEC on May 1, 2014, pursuant to Rule 424(b) under the Securities Act, and any amendments or reports filed updating that description.

Series D Preferred Shares

In June, 2014 we issued

2,800,000 shares of our Series D Preferred Shares. The initial liquidation preference of the Series D Preferred Shares is $25.00

per share. The shares are redeemable by us at any time on or after June 30, 2019. The shares carry an annual dividend rate of 8.00%

per $25.00 of liquidation preference per share. The Series D Preferred Shares represent perpetual equity interests in us and, unlike

our indebtedness but like our Series B Preferred Shares and our Series C Preferred Shares, do not give rise to a claim for payment

of a principal amount at a particular date. As such, the Series D Preferred Shares rank junior to all of our indebtedness and other

liabilities with respect to assets available to satisfy claims against us and pari passu with the Series B Preferred Shares and

with the Series C Preferred Shares. Upon any liquidation and dissolution of us, holders of the Series D Preferred

Shares will generally

be entitled to receive the cash value of the liquidation preference of the Series D Preferred Shares, plus an amount equal to accumulated

and unpaid dividends, after satisfaction of all liabilities to our creditors, but before any distribution is made to or set aside

for the holders of junior stock, including common stock. The Series D Preferred Shares are not convertible into common stock or

other of our securities, do not have exchange rights and are not entitled to preemptive or similar rights. A description of our

Series D Preferred Shares can be found in our registration statement on Form 8-A (File No. 001-34077), filed with the SEC on June

30, 2014 which incorporates by reference the description of the Series D Preferred Shares contained in our prospectus filed with

the SEC on June 24, 2014, pursuant to Rule 424(b) under the Securities Act, and any amendments or reports filed updating that description.

Stockholder Rights Plan

Each share of our common

stock includes a right that entitles the holder to purchase from us a unit consisting of one- thousandth of a share of our Series

A participating preferred stock at a purchase price of $25.00 per unit, subject to specified adjustments. The rights are issued

pursuant to a stockholder rights agreement between us and American Stock Transfer & Trust Company, as rights agent. Until a

right is exercised, the holder of a right will have no rights to vote or receive dividends or any other stockholder rights.

The rights may have

anti-takeover effects. The rights will cause substantial dilution to any person or group that attempts to acquire us without the

approval of our board of directors. As a result, the overall effect of the rights may be to render more difficult or discourage

any attempt to acquire us. Because our board of directors can approve a redemption of the rights or a permitted offer, the rights

should not interfere with a merger or other business combination approved by our board of directors. The adoption of the rights

agreement was approved by our existing stockholder prior to our initial public offering in May 2008.

We have summarized the

material terms and conditions of the rights agreement and the rights below. For a complete description of the rights, we encourage

you to read the stockholder rights agreement, which we filed with the SEC on May 16, 2008 as an exhibit to our Registration Statement

on Form F-1.

|

|

(2)

|

Detachment of the Rights

|

The rights are attached

to all certificates representing our outstanding common stock and will attach to all common stock certificates we issue prior to

the rights distribution date that we describe below. The rights are not exercisable until after the rights distribution date and

will expire at the close of business on the tenth anniversary date of the adoption of the rights plan, unless we redeem or exchange

them earlier as described below. The rights will separate from the common stock and a rights distribution date will occur, subject

to specified exceptions, on the earlier of the following two dates:

|

|

·

|

ten days following the first public announcement that a person or group of affiliated or associated

persons or an “acquiring person” has acquired or obtained the right to acquire beneficial ownership of 15% or more

of our outstanding common stock; or

|

|

|

·

|

ten business days following the start of a tender or exchange offer that would result, if closed,

in a person becoming an “acquiring person.”

|

One of our principal

stockholders, Vorini Holdings Inc., and its affiliates are excluded from the definition of “acquiring person” for purposes

of the rights, and therefore their ownership or future share acquisitions cannot trigger the rights. Specified “inadvertent”

owners that would otherwise become an acquiring person, including those who would have this designation as a result of repurchases

of common stock by us, will not become acquiring persons as a result of those transactions.

Our board of directors

may defer the rights distribution date in some circumstances, and some inadvertent acquisitions will not result in a person becoming

an acquiring person if the person promptly divests itself of a sufficient number of shares of common stock.

Until the rights distribution

date:

|

|

·

|

our common stock certificates will evidence the rights, and the rights will be transferable only

with those certificates; and

|

|

|

·

|

any new shares of common stock will be issued with rights and new certificates will contain a notation

incorporating the rights agreement by reference.

|

As soon as practicable

after the rights distribution date, the rights agent will mail certificates representing the rights to holders of record of common

stock at the close of business on that date. As of the rights distribution date, only separate rights certificates will represent

the rights.

We will not issue rights

with any shares of common stock we issue after the rights distribution date, except as our board of directors may otherwise determine.

A “flip-in event”

will occur under the rights agreement when a person becomes an acquiring person. If a flip-in event occurs and we do not redeem

the rights as described under the heading “—Redemption of Rights” below, each right, other than any right that

has become void, as described below, will become exercisable at the time it is no longer redeemable for the number of shares of

common stock, or, in some cases, cash, property or other of our securities, having a current market price equal to two times the

exercise price of such right.

If a flip-in event occurs,

all rights that then are, or in some circumstances that were, beneficially owned by or transferred to an acquiring person or specified

related parties will become void in the circumstances which the rights agreement specifies.

A “flip-over event”

will occur under the rights agreement when, at any time after a person has become an acquiring person:

|

|

·

|

we are acquired in a merger or other business combination transaction; or

|

|

|

·

|

50% or more of our assets, cash flows or earning power is sold or transferred.

|

If a flip-over event

occurs, each holder of a right, other than any right that has become void as we describe under the heading “—Flip-In

Event” above, will have the right to receive the number of shares of common stock of the acquiring company having a current

market price equal to two times the exercise price of such right.

The number of outstanding

rights associated with our common stock is subject to adjustment for any stock split, stock dividend or subdivision, combination

or reclassification of our common stock occurring prior to the rights distribution date. With some exceptions, the rights agreement

does not require us to adjust the exercise price of the rights until cumulative adjustments amount to at least 1% of the exercise

price. It also does not require us to issue fractional shares of our preferred stock that are not integral multiples of one one-hundredth

of a share, and, instead we may make a cash adjustment based on the market price of the common stock on the last trading date prior

to the date of exercise. The rights agreement reserves us the right to require, prior to the occurrence of any flip-in event or

flip-over event that, on any exercise of rights, that a number of rights must be exercised so that we will issue only whole shares

of stock.

At any time until ten

days after the date on which the occurrence of a flip-in event is first publicly announced, we may redeem the rights in whole,

but not in part, at a redemption price of $0.01 per right. The redemption price is subject to adjustment for any stock split, stock

dividend or similar transaction occurring before the date of redemption. At our option, we may pay that redemption price in cash,

shares of common stock or any other

consideration our board of directors may select. The rights are not exercisable after a flip-in

event until they are no longer redeemable. If our board of directors timely orders the redemption of the rights, the rights will

terminate on the effectiveness of that action.

We may, at our option,

exchange the rights (other than rights owned by an acquiring person or an affiliate or an associate of an acquiring person, which

have become void), in whole or in part. The exchange must be at an exchange ratio of one share of common stock per right, subject

to specified adjustments at any time after the occurrence of a flip-in event and prior to:

|

|

·

|

any person other than our existing stockholder becoming the beneficial owner of common stock with

voting power equal to 50% or more of the total voting power of all shares of common stock entitled to vote in the election of directors;

or

|

|

|

·

|

the occurrence of a flip-over event.

|

|

|

(8)

|

Amendment of Terms of Rights

|

While the rights are

outstanding, we may amend the provisions of the rights agreement only as follows:

|

|

·

|

to cure any ambiguity, omission, defect or inconsistency;

|

|

|

·

|

to make changes that do not adversely affect the interests of holders of rights, excluding the

interests of any acquiring person; or

|

|

|

·

|

to shorten or lengthen any time period under the rights agreement, except that we cannot change

the time period when rights may be redeemed or lengthen any time period, unless such lengthening protects, enhances or clarifies

the benefits of holders of rights other than an acquiring person.

|

At any time when no

rights are outstanding, we may amend any of the provisions of the rights agreement, other than decreasing the redemption price.

Dividends

The declaration and

payment of dividends, if any, will always be subject to the discretion of our board of directors and the requirements of Marshall

Islands law. The timing and amount of any dividends declared will depend on, among other things: (a) our earnings, financial condition

and cash requirements and availability, (b) our ability to obtain debt and equity financing on acceptable terms as contemplated

by our growth strategy, (c) provisions of Marshall Islands and Liberian law governing the payment of dividends, (d) restrictive

covenants in our existing and future debt instruments and (e) global financial conditions. There can be no assurance that dividends

will be paid. Our ability to pay dividends may be limited by the amount of cash we can generate from operations following the payment

of fees and expenses and the establishment of any reserves as well as additional factors unrelated to our profitability. We are

a holding company, and we depend on the ability of our subsidiaries to distribute funds to us in order to satisfy our financial

obligations and to make dividend payments.

Marshall Islands Law and

Our Articles of Incorporation and Bylaws

Our purpose, as stated

in our articles of incorporation, is to engage in any lawful act or activity for which corporations may now or hereafter be organized

under the Business Corporations Act of the Marshall Islands, or the “BCA,” and without in any way limiting the generality

of the foregoing, the corporation shall have the power: (a) to purchase or otherwise acquire, own, use, operate, pledge, hypothecate,

mortgage, lease, charter, sub-charter, sell, build, and repair steamships, motorships, tankers, sailing vessels, tugs, lighters,

barges, and all other vessels and craft of any and all motive power whatsoever, including, landcraft and any and all other means

of conveyance and transportation by land or water, together with engines, boilers, machinery equipment and appurtenances of all

kinds,

including masts, sails, boats, anchors, cables, tackle, furniture and all other necessities thereunto appertaining and belonging,

together with all materials, articles, tools, equipment and appliances necessary, suitable or convenient for the construction,

equipment, use and operation thereof; and to equip, furnish, and outfit such vessels and ships; (b) to carry on its business, to

have one or more offices, and or exercise its powers in foreign countries, subject to the laws of the particular country; (c) to

borrow or raise money and contract debts, when necessary, for the transaction of its business or for the exercise of its corporate

rights, privileges or franchise or for any other lawful purpose of its incorporation; to draw, make, accept, endorse, execute and

issue promissory notes, bills of exchange, bonds, debentures, and other instruments and evidences of indebtedness either secured

by mortgage, pledge, deed of trust, or otherwise, or unsecured; (d) to purchase or otherwise acquire, hold, own, mortgage, sell,

convey, or otherwise dispose of real and personal property of every class and description; and (e) to act as agent and/or representative

of ship-owning companies.

Our articles of incorporation

and bylaws do not impose any limitations on the ownership rights of our stockholders.

Under our bylaws, annual

stockholder meetings will be held at a time and place selected by our board of directors. The meetings may be held inside or outside

of the Marshall Islands. Special meetings may be called by the Chairman of the board of directors, the Chief Executive Officer

or by the Chairman of the board of directors or the Chief Executive Officers at the request of a majority of the board of directors.

Our board of directors may set a record date between 15 and 60 days before the date of any meeting to determine the stockholders

that will be eligible to receive notice and vote at the meeting. Our articles of incorporation and bylaws permit stockholder action

by unanimous written consent.

We are registered with

the Registrar of Corporations of the Republic of the Marshall Islands under registration number 27394.

Under our articles of

incorporation and bylaws, our directors are elected by a plurality of the votes cast at each annual meeting of the stockholders

by the holders of shares entitled to vote in the election. There is no provision for cumulative voting.

Pursuant to the provision

of our bylaws, the board of directors may change the number of directors to not less than three, nor more than 15, by a vote of

a majority of the entire board. Each director shall be elected to serve until the third succeeding annual meeting of stockholders

and until his or her successor shall have been duly elected and qualified, except in the event of death, resignation or removal.

A vacancy on the board created by death, resignation, removal (which may only be for cause), or failure of the stockholders to

elect the entire class of directors to be elected at any election of directors or for any other reason, may be filled only by an

affirmative vote of a majority of the remaining directors then in office, even if less than a quorum, at any special meeting called

for that purpose or at any regular meeting of the board of directors. The board of directors has the authority to fix the amounts

which shall be payable to the non-employee members of our board of directors for attendance at any meeting or for services rendered

to us.

|

|

(3)

|

Dissenters’ Rights of Appraisal and Payment

|

Under the BCA, our stockholders

have the right to dissent from various corporate actions, including any merger or sale of all, or substantially all, of our assets

not made in the usual course of our business, and receive payment of the fair value of their shares. In the event of any amendment

of our articles of incorporation, a stockholder also has the right to dissent and receive payment for his or her shares if the

amendment alters certain rights in respect of those shares. The dissenting stockholder must follow the procedures set forth in

the BCA to receive payment. In the event that we and any dissenting stockholder fail to agree on a price for the shares, the BCA

procedures involve, among other things, the institution of proceedings in the high court of the Republic of the Marshall Islands

or in any appropriate court in any jurisdiction in which our shares are primarily traded on a local or national securities exchange.

The value of the shares of the dissenting stockholder is fixed by the court after reference, if the court so elects, to the recommendations

of a court-appointed appraiser.

|

|

(4)

|

Stockholders’ Derivative Actions

|

Under the BCA, any of

our stockholders may bring an action in our name to procure a judgment in our favor, also known as a derivative action,

provided

that the stockholder bringing the action is a holder of common stock both at the time the derivative action is commenced and

at the time of the transaction to which the action relates.

Anti-takeover Provisions

of Our Articles of Incorporation and Bylaws

Several provisions of

our articles of incorporation and bylaws, which are summarized in the following paragraphs, may have anti-takeover effects. These

provisions are intended to avoid costly takeover battles, lessen our vulnerability to a hostile change of control and enhance the

ability of our board of directors to maximize stockholder value in connection with any unsolicited offer to acquire us. However,

these anti-takeover provisions could also delay, defer or prevent (a) the merger or acquisition of our company by means of a tender

offer, a proxy contest or otherwise that a stockholder might consider in its best interest, including attempts that may result

in a premium over the market price for the shares held by the stockholders, and (b) the removal of incumbent officers and directors.

|

|

(2)

|

Blank Check Preferred Stock

|

Under the terms of our

articles of incorporation, our board of directors has authority, without any further vote or action by our stockholders, to issue

up to 20,000,000 shares of blank check preferred stock, of which 1,000,000 shares have been designated Series A Participating Preferred

Stock, in connection with our adoption of a stockholder rights plan as described above under “—Stockholder Rights Plan”

and as of October 13, 2016, 1,501,477 Series B Preferred Shares are issued and outstanding, 2,300,000 Series C Preferred Shares

are issued and outstanding and 3,200,000 Series D Preferred Shares are issued and outstanding. Our board of directors may issue

shares of preferred stock on terms calculated to discourage, delay or prevent a change of control of our company or the removal

of our management.

|

|

(3)

|

Classified Board of Directors

|

Our articles of incorporation

provide for a board of directors serving staggered, three-year terms. Approximately one- third of our board of directors will be

elected each year. This classified board provision could discourage a third party from making a tender offer for our shares or

attempting to obtain control of our company. It could also delay stockholders who do not agree with the policies of the board of

directors from removing a majority of the board of directors for two years.

|

|

(4)

|

Election and Removal of Directors

|

Our articles of incorporation

prohibit cumulative voting in the election of directors. Our bylaws require parties other than the board of directors to give advance

written notice of nominations for the election of directors. Our articles of incorporation and bylaws also provide that our directors

may be removed only for cause. These provisions may discourage, delay or prevent the removal of incumbent officers and directors.

|

|

(5)

|

Calling of Special Meetings of Stockholders

|

Our articles of incorporation

and bylaws provide that special meetings of our stockholders may only be called by our Chairman of the board of directors, Chief

Executive Officer or by either, at the request of a majority of our board of directors.

|

|

(6)

|

Advance Notice Requirements for Stockholder Proposals

and Director Nominations

|

Our bylaws provide that

stockholders seeking to nominate candidates for election as directors or to bring business before an annual meeting of stockholders

must provide timely notice of their proposal in writing to the corporate secretary.

Generally, to be timely,

a stockholder’s notice must be received at our offices not less than 90 days nor more than 120 days prior to the first anniversary

date of the previous year’s annual meeting. Our bylaws also specify requirements as to the form and content of a stockholder’s

notice. These provisions may impede stockholders’ ability to bring matters before an annual meeting of stockholders or to

make nominations for directors at an annual meeting of stockholders.

DESCRIPTION

OF WARRANTS

We may issue warrants

to purchase our equity securities or securities of third parties or other rights, including rights to receive payment in cash or

securities based on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination

of the foregoing. Warrants may be issued independently or together with any other securities and may be attached to, or separate

from, such securities. A series of warrants may be issued under a separate warrant agreement to be entered into between us and

a warrant agent. The terms of any warrants to be issued and a description of the material provisions of any applicable warrant

agreement will be set forth in the applicable prospectus supplement.

The applicable prospectus

supplement will describe the following terms of any warrants in respect of which this prospectus is being delivered:

|

|

·

|

the title of such warrants;

|

|

|

·

|

the aggregate number of such warrants;

|

|

|

·

|

the price or prices at which such warrants will be issued;

|

|

|

·

|

the currency or currencies, in which the price of such warrants will be payable;

|

|

|

·

|

the securities or other rights, including rights to receive payment in cash or securities based

on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the

foregoing, purchasable upon exercise of such warrants;

|

|

|

·

|

the price at which and the currency or currencies, in which the securities or other rights purchasable

upon exercise of such warrants may be purchased;

|

|

|

·

|

the date on which the right to exercise such warrants shall commence and the date on which such

right shall expire;

|

|

|

·

|

the amount of warrants outstanding;

|

|

|

·

|

if applicable, the minimum or maximum amount of such warrants which may be exercised at any one

time;

|

|

|

·

|

if applicable, the designation and terms of the securities with which such warrants are issued

and the number of such warrants issued with each such security;

|

|

|

·

|

if applicable, the date on and after which such warrants and the related securities will be separately

transferable;

|

|

|

·

|

information with respect to book-entry procedures, if any;

|

|

|

·

|

if applicable, a discussion of any material United States Federal income tax considerations; and

|

|

|

·

|

any other terms of such warrants, including terms, procedures and limitations relating to the exchange

and exercise of such warrants.

|

DESCRIPTION

OF SUBSCRIPTION RIGHTS

We may issue to our

stockholders subscription rights to purchase our equity securities. These subscription rights may be issued independently or together

with any other security offered by this prospectus and may or may not be transferable by the stockholder receiving the rights in

the rights offering. In connection with any rights offering, we may enter into a standby underwriting agreement with one or more

underwriters pursuant to which the underwriter will purchase any securities that remain unsubscribed for upon completion of the

rights offering.

The applicable prospectus

supplement relating to any subscription rights will describe the terms of the offered subscription rights, including, where applicable,

the following:

|

|

·

|

the exercise price for the subscription rights;

|

|

|

·

|

the number of subscription rights issued to each stockholder;

|

|

|

·

|

the extent to which the subscription rights are transferable;

|

|

|

·

|

any other terms of the subscription rights, including terms, procedures and limitations relating

to the exchange and exercise of the subscription rights;

|

|

|

·

|

the date on which the right to exercise the subscription rights will commence and the date on which

the right will expire;

|

|

|

·

|

the amount of subscription rights outstanding;

|

|

|

·

|

the extent to which the subscription rights include an over-subscription privilege with respect

to unsubscribed securities; and

|

|

|

·

|

the material terms of any standby underwriting arrangement entered into by us in connection with

the subscription rights offering.

|

The description in the

applicable prospectus supplement of any subscription rights we offer will not necessarily be complete and will be qualified in

its entirety by reference to the applicable subscription rights certificate or subscription rights agreement, which will be filed

with the SEC if we offer subscription rights. For more information on how you can obtain copies of any subscription rights certificate

or subscription rights agreement if we offer subscription rights, see “Where You Can Find Additional Information” beginning

on page 4 of this prospectus. We urge you to read the applicable subscription rights certificate, the applicable subscription rights

agreement and any applicable prospectus supplement in their entirety.

DESCRIPTION

OF DEBT SECURITIES

We may elect to offer

debt securities. The following description of debt securities sets forth the material terms and provisions of the debt securities

to which any prospectus supplement may relate. Our debt securities would be issued under an indenture between us and a trustee.

The debt securities we may offer may be convertible into common stock or other securities. The indenture, a form of which is included

as an exhibit to the registration statement of which this prospectus is a part, will be executed at the time we issue any debt

securities. Any supplemental indentures will be filed with the SEC on a Form 6-K or by a post-effective amendment to the registration

statement of which this prospectus is a part.

The particular terms

of the debt securities offered by any prospectus supplement, and the extent to which the general provisions described below may

apply to the offered debt securities, will be described in the applicable prospectus supplement. The indenture will be qualified

under the Trust Indenture Act of 1939, as amended. The terms of the debt securities will include those stated in the indenture

and those made part of the indenture by reference to the Trust Indenture Act.

Because the following

summaries of the material terms and provisions of the indenture and the related debt securities are not complete, you should refer

to the form of the indenture and the debt securities for complete

information on some of the terms and provisions of the indenture,

including definitions of some of the terms used below, and the debt securities.

General

The provisions of the

indenture do not limit the aggregate principal amount of debt securities which may be issued thereunder. Unless otherwise provided

in a prospectus supplement, the debt securities will be our direct, unsecured and unsubordinated general obligations and will have

the same rank in liquidation as all of our other unsecured and unsubordinated debt. The debt securities may be convertible into

common stock or other securities if specified in the applicable prospectus supplement.

Payments

We may issue debt securities

from time to time in one or more series. The provisions of the indenture allow us to “reopen” a previous issue of a

series of debt securities and issue additional debt securities of that series. The debt securities may be denominated and payable

in U.S. dollars or other currencies. We may also issue debt securities from time to time with the principal amount or interest

payable on any relevant payment date to be determined by reference to one or more currency exchange rates, securities or baskets

of securities, commodity prices or indices. Holders of these types of debt securities will receive payments of principal or interest

that depend upon the value of the applicable currency, security or basket of securities, commodity or index on the relevant payment

dates.

Debt securities may

bear interest at a fixed rate, which may be zero, a floating rate, or a rate which varies during the lifetime of the debt security.

Debt securities bearing no interest or interest at a rate that at the time of issuance is below the prevailing market rate may

be sold at a discount below their stated principal amount.

Terms Specified in the Applicable

Prospectus Supplement

The applicable prospectus

supplement will contain, where applicable, the following terms of, and other information relating to, any offered debt securities:

|

|

·

|

the specific designation;

|

|

|

·

|

any limit on the aggregate principal amount of the debt securities, their purchase price and denomination;

|

|

|

·

|

the currency in which the debt securities are denominated and/or in which principal, premium, if

any, and/or interest, if any, is payable;

|

|

|

·

|

if other than denominations of $1,000 or any integral multiples thereof, the denominations in which

the debt securities will be issued;

|

|

|

·

|

the interest rate or rates or the method by which the calculation agent will determine the interest

rate or rates, if any;

|

|

|

·

|

the interest payment dates, if any;

|

|

|

·

|

the place or places for payment of the principal of and any premium and/or interest on the debt

securities;

|

|

|

·

|

our right, if any, to defer payment of interest and the maximum length of the deferral period;

|

|

|

·

|

any repayment, redemption, prepayment or sinking fund provisions, including any redemption notice

provisions;

|

|

|

·

|

whether we will issue the debt securities in registered form or bearer form or both and, if we

are offering debt securities in bearer form, any restrictions applicable to the exchange of one form for another and to the offer,

sale and delivery of those debt securities in bearer form;

|

|

|

·

|

whether we will issue the debt securities in definitive form and under what terms and conditions;

|

|

|

·

|

the terms on which holders of the debt securities may convert or exchange these securities into