Health-Care REITs Back Off Nursing

October 11 2016 - 1:23PM

Dow Jones News

By Esther Fung

Senior housing, medical-office buildings and hospitals all have

generated big gains for commercial-real-estate investors in recent

years, but skilled-nursing facilities have gotten short shrift.

A revenue squeeze stemming from a change in medical billing

practices suggests that corner of the health-care sector could

continue to face pressure.

The problem: Payments from Medicare and other government

insurance programs make up the bulk of the revenue at skilled

nursing facilities. Landlords say their tenants are battling with

shorter lengths of stay and lower rates as billing practices focus

more on the value of care delivered than earlier models based on

the volume of services the facility provided. Now, some big

real-estate investment trusts that focus on health care are

starting to pare their skilled-nursing holdings.

Chicago-based Ventas Inc. in August 2015 spun off 355 skilled

nursing facilities and outpatient recovery centers into a new REIT.

Irvine, Calif.-based HCP Inc. is carrying out its own separation,

while Sabra Health Care REIT Inc. is trimming its exposure and is

now in the process of selling 29 of these assets.

"It's a turning point for health-care REITs," said Britton

Costa, director in Fitch Ratings' U.S. REITs group.

For REITs, heavy exposure to skilled-nursing operators that

might face pressure in their ability to pay rent adds a layer of

risk that, in turn, makes it costlier for them to raise funds.

Medical office buildings and hospitals, which have steadier income

and more control over billings, are seen as better bets.

"The spinoff will improve our portfolio quality...and reinforce

the stability and growth profile of our cash flow," said Mike

McKee, executive chairman of HCP in June when the company announced

the spinoff of its HCR ManorCare portfolio of skilled nursing and

assisted-living assets. ManorCare has been struggling with

operational missteps and headwinds from reimbursement changes.

After its 2015 spinoff, Ventas enjoyed stronger growth and

achieved a greater portion of its net income from so-called

private-pay assets, said Chief Executive Officer Debra Cafaro.

Private-pay assets largely serve those who pay out of pocket or

have coverage from commercial insurers rather than the

government.

Some investors have been more hesitant about parking money in

health-care REITs that contain skilled-nursing facilities, because

landlords face the risk of their tenants struggling with rent

payments if government budgets tighten.

But real-estate investors and analysts also say it is unlikely

the market would see a resurgence of bankruptcies among these

facilities that occurred in the late 1990s, when the operators then

were more highly leveraged.

"It's not going to be as bad as what's perceived out there, but

it's going to be bumpy for a while," said Jerry Ehlinger, managing

director at Heitman, a real-estate investment-management firm,

which has been underweight on health-care REITs for the past five

years. It has $250 million invested in health-care REITs, which

account for about 12% of its U.S. REIT investments.

"Health-care REITs had been on an enormous pie-eating contest

for market share six, seven years ago. These billion-dollar deals

have to come to an end," Mr. Ehlinger said.

To be sure, there is still potential for growth in REITs

specializing in skilled-nursing centers, given rising demand from

aging demographics and their position as a cheaper alternative to

prolonged hospital stays. Investors now pay twice as much to invest

in skilled nursing facilities as they did a decade ago. Last year,

the average price of a bed in a skilled nursing property priced

above $1 million was $78.28, double the $37.74 recorded in 2005,

according to data from commercial-real-estate firm Marcus &

Millichap. The numbers aren't adjusted for inflation.

Omega Healthcare Investors Inc., the largest REIT focused solely

on skilled nursing properties, saw its net income nearly double in

the first half this year compared with the same period last year,

mainly from acquisitions and other investments. Its share price is

down around 7% over the past year.

"Most of our tenants are experiencing modest earning pressure as

a result of CMS's [Centers for Medicare & Medicaid Services']

continued push towards episodic payment systems," but lease

payments aren't affected, said Omega spokesman Thomas H. Peterson.

The Centers for Medicare & Medicaid Services' has been moving

away from a fee-for-service payment model for years now, but the

vast majority of Omega's tenants have cash flow that exceeds their

rent obligations, he said.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

October 11, 2016 13:08 ET (17:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

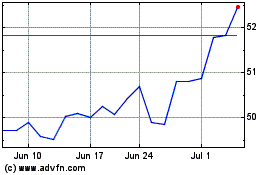

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

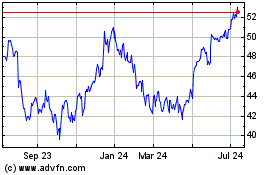

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024