Community Health Systems Faces Heat From Investor

October 12 2016 - 11:30PM

Dow Jones News

Community Health Systems Inc. came under fire from an investor

crying foul over a recent spinoff by the embattled hospital

chain.

Q Investments LP sent a letter on Wednesday to Quorum Health

Corp., a chain of 38 rural hospitals that Community Health spun off

in April. In the letter, which was reviewed by The Wall Street

Journal, Q Investments asks Quorum to investigate whether Community

Health concealed costs as it prepared the spinoff to enable it to

extract more cash from the deal. Q Investments said it wants Quorum

to "take appropriate legal action."

"We categorically reject the allegations by Q Investments that

Community Health Systems committed fraud or any other wrongdoing in

connection with the Quorum spin-off," said Tomi Galin, a Community

Health spokeswoman. "Community Health Systems conducted itself

appropriately and made all necessary disclosures throughout the

process."

Quorum didn't respond to requests for comment.

At the time of the spinoff, which enabled Community Health to

focus on larger markets, Quorum borrowed $1.2 billion and used the

proceeds to pay a dividend to its former parent. Four months later,

Quorum slashed its earnings guidance, citing unexpectedly high

costs and disappointing sales volume. The stock plunged by 50% that

day.

Community Health is already facing a deterioration in its

business that has helped put a spotlight on the company's debt

level. Community Health is selling assets to help pay down a $15

billion debt load and said last month it would explore strategic

alternatives.

Its shares have tumbled from a high of $52.71 in June 2015 to

$10.46 Wednesday, giving it a market value of just $1.1

billion.

"We believe Community Health was desperate to raise cash, and

they saw an easy path to do so by stuffing new investors in Quorum

with inflated guidance and concealing costs within what they knew

was a disintegrating business," the letter reads.

In August, Quorum cut its forecast for 2016 earnings before

interest, taxes, depreciation and amortization to between $175

million and $200 million, from the $265 million to $275 million

range it set before the spinoff. The company attributed the drop to

higher-than-expected costs and wider losses in some hospitals it

said it would divest itself of.

It cited in particular $18 million in fees stemming from

renegotiated contracts and $12 million in labor costs.

Q Investments said it believes Community Health likely knew or

should have known about those costs at the time of the spinoff and

failed to properly disclose them.

Q Investments, a Texas hedge fund that isn't typically activist,

owns 1.3 million shares of Quorum stock, worth about $8 million

Wednesday. That makes it a top-10 investor in the company, which

has a market value of just under $200 million. Q Investments also

owns $50 million of Quorum bonds.

Write to David Benoit at david.benoit@wsj.com and Melanie Evans

at Melanie.Evans@wsj.com

(END) Dow Jones Newswires

October 12, 2016 23:15 ET (03:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

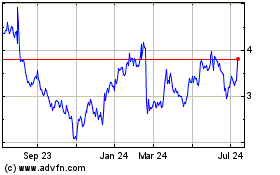

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Apr 2023 to Apr 2024