Oracle Extends Deadline for $9.3 Billion NetSuite Deal -- WSJ

October 10 2016 - 3:03AM

Dow Jones News

Shareholder concerns that offer undervalues cloud-computing firm

threaten to derail bid

By Jay Greene

Oracle Corp. is extending the deadline to complete its $9.3

billion deal to buy NetSuite Inc. by one more month, after having

received only about a quarter of the shares necessary from the

cloud-computing pioneer's stockholders.

Concerns by NetSuite's largest institutional shareholder, T.

Rowe Price Group Inc., that Oracle's offer of $109 a share

undervalued the company, are apparently derailing the deal. A

spokesman for T. Rowe declined to comment.

Oracle -- which wants to buy NetSuite to extend its

cloud-software offerings, a market segment where Oracle widely has

been perceived as a laggard and is racing to add new services --

said the Nov. 4 deadline would be the final extension.

"In the event that a majority of NetSuite's unaffiliated

shareholders do not tender sufficient shares to reach the minimum

tender condition, Oracle will respect the will of NetSuite's

unaffiliated shareholders and terminate its proposed acquisition,"

the company said in a news release.

Oracle needs 20.4 million shares to be tendered to close the

deal. As of Thursday, only 4.6 million shares had been

tendered.

NetSuite shares fell 3.4% to $105.61 in midday trading in New

York, while Oracle shares slipped 0.2% to $38.66.

Oracle last month had extended the tender offer to Oct. 6 "to

facilitate the completion of outstanding antitrust reviews." In

September, Oracle received the final antitrust clearance needed,

from the U.S. Department of Justice.

Both companies provide business applications that help automate

operations in areas including finance and human resources,

collectively called enterprise-resource planning.

The deal has been complicated by Oracle executive chairman Larry

Ellison's substantial stake in NetSuite, raising the issue of

conflicts of interest. In a September regulatory filing, NetSuite

said Mr. Ellison had an "indirect beneficial ownership of

approximately 39.5%" of NetSuite's common stock, making him the

company's largest investor.

From an Oracle shareholder's point of view, Mr. Ellison's

majority stake in NetSuite may influence him to support Oracle

overpaying for the acquisition. From a NetSuite shareholder's point

of view, his holdings may scare off other bidders.

To address such concerns, Oracle appointed a committee of

independent directors to oversee its side of the deal. Moreover,

the two companies agreed that the transaction must be approved by

owners of a majority of NetSuite shares not held by Mr. Ellison and

his family, giving independent NetSuite shareholders more clout in

approving the deal.

Last month, T. Rowe notified the company that it wouldn't tender

its 14.5 million shares in favor of the deal. The firm has

increased its stake since a June 30 regulatory filing, when it held

nearly 12.2 million shares that accounted for slightly more than

15% of NetSuite's outstanding stock at the time.

In a letter to NetSuite's board, T. Rowe said the $109 per share

offered by Oracle undervalued the company, in part because

"potential synergies" in cloud computing could be realized by

Oracle when the deal is completed.

At the time, Oracle declined to comment on T. Rowe's concerns,

and NetSuite didn't respond to a request for comment. But in a

regulatory filing, NetSuite noted that its board "unanimously

reaffirmed its recommendation that stockholders accept Oracle's

offer and tender their shares."

Corrections & Amplifications: Oracle in July agreed to pay

$9.3 billion for NetSuite. An earlier version of this article

misstated the deal's value.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

October 10, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

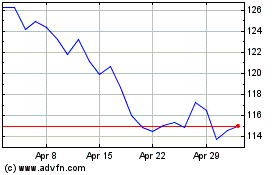

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

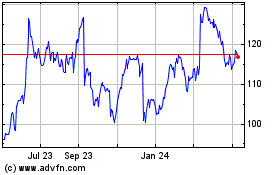

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024