If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following box.

☐

If any of the securities being registered

on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box:

☑

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering:

☐

If this form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering:

☐

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box.

☐

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate by check mark whether the Registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act (Check one):

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed on behalf of the selling stockholders with the Securities and Exchange Commission (the “SEC”)

to permit the selling stockholders to sell the shares described in this prospectus in one or more transactions. The selling stockholders

and the plan of distribution of the shares being offered by them are described in this prospectus under the headings “Selling

Stockholders” and “Plan of Distribution.”

As permitted by the rules and regulations

of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read

the registration statement and the other reports we file with the SEC at the SEC’s web site or its offices described below

under the heading “Where You Can Find More Information.”

You should rely only on the information

that is contained in this prospectus or that is incorporated by reference into this prospectus. We and the selling stockholders

have not authorized anyone to provide you with information that is in addition to or different from that contained in, or incorporated

by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

The shares of common stock offered by this

prospectus are not being offered in any jurisdiction where the offer or sale of such common stock is not permitted. You should

not assume that the information contained in, or incorporated by reference into, this prospectus is accurate as of any date other

than the date of this prospectus or, in the case of the documents incorporated by reference, the date of such documents, regardless

of the date of delivery of this prospectus or any sale of the common stock offered by this prospectus. Our business, financial

condition, liquidity, results of operations and prospects may have changed since those dates. The rules of the SEC may require

us to update this prospectus in the future.

|

PROSPECTUS SUMMARY

This summary highlights selected

information about us contained elsewhere in this prospectus or incorporated by reference in this prospectus; it does not contain

all of the information you should consider before investing in our common stock. This prospectus includes or incorporates by reference

information about the common stock being offered by the selling stockholders, as well as information regarding our business and

industry and detailed financial data. You should read the entire prospectus and the information incorporated by reference herein

before making an investment decision. This prospectus includes forward-looking statements that involve risks and uncertainties.

See “Cautionary Note Regarding Forward-Looking Statements” for more information.

Throughout this prospectus, the

terms “Lion,” “we,” “us,” “our,” and “our company” refer to Lion Biotechnologies,

Inc., a Nevada corporation.

OUR COMPANY

We are a clinical-stage biotechnology

company focused on the development and commercialization of novel cancer immunotherapy products designed to harness the power of

a patient’s own immune system to eradicate cancer cells. Our lead program is an adoptive cell therapy utilizing tumor-infiltrating

lymphocytes (TIL), which are T cells derived from patients’ tumors, for the treatment of metastatic melanoma. We are also

pursuing the development of TIL for other solid tumor cancer indications. In February 2016, we announced that the US Food and Drug

Administration (FDA) allowed our Investigational New Drug (IND) application to conduct clinical studies using our TIL therapy in

cervical and head and neck cancers.

A patient’s immune system,

particularly his/her TIL, plays an important role in identifying and killing cancer cells. TIL consist of a heterogeneous population

of T cells that can recognize a wide variety of cancer-specific mutations and can overcome tumor escape mechanisms. TIL therapy

involves growing a patient’s TIL in special culture conditions outside the patient’s body, or ex vivo, and then infusing

the T cells back into the patient in combination with interleukin-2 (IL-2). By taking TIL away from the immune-suppressive tumor

microenvironment in the patient, the T cells can rapidly proliferate. Billions of TIL, when infused back into the patient, are

better able to search out and potentially eradicate the tumor.

During the second half of 2015,

we opened enrollment in a Phase 2 clinical trial of our lead product candidate, LN-144, for the treatment of refractory metastatic

melanoma. This single-arm study is for patients with metastatic melanoma whose disease has progressed following treatment with

at least one systemic therapy. The purpose of the study is to evaluate the safety and efficacy of our autologous TIL product candidate

(LN-144).

In an online article published in

May 2016 from the Journal of Clinical Oncology, data was presented from 101 metastatic melanoma patients treated with TIL therapy

in a Phase 2 clinical trial conducted at the National Cancer Institute (NCI) by Dr. Steven Rosenberg, M.D., Ph.D., and colleagues.

In the trial, patients with metastatic melanoma were equally divided into two groups. Both groups were treated according to a standard

TIL protocol using a lympho-depleting preparative regimen prior to an intravenous infusion of TIL, followed by high-dose IL-2 given

intravenously to physiologic tolerance after the TIL was infused. The second group also received total body irradiation. 54% of

all patients treated with TIL therapy achieved an objective response. An objective response occurs when there is a complete remission

or a partial remission of the tumor. A complete remission requires a complete disappearance of all detectable evidence of disease,

and a partial remission typically requires at least approximately 50% regression of measurable disease without new sites of disease.

The publication reported that, of the 101 patients, 24 (24%) had experienced a complete remission (CR). With a median potential

follow up time of 40.9 months, only one of the patients who had achieved a CR had recurred. Overall survival (OS) was 51% at 3

years. Toxicities from treatment were primarily associated with the known adverse effects of nonmyeloablative chemotherapy and

administration of high-dose IL-2.

In further support of our internal

research and clinical development activities, we have a Cooperative Research and Development Agreement (CRADA) with the U.S. Department

of Health and Human Services, as represented by the NCI, through which we are funding the research and development of TIL-based

product candidates for the treatment of advanced solid tumors. Pursuant to the CRADA, we fund TIL research and clinical trials

that are being conducted by Dr. Steven Rosenberg. The CRADA had an initial term of five years and expired in August 2016. However,

we have amended the CRADA to extend the term for an additional five years to August 2021, and to change certain of the goals under

the CRADA. Under the amended CRADA, the goals of the CRADA have been changed to focus on the development of TIL as a stand-alone

therapy or in combination with FDA-licensed products and commercially available reagents routinely used for adoptive cell therapy.

The parties to the CRADA will continue the development of improved methods for the generation and selection of TIL with anti-tumor

reactivity in metastatic melanoma, bladder, lung, breast, and HPV-associated cancers.

|

|

We have a worldwide, exclusive patent

license from the National Institutes of Health (NIH) for intellectual property to develop, manufacture and commercialize TIL therapy

for the treatment of melanoma, which was amended in 2015 to include the exclusive license of this intellectual property for the

treatment of lung cancer, HPV-associated cancers, breast cancer, and bladder cancer. We also have an exclusive license from the

NIH for intellectual property relating to a TIL-based therapy for use in melanoma in which TIL that express various inhibitory

receptors such as 4-1BB (also known as CD137), PD-1, TIM-3 and LAG-3 are selected and expanded for infusion into the patient. TIL

that express these proteins are associated with higher tumor reactivity than other TIL populations, so fewer cells may be needed

to be therapeutically effective.

During 2015, we received orphan

drug designation for LN-144 in the United States to treat metastatic melanoma. This designation provides seven years of market

exclusivity in the United States, subject to certain limited exceptions. However, the orphan drug designation does not convey any

advantage in or shorten the duration of the regulatory review or approval process.

We are pursuing refractory metastatic

melanoma as our first target indication because of the promising initial NCI results and the commercial opportunity inherent in

the significant unmet need of this patient population. Melanoma is a common type of skin cancer, accounting for approximately 76,380

patients diagnosed and 10,130 deaths each year in the United States according to the American Cancer Society’s Cancer Estimated

2016 Facts and Figures. According to the NCI’s Surveillance, Epidemiology and End Results (SEER) program, about 4-7% of patients

with melanoma have metastatic disease. Patients with relapsed/refractory metastatic melanoma following treatment under the current

standards of care have a particularly dire prognosis with very few curative treatment options.

On

September 14, 2016, we entered into that certain Exclusive and Co-Exclusive License Agreement with PolyBioCept AB, a corporation

organized under the laws of Sweden, for the exclusive right and license to PolyBioCept’s intellectual property to develop,

manufacture, market and genetically engineer TIL produced by expansion, selection and enrichment using a cytokine cocktail. PolyBioCept

has filed two patent applications with claims related to a cytokine cocktail for use in expansion of lymphocytes. The licenses

are for the use in all cancers and are worldwide in scope, with the exception that the uses in melanoma are not included for certain

countries of the former Soviet Union.

In connection with the PolyBioCept license agreement, we also (i) entered into a clinical

trials agreement with the Karolinska University Hospital to conduct clinical trials in glioblastoma and pancreatic cancer at the

Karolinska University Hospital, and (ii) agreed to enter into a sponsored research agreement with the Karolinska Institute for

the research of the cytokine cocktail in additional indications.

In addition to the research and

development being conducted under the CRADA, in 2014 we established our own internal research and development capabilities in Tampa,

Florida, near the H. Lee Moffitt Cancer & Research Institute (Moffitt) on the campus of the University of South Florida, to

optimize the process of manufacturing TIL, explore the next-generation of TIL technology and new product candidates, as well as

to generate new intellectual property.

Company History

We filed our original Articles

of Incorporation with the Secretary of State of Nevada on September 17, 2007. Until March 2010, we were an inactive company known

as Freight Management Corp. On March 15, 2010, we changed our name to Genesis Biopharma, Inc. and in 2011 we commenced our current

business. On September 26, 2013, we amended and restated our Articles of Incorporation to, among other things, change our name

to Lion Biotechnologies, Inc., effect a 1-for-100 reverse stock split (pro-rata reduction of outstanding shares) of our common

stock, increase (after the reverse stock split) the number of our authorized number of shares of common stock to 150,000,000 shares,

and authorize the issuance of 50,000,000 shares of “blank check” preferred stock, $0.001 par value per share.

|

|

Our principal executive offices

are located at 112 West 34

th

Street, 18

th

Floor, New York, NY 10120, and our telephone number at that address

is (212) 946-4856. Our website is located at www.lbio.com. Information on our website is not, and should not be considered, part

of this prospectus.

THE OFFERING

|

|

Common Stock offered by the selling stockholders

|

14,612,033 shares(1)

|

|

|

|

|

Common Stock offered by us

|

None

|

|

|

|

|

Common Stock outstanding

|

61,931,096 shares(2)

|

|

|

|

|

Common Stock to be outstanding after the offering

|

69,431,812 shares(2)(3)

|

|

|

|

|

NASDAQ Global Market Symbol

|

LBIO

|

|

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock offered hereby. However,

we may receive up to a maximum of approximately $16,634,000 of gross proceeds from the exercise of Warrants by selling stockholders,

which proceeds we expect to use for general working capital. No assurances can be given that all or any portion of such

Warrants will ever be exercised.

|

|

|

|

|

Risk Factors

|

An investment in our common stock involves significant risks. See “Risk Factors”

beginning on page 4.

|

|

_________________________________

(1) Consists of 7,111,317

outstanding shares of common stock, 847,000 shares of common stock issuable upon the conversion of the outstanding shares of Series

A Preferred, and 6,653,716 shares of common stock issuable upon the exercise of outstanding Warrants (which Warrants may be exercised

at an exercise price of $2.50 per share).

(2) As of September

30, 2016, and does not include (i) a total of 12,149,074 restricted stock units and shares of common stock issuable upon the exercise

of outstanding options (with exercise prices ranging from $3.13 to $117.00 per share) and warrants (with exercise prices ranging

from $2.50 to $2.51) or (ii) the 847,000 shares of common stock issuable upon the conversion of the shares of Series A Preferred.

(3) Assumes the conversion of all of the Series A Preferred and

the exercise of all of the Warrants by the selling stockholders, but does not include the 5,496,358 shares of common stock issuable

upon the exercise of restricted stock units, outstanding options and other warrants.

|

RISK FACTORS

Investing in our common stock involves certain

risks. Before you decide whether to purchase any shares of our common stock, in addition to the other information in this prospectus

or incorporated by reference into this prospectus, you should carefully consider the risks described in the reports we file with

the SEC, including the “Risk Factors” disclosed in our most recent Annual Report on Form 10-K and Quarterly Report

on Form 10-Q, which are incorporated by reference into this prospectus, as such risk factors may be updated from time to time by

our future filings with the SEC. If one or more of these risks materializes, our business, financial condition and results of operations

may be adversely affected. In that event, the value of our common stock could decline. The risks that are described in this prospectus

or in any document that is incorporated by reference into this prospectus are not the only risks that we face. Additional risks

not presently known to us or that we currently believe to be immaterial may also adversely affect our business, financial condition

and results of operations.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements which relate to future events or to our future financial performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results to be materially different from any future results expressed or implied by

the forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “believe,”

“anticipate,” “intend,” “plan,” “estimate,” “may,” “could,”

“anticipate,” “predict,” or “expect” and similar expressions. You should not place undue reliance

on forward-looking statements since they involve known and unknown risks, uncertainties and other factors that are, in many cases,

beyond our control. Forward-looking statements are not guarantees of future performance. Actual events or results may differ materially

from those discussed in the forward-looking statements as a result of various factors. Except as required by applicable law, we

do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future

developments or otherwise. Important factors that could cause actual results to differ materially from those reflected in our forward-looking

statements include, among others:

|

|

·

|

our inability to obtain regulatory approval for, or successfully commercialize, our leading product candidate, LN-144 or our

other product candidates;

|

|

|

·

|

the inability of our contract manufacturers to effectively produce our products;

|

|

|

·

|

capacity constraints at our contract manufacturers;

|

|

|

·

|

our inability to obtain regulatory approval for, or successfully commercialize, our leading product candidate, LN-144 or our

other product candidates, such as LN-145;

|

|

|

·

|

our inability to secure and maintain relationships with collaborators and contract manufacturers;

|

|

|

·

|

difficultly in enrolling patients in our clinical trials, and uncertainty of clinical trial results;

|

|

|

·

|

our history of operating losses and inability to ever become profitable;

|

|

|

·

|

our limited history of complying with public company reporting requirements;

|

|

|

·

|

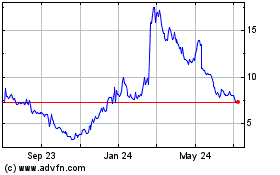

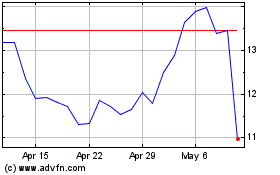

uncertainty and volatility in the price of our common stock;

|

|

|

·

|

the costs and effects of existing and potential governmental investigation and litigation;

|

|

|

·

|

our inability to meet the continued listing requirements of The NASDAQ Global Market;

|

|

|

·

|

our inability to develop, implement and maintain appropriate internal controls in the future;

|

|

|

·

|

uncertainty as to our employees’, independent contractors’ compliance with regulatory standards and requirements

and insider trading rules;

|

|

|

·

|

dependence on the efforts of third-parties to conduct and oversee our clinical trials for our product candidates, to manufacture

clinical supplies of our product candidates, and to commercialize our product candidates;

|

|

|

·

|

the extent of government regulations;

|

|

|

·

|

a loss of any of our key management personnel;

|

|

|

·

|

our inability to develop or commercialize our product candidates due to intellectual property rights held by third parties

and our inability to protect the confidentiality of our trade secrets; and

|

|

|

·

|

our inability to access capital in the future to fund proposed operations.

|

All written and verbal forward-looking statements

attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained

or referred to in this section. We caution investors not to rely too heavily on the forward-looking statements we make or that

are made on our behalf. We undertake no obligation, and specifically decline any obligation, to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise.

In addition, you should refer to the section

of this prospectus entitled “Risk Factors” for a discussion of other important factors that may cause our actual results

to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot

assure you that the forward-looking statements in this prospectus will prove to be accurate. Furthermore, if our forward-looking

statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve

our objectives and plans in any specified time frame, or at all.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of the common stock by the selling stockholders pursuant to this prospectus. All proceeds from the sale of the shares will

be for the account of the selling stockholders. The selling stockholders may sell these shares in the over-the-counter market or

otherwise, at market prices prevailing at the time of sale, at prices related to the prevailing market price, or at negotiated

prices. However, we will receive proceeds upon the cash exercise of the Warrants held by some of the selling stockholders. If all

of the Warrants are exercised at the initial exercise price of $2.50 per share (which exercise price is subject to adjustment under

customary anti-dilution protections), then we will receive gross proceeds of approximately $16,634,000. Any such proceeds will

be used for working capital and general corporate purposes. No assurance can be given, however, that all or any portion of such

Warrants will be exercised.

The selling stockholders will pay any underwriting

discounts and commissions and expenses incurred by the selling stockholders for brokerage or legal services or any other expenses

incurred by the selling stockholders in disposing of the shares included in this prospectus. We will bear all other costs, fees

and expenses incurred in effecting the registration of the shares covered by this prospectus, including all registration and filing

fees and fees and expenses of our counsel and accountants.

SELLING STOCKHOLDERS

Selling Stockholders Table

This prospectus covers an aggregate of 14,612,033

shares of our common stock, consisting of (i) 7,111,317 outstanding shares of common stock, (ii) 847,000 shares of common stock

issuable upon the conversion of the outstanding shares of Series A Preferred, and (iii) 6,653,716 shares issuable upon the exercise

of all of the common stock purchase Warrants held by certain of the selling stockholders.

On November 5, 2013, we completed a

private placement in which we issued (i) 3,145,300 shares of our common stock, (ii) 17,000 shares of our Series A Preferred,

and (iii) warrants to purchase a total of 11,645,300 shares of common stock (the “2013 Private Placement”). The

purchase price of each common stock/warrant unit was $2.50, and the purchase price of each Series A Preferred/warrants unit

was $1,000. Except for the shares owned by Ayer Capital Partners Master Fund, L.P. and Ayer Capital Partners Kestrel Fund,

LP, and 346,433 shares owned by General Merrill McPeak, all of the shares included in this prospectus were sold in the 2013

Private Placement. The shares held by Ayer Capital Partners Master Fund, L.P. and Ayer Capital Partners Kestrel Fund, LP were

issued in May 2013 in connection with a recapitalization in which all of the convertible debentures and all common stock

purchase warrants held by these two institutional investors were converted or exchanged for shares of common stock. The

446,433 shares owned by Merrill McPeak and included in in this prospectus were acquired by General McPeak in 2013 (including

100,000 shares he purchased in the 2013 Private Placement).

We are registering the shares under the

Securities Act of 1933, as amended (the “Securities Act”), to give the selling stockholders the opportunity, if they

so desire, to publicly sell the shares for their own accounts in such amounts and at such times and prices as each may choose.

The selling stockholders may from time to time offer and sell pursuant to this prospectus any or all of the below listed shares

of common stock owned by them. The registration of these shares does not require that any of the shares be offered or sold by the

selling stockholders. The selling stockholders may from time to time offer and sell all or a portion of their shares in the over-the-counter

market, in negotiated transactions, or otherwise, at prices then prevailing or related to the then current market price or at negotiated

prices.

The registered shares may be sold directly

or through brokers or dealers, or in a distribution by one or more underwriters on a firm commitment or best efforts basis. To

the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information

with respect to any particular offer will be set forth in a prospectus supplement. Please see “Plan of Distribution.”

The selling stockholders and any agents or broker-dealers that participate with the selling stockholders in the distribution of

registered shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions

received by them and any profit on the resale of the registered shares may be deemed to be underwriting commissions or discounts

under the Securities Act.

No estimate can be given as to the amount

or percentage of common stock that will be held by the selling stockholders after any sales made pursuant to this prospectus because

the selling stockholders are not required to sell any of the shares being registered under this prospectus. The following table

assumes that the selling stockholders will sell all of the shares included in this prospectus.

Transferees, successors and donees of identified

selling stockholders will not be able to use this prospectus for resales until they are named in the table below by prospectus

supplement or post-effective amendment. If required, we will add transferees, successors and donees by prospectus supplement in

instances where the transferee, successor or donee has acquired its shares from holders named in this prospectus after the effective

date of this prospectus.

On June 7, 2016, we sold (i) 9,684,000 shares

of our common stock and (ii) 11,368,633 shares of our new Series B Preferred Stock (the “Series B Preferred”) to certain

accredited and institutional investors, including to some of the selling stockholders listed in this prospectus. The 11,368,633

shares of Series B Preferred are convertible into 11,368,633 shares of our common stock (as of September 30, 2016, a total of 3,421,960

of the foregoing Series B Preferred shares had been converted into 3,421,960 shares of common stock).

The following table sets forth the beneficial

ownership of the selling stockholders. The term “selling stockholder” or “selling stockholders” includes

the stockholders listed below and their respective transferees, assignees, pledges, donees or other successors. Beneficial ownership

is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

Shares of common stock subject to options, warrants and convertible securities currently exercisable or convertible, or exercisable

or convertible within 60 days are deemed outstanding, including for purposes of computing the percentage ownership of the person

holding the option, warrant or convertible security, but not for purposes of computing the percentage of any other holder. As of

September 30, 2016, we had 61,931,096 shares of common stock issued and outstanding.

|

|

Beneficial Ownership Before Offering

|

Beneficial Ownership After Offering

(1)

|

|

|

Number of

Shares

|

|

Percent

|

Number of Shares Being

Offered

|

|

Number of

Shares

|

Percent

|

|

Ronald Bartlett & Valerie Bartlett, JT WROS

|

58,400

|

(3)

|

*

|

58,400

|

|

0

|

0

|

|

Carol Cody

|

35,000

|

(3)

|

*

|

35,000

|

|

0

|

0

|

|

Larry Caillouet

|

8,000

|

(3)

|

*

|

8,000

|

|

0

|

0

|

|

Anton Bogner & Barbara D. Bogner

|

30,000

|

(2)

|

|

30,000

|

|

0

|

0

|

|

Gerald Cohen

|

38,250

|

(3)

|

*

|

38,250

|

|

0

|

0

|

|

Michael Crawford

|

40,000

|

(2)

|

*

|

40,000

|

|

0

|

0

|

|

Robert Crothers

|

99,000

|

(3)

|

*

|

3,000

|

|

96,000

|

*

|

|

Karen Crothers & Arielle Crothers, JTIC

|

13,000

|

(2)

|

*

|

13,000

|

|

0

|

0

|

|

William A Crothers & JoAnn Crothers, JTWROS

|

1,000

|

(2)

|

*

|

1,000

|

|

0

|

0

|

|

Christine Crothers

|

1,000

|

(2)

|

*

|

1,000

|

|

0

|

0

|

|

Joseph Johnson

|

1,000

|

(2)

|

*

|

1,000

|

|

0

|

0

|

|

Caren Corvetti

|

3,000

|

(2)

|

*

|

3,000

|

|

0

|

0

|

|

Alicia Rodriguez

|

1,000

|

(2)

|

*

|

1,000

|

|

0

|

0

|

|

Jay E. Bradbury

|

7,500

|

(2)

|

*

|

7,500

|

|

0

|

0

|

|

Sudip Chakrabortty & Anshu S. Chakrabortty, JT WROS

|

26,000

|

(2)

|

*

|

26,000

|

|

0

|

0

|

|

Ficksman Family Trust

|

25,000

|

(2)

|

*

|

25,000

|

|

0

|

0

|

|

Finkelstein Living Trust, William Finkelstein,Trustee

|

24,000

|

(3)

|

*

|

12,500

|

|

0

|

0

|

|

Stanley Friedman & Leslie Friedman JT WROS

|

25,000

|

(2)

|

*

|

25,000

|

|

0

|

0

|

|

Marc Fuhrman

|

25,000

|

(3)

|

*

|

25,000

|

|

0

|

0

|

|

Carol Giorello and Anthony Giorello, JTWROS

|

12,000

|

(3)

|

*

|

12,000

|

|

0

|

0

|

|

William D. Gould

|

16,400

|

(3)

|

*

|

16,400

|

|

0

|

0

|

|

Ravi Gutta

|

50,000

|

(2)

|

*

|

50,000

|

|

0

|

0

|

|

Jennifer Nugent

|

25,000

|

(4)

|

*

|

25,000

|

|

0

|

0

|

|

Christofer Innace

|

11,700

|

(2)

|

*

|

11,700

|

|

0

|

0

|

|

Andrei Iancu

|

37,500

|

(3)

|

*

|

37,500

|

|

0

|

0

|

|

Ashish Jhingan & Dolly Jhingan JT WROS

|

49,500

|

(3)

|

*

|

49,500

|

|

0

|

0

|

|

Martin J. Junge

|

27,500

|

(2)

|

*

|

27,500

|

|

0

|

0

|

|

Edward King

|

18,800

|

(3)

|

*

|

18,800

|

|

0

|

0

|

|

George A. Kingsley, Jr. and Nadine J. Kingsley JT WROS

|

29,000

|

(3)

|

*

|

29,000

|

|

0

|

0

|

|

Paul Frederick Lawrence and Rachelle Anne Lawrence, Trustees of the Rachelle and Paul Lawrence Living Trust, dated Aug. 1, 2008

|

25,167

|

(4)

|

*

|

25,000

|

|

167

|

*

|

|

Thomas Leith

|

57,500

|

(2)

|

*

|

52,500

|

|

5,000

|

*

|

|

Jeffrey Lieberman

|

12,500

|

(2)

|

*

|

12,500

|

|

0

|

0

|

|

Robert H. Lipp Separate Property Trust

|

10,000

|

(2)

|

*

|

10,000

|

|

0

|

0

|

|

Merrill McPeak

|

585,183

|

(5)

|

*

|

446,433

|

|

138,750

|

*

|

|

Brian M. Miller

|

25,000

|

(3)

|

*

|

25,000

|

|

0

|

0

|

|

Anthony Naer

|

2,000

|

(2)

|

*

|

2,000

|

|

0

|

0

|

|

Kenneth E Normann

|

1,000

|

(2)

|

*

|

1,000

|

|

0

|

0

|

|

Steven Pisacano

|

1,200

|

(2)

|

*

|

1,250

|

|

0

|

0

|

|

Prasad Family Trust UAD 08/18/11, Subir Prasad, Trustee

|

20,000

|

(3)

|

*

|

20,000

|

|

0

|

0

|

|

|

Beneficial Ownership Before Offering

|

Beneficial Ownership After Offering

(1)

|

|

|

Number of

Shares

|

|

Percent

|

Number of Shares Being

Offered

|

|

Number of

Shares

|

Percent

|

|

R&I Family Trust u/a/d 3/15/90, Richard N. Kipper & Inta A. Kipper, Trustees

|

13,500

|

(3)

|

*

|

13,500

|

|

0

|

0

|

|

Jeff Rennell & Christine Kellye Rennell, JT WROS

|

95,000

|

(3)

|

1.63%

|

95,000

|

|

0

|

0

|

|

Charles F. Richter

|

96,000

|

(3)

|

*

|

96,000

|

|

0

|

0

|

|

Mark W. Schwartz

|

5,000

|

(2)

|

*

|

5,000

|

|

0

|

0

|

|

Randall A. Sebring & Alice M. Sebring JT WROS

|

93,668

|

(2)

|

*

|

93,668

|

|

0

|

0

|

|

Howard L. Simon & Dana B. Simon as Trustees of the Howard and Dana Simon 2000 Revocable Trust

|

17,000

|

(3)

|

*

|

17,000

|

|

0

|

0

|

|

Manish Singh

|

285,000

|

(3)

|

*

|

250,000

|

|

35,000

|

*

|

|

Sneh Singhal

|

8,000

|

(2)

|

*

|

8,000

|

|

0

|

0

|

|

Daryl Squicciarini

|

40,000

|

(4)

|

*

|

40,000

|

|

0

|

0

|

|

Joseph Telushkin

|

4,000

|

(4)

|

*

|

4,000

|

|

0

|

0

|

|

Lisa Torsiello

|

15,000

|

(2)

|

*

|

15,000

|

|

0

|

0

|

|

K. David Tritsch

|

10,000

|

(2)

|

*

|

10,000

|

|

0

|

0

|

|

Ninish Ukkan

|

16,500

|

(3)

|

*

|

16,500

|

|

0

|

0

|

|

Windward Venture Partners

|

25,000

|

(4)(14)

|

*

|

25,000

|

|

0

|

0

|

|

Leland Zurich & Valerie Zurich, JT WROS

|

33,000

|

(2)

|

*

|

33,000

|

|

0

|

0

|

|

Roth Capital Partners, LLC

|

254,369

|

(4)(6)

|

*

|

254,369

|

|

0

|

0

|

|

Perceptive Life Sciences Master Fund Ltd.

|

4,695,329

|

(7)(8)

|

8.02%

|

429,215

|

|

4,266,114.00

|

7.2%

|

|

Titan-Perc Ltd.

|

269,015

|

(4)(8)

|

*

|

269,015

|

|

0

|

0

|

|

Quogue Capital LLC

|

5,778,947

|

(9)

|

9.04%

(7)

|

4,000,000

|

|

3,778,947

|

5.91%

|

|

Acuta Capital Fund, LP

|

3,094,526

|

(10)

|

4.99%

(11)

|

1,119,265

|

|

2,885,637

(12)

|

4.64%

|

|

Acuta Opportunity Fund, LP

|

922,845

|

(10)

|

1.48

(11)

|

380,735

|

|

542,110

(12)

|

*

|

|

Broadfin Healthcare Master Fund, Ltd

|

3,094,526

|

(13)

|

4.99%

(13)

|

1,500,000

|

|

3,094,526

(13)

|

4.99%

|

|

Mark H Rachesky

|

500,000

|

(4))

|

*

|

500,000

|

|

0

|

0

|

|

Jason Stein

|

202,632

|

(3)

|

*

|

150,000

|

|

52,632

|

*

|

|

Michael Weiser

|

127,632

|

(3)

|

*

|

75,000

|

|

52,632

|

*

|

|

Elizabeth Weiser

|

25,000

|

(4)

|

*

|

25,000

|

|

0

|

0

|

|

venBio Select Fund LLC

|

4,262,219

|

(14)

|

6.87%

(14)

|

862,700

|

|

4,262,219

|

6.87%

(14)

|

|

Doverhill Partners LLC

|

275,000

|

(15)(3)

|

*

|

275,000

|

|

0

|

0

|

|

Ayer Capital Partners Master Fund, L.P.(16)

|

2,756,386

|

(2)(17)

|

4.45%

|

2,756,386

|

|

0

|

0

|

|

Ayer Capital Partners Kestrel Fund, LP(16)

|

66,947

|

(2)(17)

|

*

|

66,947

|

|

0

|

0

|

____________________

* Less than 1%

|

|

(1)

|

Assumes the selling stockholder sells all of the shares of common stock included in this prospectus.

|

|

|

(2)

|

Consists solely of currently outstanding shares of common stock.

|

|

|

(3)

|

Includes both currently outstanding shares of common stock and shares of common stock issuable upon the exercise of the stockholder’s

Warrant.

|

|

|

(4)

|

Consists solely of shares of common stock issuable upon exercise of a Warrant.

|

|

|

(5)

|

Represents 446,433 shares of common stock and options to purchase 138,750 shares of common stock that are exercisable currently

or within 60 days of September 30, 2016.

|

|

|

(6)

|

Represents shares of common stock issuable upon exercise of the Warrant issued to this broker-dealer as compensation for placement

agent services provided in the 2013 Private Placement. Byron Roth and Gordon Roth, as members of the selling stockholder, have

shared voting and investment power over the shares.

|

|

|

(7)

|

Includes 97,000 shares of our common stock issuable upon the conversion of Series A Preferred shares, 909,491 shares of our

common stock issuable upon the conversion of Series B Preferred Shares and 333,215 shares of our common stock issuable upon exercise

of a Warrant. Under the terms of the Warrant, the holder does not have the right to exercise the Warrant to the extent that after

giving effect to such exercise, the holder (together with its affiliates) would beneficially own in excess of 4.99% (the “Maximum

Percentage”) of the shares of our common stock outstanding immediately after giving effect to such exercise. By written notice

to us, however, the holder may from time to time increase or decrease the Maximum Percentage to any other percentage not in excess

of 9.99%. Similarly, under the terms of the Series A Preferred and the Series B Preferred, the holder does not have the right to

convert the Series A Preferred or the Series B Preferred to the extent that after giving effect to such conversion, the holder

(together with its affiliates) would beneficially own in excess of the Maximum Percentage. By written notice to us, however, the

holder may from time to time increase or decrease the Maximum Percentage with respect to any or all of the warrants, the Series

A Preferred and the Series B Preferred to any other percentage not in excess of 9.99%. We have received such a notice from this

holder and accordingly, this holder may exercise any portion of the warrant or convert any shares of Series A Preferred or the

Series B Preferred up until the point that the holder’s beneficial ownership equals 9.99%.

|

|

|

(8)

|

Perceptive Advisors LLC is the advisor of Perceptive Life Sciences Master Fund Ltd. and Titan-Perc Ltd., and Mr. Edelman is

the managing member of Perceptive Advisors LLC. Titan-Perc Ltd. beneficially owns 210,930 shares of common stock and a Warrant

to purchase 58,085 additional shares of common stock. Mr. Edelman and Perceptive Advisors LLC are deemed to beneficially own the

shares of Perceptive Life Sciences Master Fund Ltd. and Titan-Perc Ltd.

|

|

|

(9)

|

The number of shares beneficially owned before the offering consists of 3,846,280 shares of our common stock and 1,932,667

shares of our common stock issuable upon conversion of Series B Preferred owned by Quogue Capital LLC and does not include up to

2,000,000 shares of our common stock issuable upon the exercise of a Warrant (which warrant cannot be exercised if such exercise

would result in the holder beneficially owning more than 4.99% of our shares of common stock) owned by Quogue Capital LLC.

Under the terms of the Warrant, the holder does not have the right to exercise the warrant to the extent that after giving effect

to such exercise, the holder (together with its affiliates) would beneficially own in excess of the Maximum Percentage. Accordingly,

Quogue Capital may not exercise its Warrant if Quogue Capital’s beneficial ownership would exceed 4.99% following such exercise.

Wayne Rothbaum, a member of our board of directors, is the sole managing member of Quogue Capital LLC and may be deemed to beneficially

own the shares owned by Quogue Capital LLC.

|

|

|

(10)

|

The combined beneficial ownership of accounts affiliated with and managed by Acuta Capital Partners, LLC (including Acuta Capital

Fund, LP, Acuta Opportunity Fund, LP and other affiliates) is 5.09%, which beneficial ownership does not include any shares issuable

upon exercise of Warrants or conversion of Series B Preferred as described in footnote (11). Under the terms of these Warrants,

the holders do not have the right to exercise the Warrants to the extent that after giving effect to such exercise, the holder

(together with its affiliates) would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the shares of

our common stock outstanding immediately after giving effect to such exercise. Similarly, under the terms of the Series B Preferred,

the holders do not have the right to convert the Series B Preferred to the extent that after giving effect to such conversion,

the holder (together with its affiliates) would beneficially own in excess of the Maximum Percentage. By written notice to us,

however, the holder may from time to time increase or decrease the Maximum Percentage with respect to any or all of the Warrants

and the Series B Preferred to any other percentage not in excess of 9.99%. We have not received any such notice from this holder

and accordingly, neither the Warrants nor the Series B Preferred may be exercised or converted to the extent that after giving

effect to such exercise or conversion such holder’s beneficial ownership (together with its affiliates) would exceed 4.99%.

|

|

|

(11)

|

Includes 1,119,265 shares of our common stock issuable upon exercise of a Warrant held by Acuta Capital Fund, LP and 313,532

shares of our common stock issuable upon exercise of a Warrant held by Acuta Opportunity Fund, LP. Also includes 177,351 shares

of common stock issuable upon conversion of the Series B Preferred held by Acuta Capital Fund, LP, and 54,569 shares of common

stock issuable upon conversion of the Series B Preferred held by Acuta Opportunity Fund, LP. Under the terms of these Warrants

and the Series B Preferred, the holders do not have the right to exercise the Warrants or convert the Series B Preferred to the

extent that after giving effect to such exercise or conversion, the holder (together with its affiliates) would beneficially own

in excess of the Maximum Percentage. Accordingly, neither of the Warrants nor the Series B Preferred may be exercised or converted

to the extent that, after giving effect to such exercise or conversion, such holder’s beneficial ownership (together with

its affiliates) would exceed 4.99%. Richard Lin is the Managing Member of Acuta Capital Partners, LLC, the general partner of Acuta

Capital Fund, LP and Acuta Opportunity Fund, LP and an investment manager for 2B LLC, and has voting and investment power over

all of the shares held by Acuta Capital Fund, LP and Acuta Opportunity Fund, LP (and certain shares held by 2B LLC). Mr. Lin disclaims

beneficial ownership over all of the shares held by Acuta Capital Fund, LP and Acuta Opportunity Fund, LP, except to the extent

of his pecuniary interest therein.

|

|

|

(12)

|

Includes 177,351 shares of common stock issuable upon conversion of the Series B Preferred held by Acuta Capital Fund, LP,

and 54,569 shares of common stock issuable upon conversion of the Series B Preferred held by Acuta Opportunity Fund, LP. Under

the terms of the Series B Preferred, the holders do not have the right to convert the Series B Preferred to the extent that after

giving effect to such conversion, the holder (together with its affiliates) would beneficially own in excess of the Maximum Percentage.

Accordingly, the Series B Preferred may not be converted to the extent that, after giving effect to such conversion, such holder’s

beneficial ownership (together with its affiliates) would exceed 4.99%.

|

|

|

(13)

|

The number of shares beneficially owned before the offering consists of 2,638,259 shares of our common stock and 456,267 shares

issuable upon the conversion of some of our Series A Preferred. The number of shares beneficially owned before the offering does

not include 293,733 shares of our common stock issuable upon the conversion of our Series A Preferred, 750,000 shares of our common

stock issuable upon exercise of a warrant or 1,250,549 shares of common stock issuable upon conversion of Series B Preferred. Under

the terms of the Warrant, the holder does not have the right to exercise the warrant to the extent that after giving effect to

such exercise, the holder (together with its affiliates) would beneficially own in excess of the Maximum Percentage. Similarly,

under the terms of the Series A Preferred and the Series B Preferred, the holder does not have the right to convert the Series

A Preferred or the Series B Preferred (subject to certain limited exceptions) to the extent that after giving effect to such conversion,

the holder (together with its affiliates) would beneficially own in excess of the Maximum Percentage. The number of shares beneficially

owned after the offering consists of 2,638,259 shares of our common stock owned by Broadfin Healthcare Master Fund, Ltd and 456,267

shares of our common stock issuable upon the conversion of shares of Series B Preferred but does not include 794,282 shares of

Series B Preferred, the conversion of cannot exceed the Maximum Percentage. Kevin Kotler in his capacity as investment manager

of Broadfin Health Master Fund, Ltd., may also be deemed to have investment discretion and voting power over the shares held by

that selling stockholder. Mr. Kotler disclaims any beneficial ownership of these shares.

|

|

|

(14)

|

The numbers of shares beneficially owned before the offering does not include 525,000 shares of our common stock issuable upon

exercise of a Warrant and the 727,592 shares of our common stock issuable upon the conversion of Series B Preferred. Because the

exercise of the Warrant, and the conversion of the Series B Preferred are limited by the provision thereof that prohibits the exercise

or conversion if venBio Select Fund LLC (together with its affiliates) would beneficially own in excess of the Maximum Percentage

following such exercise or conversion. venBio Select Fund LLC also manages an investment account on behalf of 2B LLC and may also

be deemed to have investment discretion and voting power over the 281,391 shares held by 2B LLC. Behzad Aghazadeh, in his capacity

as portfolio manager of venBio Select Fund LLC may also be deemed to have investment discretion and voting power over securities

held by venBio Select Fund LLC and the 2B LLC managed account. Mr. Aghazadeh disclaims any beneficial ownership of the reported

securities.

|

|

|

(15)

|

Brian Wornow in his capacity as investment manager of Doverhill Partners LLC, may also be deemed to have investment discretion

and voting power over the shares held by that selling stockholder. Mr. Wornow disclaims any beneficial ownership of these shares.

|

|

|

(16)

|

Peter D. Kozlowski, the Managing Director of Windward Venture Partners, has investment discretion and voting power over the

shares held by that selling stockholder.

|

|

|

(17)

|

The investment advisor of this selling stockholder is Ayer Capital Management, LP (the “Advisor”). ACM Capital

Partners, LLC (“ACM”) is the general partner of the Advisor, and Ayer Capital Partners, LLC is the general partner

of the selling stockholder. Jay Venkatesan, one of this company’s directors, is the managing member of ACM and Ayer Capital

Partners LLC.

|

Relationships with Selling Stockholders

All selling stockholders, other than those

discussed below, are investors who have had no position, office, or other material relationship (other than as purchasers of securities)

with us or any of our affiliates within the past three years. Based on representations made to us by the selling stockholders,

except as noted below, no selling stockholder is a registered broker-dealer or an affiliate of a registered broker-dealer.

Wayne P. Rothbaum is the Managing Member

of Quogue Capital LLC. Mr. Rothbaum is a member of our Board of Directors.

On June 7, 2016, we raised gross proceeds

of $100 million in a private placement (the “2016 Private Placement”). The following selling stockholders who are included

in this prospectus also invested in the 2016 Private Placement: Quogue Capital LLC, Broadfin Healthcare Master Fund, Ltd., Perceptive

Life Sciences Master Fund Ltd., venBio Select Fund LLC, Acuta Opportunity Fund, LP (formerly Three Arch Opportunity Fund), Michael

Weiser and Jason Stein. The foregoing selling stockholders purchased a total of $45,400,000 of securities in the 2016 Private Placement.

In connection with the 2016 Private Placement, we entered into a purchase agreement and a registration rights agreement with Quogue

Capital LLC and the other institutional and accredited investors in that offering. The purchase agreement included certain provisions

requiring that the number of directors constituting the full Board of Directors of our company be increased from five to seven

directors and that Mr. Rothbaum be appointed to serve on our Board of Directors. On June 1, 2016, the size of our Board was increased

to seven directors, and on June 7, 2016 Mr. Rothbaum joined our Board. In the purchase agreement, we also agreed to appoint Iain

Dukes to the Board of Directors effective at a future date, and that, until the earlier of (i) the date Quogue Capital LLC, an

affiliate of Mr. Rothbaum, beneficially owns less than 5% of our outstanding common stock, and (ii) June 30, 2017, which we refer

to as the “effective period,” we will take no other action to (x) change the size of our Board, (y) amend, in any respect,

our articles of incorporation or bylaws, or (z) enter into any agreement to do any of the foregoing, in each case, without the

prior written consent of Quogue Capital. During the effective period, we also agreed that either Mr. Rothbaum or Dr. Dukes will

be appointed to the Compensation Committee, Audit Committee and Nominating and Governance Committee of our Board of Directors.

Dr. Dukes was appointed to our Board on August 4, 2016. On August 16, 2016, Mr. Rothbaum was appointed to our Compensation Committee,

and Dr. Dukes was appointed to our Nominating and Governance Committee and our Audit Committee.

Jay Venkatesan has been a member of our

Board of Directors since September 3, 2013. Through his affiliates ACM Capital Partners LLC, Ayer Capital Management, LP, and Ayer

Capital Management, LP., Dr. Venkatesan manages the investments. In the May 22, 2013, this company restructured certain of its

outstanding indebtedness and its warrants. As part of that restructuring, Ayer Capital Partners Master Fund, L.P., Ayer Capital

Partners Kestrel Fund, LP, and Epworth-Ayer Capital (i) converted approximately $5.32 million of senior secured promissory notes

and other indebtedness (including accrued interest and penalties) into shares of our common stock, (ii) purchased additional shares

of common stock for $1.00 per share, received additional shares for no additional consideration, and (iii) exchanged warrants for

the purchase of 33,604 shares of capital stock into shares of common stock. The 2,756,386 shares of common stock owned by Ayer

Capital Partners Master Fund, L.P. and included in this prospectus, and the 66,947 shares owned by Ayer Capital Partners Kestrel

Fund, LP. and included in this prospectus, were received in the May 2013 restructuring.

Merrill McPeak is a member of our Board

of Directors. As compensation for his services as a director of this company (including for his services as our lead director and

as a member of various committees of the Board of Directors), during the three years preceding the date of this prospectus, General

Merrill McPeak has received $158,750 in fees and options to purchase a total of 160,000 shares of common stock.

Roth Capital Partners LLC acted as lead

placement agent in the 2013 Private Placement. As compensation for it services in the 2013 Private Placement, Roth Capital Partners

LLC received a Warrant to purchase 544,369 shares of common stock and $896,608 of cash compensation. Roth Capital Partners LLC

is a registered broker-dealer. Roth Capital Partners LLC received its Warrant in the ordinary course of business for services rendered

in the 2013 Private Placement, and at the time that it received the foregoing Warrant, we had no agreements or understandings,

directly or indirectly, with Roth Capital Partners LLC, or to our knowledge with any other person, to distribute the Warrants or

the underlying securities.

William Gould, David Ficksman, and Martin

Goldblum are attorneys at TroyGould PC, a law firm. TroyGould PC has, since February 2011, from time to time acted as one of this

company’s corporate/securities law firms. Members of TroyGould PC purchased $210,000 of common stock and Warrants in the

2013 Private Placement.

Charles F. Richter is the husband of Elma

Hawkins. Dr. Hawkins was our President, Chief Executive Officer and a director until June 1, 2016.

Manish Singh was our Chief Executive Officer

until December 31, 2014.

The information in the above table is as

of the date of this prospectus. Information concerning the selling stockholders may change from time to time and any such changed

information will be described in supplements to this prospectus if and when necessary.

PLAN OF DISTRIBUTION

The selling stockholders, which, as used

herein, includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares

of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution

or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or

interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private

transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to

the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one

or more of the following methods when disposing of shares or interests therein:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of

the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by

the SEC;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per

share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted by applicable law.

|

The selling stockholders may, from time

to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in

the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from

time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest

as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this

prospectus.

In connection with the sale of our common

stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The

selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions,

or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also

enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative

securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus,

which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended

to reflect such transaction).

The aggregate proceeds to the selling stockholders

from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions,

if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject,

in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the

proceeds from this offering.

The selling stockholders also may resell

all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they

meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters,

broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters”

within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities

Act.

To the extent required, the shares of our

common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the

names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be

set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

In order to comply with the securities laws

of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers

or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or

an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders

that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities

of the selling stockholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus

(as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the

prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates

in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities

Act.

We have agreed to indemnify the selling

stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration

of the shares offered by this prospectus.

We have agreed with the selling stockholders

to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (1) such time as

all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement

or (2) the date on which all of the shares may be sold without restriction pursuant to Rule 144 of the Securities Act.

DESCRIPTION OF SECURITIES

The following is a summary of all material

characteristics of our capital stock as set forth in our amended and restated articles of incorporation and bylaws, as amended.

Copies of these documents are filed or incorporated by reference as exhibits to the registration statement of which this prospectus

forms a part.

We are presently authorized to issue 150,000,000

shares of $0.000041666 par value common stock and 50,000,000 shares of $0.001 par value preferred stock. As of September 30, 2016,

we had 61,931,096 shares of common stock issued and outstanding, 1,694 shares of Series A Preferred issued and outstanding, and

7,946,673 shares of Series B Preferred issued and outstanding. There are no other series of shares of our preferred stock currently

issued or outstanding.

Common Stock

We have one class of common stock. Holders

of our common stock are entitled to one vote per share on all matters to be voted upon by stockholders and do not have cumulative

voting rights in the election of directors. Holders of shares of common stock are entitled to receive on a pro rata basis such

dividends, if any, as may be declared from time to time by our board of directors in its discretion from funds legally available

for that use, subject to any preferential dividend rights of outstanding preferred stock. They are also entitled to share on a

pro rata basis in any distribution to our common stockholders upon our liquidation, dissolution or winding up, subject to the prior

rights of any outstanding preferred stock. Common stockholders do not have preemptive rights to subscribe to any additional stock

issuances by us, and they do not have the right to require the redemption of their shares or the conversion of their shares into

any other class of our stock. The rights, preferences and privileges of holders of common stock are subject to, and may be adversely

affected by, the rights of the holders of any series of preferred stock that we may designate and issue in the future.

Preferred Stock

Under our articles of incorporation, our

board of directors has the authority, without further action by stockholders, to designate one or more series of preferred stock

and to fix the voting powers, designations, preferences, limitations, restrictions and relative rights granted to or imposed upon

the preferred stock, including dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference

and sinking fund terms, any or all of which may be preferential to or greater than the rights of the common stock.

Our board of directors may authorize the

issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the

holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions

and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control

and may adversely affect the market price of the common stock and the voting and other rights of the holders of common stock.

Series A Preferred

. In October 2013,

we created a new class of preferred stock designated as “Series A Convertible Preferred Stock.” The shares of Series

A Preferred have a stated value of $1,000 per share and are convertible into shares of common stock at a price of $2.00 per share

(subject to adjustment as described below). The rights of the Series A Preferred are set forth in the Certificate of Designation

of Preferences and Rights of Series A Convertible Preferred Stock (the “Series A Certificate of Designation”), which

gives the holders of the Series A Preferred the following rights, preferences and privileges:

The Series A Preferred may, at the option

of the holder, be converted at any time or from time to time into fully paid and non-assessable shares of common stock at the conversion

price in effect at the time of conversion; provided, that a holder of Series A Preferred may at any given time convert only up

to that number of shares of Series A Preferred so that, upon conversion, the aggregate beneficial ownership of the common stock

(calculated pursuant to Rule 13d-3 of the Act) of such holder and all persons affiliated with such holder, is not more than 4.99%

of the common stock then outstanding (subject to adjustment to up to 9.99% solely at the holder’s discretion upon 60 days’

prior notice). The number of shares into which one share of Series A Preferred is convertible is determined by dividing the stated

value of $1,000 per share by the Conversion Price. The “Conversion Price” per share for the Series A Preferred is $2.00

(subject to appropriate adjustment for certain events, including stock splits, stock dividends, combinations, recapitalizations

or other recapitalizations affecting the Series A Preferred).

The Series A Preferred will automatically

be converted into common stock at the then applicable Conversion Price (i) upon the written consent of the holders of at least

a majority of the outstanding shares of Series A Preferred or (ii) if required by us to be able to list our common stock on a national

securities exchange; provided, any such conversions will continue to be limited by, and subject to, the beneficial ownership conversion

limitations set forth above.

Except as otherwise required by law, the

holders of shares of Series A Preferred do not have the right to vote on matters that come before the stockholders; provided, that

we may not, without the prior written consent of a majority of the outstanding Series A Preferred: (i) amend, alter, or repeal

any provision of our Articles of Incorporation (including the Series A Certificate of Designation) or Bylaws in a manner adverse

to the Series A Preferred; (ii) create or authorize the creation of or issue any other security convertible into or exercisable

for any equity security, having rights, preferences or privileges senior to or on parity with the Series A Preferred, or increase

the authorized number of shares of Series A Preferred; or (iii) enter into any agreement with respect to any of the foregoing.

In the event of any dissolution or winding

up of our company, whether voluntary or involuntary, the proceeds would be paid

pari passu

among the holders of shares of

our common stock, Series A Preferred and Series B Preferred, pro rata based on the number of shares held by each such holder,

treating for this purpose all such securities as if they had been converted to common stock.

We may not declare, pay or set aside any

dividends on shares of any class or series of our capital stock (other than dividends on shares of common stock payable in shares

of common stock) unless the holders of the Series A Preferred shall first receive, or simultaneously receive, an equal dividend

on each outstanding share of Series A Preferred.

Series B Preferred

. In June 2016

we created a new class of Preferred Stock designated as “Series B Preferred Stock.” The rights of the Series B

Preferred are set forth in the Certificate of Designation of Preferences and Rights of Series B Preferred Stock (the “Series B

Certificate of Designation”). A total of 11,500,000 shares of Series B Preferred are authorized for issuance under Series B

Certificate of Designation. The shares of Series B Preferred have a stated value of $4.75 per share and, as of August 16, 2016,

were convertible into shares of our common stock at a conversion price of $4.75 per share.

Holders of Series B Preferred are entitled