By Andrew Tangel and Ted Mann

A global pact to limit planet-warming emissions is likely to

force manufacturers of air conditioners and refrigerators to

consider passing the additional cost of alternative coolants to

consumers.

Global envoys agreed on Saturday to phase out hydrofluorocarbons

from cooling appliances beginning in 2019. Meeting in Rwanda, major

emitters including the U.S., China and India agreed to aim for an

80% reduction in their use by 2045.

Alternative coolants exist to power window-unit air

conditioners, commercial chillers and household refrigerators, but

many are unapproved for use in the U.S. Some are flammable.

Manufacturers will have to convince regulators the new compounds

are safe before retooling production.

"It's not going to be easy, but we're committed to doing it,"

said Stephen Yurek, chief executive of the Air-Conditioning,

Heating, and Refrigeration Institute, a trade group.

Many companies anticipated that so-called HFCs would eventually

be banned. They have collectively spent billions of dollars

researching alternatives, Mr. Yurek said, adding that his group

supported a global framework for coolant regulations.

The U.S. Environmental Protection Agency recently set deadlines

to phase out HFCs in new appliances such as refrigerators by 2021

and in chillers by 2024. Industry groups have said those targets

would hurt business.

"Our members are rushing right now to make sure that the

alternative refrigerants are going to work, going to be safe," said

Joe McGuire, chief executive of the Association of Home Appliance

Manufacturers.

He said manufacturers want more time to harmonize guidelines

related to refrigerants as well as new expected rules mandating

greater energy efficiency. Meeting the 2021 refrigerator deadline,

instead of the 2024 date the industry proposed, could collectively

cost manufacturers an additional $230 million, he added.

"We don't want to have to do major redesigns twice within a

couple-year period," Mr. McGuire said.

An EPA spokesman said: "While there will be some costs

associated with transitioning to alternatives, we do not anticipate

that this will pose a significant burden on industry --

particularly given the many commitments they have already made to

move to climate-friendly alternatives."

Kevin Fay, executive director of the Alliance for Responsible

Atmospheric Policy, an industry group that represents chemical

companies and appliance makers, said retooling a chemical plant for

a new coolant could cost more than $200 million. But consumer

prices for appliances might eventually rise only as much as about

2%, as has been the case in previous coolant phaseouts, he

said.

The phaseout could be a boon for makers of less-polluting HFC

alternatives that are already on the market.

Honeywell International Inc. over the past few years has ramped

up production of refrigerants that emit less greenhouse gas than

HFCs.

A vice president from the company's Performance Materials &

Technologies unit, Patrick Hogan, told investors at a conference in

June that its "Solstice" line of refrigerants, aerosols and

solvents would be "a $1 billion business in the next year."

Honeywell said is was designing as many offerings as possible in

the Solstice line as "drop-ins," meaning they can be used by

appliance and vehicle manufacturers with minimal design changes,

which could help offset the higher cost of the new coolants. Some

nine million vehicles are equipped with air conditioners using

Honeywell's post-HFC refrigerant, the company said in June, and

that number should double by the end of this year.

Honeywell has $3.4 billion in long-term agreements to supply

Solstice chemicals to major car companies and appliance makers like

Whirlpool Corp., Haier Electronics Group Co. and Midea Group Co.

The company says government action to limit greenhouse-gas

emissions in China and India could drive further growth in sales of

these products.

Ingersoll-Rand PLC, the maker of Trane air-conditioning

equipment, said it was testing a climate-friendly refrigerant

alternative for small air conditioning systems that would require

no additional engineering to use in existing systems.

Johnson Controls International PLC, the Milwaukee-based global

manufacturing firm, recently introduced two building-cooling

systems that use an alternative coolant made by Chemours Co., a

Delaware company that was spun off from DuPont Co. last year. Laura

Wand, Johnson Controls vice president of global chillers, said the

coolant was chosen because it is nonflammable and significantly

less harmful to the environment than other refrigerants.

Carrier Corp., a maker of air conditioners and refrigeration

devices, said it has anticipated such an accord for nearly a

decade. "We will continue to invent and deliver sustainable

solutions that meet or exceed this agreement," said a spokeswoman

for the Connecticut-based company's parent, United Technologies

Corp.

Fomo Products, an Ohio manufacturer of spray-on insulation, said

last year it intended to use more hydrofluoroolefin, a less-potent

greenhouse gas than what HFCs emit. Fomo Products was acquired by

Innovative Chemical Products Group in April.

Doug Mattscheck, chief executive of Innovative Chemical

Products, said the new gas would have a material impact on

insulation pricing. He wrote in an email that "the input materials

for the HFO formulations are currently more expensive and the

manufacturing process is more challenging." He added that he hoped

that as production of HFO increases, costs for HFOs would be pushed

down.

--Russell Gold and Bob Tita contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Ted Mann at

ted.mann@wsj.com

(END) Dow Jones Newswires

October 16, 2016 21:56 ET (01:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

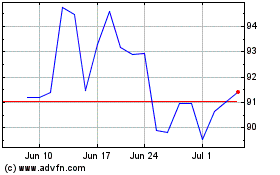

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Apr 2023 to Apr 2024