Current Report Filing (8-k)

October 14 2016 - 7:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 14, 2016

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-32868

(Commission File Number)

|

52-2319066

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

7102 Commerce Way

Brentwood, Tennessee

(Address of principal executive offices)

|

37027

(Zip Code)

|

Registrant's telephone number, including area code:

(615) 771-6701

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On October 14, 2016, Delek filed with the United States Securities and Exchange Commission (the "SEC") the third amendment to Delek's Schedule 13D ("Amendment No. 3") pertaining to Delek's investment in approximately 47% of the outstanding common stock of Alon USA Energy, Inc. (NYSE: ALJ) ("Alon"). Amendment No. 3 discloses that Delek has submitted a written proposal to Alon to acquire the remaining outstanding shares of Alon common stock in an all stock-for-stock transaction. The proposal is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward Looking Statements / Additional Information

Certain statements in this Current Report on Form 8-K related to Delek’s offer to acquire the shares of common stock of Alon that it does not already own, including expectations concerning the proposed combined company’s future performance, results, and plans, are “forward-looking statements” that are subject to risks and uncertainties, are based on management’s current expectations, and as a result of the following risks and uncertainties, among others, actual results and events may differ materially:

|

|

|

|

•

|

The possibility that Delek and Alon may not reach a definitive agreement for the proposed transaction;

|

|

|

|

|

•

|

The consummation of the proposed transaction;

|

|

|

|

|

•

|

The successful integration of Delek and Alon and the ability to realize synergies and other benefits;

|

|

|

|

|

•

|

The availability of funds to meet debt obligations and to fund operations and necessary capital expenditures; and

|

|

|

|

|

•

|

The risks and uncertainties detailed by Delek and Alon in their respective filings with the SEC.

|

More information on potential factors that could affect our financial results is included from time to time in our SEC filings and reports. Delek disclaims any obligation to update information contained in these forward-looking statements.

The statements made in this Current Report on Form 8-K are not an offer nor a solicitation of an offer to purchase, sell or exchange securities or a solicitation of a proxy from any stockholder. Subject to future developments, additional documents regarding the proposed transaction may be filed with the SEC, which investors and stockholders should read carefully if and when they become available because they contain important information about Delek, Alon and the proposed transaction. Investors and stockholders may obtain a free copy of the documents filed with the SEC containing information about Delek, Alon and the proposed transaction, when they are available, from the SEC’s website at www.sec.gov. Delek, its directors and certain of its executive officers may be deemed to be participants in a solicitation of proxies for the proposed transaction. Information about the directors and executive officers of Delek is set forth in its proxy statement for the 2016 annual meeting of stockholders and subsequent reports on Form 8-K, as filed with the SEC, and will be included in the relevant documents regarding the proposed transaction that may be filed with the SEC.

Item 9.01

Financial Statements and Exhibits.

|

|

|

|

(a)

|

Financial statements of businesses acquired.

|

Not applicable.

|

|

|

|

(b)

|

Pro forma financial information.

|

Not applicable.

|

|

|

|

(c)

|

Shell company transactions.

|

Not applicable.

|

|

|

|

99.1

|

Correspondence from Delek US Holdings, Inc. to Alon USA Energy, Inc. dated October 14, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dated: October 14, 2016

|

DELEK US HOLDINGS, INC.

|

|

|

|

|

|

/s/ Assaf Ginzburg

|

|

|

Name: Assaf Ginzburg

|

|

|

Title: EVP / Chief Financial Officer

|

EXHIBIT INDEX

Exhibit No.

Description

99.1 Correspondence from Delek US Holdings, Inc. to Alon USA Energy, Inc. dated October 14, 2016.

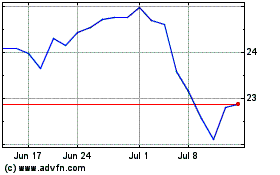

Delek US (NYSE:DK)

Historical Stock Chart

From Mar 2024 to Apr 2024

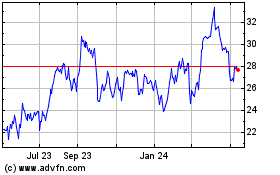

Delek US (NYSE:DK)

Historical Stock Chart

From Apr 2023 to Apr 2024