Pearson Shares Tumble after Sales Slump -- Update

October 17 2016 - 5:46AM

Dow Jones News

(Rewrites, adds detail.)

By Simon Zekaria and Razak Musah Baba

LONDON--Shares in Pearson PLC (PSON.LN) tumbled on Monday after

its sales dropped on weaker-than-expected trading across

higher-education in North America.

The U.S.-focused educational-products specialist, which has

faced a prolonged bout of restructuring amid multibillion-dollar

asset disposals, said sales adjusted for currency changes, as well

as merger and acquisition activity, in the first nine months fell

7% year-over-year reflecting "expected" declines in revenue from

student-testing contracts in the U.S. and U.K., two of its key

Western markets.

It also recorded declines in North American higher-

education-courseware, reflecting a further draw down of inventories

by retailers in July and August.

The strength of the U.S. dollar verses the sterling helped limit

the decline in total sales to 3%. The decline was steeper at 10% at

constant exchange rates.

At 1032 GMT, Pearson shares were down 9.5% at 754 pence.

Analysts said the sales slump was wider than expected. In recent

trading, its stock has been boosted by improved sentiment following

the pound's weakness.

Still, Pearson said trends are improving and it reaffirmed its

2016 targets and 2018 goals.

"Our competitive performance is good," it said in a statement."

Our markets have been challenging but we are managing discretionary

costs tightly."

The company expects to report adjusted operating profit, before

restructuring costs, of between 580 million pounds ($706 million)

and GBP620 million in 2016, and adjusted earnings per share of

share of between 50 pence and 55 pence.

It also said if current exchange rates persist until the end of

2016 the earnings per share guidance range will increase by

approximately 4.5 pence.

U.K.-headquartered Pearson, which used to own the Financial

Times newspaper--once its flagship publishing asset--and a stake in

the publisher of the Economist magazine, expects to report at least

GBP800 million in operating profit by 2018.

At the start of the year, the company launched cost-savings

worth half a billion dollars and released plans to ax 4,000 staff,

or 10% of its workforce world-wide.

At the time, it said it had underestimated the impact of trading

pressures across its key markets. Rapid growth in employment and

increasing education regulation in the U.S. has roiled

higher-education enrollments in the company, which has put pressure

on Pearson's business.

To counter a slowdown in mature educational markets, it has

pushed into emerging economies, such as Brazil and China, where

there is greater demand for learning services.

The company plans to simplify its structure by merging

businesses and focus on fewer, bigger opportunities. This year, the

costs of its reorganization are forecast to hit GBP320 million, as

it books savings of about GBP350 million across this year and

next.

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing,

business-news and education divisions.

Write to Simon Zekaria at simon.zekaria@wsj.com and Razak Musah

Baba at razak.baba@wsj.com

(END) Dow Jones Newswires

October 17, 2016 05:31 ET (09:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

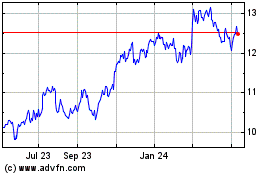

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

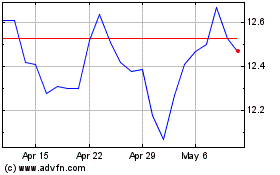

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024